My Lover Cindi on brink of closure as cost-of-living crisis causes havoc across SA’s hospitality industry

SA’s hospitality crisis is so widespread every owner is considering throwing in the towel, one Adelaide pub operator says, as she loses $8000 a week – and power bills surge.

SA News

Don't miss out on the headlines from SA News. Followed categories will be added to My News.

A cost-of-living crisis is ripping through SA’s hospitality industry as utility bills spiral and people cut their spending.

The massive increase in operational costs, combined with lower profits has forced numerous SA businesses to close, with one popular nightclub on the brink of shutting its doors for good.

One of Adelaide’s most adored LGBTIQ+ bars, My Lover Cindi, is facing an uncertain future, with a huge spike in costs threatening the Pirie St night space.

So far in 2024, nine hospitality businesses have announced closures as the cost-of-living crisis takes hold.

The Little Banksia Tree, Enzo’s Ristorante, the Edinburgh Castle, , Folklore Cafe, Morris Bakery, Red Square, and Lost in a Forest have closed while Big Shed Brewing is in administration and battling to keep its doors open, and The Stag on Rundle Street has gone up for sale.

My Lover Cindi’s operators took to Facebook to let their “lovers and friends” know they were facing “extreme” venue challenges.

“We are taking a moment to be vulnerable,” they said in a Facebook post on Wednesday.

“A huge spike in operational costs along with the cost-of-living crisis means that the future of Cindi’s is uncertain.

“Over the past few months, more than seven well-established CBD venues have closed, and we are close to sharing their fate.

“Cindi’s has been the backdrop to people’s coming out, coming in, finding themselves, finding love and finding community. It is this magic that has kept us going so far.”

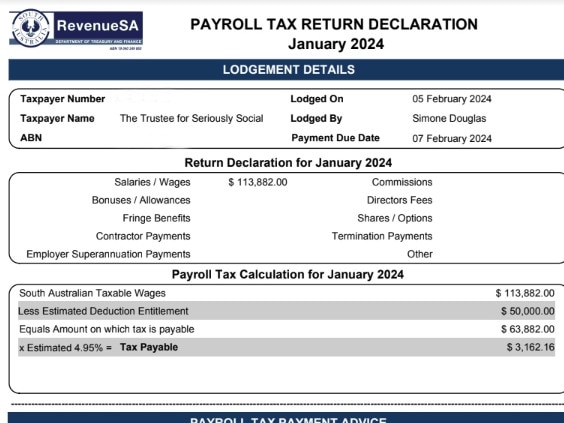

Another business owner, Simone Douglas, has managed to keep three hospitality venues going during this cost-of-living crisis but said rises in utility costs and increased wages were having a massive impact.

The Duke of Brunswick Hotel’s gas and electricity bill has gone up a whopping 30 per cent, while their wage costs have increased by 21.5 per cent.

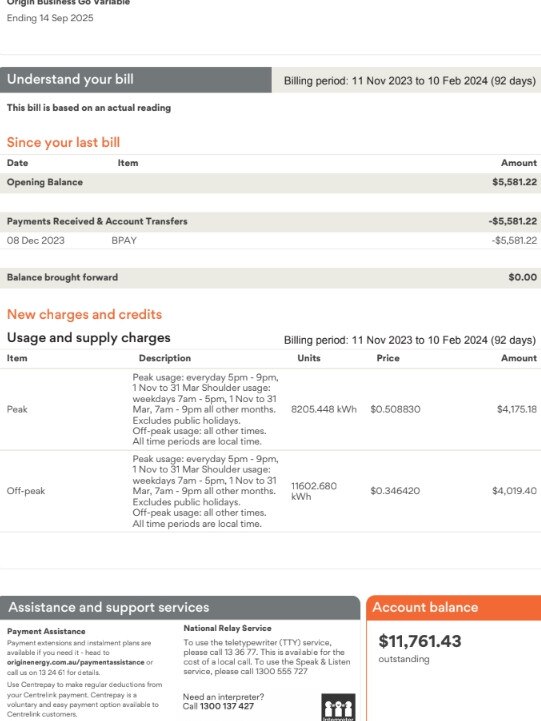

Earlier in the month, Ms Douglas was charged an $11,761 electricity bill over a 92-day period from November 11, 2023, to February 10, 2024.

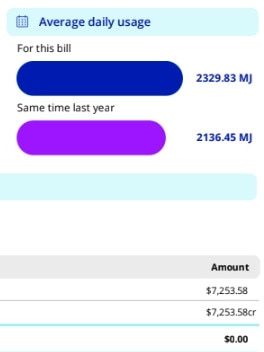

“The rising utility cost is extreme. As someone who has solar on the roof of two of our venues, the fact I’m getting a $3500 to $4000 electricity bill every month is insane,” the 48-year-old said.

“Gas and electricity have gone up 30 per cent and then you have our work cover fee that’s gone up by $1000 a month for our premium. Superannuation costs went up for staff – which we don’t begrudge – but it’s another cost for the business.

“You’ve got all of that, plus suppliers are putting up the basic costs for everything. Everybody is under pressure but we also are too.

“Ask anyone in hospo who doesn’t have a gaming room and they’ll say their sales fell off a cliff after January.”

Ms Douglas said the Duke of Brunswick was down $8000 a week in sales during a festival season that would have historically seen them earn a weekly $50,000.

“People used to come out twice or three times a week but now they come out once, and if they don’t come out once a week then they come out once a month,” she said.

“It’s very easy for a venue to make a loss right now. If you’re a hospo owner that only offers food and beverage then you’re probably only making 5-8 per cent profit.

“There’s not a hospitality operator that isn’t asking themselves, ‘is now the time to get out?’

“You look at the return on property etc. and they’re making you more than being in the hospitality environment.

“We’ve pulled all of the rabbits out of the hats already and then you add the cost-of-living crisis on top of that.”

Emily Raven, the owner of My Kingdom for a Horse, also shared similar frustrations, saying that during her 35 years in the industry she’s had to experience two recessions.

“We have seen a significant 20-40 per cent increase, especially in electricity,” she said.

“At the cafe end of the market, there’s no money to be made at all. I have three businesses in the CBD so I’ve also been impacted by the fact that we’ve got significantly less people in the city on Fridays and Mondays.

“We remain really positive, really people-focused. We’re a business that’s really about putting people first – our team and our customers.

“I don’t want to say negative things about labour costs; the fact of the matter is we have a lot of people in our industry who work in the business full-time – you can’t just let go of salaried staff.”

SA Business Chamber chief executive Andrew Kay said the escalating cost of doing business remains the primary worry for hospitality owners, according to a recent survey they conducted with William Buck.

Mr Kay said operators are experiencing up to a 30 per cent increase in their electricity costs, combined with substantial wage bills, growing payroll tax levies, inflated prices of food and beverages, and rising insurance premiums.

“Unfortunately, you don’t need to travel far to see a local cafe or restaurant that has shut down in recent months,” he said.

“Business owners are experiencing significant pressure. Understandably, many in hospitality are concerned about their future.

“Profit margins have been squeezed if not eroded for many over the past 18 months.”

SA Business Chamber has called for the upcoming state budget to include relief in areas such as electricity, gas, and payroll tax. It follows last year’s $650 electricity bill rebate scheme, brought in by the state and federal governments, to help businesses through a period of rising costs.

“It’s clear that operators believe the increase in costs is beyond what customers would be willing to bear, should they pass them on in full,” Mr Kay said.

“With consumers facing their own cost of living struggles, they feel caught between a rock and a hard place.”

Australian Hotels Association SA chief executive Anna Moeller said city hospitality businesses were the worst affected, including nightclubs who were “decimated” during the pandemic.

“Their business model was dancing and that was outlawed,” she said.

“They have struggled to come back and we’ve seen a closure of a number of them. They have limped out of Covid straight into a cost-of-living crisis, which for hospitality is a double hit.

“Not only do patrons have less money to spend … but they’ve also got increased business costs for themselves. By the time all of these come together it’s created a terrible storm.”

Ms Moeller said operational costs were up about 15 per cent across the board for hospitality businesses.

She said wages and rent were the biggest growing expense, along with insurance premiums for any venue with a dancefloor.

“Your public liability goes through the roof if you have a dancefloor – it’s crippling,” she said.