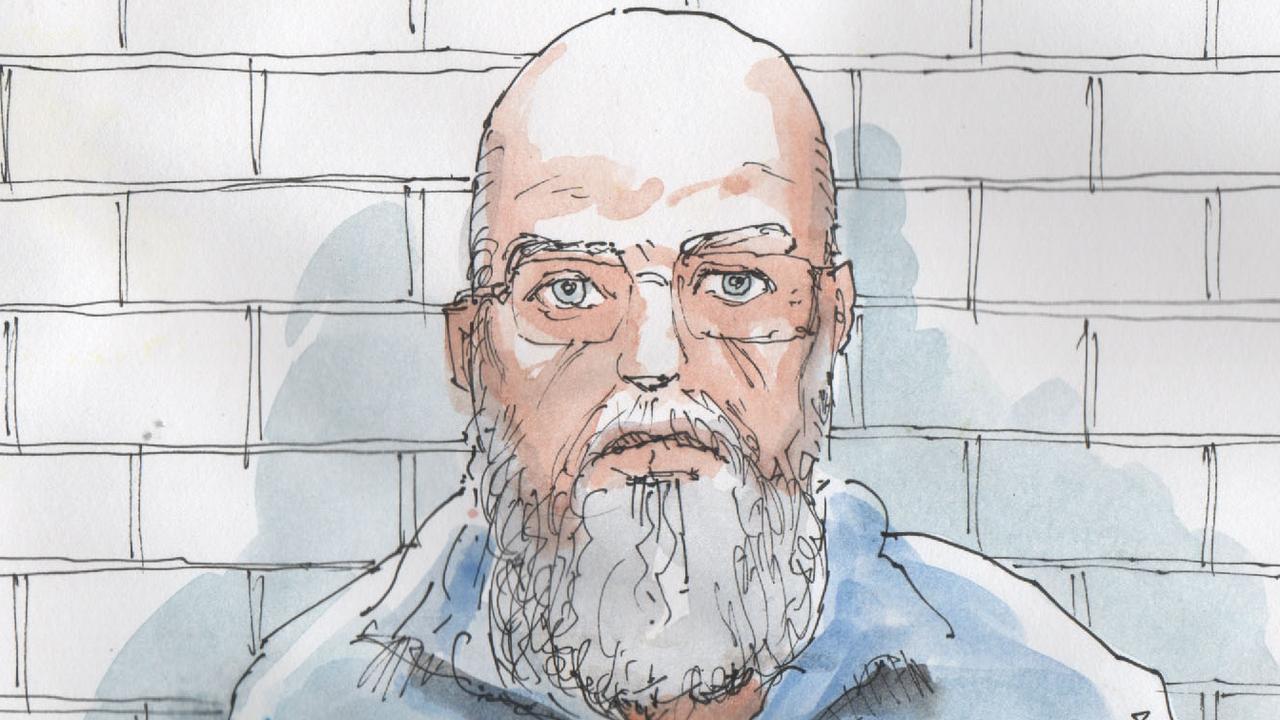

Bankrupt winemaker and serial entrepeneur and litigant Andrew Garrett back in court

FORMER winemaker, bankrupt, vexatious litigant, aspiring sugar daddy and serial “entrepreneur” Andrew Garrett, after a hiatus of some years, has again been listed to appear in a South Australian court.

Law and Order

Don't miss out on the headlines from Law and Order. Followed categories will be added to My News.

Andrew Garrett’s court history:

- 2006: Weeping outside court

- 2007: Pestering ex-lover with sex texts

- 2009: $900,000 fraud charges dropped

- 2009: Looking for love

- 2016: Judge tells him not to ramble in court

FORMER winemaker, bankrupt, vexatious litigant, aspiring sugar daddy and serial “entrepreneur” Andrew Garrett, after a hiatus of some years, has again been listed to appear in a South Australian court.

Garrett, whose name still graces the sparkling shiraz which made him all but a household name in the 1990s, was listed to appear in the Adelaide Magistrates Court this morning, but failed to appear.

Garrett has not been prominent in Adelaide business circles in recent years, however The Advertiser can reveal that Garrett, 61, of Hobart, has been charged with one count of attempting to obtain a financial advantage by deception.

The charge, which is a Commonwealth offence, arises out of Garrett’s alleged conduct in Adelaide on June 25, 2016.

The offence carries a maximum penalty of 10 years’ jail — but only if the matter is referred to the District Court for trial.

If it is dealt with in the Magistrates Court, it carries a two-year maximum penalty.

The Advertiser has applied to the court for access to the case file, which will outline the allegations against the bankrupt.

It is not, by a long shot, the first time Garrett’s presence has been warranted in a court of law, many times as a result of his own instigation of legal proceedings — to the point where he was declared a vexatious litigant in 2006.

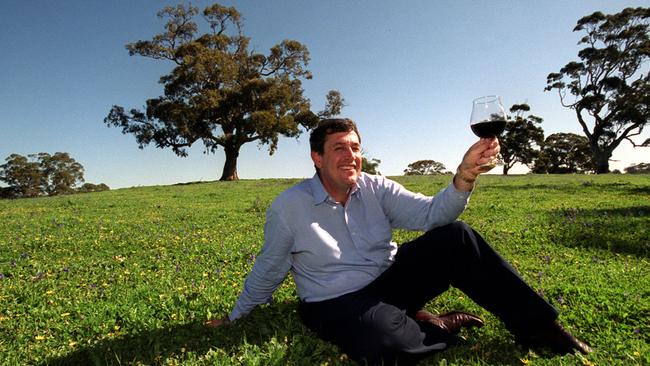

Garrett was a high flyer in the 1990s, selling his business to Foster’s for an initial amount plus an ongoing income stream, with the sparkling shiraz which bore his name the jewel in the crown.

He went on to attempt to build a wine empire, but failed, with his Braidwood Group of companies collapsing in 2003 with debts of more than $12 million, including about $9.6 million owed to the National Australia Bank, which he blamed for the failure of his businesses.

A chaotic few years characterised by bizarre legal claims, attempts to pay outstanding debts with cheques from non-existent banks, and a suspended 10-month jail term for 92 breaches of a restraining order and three breaches of bail followed.

In 2009 The Advertiser reported that Mr Garrett was telling prospective partners on the Sugardaddie.com website that he was worth an estimated ``$10,000,000 Or More’’.

He admitted at the time that admitted that ``what is displayed on the website is not a true indication’’ of his financial situation.

One of Garrett’s business ideas in recent years has been “urban wineries’’ - a proposal he tried to sell in Adelaide some years ago.

He told The Mercury in Hobart last month he planned to build 3000 urban wineries globally, which would process blast-frozen grape juice from around the world.

“Somewhere in Macquarie Point or Salamanca would be nice for the first one,” Garrett said.

In March, The Mercury reported, he pleaded guilty in the Melbourne Magistrates Court to managing companies while disqualified, for which he copped a $2500 fine.

Mr Garrett blamed his legal troubles on “maladministration” by the Australian Securities and Investments Commission, “corruption” within the South Australian courts and “cover ups” by the SA Government.

Mr Garrett said he was not breaching his ban on managing companies because the urban winery concept was being managed by a trust, of which he is managing trustee.

“How can I be involved in managing a company when I’m a trustee of a trust?” he said.

Mr Garrett said he had moved to Tasmania to join a colleague in setting up a yet-to-be-announced forestry venture.

ASIC documents searches show he is still a bankrupt, and is listed as “managing controller” of companies called Waverley Enterprises and Waverley Trading.

Both are under external administration.

The Advertiser has attempted to contact Garrett.

The matter has been listed for a future date.

cameron.england@news.com.au

Andrew Garrett Timeline

September 24, 2004: Garrett is declared bankrupt during a hearing of the Federal Court. The court hears Garrett owes the National Australia Bank $10m as well as thousands of dollars to about 150 other creditors. He tries to clear his name and $80,000 in unpaid taxes with a note he claims to be a bill of exchange from a Swiss bank. The Reserve Bank concludes the note isn’t worth the paper it’s printed on.

November 1, 2005: Springwood Park, Garrett’s sprawling 204-hectare estate in Adelaide’s inner southern suburbs is put on the market by an insolvency firm. He had taken out four mortgages against the property which was valued at $4m.

2006: Garrett declared a vexatious litigant after filing numerous lawsuits against NAB and other creditors.

December 11, 2006: After almost being arrested for being late to court Garrett breaks down outside court. Weeping from what he called the stress of fighting 40 court actions in the civil and criminal courts, he vows to pursue fraud and perjury against NAB.

November 19, 2007: Garrett is sentenced to 10 months in prison for 92 breaches of a restraining order taken out by a former lover and three breaches of bail but has the sentence suspended. Magistrate Bill Ackland berates him for 15 minutes before imposing the sentence, calling the winemaker a narcissist and likening him to Icarus. Garrett admitted to harassing his former lover for money almost 100 times in two months.

May 4, 2009: Garrett admits to exaggerating his finances in a profile on dating website Sugardaddie.com. He claims his wealth is over $10m on the site which caters for women who find wealth an “attractive quality”.

November 30, 2009: Seven charges of fraud totalling more than $900,000 are dropped in the District Court. Garrett pleads guilty to defrauding $5000 by dishonestly dealing with documents.

October 21, 2010: Springwood Park is demolished to make way for one Adelaide’s most expensive houses.

October 22, 2010: A District Court judge places Garrett on a good behaviour bond and wishes him luck after sentencing him for using the fake Swiss bank note in 2004.

October 18, 2011: Garett faces bankruptcy for a second time after his lawyers failed to arrive at a Federal Court hearing. The judge hands NAB a default win and awards costs to the bank.

May 10, 2016: A Federal Court judge tells Garrett to stop “rambling” and talking over him during a farcical court appearance called on by NAB. Garrett accuses the judge of threatening him.

February 10, 2017: Garrett convicted and fined $2500 by the Australian Securities and Investments Commission for three counts of managing a company while disqualified.