A stark new report on housing affordability shows just how dire things are in Australia – for everyone

A startling new report into the state of Australia’s housing markets has revealed just how bad things have gotten – and everyone is impacted.

The typical Australian who might’ve once bought a home a few generations ago is now much more likely to rent thanks to plunging housing affordability, which is now at its worst level in more than 20 years.

And they’re flooding rental markets that are beyond capacity, competing with low-income and vulnerable people who are unable to keep pace.

Stark analysis of the state of the country’s housing markets has found both homeowners and renters are struggling to keep a reasonably priced roof over their heads.

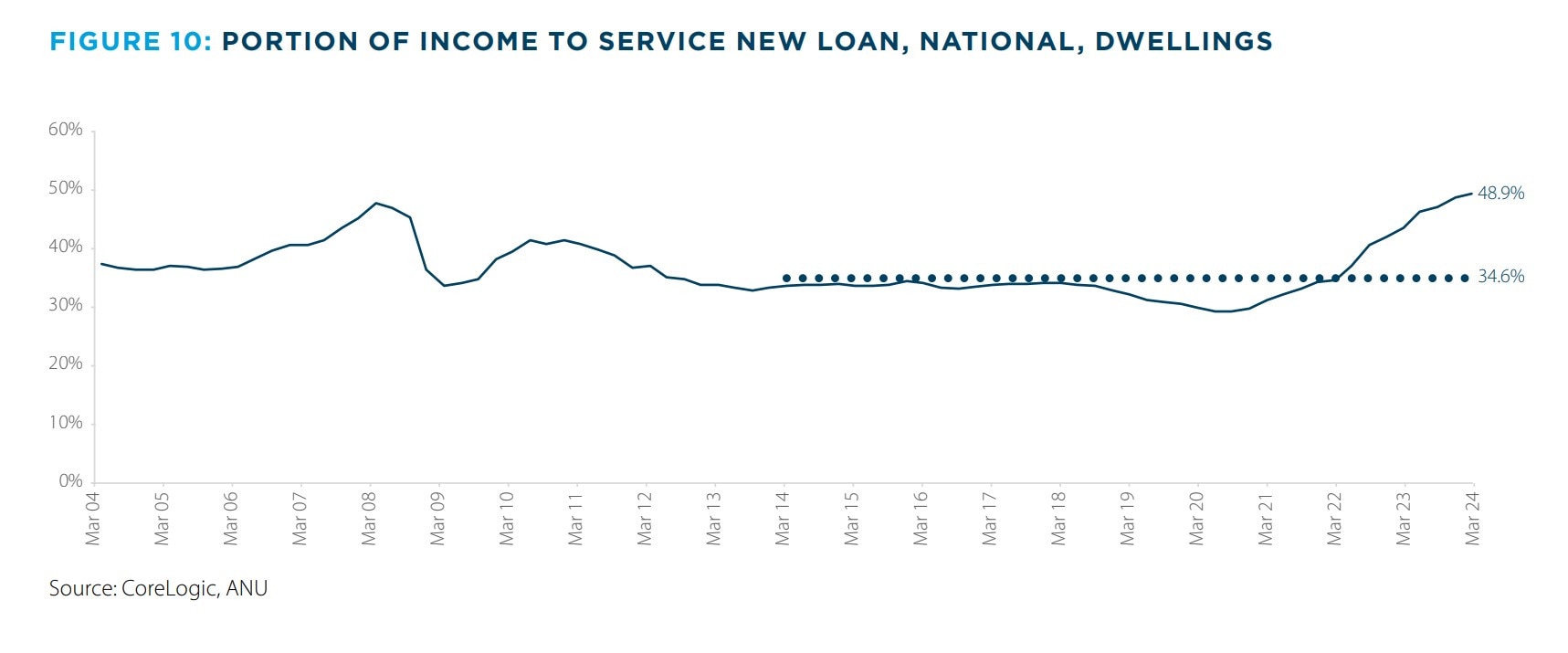

When it comes to owning, the proportion of median income needed to repay a new home loan has hit a record high of 48.9 per cent, the latest ANZ CoreLogic Housing Affordability Report has found.

That’s up sharply from about 43 per cent just a year ago and well above the decade average of 34.8 per cent.

Hopeful homebuyers in a position to squirrel away 15 per cent of their annual income would need to diligent save for more than a decade to meet the minimum 20 per cent deposit for a mortgage.

And that’s based on current median home prices, not accounting for future value growth, so the timeline would likely blow out.

To put the dire situation into perspective, the median house prices in Sydney, Melbourne and Brisbane have surged by about 96 per cent in the past 10 years.

Housing Minister Julie Collins said the government had committed more than $25 billion to address the housing crisis over the coming decade.

One of its flagship programs is the Help to Buy scheme will help low- and middle-income Aussies to purchase with just a two per cent deposit. The Commonwealth then takes an equity stake of up to 40 per cent for new dwellings and up to 30 per cent for existing properties.

“We want to help more renters become homeowners through our Help to Buy shared equity scheme, which will reduce the cost of a mortgage by up to 40 per cent for low- and middle-income earners,” she said.

“For tens of thousands of Australians, this will mean a smaller deposit and smaller ongoing repayments.”

Keeps going up and up

When the Reserve Bank began hiking interest rates two years ago, slamming mortgage holders with 13 increases and taking the official cash rate from 0.1 per cent to 4.35 per cent, economists expected the worst for housing markets.

While there was a relatively brief period of median home price declines, the correction was short-lived.

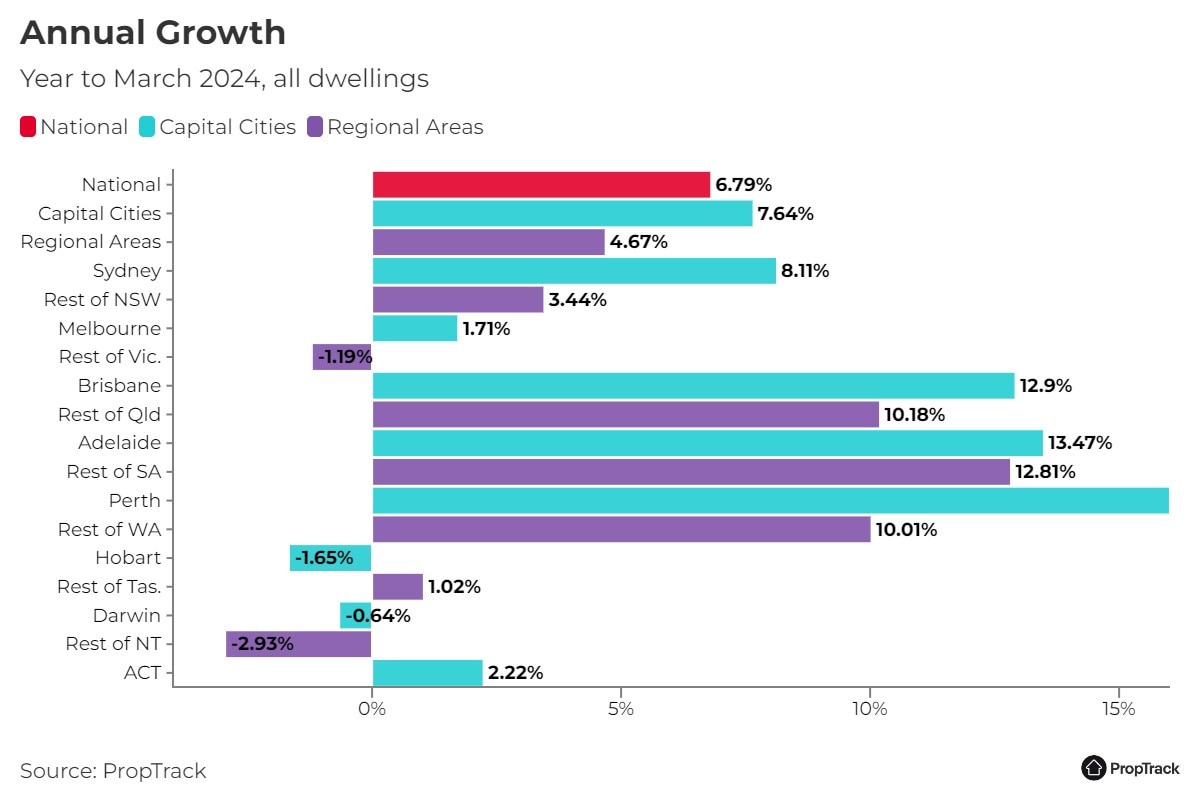

Over the past 12 months, CoreLogic’s Home Value Index has risen by a staggering 8.9 per cent at a national level, adding about $63,000 to the cost of a typical home.

Suburb-level analysis conducted by the data house found that 88.4 per cent of Australian suburbs saw an increase and house and unit prices over the past year.

That’s up sharply from 52.9 per cent of suburbs recording growth in the previous 12-month period in 2023.

“Despite rate hikes, worsening affordability, and the rising cost of living, the increasingly entrenched undersupply in housing stock, and above average demand thanks to strong net migration, has helped push values higher,” CoreLogic economist Kaytlin Ezzy said.

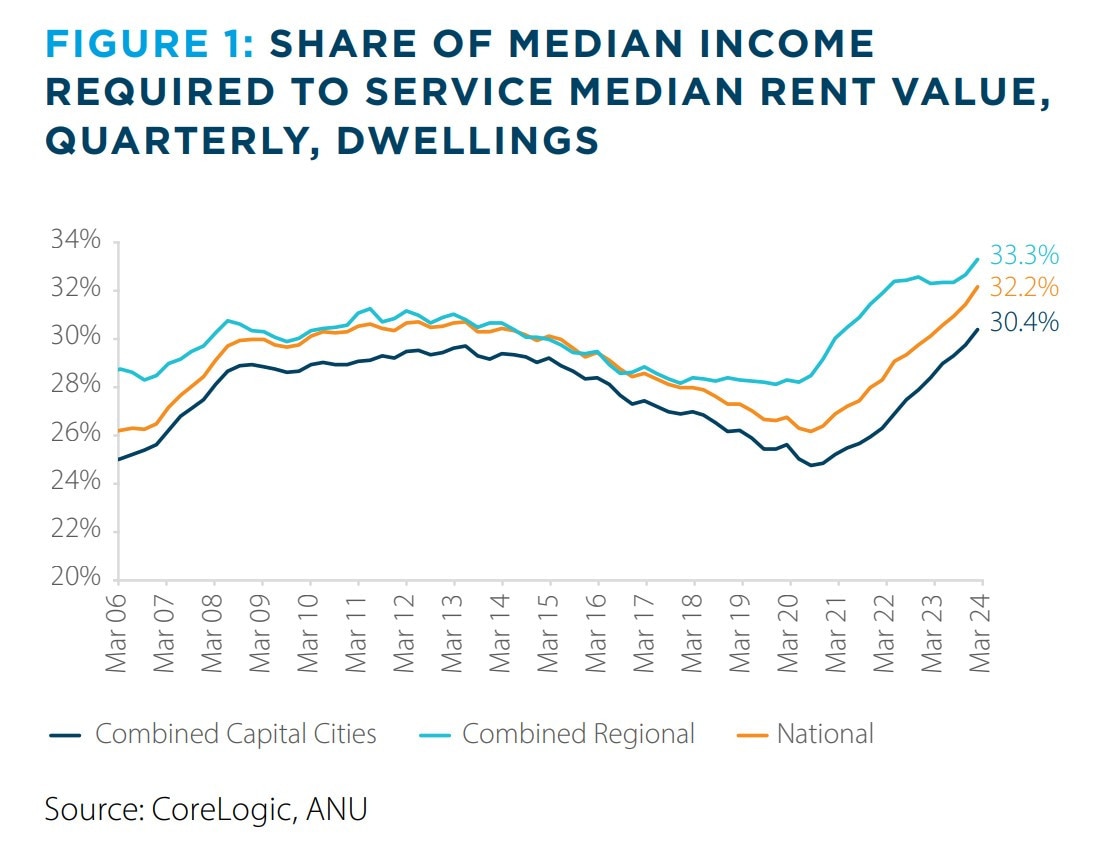

The situation is even starker when it comes to rental prices, Ms Ezzy said, with 94 per cent of all Australian suburbs seeing values increase in the past year.

In 40 per cent of those suburbs, the level of rent price growth was in the double-digits.

“Over the past few years, rental growth has been skewed to capital city units,” Ms Ezzy said.

“But as unit rent affordability has been eroded, some prospective tenants may be shifting towards house rentals, likely reforming larger households as a way of sharing the rental burden or to more affordable markets further afield.”

Research last year by the charity Salvation Army found one-in-four people were unable to pay their rent on time and 30 per cent had struggled to find a suitable and affordable place to live.

Most vulnerable Aussies suffering

Households on low incomes have seen faster income growth than other demographics in recent years on the back of minimum wage increases.

The Fair Work Commission also increased the minimum wage by 5.75 per cent for the 2023-24 financial year, adding about $48 per week to the pay packets of full-time workers.

While this should be good news, especially amid a cost-of-living crisis, every single dollar of that increase – and then some – has been eaten up by skyrocketing rents.

Those in the bottom quarter of incomes are paying about $53 per week more on rent over the past 12 months, thanks to low supply, high demand and intense competition.

The rental vacancy rate at the end of last year sat at just 1.2 per cent nationally. For context, economists consider a rate of less than three per cent to be a sign of an imbalanced market.

Before Covid, the five-year average rental vacancy rate was 3.3 per cent, showing just how much the pool of available rentals has evaporated.

Since the onset of the pandemic, Aussies in the lowest 25 per cent of income-earners have seen their rental prices explode by 42 per cent, adding about $155 per week to housing costs.

That low-income demographic now needs to devote 54 per cent of their total income to paying rent.

Compare that to middle-income households, who on average must spend a third of their wages on rent, and the financial pain being felt by vulnerable Aussies is clear.

As advocacy group Launch Housing has revealed, the fastest-growing cause of homelessness in Australia in the past four years is housing affordability.

The rise of ‘Generation Rent’

Australian households on high incomes are becoming and more reliant on the private rental market, the ANZ CoreLogic Housing Affordability Report pointed out.

Back in 1996, just eight per cent of people earning $140,000 per year, with most well-off people pursuing the so-called Great Australian Dream of homeownership.

These days, 24 per cent of those bagging six figures lease the property they live in.

“Part of the reason for higher income households in the private rental market over time likely comes back to longer term declines in the rate of home ownership,” the report reads.

The unfortunate reality of this trend is that a demographic shift in rental means higher demand for a dwindling pool of homes.

And it means lower-income renters are facing tougher competition – against a cohort that’s able to pay more than they are.

“High-income earners can move to cheaper markets when rents rise, but that means low-income earners already renting in lower cost pockets of the market have fewer options,” the report reads.

Is the Dream dead?

The so-called Great Australian Dream of homeownership has increasingly become a nightmare for younger cohorts.

Problems have been brewing for the better part of two decades, but an acceleration has taken place in more recent times – and is worsening.

“First-home buyers are arguably in the most challenging position,” the ANZ CoreLogic Housing Affordability Report points out.

“They face an increase in the deposit hurdle as prices rise, and are more likely to buy with a low deposit, increasing their interest costs.”

According to the Australian Housing and Urban Research Institute, homeownership rates for first-timers born in the late 1980s is “significant less” than was the case in previous decades.

“Over the last 30 years, ownership rates for households at age 30 to 34 have declined substantially, from 65 per cent of people born in the mid to late 1950s being homeowners by age 30 to 34, to only 45 per cent of people born in the mid to late 1980s’, Professor Stephen Whelan from the School of Economics University of Sydney said.

“This fall in ownership rate has happened as house prices have nearly tripled, indicating that increasing house prices and falling affordability are associated with a delay in housing market entry for Australian households.”

Eliza Owen, CoreLogic’s head of residential research Australia, said the number of first-home buyers securing finance to buy in February was up, hitting 29.2 per cent of all lending.

“But it’s down from HomeBuilder highs of 33 per cent in January 2021,” Ms Owen said, referring to the previous Federal Government’s generous grants to build dished out during the pandemic.

“As the year progresses and home values are likely to continue rising, the share of first homebuyer activity is likely to weaken further.”

Mortgage stress evolving

Conventional wisdom has long considered ‘mortgage stress’ as being a state where a homeowner is forking out more than 30 per cent of their income on repayment costs.

But on the back of rising home prices, much higher interest rates and the general cost-of-living crunch, it appears that 40 is the new 30, the ANZ CoreLogic Housing Affordability Report points out.

“Based on the latest estimate of median annual household income nationally of $100,244 before taxes, and assuming 30 per cent of this income is used on mortgage payments at current average variable rates, an affordable dwelling purchase would be around $503,000.

“However, ongoing increases in housing values mean that this affordable purchase price is below most actual dwelling values, with the median Australian unit price around $640,000, and the median house price around $834,000 across Australia.”

As a result, just 17 per cent of all homes are considered ‘affordable’ on the 30 per cent of income measure.

At 40 per cent, this figure increases to 37 per cent of all dwellings, forcing an uncomfortable question about whether how ‘stress’ is defined needs to be changed.

Even then, as the report points out: “With home values reaching new record highs in November last year, and the cash rate rising a further 25 basis points in the same month, the portion of median income needed to service a new loan on the median dwelling value reached 48.9 per cent nationally.”

Originally published as A stark new report on housing affordability shows just how dire things are in Australia – for everyone