Quick phone calls that can save you thousands on bills

I was giving myself high-fives after making $500 in five minutes. It’s something that millions of Australians can do too. All it takes is a telephone call.

I was giving myself high-fives after making $500 in five minutes. It’s something that millions of Australians can do too. All it takes is a telephone call.

Rental property loans are now under the ATO’s microscope as a new data-matching program gives it more power to trap cheats.

Investors seeking to profit from high food prices need to tread carefully as companies produce and mixed bag of results.

Painful electricity price rises from July 1 are just one of several cost increases that will strike consumers soon.

Don’t take the bait from a fresh wave of COVID-19 scams as fraudsters try old and new tricks to steal your hard-earned money.

The Federal Government’s JobKeeper program has helped millions of employees so far, but those deliberately cheating the system are in for a nasty surprise.

Car insurance is one of many annual bills Aussies struggle to save money on. But you can keep more cash in your pocket if you follow these easy tips.

Work is drying up for thousands of workers, with one in three reportedly taking a financial hit because of the pandemic. Here is how you can keep the bills at bay.

Thousands of Australians walked away from private health insurance as elective surgeries were banned as part of the government’s response to COVID-19.

Coronavirus has impacted the way we view our finances. Here are some of the major changes we’ve experienced in recent months, and what may come next.

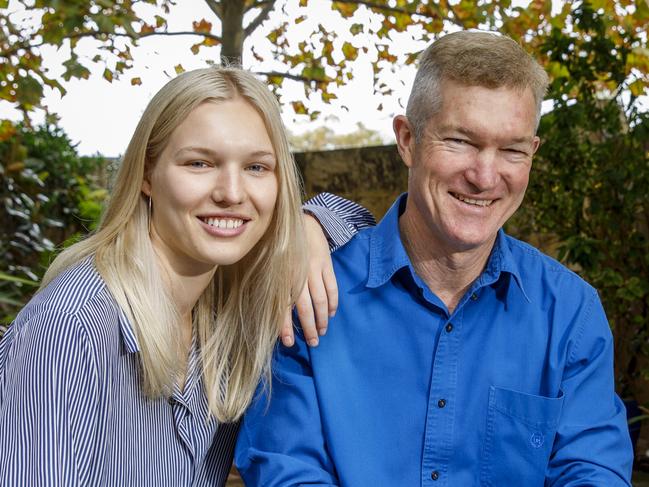

Family finances are usually a case of parents handing down knowledge to children, but older Australians can learn some investment ideas from their young adult offspring.

More than 1.5 million Australians have rushed to access their super early but there are some important things to make sure you pay close attention to in order to get your money quickly.

JobKeeper is paying millions of Australian workers $1500 a fortnight, but growing talk of changes that may end the six-month scheme sooner for some means you need to have a plan.

Superannuation balance down sharply? It’s not all bad news for millions of Australians with opportunities for future growth and tax benefits are opening up.

Original URL: https://www.adelaidenow.com.au/moneysaverhq/page/134