Rate rise number 12: Will they or won’t they?

More pain looms amid the increasing likelihood of further interest rate rises. If the predictions are correct, everyone’s a loser.

More pain looms amid the increasing likelihood of further interest rate rises. If the predictions are correct, everyone’s a loser.

An aggressive run of interest rate hikes are seeing a rising number of households fall behind on their loan repayments, with one state home to the greatest number of struggling borrowers.

Cash in the bank held by Aussie households has hit a huge milestone, even while millions are doing it tough. Here’s why.

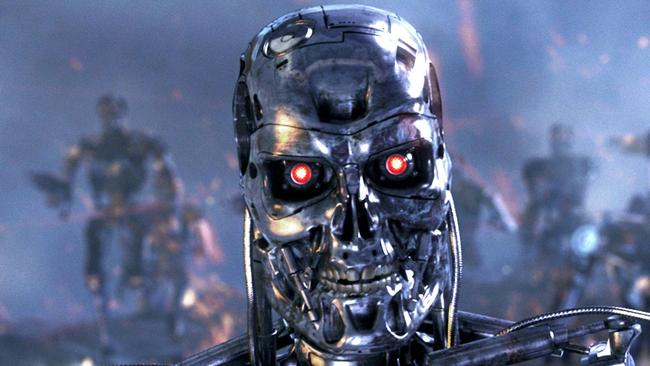

AI’s rapid evolution is capturing investors’ imaginations and will benefit many businesses, but others will die in the crossfire.

New research has found many of the millions of employees working from home during the pandemic don’t know their tax deductions. Here’s how to avoid missing out on a cash bonus.

With the coronavirus restrictions, Australian small business owners are learning in real time just how they need to adapt to survive now and for the future.

Australia may be facing one of the greatest economic disasters since the Great Depression, but there are steps worth taking to save your money.

It’s been 29 years since Australia experienced a recession — and there are ways you can still get ahead. This is what it means and what you should do right now.

It’s wise to make money changes well before June 30 if you want to grab a bigger tax refund and make the best of your investment mix. Here’s why …

The Reserve Bank of Australia has kept the cash rate on hold but experts have revealed why now is the perfect time to fix your home loan rate.

Cash-strapped Australians who have pulled out their super early can end up losing tens of thousands of dollars in retirement. But it’s easier than you might think to pay it back.

The Australian economy has hit extremely tough times and there are fears among mortgage customers their property could fall into negative equity territory.

Cash-strapped borrowers who have taken out a mortgage deferral have started to receive calls from their bank asking them if they can begin repaying again.

Cars can cost us more than $30 a day to own and run, so it’s a good idea to seek savings when you can – especially if you’ve been driving less during the pandemic.

Original URL: https://www.adelaidenow.com.au/moneysaverhq/page/132