Who owns South Australia’s biggest wineries, vineyards and popular wine brands?

A trade war may be looming with China, but Australia’s wine industry is used to dealing with formidable challenges. So who are the dominant players in SA’s massive wine sector? Our business editor has been finding out.

The South Australian wine industry – the undisputed national leader – is made up of a varied mix of producers, from bespoke single-vineyard operations, to the largest wine companies in the world.

In this special report, The Advertiser’s Business Editor Cameron England takes a look at the companies which dominate our wine sector from a volume and value point of view.

The firms range from private-equity backed international behemoths, to dynamic family businesses and Warren Randall’s eclectic empire based around the historic Seppeltsfield winery in the Barossa Valley.

ACCOLADE WINES

While the marketing guff traces the Accolade lineage back to the establishment of Hardys in South Australia in 1853, it’s more of a private-equity backed stable of brands than any one entity which has grown into what exists today. Some of the brands which have been absorbed by the global wine juggernaut include Banrock Station, BRL Hardy, Adelaide-Hills based Petaluma, Barossa-based St Hallett and Grant Burge and Berri Estates.

The birth of what we now know as Accolade started in 2003, when Constellation Brands bought BRL Hardy, creating what it said at the time was the world’s largest wine business. In 2011, private equity company CHAMP bought an 80 per cent interest in the UK and Australian divisions, renaming it Accolade Wines.

Big buys over the next decade include Grant Burge and in 2017 the Fine Wine Partners portfolio taking in St Hallett, Petaluma, Croser, Stonier, Knappstein and Tatachilla. Another private equity firm, The Carlyle Group, bought the whole kit and caboodle in 2018, and claims Accolade is “the largest wine company in Australia and fifth largest wine company in the world, by volume’’.

In September 2020, the company picked up Katnook Estate in the Coonawarra, saying it was after more premium grapes for the 2021 vintage and the winery’s premium wine stable.

Accolade's Berri winery processes around a third of the state’s entire grape harvest – over 200,000 tonnes – and produces tens of millions of litres of wine in cask and bottle every year.

“Last year saw the opening of a new $45m, 33,000 sqm glass bottling, packaging and warehousing facility at Berri, which now employs 100 South Australians,’’ the company said.

“This facility is capable of producing 100,000 cases of bottled wine and 400,000 casks per week, and can store up to 26,000 pallets of product.

“We are making further investments into our capacity at Berri and look forward to discussing these in the near future.’’

TREASURY WINE ESTATES

There’s probably no better advertisement for South Australia’s wine industry than the dynamic duo of the Penfolds range and its charismatic chief winemaker Peter Gago.

While every new vintage release of the super-premium Grange at $900 or so a bottle, and the invariable rare collector’s items released each year or two at multiples of that price spawn the perennial debate: “Why would you pay that much for a bottle of wine?”, the reality is there’s a big market for it and well-heeled people around the world love the stuff.

Treasury was born from Foster’s big move into wine starting in the 1990s, buying US-focused Beringer Blass and Southcorp, before demerging the company into what is now Treasury in 2011 after a lacklustre few years.

The company results remained moribund until Michael Clarke took over the top role and swept through the place like a dose of salts, changing up marketing and sales processes and putting a rocket under the share price. Adelaide expat Tim Ford has taken over in recent months and has COVID and a possible Chinese trade war to deal with.

The company, which owns more than 70 brands globally, is still considering splitting Penfolds off into a single entity. Other SA brands in the portfolio include Pepperjack, Rosemount Estate, Wolf Blass and Wynns Coonawarra.

While Treasury does not break out its local production figures, it's both a very large local producer and buyer, with Penfolds Grange parcels produced from Treasury-owned vineyards and bought from a select range of external growers.

PERNOD RICARD

Australia’s top selling wine in the UK is owned by a French company – Pernod Ricard, with Jacob’s Creek, produced at Rowland Flat in the Barossa Valley, first released in 1876 by Orlando Wines, now a runaway success globally.

With an approachable price and high quality product, Jacob’s Creek can lay claim to an impressive set of numbers including: being the number one bottled wine brand in Australia; the number one premium Australian wine brand in 14 global markets; one million glasses drunk per day, and it is exported to about 70 countries. Other brands in the Pernod Ricard stable include fellow Barossa label St Hugo as well as I Am George, and Marlborough’s Brancott Estate.

Rumours swirled last year that Pernod – the second biggest wine and spirits company in the world – was looking to sell its wine division, however that push seems to have abated.

SEPPELTSFIELD WINES/RANDALL WINE GROUP

Headed by the dynamic Warren Randall, Seppeltsfield has been defined by reinvention since he took it over, albeit with great respect for the brand, and the winery’s heritage. Seppeltsfield was established in the Barossa Valley in 1851, by Joseph and Johanna Seppelt, just 15 years after the European settlement of South Australia.

It remained under family ownership until 1985, and in 2009, was bought by Mr Randall, who had worked for the Seppelt family in the 1980s. In 2022, a six star luxury hotel, Oscar Seppeltsfield is set to open.

It is described by the company as an iconic landmark for the Barossa and Australia – “gently positioned in the middle of Great Terraced Vineyard”.

The Randall Wine Group is the largest private, luxury private vineyard holder in Australia, with total holdings of 3318 hectares across eight premium wine growing districts including the Barossa, McLaren Vale, Clare, Langhorne Creek, Currency Creek, Coonawarra, Eden Valley and the Riverland.

Mr Randall got his break buying Tinlins with a couple of partners in the early 1990s and is now a supplier of high quality bulk wines to many of the large wine companies.

CASELLA

![Casella’s [yellowtail] is one of Australia’s biggest wine exports.](https://content.api.news/v3/images/bin/debdc661df8f07f947d9f14fb4dcb08d?width=650)

Another story of immigrant success in the wine field, NSW-based Casella, by its own admission, found success “After many years of hard work and struggle” with John Casella’s creation of the consumer-friendly [yellow tail] brand, which first shipped in 2001.

While wine snobs may have turned up their noses at the simple sales pitch and branding, which relies on the iconic Aussie kangaroo, the proof was in the drinking – and selling – and the brand is synonymous with Australian wine across the US.

“Our initial plan was to sell over 25,000 cases in the first year, however actual sales were well over one million cases in 13 months,’’ the company’s website says. By 2003 global sales reached five million cases, and by 2011, the company says it was the nation’s largest single wine export.

![[yellow tail]’s distinctive branding is recognised around the world.](https://content.api.news/v3/images/bin/e36525dee42d69625f96af9dc8a366a3?width=650)

The NSW-based company’s mass market success has allowed it to add up-market brands to its stable, buying the Barossa-based Peter Lehmann Wines in 2014, Brand’s Laira of Coonawarra in 2015, and Morris Wines of Rutherglen in 2016.

DUXTON

Duxton has assets across classes from bees to dried fruit, but over the past five years has quietly grown into one of the nation’s largest owners of vineyards. Headquartered at Stirling in the Adelaide Hills, the company is headed up by Ed Peter, whose personal wine assets include stakes in Kaesler and Yarra Yering.

Consistent with its focus on agricultural land and securities, Duxton acquired two of Australia’s largest vineyard holdings in 2016 under Duxton Vineyards and is now a large scale, vertically integrated wine enterprise, employing up to 200 people.

AUSTRALIAN VINTAGE

Listed wine firm AVG, which claims to crush about 7 per cent of total Australian production, has been on a mission to shift the focus to branded sales away from bulk wine in recent years, and says its key brands, McGuigan, Tempus Two and Nepenthe now account for 65 per cent of sales.

The company does particularly well in the UK and Europe, where well over half of its revenues flow from, with Australia second, followed by modest contributions from Asia and the US.

Its Buronga Hill Winery in the Sunraysia district of southern NSW is the third largest winery in Australia, with 90 per cent of its energy coming from renewable sources.

Chief executive Mike Noack says the company, which has its head office in Cowandilla, also has a viticulture team based in the Adelaide Hills and employs just under 100 people locally, spending about $50 million a year with local suppliers.

“We have 3 vineyards in the Adelaide Hills, 1 vineyard in the Barossa and 3 very large vineyards in the Riverland (Loxton, Qualco and near Yamba),’’ he says.

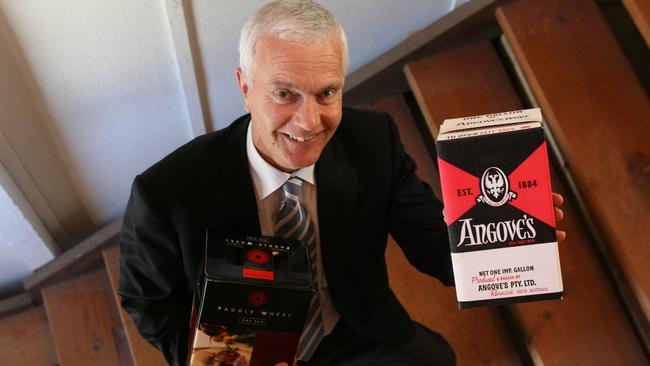

ANGOVE FAMILY WINEMAKERS

One of the older wine companies in SA, the family owned and operated Angove’s has, over the past 20 years, strategically redirected towards organic, sustainable viticulture and premium McLaren Vale winemaking.

With this, has come a move away from commodity and bulk wine trade as this part of the market did not suit the future aspirations for the family or business,’’ the company says.

“As such, on a tonnage basis we have changed our mix, taking in smaller but significantly more premium parcels of fruit.

“We are now Australia’s leading certified organic grape grower and winemaker (certified by ACO). We are incredibly grateful to have a hard working and committed team across the business who do an outstanding job.’’

Angove’s famously invented cask wine, with the process patented by Thomas Angove in 1965.

The family continues to own and operate the St Agnes Distillery. Vintage House Wine & Spirits is the family’s national sales, marketing and distribution business that represents a number of domestic and international brands in the Australian market.

KINGSTON ESTATE

Bill Moularadellis’s Kingston Estate is a bulk wine specialist – to take nothing away from its bottled varieties – but with 60 million litres of wine shipped a year, exported in 24,000l flexi tanks – they’re one of the key players in the commercial export market. More than 60% of Australia’s wine is exported in bulk.

The company says 50 to 70 bulk tanks leave its premises each week and Kingston Estate is one of Australia’s largest grape growers with more than 3000 hectares of vineyards in the Riverland, Coonawarra, Clare Valley, Limestone Coast and central Victoria.

The winery this year crushed 85,000 tonnes and made more wine than the Barossa, McLaren Vale, Adelaide Hills and Clare regions combined.

The winery, originally built in 1985, is now effectively two wineries, with one making small batch super premium wines, and the other efficiently producing under $10 /bottle commercial wine that has found favour in all of our major export markets.

Kingston Estate is an immigrant success story, with Bill’s parents emigrating from Greece independently before meeting each other picking grapes in the Riverland in 1961.

They bought a plot of land and picked the first grapes from their own vineyard in 1965.

Bill set up a winery next to the family vineyard in 1985 and has gone from strength to strength since.

“From these beginnings we have grown to become one of Australia’s most significant grape growers and wine exporters, strongly focused on long term relationships with customers around the world and building our reputation for quality, reliability and continuous improvement,’’ he says on the company website.

The next generation of the family is already well along the path of growing the family business, with Bill’s daughters setting up the Mo Sisters brand in 2016.

CALABRIA FAMILY WINES

The pride and joy of Italian immigrants who arrived in the 1920s and 1930s, the Griffith-based company was established as the Second World War ended, and was crushing a modest 84 tonnes by 1959. In 1996 the company sent its first container of wine to the UK and expansion plans grew the winery from 280 tonnes to 950.

This had grown to an 8000 tonne crush capacity at the winery by 2006, exporting to 36 countries and making Calabria a top-20 producer. The family company bought a 100 year old vineyard estate in the Barossa in 2015, and in 2019 opened a newly acquired cellar door and restaurant.

YALUMBA

“Fiercely independent” is the catchcry at Yalumba, and for six generations the wine company founded by Samuel Smith has been a stalwart of the Barossa.

Yalumba also operates the only cooperage in the southern hemisphere as well as a nursery where research is carried out as well as supplying the industry.

Robert Hill-Smith heads up the family firm as its fifth-generation custodian, and also established

“Australia’s First Families of Wine” as a collaboration between the family-owned companies which underpin the Australian wine sector. Nick Waterman has been managing director since 2015.