Revealed: The 50 local, interstate and foreign families and investors who control Rundle Mall’s prime real estate

SOME of the state’s wealthiest families have amassed the lion’s share of property on Adelaide’s premier shopping strip. We’ve scoured business records and today can reveal who owns the 66 buildings that line Rundle Mall.

- Revealed: Who owns Adelaide’s towers

- Who owns SA’s wineries

- Virtual reality gives new perspective to Rundle Mall Plaza

SOME of the state’s wealthiest families have amassed the lion’s share of property on Adelaide’s premier shopping strip, which has become home to some of the city’s most expensive real estate.

Rundle Mall has attracted waves of investment since becoming one of Australia’s first pedestrian-only streets in 1976, but a mix of the state’s old and new money have tightened their hold on Adelaide’s retail centrepiece.

Analysis undertaken by The Advertiser and international property group JLL reveals local South Australian families have become the dominant landlord group in the Mall, owning close to 60 per cent, or 38, of the 66 properties surveyed.

MAP VIEW

Peregrine Corporation's Shahin family commands five properties, including the Charlesworth and Supre buildings, which it paid a combined $15.8 million for in 2016.

The Angelopoulos family — whose extensive retail property portfolio includes real estate on King William Rd, Unley and Jetty Rd, Glenelg — invested heavily in the mid 2000s, and now controls seven properties including the homes of Forever New, Lorna Jane and Valleygirl.

The Haigh and Cox families own the properties from which they operate their chocolate and jewellery businesses, while the Whittenbury family — sixth generation owner of the Grundy’s and Barlow shoe stores — is Optus’ landlord.

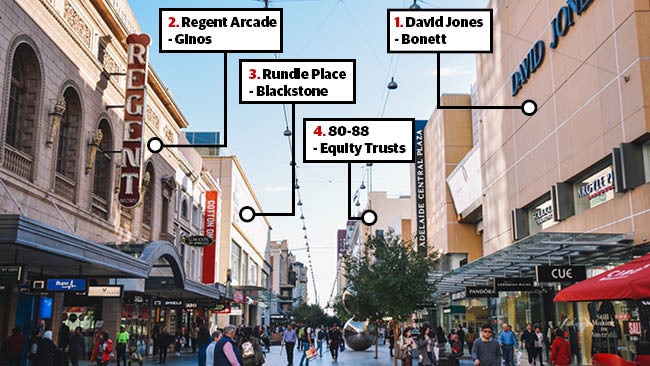

Paramount Browns’ Brown family, Olympic Industries’ Karytinos family and Burns for Blinds’ Sims family are also Mall property owners, while Regent Arcade is owned by the Ginos family, which has spearheaded the revival of the Leigh and Peel street laneways precinct in recent years.

The property empires of the Roche, Polites and Makris families also extend to Rundle Mall, including the grand, heritage-listed home of Bailey Nelson and the City Cross arcade.

Meanwhile, a syndicate of local investors led by developer Pep Rocca is investing in a multimillion-dollar upgrade of the Citi Centre building, which will welcome a new Romeo’s Foodland later this year.

SATELLITE VIEW

JLL head of sales and investments Roger Klem says local ownership swelled after 2000, when foreign property owners cashed in on rising property values.

“Purchaser groups have changed over time,” he said.

“Melbourne and Sydney based investors, well aware of the strength of high streets in those cities, were the major acquirers in the 1980s, with many of these families having interests in the fashion industry.

“With the high interest rate environment that saw a decline in property values around 1990, a significant wave of Singaporean buyers arrived, acquiring distressed assets and major properties.

“A decade later many of these Asian based owners capitalised on the growth in values and commenced the sell down, with investment generally coming from the local Adelaide investor market.”

While local families control the majority of Rundle Mall’s prime real estate, interstate investors control more than a third, or 24 of the properties surveyed.

Many are members of Melbourne and Sydney’s Jewish communities, with family links to the garment trade that flourished in those cities after World War II.

Others include Melbourne’s De Lutis family, which founded Westco Jeans and now oversees a national property portfolio worth more than $500 million, prominent Fremantle developer Gerard O’Brien and Precision Group rich-lister Shaun Bonett.

Foreign ownership in the Mall is limited to just four properties, including the Myer Centre, which was acquired by Singapore’s Starhill Global REIT for $288 million in 2015.

Despite land values reaching up to $25,000 per square metre in the Mall, Mr Klem expects more investment from local families looking to build wealth for future generations.

“Commercial properties along Rundle Mall are considered to possess some of the highest trophy value, but remain relatively affordable,” he said.

“Sales in any given year are very tight — generally just one or two properties transacting — with many remaining in the same family ownership for the better part of 50 years.

“In the last five years nearly all acquisitions have been made by just one or two families, with most purchasers growing their Rundle Mall portfolios and now owning multiple assets in the strip.

“But the financial returns are so low that it is clear families are acquiring properties on Rundle Mall for multi-generational wealth creation rather than for any immediate return.”

According to figures from property group CBRE, Rundle Mall property attracts average annual rent of around $3000 per square metre, but for premium sites that can rise to more than $5000.

As rents continue to rise, CBRE manager Julie Thomas expects the mix of tenants to evolve, with national fashion brands making way for international chains seeking entry into Adelaide’s retail landscape.

“Traditionally dominated by national fashion brands, prime sites within Rundle Mall are now heavily dominated and hotly contested by new international brands to the Adelaide market, who will pay the rent to secure the rare frontages and prime sites,” she said.

“We are seeing heightened interest from luxury brands off the back of major international tourist investment like the Riverbank, Adelaide Casino and Adelaide Airport expansions, combined with major hotel investment.

“There is certainly no lack of demand from internationals keen to enter the Adelaide market, but the issue is catering for the large frontages and ground floor area requirements of these brands.”

One international brand set to launch in Rundle Mall later this year is Swedish fashion giant H&M, which is anchoring a $40 million upgrade of Weinert Group’s Rundle Mall Plaza

The Weinert family took over a portfolio of Rundle Mall property from Funds SA in the late 1990s, when it saw an opportunity to breathe new life into the strip’s ageing property.

That included the former David Jones department store, which the Weinerts transformed and reopened as an integrated retail and office building in 2002.

Weinert Group executive director Peter Weinert says continued building upgrades and investment are crucial to remaining relevant in a fast-changing retail environment.

“To attract other international brands to Rundle Mall, landlords need to be prepared to spend money to upgrade buildings and offer competitive rents,” he said.

“We need to continue to innovate our offerings to better suit the needs of contemporary retail.

“With the rise of online shopping, customers are looking for experiential retail from bricks and mortar businesses, so precincts like Rundle Mall need to foster this to remain competitive.

“Developments that set new retail standards, like Rundle Mall Plaza, will also assist in promoting the destination to other international brands.”

Property Council SA executive director Daniel Gannon says more can be done to encourage building owners to invest in their properties.

“Adelaide’s building ownership market is uniquely Adelaide, which presents its own deep strengths and occasional challenges,” he said.

“Given the age profile of some buildings in Rundle Mall, compliance aspects can have a negative impact on rejuvenation before landlords even consider cosmetic upgrades or tenant specific requirements.

“While title boundaries and current ownership structures will prevent changes to frontages, what we can do is look at development controls to allow buildings to be redeveloped in a timely and cost effective manner so that creative and modern retail spaces can be designed and built.”

Despite the challenges, Rundle Mall Management Authority acting general manager Kate Fuss expects the precinct to continue to attract major investment on the back of stronger student and tourist visitation.

“The Rundle Mall precinct is regarded as the heart of Adelaide — an important social, economic and cultural hub,” she said.

“These factors make it one of the most visited places in South Australia, with more than 400,000 people visiting the Mall each week.

“Over the past five years, the City of Adelaide has granted planning approval to $287 million in developments in the precinct, and from our discussions with property owners, we expect that pattern to continue in the years ahead, as shown by news last month of a proposal to build student accommodation in Twin St.”