‘We needed Hayne royal commission to help us transform,’ says ANZ CEO Shayne Elliott

For the big banks the experience of going through the royal commission was harrowing, but they believe they are ultimately better for it.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

In the weeks leading up to his appearance at the Hayne financial services royal commission, the then newish ANZ chief executive took in some unusual footage.

Shayne Elliott had already undertaken a deep dive into the past decade of his bank’s dealings with customers. But as homework he screened dozens of parliamentary hearings covering all kinds of topics, be it business or bureaucracy. The tapes even included media mogul Kerry Packer’s infamous appearance at a tax inquiry in Canberra in 1991.

It was all to get a sense of what it was like to face a grilling. But nothing could prepare Elliott, a highly experienced global banking boss, when he walked past TV cameras into Melbourne’s Federal Court in November 2018 for a two-day stint on the witness stand.

“It was pretty harrowing,” Elliott recalls. “It’s not something that many of us had any experience with.”

Elliott was speaking on the five-year anniversary of the landmark financial services royal commission into banking and financial services. After a year of drama-filled hearings overseen by former high court judge Kenneth Hayne, the final report was delivered to the then Morrison government on February 1, 2019. The full three-volume report was released days later and set off a round of far-reaching shocks that are still being felt.

For the entire banking sector the royal commission represented a deeply confronting experience. For much of the 2000s, the big banks had developed a swagger. They were building up wealth management empires and expanding quickly offshore. The big four sailed through the Global Financial Crisis to become bigger and stronger and were generating super profits. But along the way they had lost sight of their customers, particularly when it came to wealth management.

Bank customers were seen to them to be sold more and more life insurance, superannuation or investments. Bank staff were becoming sales agents to generate more revenue and not to provide a service. There were 76 recommendations coming out of the final Hayne report, but much of the damage had already been done.

Many reputations had been shredded and several executive careers had brutally ended. The nation’s financial advice industry was exposed as a hungry money-making machine and the once-dominant global leaders such as AMP never recovered.

Since Hayne landed, banks have been put on a tighter leash with more regulation and intense executive scrutiny. They have also become more cautious, with some critical that they are now too risk-averse.

But in the wash-up, Elliott said it was the royal commission that the banking industry had to have.

“Undoubtedly, it was a good thing,” he tells The Australian. “It had a big influence on the way we’ve adopted a sense of purpose, the way we think about customers, the way we think about conduct.”

Elliott is one is of the two chief executives who remain in the role and lived through the Hayne grilling, the other being Commonwealth Bank’s Matt Comyn. The two bank bosses had only been appointed in the years before Hayne. In CBA’s case, Comyn took charge after the nation’s biggest bank was hit with one of the biggest scandals in its history. A monster money-laundering case, a board clean-out and a damning capability review from APRA had given Comyn a mandate to change. He had already started this by offloading CBA’s troubled wealth management businesses.

At ANZ, Elliott was at the beginning of his own cultural change program when Hayne kicked off. In the decade prior, ANZ had expanded rapidly in Asia, but was burning shareholder returns in a market where it was sub-scale. At home, it was complicated and had too many risky exposures. But without its own existential crisis like CBA had been going through, Hayne gave ANZ the wake-up call it needed.

“I had already been spending a lot of time thinking about the company, where it was, what needed to change to build a better bank and the environment around us. We’d already started a lot of that,” Elliott says.

“In many ways the royal commission was a blessing to us, and not in all ways but in some ways. It forced me to do a deep dive into our history that I probably wouldn’t have done otherwise.

“I wasn’t here when a lot of things happened … so the royal commission forced me to go back and look at all those things in excruciating detail.

“That was actually to our benefit, and because it coincided with the pivot on our strategy. We tried to use the royal commission to our advantage – I don’t mean that competitively, I just mean culturally and internally to say: ‘We’ve got this new strategy; we’re doing things that we need to do and we’ve got a royal commission. We put the two together. And that’s how we approached it all.

“Today, partly because of our strategy and partly because of the royal commission, ANZ is far simpler than it was.”

While Elliott came under intense grilling for ANZ’s past missteps with customers, he emerged from Hayne relatively unscathed. So too did CBA’s Comyn, who had shown he was determined to fix CBA, which was in a deeper hole.

Hayne concluded that the two chief executives were “well aware of the size and nature of the tasks that lie ahead”.

However, Hayne left more stinging criticism for National Australia Bank’s then leadership, including chief executive Andrew Thorburn and chair Ken Henry. Hayne concluded that he was not certain NAB was willing to accept the responsibility for deciding what was the right thing to do. Both Thorburn and Henry resigned days later.

Comyn declined to comment, but a CBA spokesman told The Australian: “The royal commission was a thorough examination of the industry which brought benefits for all parties – customers, communities, financial services institutions, government, regulators and policymakers.

“As challenging as the royal commission process was, CBA is a simpler, better bank as a result. We believe that is also reflected across the banking sector as a whole.”

Banking culture

Elliott’s grilling over two days was initially around the bank’s shortcomings among customers, particularly through its wealth business, where there were cases where it overcharged customers on fees; pre-approved credit card increases; and failure to pass on hundreds of millions of dollars in promised discounts on mortgages. He also came under questioning for ANZ dragging its feet on reporting a breach of its wealth licence and branch closures.

But then the second day was spent discussing banking culture, and how remuneration mix had influenced poor outcomes.

Indeed, Elliott was making changes in how staff were paid, with the CEO concerned that too many staff had sales and individual-based targets. This approach was flawed, Elliott said at the time. A large organisation like ANZ required far more team work and collaboration to achieved good outcomes. Since Hayne, sales-based commissions have largely been eliminated among all banks.

It was part of his appearance where Elliott said ANZ had suffered from a culture “that liked to hear good news” and it was a culture that promoted largely individualistic behaviour. “It valued stars, it rewarded individuals” and, led to this model of confederation at the cost of collaboration. Elliott wanted to move the culture to a point of “customer centricity, learning and simplicity”. The bank boss has since sold more than 50 businesses, including the problematic wealth operations which had been folded into IOOF – now renamed Insignia Financial.

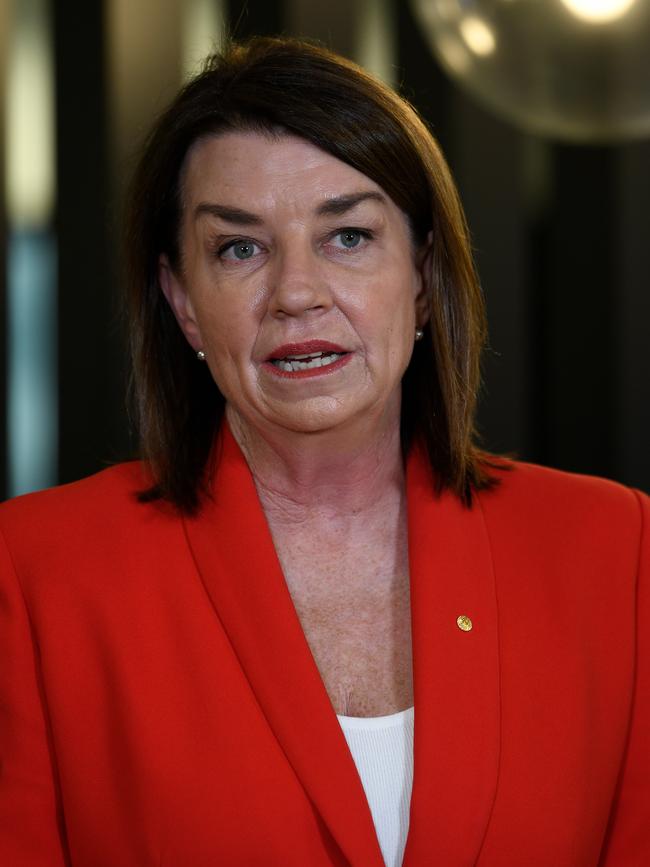

Australian Banking Association chief executive Anna Bligh – who also appeared on the Hayne witness stand – said that, since Hayne, banks had shaken up their cultures to benefit customers, and improved all parts of their governance.

This includes “abolishing sales commissions for staff to ensure that customers come first and mis-selling is a thing of the past”.

“The job of embedding a culture that prioritises customers interests is never complete. It is an ongoing task that banks continue to prioritise,” Bligh says.

Elliott says it is unfair to lump all the regulation that has come in recent years entirely on the royal commission. There had been a strong regulatory push already under way since the GFC to make banks safer.

However, where the royal commission was different is that it focused on conduct. In many ways it made ANZ more risk-averse and finding that balance is ongoing.

It also forced ANZ to embed Hayne-linked customer lessons at the very start of designing new products – be it credit cards or the new ANZ-Plus smartphone app.

“We are much more risk-averse as a company today than we were prior to the royal commission,” Elliott says.

For his part Elliott said the cultures of wealth and banking are incompatible. Wealth involves selling products that customers aren’t thinking about, while banking involves fulfilling a demand from customers – be it a deposit or a home loan. He has no intention of ANZ getting back into wealth management, but acknowledges there is a broader community challenge of people not having access to affordable financial advice.

John Lonsdale, who chairs bank regulator APRA, said Hayne was a continuation of three landmark reviews into the banking system over the decades. These were the Campbell Inquiry (1979), the Wallis Report (1997) and the Murray Review (2014) that each shaped the regulatory architecture.

“I think it made a stronger system and a system that has produced good community outcomes because it’s stronger,” Lonsdale said. Hayne also forced APRA to develop a stronger enforcement capability and focus deeper on potential governance issues, he adds.

Elliott acknowledges the royal commission has made banks approach today’s issues like fraud and scams differently.

It also played a role during the Covid pandemic four years ago when hundreds of billions of loans were “frozen” by all the banks when it looked as though a million Australians would lose their jobs overnight.

“In making the decision I don’t know if anybody in the room mentioned the term royal commission, but (the bank CEOs) were all very, very much more aware of our social licence than we would have been prior to Hayne.

“I’m certain that it played a factor – what’s the right thing to do when thinking about our conduct over the long term.”

johnstone@theaustralian.com.au

More Coverage

Originally published as ‘We needed Hayne royal commission to help us transform,’ says ANZ CEO Shayne Elliott