Ten’s bid for AFL broadcast rights hampered by poor ratings

Ten’s audacious pitch for the broadcast rights to the AFL comes as the network’s existing catalogue of live sports has recorded a dramatic ratings slump over the past few months.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Ten’s audacious pitch for the broadcast rights to the AFL – the most lucrative media sports deal in Australia – comes as the network’s existing catalogue of live sports has recorded a dramatic, across-the-board ratings slump over the past few months.

Ten’s bold bid for the AFL rights would see home-and-away and finals matches spread across its free-to-air channel and its streaming partner Paramount+ from the beginning of the 2025 season.

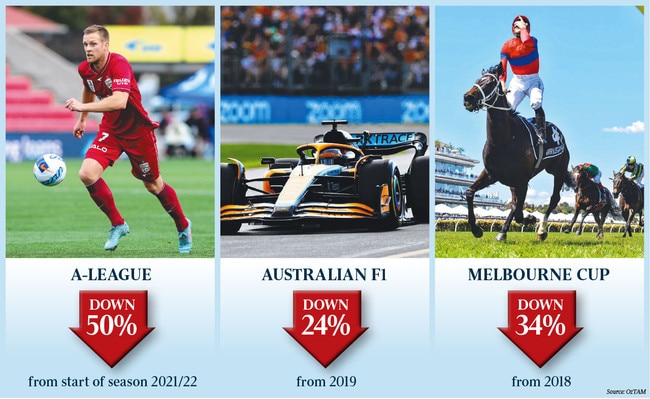

But the network’s push to wrest the contract away from current rights holders Foxtel (majority-owned by News Corp, publisher of The Australian) and Seven could be compromised by its diminishing audiences for its coverage of the A-League soccer, the Australian Formula One Grand Prix, and the Melbourne Cup. Foxtel and Seven have shared the AFL broadcast rights for the past decade, with their current deal due to expire in 2024.

In 2015, Seven, Foxtel and Telstra signed a shared, six-year $2.508bn deal for AFL broadcast rights, which was extended to 2024 with a two-year $946m agreement.

AFL chief executive Gillon McLachlan is looking to finalise the code’s next TV rights deal before he vacates his role at the end of this season. The AFL boss met Ten’s co-chief executives Beverley McGarvey and Jarrod Villani in the US a fortnight ago, where it is understood the future of the AFL rights was discussed.

Ten executives are said to be desperate to add a top-tier sport to their content slate, given the other Australian commercial networks and pay-TV operators share the rights to the so-called big four – AFL, NRL, cricket and tennis. But Ten’s recent returns on its investment in live sports could give the AFL pause for thought.

In the first year of Ten’s five-year, $200m deal with the A-League and W-League, the sport’s ratings have tanked.

The regular season’s matches have averaged just 86,000 viewers nationally, and 65,000 into the lucrative metro markets, according to ratings agency OzTAM.

Such numbers not only put soccer’s television ratings well behind those recorded by the AFL and NRL, but they also lag those of Super Rugby, Super Netball, AFLW and the WBBL.

Ten’s broadcast of the Australian FI Grand Prix last month was also a ratings disappointment for the network, with the national TV audience down 24 per cent against the previous race in 2019, and down 33 per cent in the key 25-54 demographic, according to OzTAM. Ratings for Ten’s coverage of the Melbourne Cup have also fallen steadily since 2018.

A Paramount spokesman defended the network’s ratings for the A-Leagues (men’s and women’s competitions).

“We are really happy with the direction the A-Leagues is headed … numbers for football on Paramount+ have been strong and matches that are livestreamed on 10 Play are performing well. We are committed to the game and are confident that TV audiences will only continue to grow.”

As for the bid by Ten-Paramount for the AFL rights, the spokesman said: “Paramount is in a unique position both domestically and globally with platforms including Network 10’s free-to-air channels and BVOD service 10 Play, and the world’s fastest growing streaming service, Paramount+, and is perfectly poised to bid for broadcast rights for AFL.”

Patrick Delany, chief executive of Foxtel, said the streaming-led company was well-placed to renew its rights deal with the AFL.

“We have been the AFL’s partner through the development of the national competition and the continuing growth of the game’s popularity,” he said. “We bring something unique to the AFL – the scale of our sports platform, with 2.4 million sports subscribers and growing, the power of Kayo Sports and the unrivalled quality of Fox Sports production and shows. It positions us well in the renewal process.”

Seven is also intending to extend its existing broadcast deal with the AFL. Earlier this month, Seven chief executive James Warburton told The Australian: “We have a great relationship with the AFL. We’ve been talking to them for a while.

“We’ll be sensible. It’s economics, not ego.”

Originally published as Ten’s bid for AFL broadcast rights hampered by poor ratings