Trump’s wooing of Greenland shines spotlight on awakening resource giant

US President-elect Donald Trump’s interest in Greenland has brought its resource bounty into the limelight.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Interest in Greenland’s resource potential has grown following US President-elect Donald Trump's call for the US to buy the island

Greenland is rich in critical minerals such as rare earths as well as potential for oil and gas

It is well positioned to provide secure supplies to the West

US President-elect Donald Trump is well known for making big calls that dominate headlines and his latest calling for the US to buy Greenland – amongst other things – is no different.

With less than a week to go before taking office once again, Trump said the US needs Greenland “for national security purposes” and went so far as to refuse ruling out the use of military force to do so.

Unsurprisingly, the call was quickly rejected by Prime Minister Múte Egede of the Danish autonomous territory.

It isn’t the first time that Trump has called for the US to buy Greenland, having flagged the same thing during his first term, though that too was similarly rebuffed by Egede.

While Greenland already plays host to US military installations – including its ballistic missile early-warning system and being able to expand these is likely attractive, the president-elect’s renewed interest might have well been driven by the increasing realisation that relying on China for the supply of rare earths – especially in light of its recent moves to restrict exports – is a BAD THING©.

Happily, the giant island – the world’s largest actually – is rich in resources including rare earths and is in the perfect position to supply the US, so having it as part of the US rather than held by a friendly country undoubtedly plays some part in Trump's call.

Greenland stepping into the spotlight

While it is hugely unlikely that Trump will get his wish, it has generated a great deal of interest in Greenland and its resource endowment.

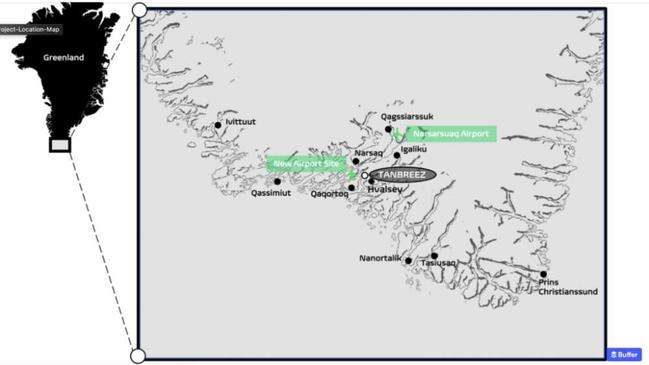

Speaking to Stockhead, Tony Sage, European Lithium (ASX:EUR) executive chairman and Nasdaq-listed Critical Minerals Corp (CRML) executive chairman, said the increased attention was exciting for CRML, which currently owns a 42% interest in the giant Tanbreez REE project in Greenland.

Tanbreez has seen a significant amount of activity, enough for the definition of a massive resource of 4.7 billion tonnes hosting a contained REE inventory of some 28.2Mt.

REEs are valued for a range of applications including aerospace alloys and permanent magnets used in electric vehicle motors and wind turbines.

The project also hosts a significant amount of niobium – another critical mineral used to make high-strength steel alloys and more recently as a superconductor material in battery applications – and if initial results from recent CRML drilling is any indication, the potential to contain gallium, which is used for the production of semiconductors.

This drilling had returned what Sage described as the highest grade hit of gallium in the last five years from anywhere.

The latter comes as a (no doubt welcome) surprise to Tanbreez founder and now principal geologist Greg Barnes who has been exploring in Greenland for some 22 years now and was instrumental in getting the territory’s resource bounty into Trump’s crosshairs.

Should this be proven, it just adds further to the importance of Tanbreez given its location in the US’ backyard and recent Chinese export bans on gallium and other critical metals.

A positive development for Greenland

“China controls the bulk of supply of these critical metals and with Trump’s policy of tariffs, the only way they can retaliate is stopping exports of these crucial minerals for the defence industries and national security, and the US is big on both of those,” Sage said.

“It is extremely important that the West gets a supply of REEs from somewhere else.”

That supply could well come from Tanbreez and Greenland with Sage saying that the combination of recent events has put CRML in the limelight and that it was a positive development for both the company and Greenland in the long-run.

“That’s how it gets to the hearts and minds of people,” he added.

This strong interest also validates CRML’s move to acquire the project.

“When I decided to buy this asset for CRML, we obviously looked at all the meetings that Greg had with the US State Department, the EU, and we figured that at some point in time, this assets would become extremely valuable,” Sage said.

“Five months after we bought it, it has become extremely important and more valuable because Trump has put everyone’s eyeball on this island.”

He adds that CRML has a very good relationship with the Greenland government and can actually start mining at any time given that it already has a mining licence in place.

All this is also a positive for EUR, which despite holding a 73% stake in ~$1.1bn capitalised CRML only has a market capitalisation of ~$79.5m despite its share price more than doubling from 2.4c before the news broke to the current 5.9c.

“CRML is trading at roughly $1bn, so we should trade around $700m maybe $600m, we are trading at $78m. The arbitrage opportunities are huge,” Sage pointed out.

“People are looking at Greenland, CRML, they are looking at the shareholder base of CRML and they are noticing that EUR owns 73%.

“At some point there’s going to be arbitration funds coming in and start buying the stock. The only issue that most investors see is – because we own so much of CRML – it is thinly traded.”

He added that EUR always planned to sell down its stake in CRML to less than 40%.

CRML plans to finalise further drilling between April and June and will concurrently move to finish the scoping study that Barnes started in 2017.

This is expected to be completed in Q3 2025 with Sage expressing his belief that the company could get the mine up and operating within 18 months of completing the study.

He adds that this has always been the plan and that the only thing that the recent developments has changed is the increased interest in the project.

Tanbreez project founder and long-time owner Barnes expressed excitement about his collaboration with CRML, saying that development efforts to date had shown significant promise and that he was confident in the continued success of the project.

He also highlighted the importance of advancing the company’s plans, saying the project will play a crucial role in supporting the West’s energy and national security goals.

Not the only rodeo in town

While CRML’s Tanbreez is certainly drawing attention, it is far from being the only project that has been explored in Greenland.

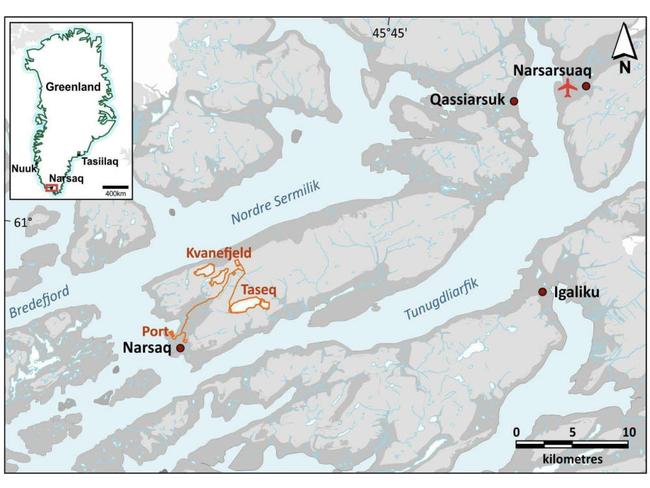

Up until recently, Energy Transition Minerals (ASX:ETM) has also been progressing its Kvanefjeld project that has a contained resource of 11.1Mt of REEs and 593Mlb of uranium.

The company – then known as Greenland Minerals – completed a feasibility study back in 2015 but was refused an exploitation license after the government passed the Uranium Act in 2021, which prohibits exploration for production of uranium above a 100ppm threshold – well below Kvanefjeld’s >300ppm.

Arbitration was started after the company’s revised exploitation licence application, which excluded the extraction of uranium and other radioactive elements, was also rejected.

Further legal action has since been taken by the company against the Greenland and Danish governments.

To improve its engagement with the Greenlandic community, key stakeholders and government, ETM has engaged Julie Bishop & Partners for the provision of strategic advice, stakeholder engagement and government relations services.

Represented by Julie Bishop, who served as Australia’s Minister for Foreign Affairs between 2013 and 2018, the boutique advisory firm will provide the company with support and counsel to negotiate a win-win solution and address challenges faced in advancing Kvanefjeld towards development.

Its management team will also visit Greenland in early February 2025 to engage with members of the government, local interests and media outlets.

While Kvanefjeld is unlikely to progress while until the issues are resolved, its potential helps to highlight the significant resource potential that is present in Greenland and why the guns are afiring.

At Stockhead, we tell it like it is. While European Lithium is a Stockhead advertiser, it did not sponsor this article.

Originally published as Trump’s wooing of Greenland shines spotlight on awakening resource giant