The Ethical Investor: Australia’s first global defence ETF hits the ASX – how ESG is it?

Australia’s first global defence ETF, VanEck DFND, launched on the ASX this week. Should ethical investors buy?

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

VanEck launches Australia's first global defence ETF

Defence ETFs gain traction as global spending surges

We look at how this new ETF stacks up with regards to ESG credentials

On Thursday, Australia saw its first ever global defence ETF (exchange-traded fund), after VanEck launched the VanEck Global Defence ETF (ASX: DFND) on the ASX.

This ETF will give investors access to a range of leading defence companies – mostly US stocks – covering sectors including aerospace, communications, security software and training.

As global geopolitical tensions rise, investors are increasingly concerned about how these changes affect government spending and investment strategies.

A recent report from the Stockholm International Peace Research Institute (SIPRI) revealed that global military spending surged by 7% to US$2.43 trillion in 2023, the largest annual increase since 2009. This trend is expected to continue, with spending projected to hit US$3.1 trillion by 2030.

“Unfortunately, the world has changed since the days of celebrating the peace dividend,” said VanEck’s CEO for Asia Pacific, Arian Neiron.

“Where countries used to extol the economic benefits of reduced defence spending, they’re ramping up military expenditure."

Investors are adapting to the likely reality that this will keep rising in the years ahead, Neiron added.

The DFND ETF will build on VanEck’s success in Europe, where the fundie launched a similar fund in 2023 that has attracted significant interest.

Neiron said that defence companies offer a unique investment opportunity.

“Global defence companies benefit from a unique investment complex. Demand is driven by structural growth drivers and cashflows are typically secured by long-term government mandates."

"This can be a strategic allocation for investors, providing a different form of equity risk management.”

Neiron added that the defence industry has historically been at the forefront of technological development and advancement.

“This sector generally places a greater emphasis on research and development, leading to numerous innovations that have filtered through to mainstream applications such as GPS navigation, epinephrine autoinjectors (better known as EpiPens), the internet, and super glue,” he said.

The launch of DFND brings VanEck’s total number of ETFs on the ASX to 43.

Can defence stocks fit into an ethical investor’s portfolio?

Traditionally, defence stocks have been avoided due to ethical concerns about their role in warfare.

But they're getting more attention from ESG-focused investors recently, thanks to the ongoing conflicts in Ukraine and the Middle East.

With government defence budgets rising and industry profits booming, some fund managers are now willing to include them in sustainable portfolios, though this remains a hotly debated topic.

Swedish defence firm Saab, for instance, has seen a huge spike in shareholder interest since the Ukraine war began, but not all investors are ready to back defence companies, citing moral reservations.

This conversation is evolving, with some arguing that investing in defence is a necessary part of safeguarding freedom and security.

“The debate about whether defence companies could be considered ethical investments – or at least not unethical – is changing,” said VanEck’s Europe CEO, Martijn Rozemuller.

“For some, the matter may remain black and white: companies that make weapons for killing will never be acceptable investments.

“For others, though, there are shades of grey and it looks like defence stocks are likely to become increasingly sustainable.”

How the DFND stacks up on the ESG scale

The VanEck Global Defence ETF charges a management fee of 0.65% per annum.

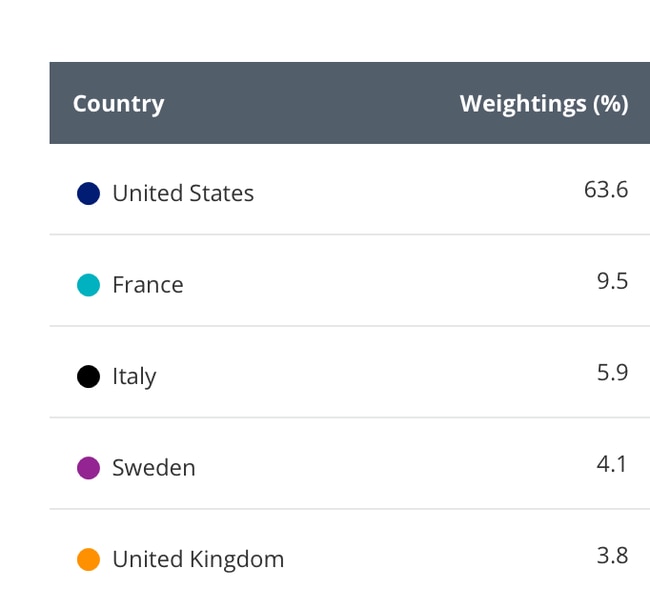

In terms of country allocations, the fund invests mostly in the US, France and Italy.

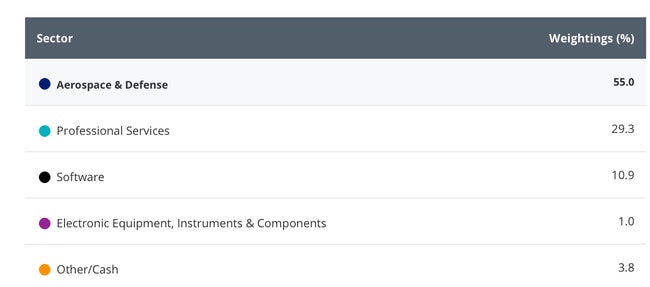

Sector wise, the fund invests mostly in Aerospace and Defence, while the rest is allocated to adjacent defence sectors such as Services, Software and Equipments.

ESG credentials of the portfolio

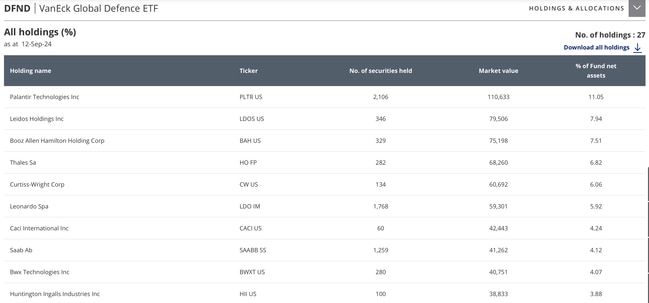

As of September 12, the fund is made of these positions:

Palantir Technologies (NYSE: PLTR)

The fund’s biggest position right now is in Palantir, a US$77 billion data analytics and software firm, which is all about big data solutions.

Based in Denver, Colorado, the company’s software is the number one go-to for both government and defence agencies.

For counter-terrorism, Palantir’s tools help sift through massive amounts of data to pinpoint terrorist activities and threats.

Palantir is also heavily involved in military operations, providing data analysis tools that aid in executing missions for armed forces.

On top of that, the tech plays a crucial role in security and surveillance, being used to monitor everything from cybersecurity to physical security.

Peter Thiel, co-founder of Paypal and an early investor in Facebook, is also the co-founder of Palantir and has served as the Chairman of the Board since 2003.

Palantir is set to be added added to the S&P 500 index on September 23. The news sparked a 20% rise in PLTR’s stock price over five consecutive trading sessions.

However, Palantir has had its share of ethical controversies, particularly over how its technology is used by government agencies.

For instance, Palantir's technology has been utilised by the US government agency ICE, which has faced criticism for its treatment of migrants.

Additionally, the company’s predictive policing tools have raised privacy concerns due to its extensive data collection. Critics argue that Palantir has not done enough to mitigate these issues.

Leidos Holdings (NYSE:LDOS)

Leidos is a US$20 billion market-capped company specialising in defence, aviation, and biomedical research.

Based in Reston, Virginia, it provides critical support to military and intelligence agencies, including cybersecurity solutions, surveillance systems, and counterterrorism efforts.

In aviation, the company provides technology to support air-traffic control and management, and in biomedical research, the firm develops systems to track public health data.

Just this week, Leidos Australia was contracted by Lockheed Martin Australia to provide software development, cybersecurity, and validation services for Project Air 6500.

Project Air 6500 provides the Australian Defence Force (ADF) with a Joint Air Battle Management System (JABMS) that will form the architecture at the core of the ADF's future Integrated Air and Missile Defence capability.

Leidos is also doing a lot of initiatives in the local community. Earlier this year, the company teamed up with Carma to plant 1,000 trees across the UK, which helps it move toward its Net Zero goal by 2040.

In addition, Leidos is partnering with EVERFI to improve mental health literacy among teenagers in Maryland and West Virginia through a digital course called Understanding Mental Wellness.

This initiative addresses the growing mental health crisis among teens.

Booz Allen Hamilton (NYSE:BAH)

Booz Allen Hamilton, headquartered in McLean, Virginia, is a management and technology consulting firm specialising in providing services to government agencies and large corporations.

The company offers expertise in areas such as strategy, digital transformation, data analytics, engineering, and cybersecurity.

The US$20 billion market-capped company was deeply involved in the creation of the US National Security Agency’s (NSA) "Tailored Access Operations" (TAO) unit, which is known for its sophisticated cyber operations and capabilities.

In March this year, Booz Allen Hamilton was recognised as one of the World’s Most Ethical Companies for the fifth consecutive year.

Out of 136 global honourees from 20 countries, Booz Allen was noted for its dedication to ethical practices amid ever-evolving technology and complex global issues.

Now read: ASX Defence Stocks Part 1: Who’s fighting who, and who’s out at sea?

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decision.

Originally published as The Ethical Investor: Australia’s first global defence ETF hits the ASX – how ESG is it?