Resources Top 5: Just about all ressie commodities have a winner today

Rare earths, copper, iron ore, uranium and graphite were all star turns in a bright start to Monday for resources stocks. Here's our lunchtime fab five.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Australian Rare Earths’ Koppamurra resource increases 27% to 236Mt at 748ppm TREO

Alderan eyes 28% copper at New Year prospect

Hazer completes 360 hours of continuous graphite production from CDP plant

Here are the biggest small cap resources winners in morning trade, Monday, September 30. Prices accurate at time of writing.

Australian Rare Earths (ASX:AR3)

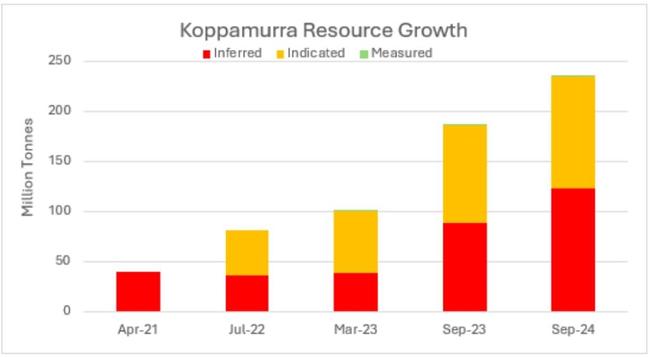

A resource expansion at Koppamurra has sent AR3 shares flying on Monday, expanding the resource by 27% up to 236Mt, which includes a 70% upgrade of its higher-grade core, now 68Mt at >1000ppm.

That’s some very decent grades and puts South Australia and Victoria (it cuts through the border) on the radar to contain its very own world-class ionic clay-hosted REE deposit, which AR3 has been proving up for the past few years.

The results further back up the company’s bold theory that Koppamurra is a discovery of “multi-generational significance”.

It’s gearing towards an accelerated timeline for developing the resource and now has a large swathe of tonnes in the higher confidence indicated category that makes up just 2% of its massive 7700km2 landholding in the region.

Infill drilling has extended borders to the north and south of the current REE mineralisation and AR3 reckons it can continue to grow the resource, which is open to both the north and south.

“The updated MRE has underscored the significant potential for a shallow, higher-grade subset of the broader rare earth deposit,” AR3 MD and CEO Travis Beinke said.

“The additional drilling, along with ongoing improvements to the resource model provide us with growing confidence in the consistency of the mineralisation.”

Shares in the now nearly $15m market-capped rare earth hunter have gone gangbusters today, rising >43% to trade at 13.5c at time of writing.

Alderan Resources (ASX:AL8)

Early doors exploration minnow AL8 must be chuffed with its decision to kick off a Stage 1 drill program at its Cactus copper-gold project in Utah.

Targeting the New Years prospect, the junior has hit into a thick 30m copper zone with spot grades using a pXRF reader that show up to 28% copper and visible oxide mineralisation from surface down to a depth of nearly 100m in two out of the three Stage 1 holes.

While pXRF readers are good initial indicators of mineralisation, they are more of a suggestion of it, with drill cores requiring to be assayed for confirmation.

That being said, there’s a reason the handheld mineralisation analysers are widely used to get preliminary readings for potential deposits.

It comes on the back of assays of up to 2.32% copper were found from historical holes – which the junior took as positive signs for the prospect as it looks to verify the red metal mineralisation intersected between 1964 and 2002.

The prospect has a coincident magnetic low anomaly and sits within the same northwest-southeast magnetic low corridor as the historical Cactus and Comet copper-gold mines.

AL8 MD Scott Caithness said the 30m copper mineralised intersection in Alderan’s hole NY2024-DDH2 from 10m downhole appears to broadly correlate and extend the historical hole NY-6 intersection – which was 13.7m at 2.32% copper within 19.8m at 1.67% copper from 22.9m downhole.

“Although pXRF assays are not yet available, based on visuals hole NY2024-DDH3 appears to have intersected copper mineralisation to a depth of around 99m from surface – much deeper than historical hole NY-2,” said Caithness.

Burley Minerals (ASX:BUR)

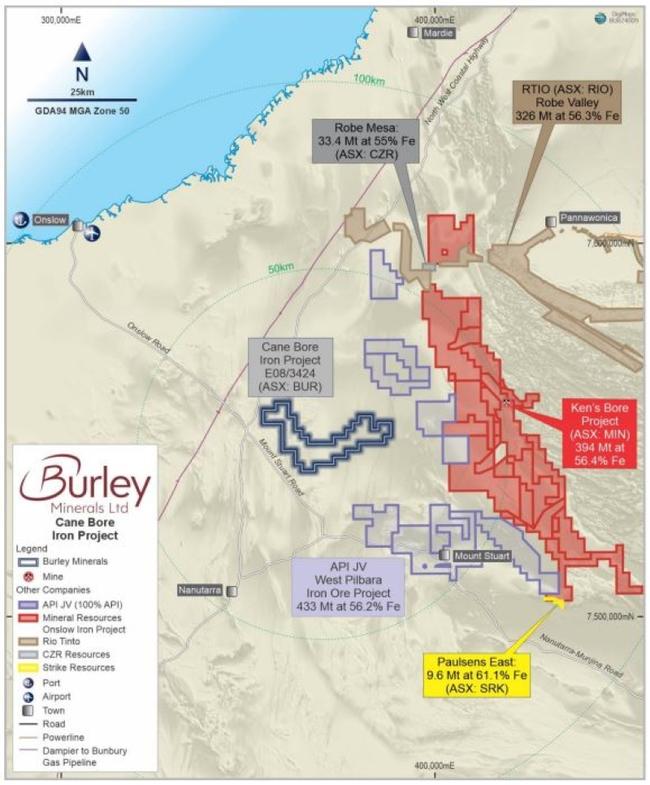

BUR has had its Cane Bore iron ore project exploration licence granted after recently discovering >30km of remnant Channel Iron Deposits (CID) identified through historical samples showing up to 55% Fe.

"This is a major milestone for Burley as Cane Bore has the potential for significant CID-style iron resources, rivalling its neighbours in the local region," BUR MD and CEO Stewart McCallion said.

"Our geologists are getting ready to mobilise to site and complete mapping and surface sampling over that sits up to 20m above the surrounding terrain."

CID deposits are a major source of cheap iron ore that is close to the surface and can be calcined into 63%+ iron and are mined nearby at Rio Tinto (ASX:RIO) 326Mt at 56.3% Fe Mesa A and CZR Resources (ASX:CZR) 33.4Mt at 55% Fe Robe Valley in the Pilbara’s Robe River region.

Another two ASX juniors are nearby – Leeuwin Metals (ASX:LM1) and Strike Resources (ASX:SRK) – have similar CID iron values across their West Pilbara projects.

SRK has already proven up a 9.6Mt at 61.6% Fe resources at Paulsens East, with both CZR and SRK looking to sell their Pilbara assets to Chinese businesses keen on CID red dirt.

Forging up the charts, iron ore hunter BUR's stock price has jumped a further 30%, rising from 4.4c on September 24 to trade at 6.9c a share.

Odessa Minerals (ASX:ODE)

ODE shares have doubled on news the company has received the nod for $1.1m through a share placement to continue exploration and drilling of its Lyndon uranium project, where impressive grades of up to 6,612ppm U3O8 were discovered.

Odessa completed a heritage survey last month across the tenure in the Carnarvon Basin previously conducted detailed airborne magnetics and radiometrics over a large part of the project area.

Results showed multi-commodity prospectivity for lithium-pegmatites, uranium, REEs, intrusive nickel-copper-PGE, orogenic gold and sedimentary-hosted copper-lead-zinc mineralisation and it looks like yellowcake has been plucked out of the pack to be targeted.

Drilling across an identified 8km trend by Newera Uranium in 2008 and 2009 was confirmed and has since had no further drill testing.

Shares in the less-than-penny stock are up 100%, trading at 0.4c.

Hazer Group (ASX:HZR)

HZR has completed >360 hours of continuous operation at its CDP graphite plant, a milestone achievement that comes on the back of recently shipping 105kg of graphite to FortisBC to be used on commissioning their small-scale test unit in November as part of the project development plan.

FortisBC’s test rig has completed construction and will be installed on-site in Q4 for testing in early 2025 ahead of a final investment decision.

Hazer's climate tech enables the production of clean and economically competitive hydrogen and high-quality graphite, using a natural gas (or biogas) feedstock and iron ore as the process catalyst.

While its 'HAZER' process is essentially a variation of methane pyrolysis, which uses heat to break down methane into hydrogen and a solid carbon, the company is considerably ahead of its competitors with some 17 years of work and $110m invested into its development.

“We continue to demonstrate Hazer’s technology is at the forefront of innovation with excellent test program performance, which is supporting our commercialisation strategy," HZR CEO Glenn Corrie said.

"These strong operational milestones are a result of many years of technology development and scale-up success and continue to de-risk and demonstrate that Hazer’s technology is fast approaching commercial readiness."

Shares are up 22.4% at time of writing to trade for 35.5c.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Resources Top 5: Just about all ressie commodities have a winner today