Resources Top 5: Arafura’s Canberra cash and a new gold mine moves one step closer

Arafura Rare Earths has been earmarked as the first mine investment for a $15bn federal fund; WGR edging closer to gold producer status.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Arafura nabs more government support for Nolans rare earths project

Western Gold Resources selects contractor for Gold Duke mine

St George Mining in niobium MoU with Chinese steelmaker

Your standout small cap resources stocks on Wednesday, January 15, 2025.

ARAFURA RARE EARTHS (ASX:ARU)

Gina Rinehart-backed Arafura's Nolans project has sat in development hell for years, with volatile rare earths pricing and the challenges of funding a multi-billion dollar project in the dead centre of Australia.

The site would produce around 4% of the world's supply of neodymium and praseodymium from 2032 – 4440t annually for 38 years – presenting a key weapon in the fight to detach western automakers, electronics and renewables manufacturers from China's supply chain.

But if there's one thing we know, it's that the federal government is hellbent on making the rare earths industry a thing in Australia. Check its capitulation to extend a loan by $400 million after Iluka Resources (ASX:ILU) blew its $1.2 billion budget out to up to $1.8bn for the Eneabba refinery in WA.

Australian government commitments to Arafura's Nolans were already at around $800 million. But a newly established $15bn body called the National Reconstruction Fund Corporation has today announced $200m in conditional, unsecured convertible notes, extending taxpayer support for the development near Alice Springs in the NT even further.

It's the first investment directly into a mining operations by the NRFC, which also tips investments into technology, minerals processing, agriculture, renewables, medical science and defence capability among other STEM-my activities.

Importantly, the NRFC can convert its debt into equity at a 40 per cent premium to the reference price set by a future equity raising.

“I am immensely proud to confirm a A$200 million commitment from the NRFC, which demonstrates the strategic and economic importance of Nolans to the Northern Territory, and Australia more broadly," ARU MD Darryl Cuzzubbo said.

"This is indeed a significant day for Arafura and the Nolans Project. This deal has been months in the making and de-risks the equity funding required for the development of Nolans."

Canaccord Genuity analyst Reg Spencer said, based on the broker's modelling, around $900m of funding would be required from equity investors, representing a 60-40 split of debt to equity with contributions from commercial banks and other international credit agencies. The experience mining observer estimates around $2.8bn will be required to ensure working capital, financing costs and cost overruns are covered.

CG lifted its price target from 25c to 30c on the news of the NRFC funding with a spec buy label, more than double the company's current share price.

"Nolans remains a strategically critical project to Australia (long mine life at 38 years and large production capacity of 4.4ktpa NdPr oxides), noting we remain constructive on rare earths (US-China trade tensions, lack of new ex-China supply, recovery in key demand centres) as we move into 2025," Spencer said in a note to clients.

The Nolans project will support 600 construction and 350 operational jobs and be a supplier of critical magnet metal oxides to South Korea's Hyundai and Kia and wind turbine supplier Siemens Gamesa.

“Rare earth minerals are strategically important resources that are crucial to modern economies and the global transition to net zero," NRFC chair Martijn Wilder said.

"Arafura’s Nolans Project demonstrates the enormous contribution that Australia can make to the global supply of rare earth minerals and the considerable opportunities for Australia to add value to the raw materials that it mines.”

ARU shares were 18% higher at 12.15pm AEDT.

WESTERN GOLD RESOURCES (ASX:WGR)

Progressing a gold deposit to production is a canny if obvious move with gold prices trading around record highs, and experts tipping them to rise even further in 2025.

In Aussie dollar terms they're fetching around $4320/oz at the moment, around 30% higher over the past 12 months.

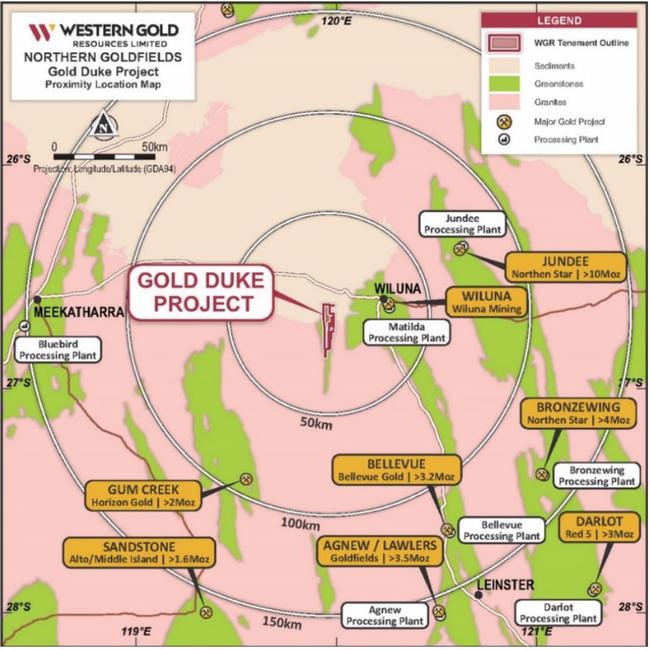

WGR is the latest junior looking to move swiftly into production, preparing a first stage at its Gold Duke project near Wiluna in WA that will deliver 34,000oz through the mining of 447,000t of ore at 2.55g/t.

The latest update, as the company looks to take Gold Duke through to 'shovel ready' status, is the selection of mining contractor SSH Group (ASX:SSH), which will manage mining services and haulage, with negotiations over the terms of the agreement to progress 'in due course'.

"The issuing of a notice to our preferred mining contractor, SSH Group, marks another significant milestone as we advance the Gold Duke Project toward 'shovel-ready' status," WGR MD Cullum Winn said.

"This achievement builds on recent milestones, including increased confidence in our Gold King deposit, excellent metallurgical test results3, and expanded mining proposal approvals for the Gold King deposit.

"These developments further strengthen our position in ongoing discussions with potential processing plants located within an economic distance of the Gold Duke Project."

There's a bit of water to go under the bridge here. WGR needs to execute an agreement to process its ore at a third party plant and make a final investment decision.

But the agreement will likely include a deferred payment facility proposed by SSH, meaning WGR will be able to preserve upfront costs and cover funding under the contract from cashflows once it's in operation.

A scoping study collated at a gold price of just $3500/oz, well below current levels, estimated a cash surplus after working capital costs and pre-mining capex of $38.1m, with the mine to cost just $2.1-2.5m to establish, delivering a massive internal rate of return of 617%.

Mining will run for 10 months once Gold Duke is established, centering on the Eagle, Emu, Golden Monarch and Gold King deposits, the latter of which was subsequently brought to a higher confidence level with 427,000t at 1.91g/t Au for 26.000oz including a maiden indicated resource of 251,000t at 2.02g/t Au for 16,000oz.

Gold Duke has a broader measured, indicated and inferred JORC 2012 resource estimate of 3.25Mt at 2.1g/t Au for 214,000oz and is surrounded by a host of processing plants, including Northern Star Resources' (ASX:NST) Jundee, the Wiluna mine, the mothballed Bronzewing mill and Westgold Resources' (ASX:WGX) Bluebird plant. WGX has already demonstrated its hunger for third party material at Bluebird, signing a deal to process ore from New Murchison Gold's Crown Prince deposit.

YANDAL RESOURCES (ASX:YRL)

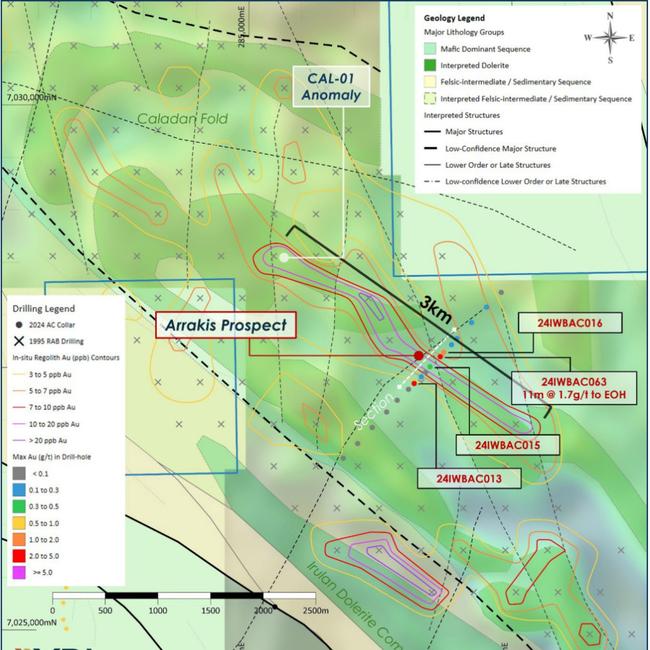

Not far up the road, YRL is moving higher on some shallow drill hits that point to a potential discovery just 18km north of Siona, a discovery near NST's Jundee mine that sent the stock soaring back to relevance with a hit of 78m at 1.2g/t Au in October last year.

Aircore drilling at the Caladan area returned 11m at 1.7g/t Au from 97m to the end of hole including 3m at 3.5g/t Au from 102m.

The prospect has been named Arrakis, with an RC rig at Siona meaning follow-up testing will be able to commence in short order. Diamond drilling is coming up at Siona as well.

Aircore drilling is cheap but has its limitations, typically good for shallower discoveries in oxidised material.

RC drilling goes deeper and works faster, and is more adept at penetrating harder fresh rock.

YRL has drilled 17 aircore holes for a total of 2688m for 2.3km along the Caladan Fold, an 8km long by 3km-wide structure that includes a more than 3km-long historic, low-level gold in regolith anomaly.

“This is an extremely satisfying result for Yandal and is the product of excellent work completed by the Exploration Team. The Caladan target area was only a concept six months ago," Yandal MD Chris Oorschot said.

"The re-capture and analysis of historic data identified a 3km long low-level geochemical anomaly under transported cover associated with the Caladan Fold axis. To have an intercept of this tenor after completing one line of first-pass air-core drilling within this large-scale geochemical anomaly is highly encouraging and may represent the emergence of a new greenfield discovery.

"We are very excited by these initial results and will look to complete follow-up drilling on the cleared air-core line as soon as possible, and more broadly, preparations are underway for a larger air-core program across the Caladan target area.”

The benefit of a discovery in Yandal's broader Ironstone Well-Barwidgee project is it doesn't need to be big enough to stand alone to deliver value. $20bn-capped Northern Star has shown its interest in paying handsomely for small deposits which it can plug into Jundee – evidenced in its $61m deal to acquire Strickland Metals' (ASX:STK) Millrose project in 2023.

ST GEORGE MINING (ASX:SGQ)

A deal to supply niobium to a top 20 global steelmaker has seen interest in SGQ flood in on Wednesday, with close to 37 million shares worth almost $1 million changing hands in its wake.

The MoU would see St George and Liaoning Gangda Group, a Chinese steel and heavy mine equipment manufacturer that produces 20Mt of steel products annually, potentially collaborate on the development of the Araxá project.

The high-grade niobium/rare earths project was picked up by St George last year and sits close to the world's largest and highest grade mine owned by dominant supplier CBMM. Now 70 years old, CBMM produces over 80% of the world's primary niobium, though major discoveries in recent years have opened the door for new entrants, likely welcomed by customers keen to sidestep the monopoly.

Liaoning Fangda is one such customer. The 16th most prolific steel producer by volume, it wants to expand capacity to 50Mtpa, something that could make it a top 5 player, with a big focus on niobium rich products used in high-strength applications like construction, bridges, ships, cars and yellow goods.

“The relationship with Fangda – through potential financial and technical support as well as mine development – is another key milestone in de-risking the Project," SGQ exec chair John Prineas said.

“The global niobium sector has only three primary producers – the global leader being CBMM, with its flagship project located immediately adjacent to the Araxá Project. With extensive near-surface niobium mineralisation already confirmed by historical drilling at the Araxá Project – including more than 500 intercepts of +1% Nb2O5 – as well as access to existing regional infrastructure, St George is continuing to position itself to be the next global player in niobium.

“St George’s ability to attract global giants like Fangda speaks volumes to the potential of the Araxá Project and also recognises the high-performance in-country management established by St George to drive project development."

The companies are aiming to negotiate a binding partnership agreement within nine months of signing Wednesday's MoU, with potential offtake terms to include exclusive rights for Fangda for 20% of niobium products for the project for up to ten years linked to market prices and a pre-payment loan facility.

Fangda is also looking into opportunities to apply niobium in lithium-ion batteries.

St George is expecting to complete the Araxá acquisition this quarter.

BEACON MINERALS (ASX:BCN)

The tiny WA gold miner produced 6861 ounces of gold in the December quarter, selling 6551oz at an average price of $4060/oz for receipts of $26.6m. Output rose 31%, outstripping guidance of 6500oz.

BCN, which owns the Jaurdi project, which includes a mill as well as the MacPhersons mine near Coolgardie, produced 5230oz in the September quarter.

Productivity is expected to step up further in the March quarter, with a night shift being introduced from February, lifting production for the current period to 7000-8000oz.

At Stockhead, we tell it like it is. While Western Gold Resources and St George Mining are Stockhead advertisers, they did not sponsor this article.

Originally published as Resources Top 5: Arafura’s Canberra cash and a new gold mine moves one step closer