Pure Hydrogen eyes off an IPO for a strategic spinout of its Australian gas assets

Pure Hydrogen’s proposed spin-off Eastern Gas will focus on developing its Windorah gas project and Project Venus coal seam gas play in Queensland.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Pure Hydrogen is spinning off its Australian natural gas assets into a new ASX-listed company

Eastern Gas will raise $8-10m to fund near-term work at the Windorah gas project and Project Venus in Queensland

Shareholders in PH2 will receive the company’s shareholding in Eastern Gas through an in-specie distribution

Special Report: Pure Hydrogen is spinning off its Australian natural gas assets into a new ASX-listed company to focus on the commercial rollout of its zero emissions vehicles and hydrogen infrastructure business.

The new company – Eastern Gas – will look to raise between $8m and $10m through an initial public offering to fund near-term works at its Windorah gas project in the Cooper Basin and Project Venus in the Walloon coal seam gas fairway.

The newly-listed entity will aim to advance development of its strategic gas resources at a time when the Australian east coast is facing the likelihood of gas supply shortages, with the Australian Energy Market Operator forecasting in its 2024 Gas Statement of Opportunities shortfalls on extreme peak demand days as early as 2025 and small seasonal supply shortages from 2026.

Pure Hydrogen (ASX:PH2) shareholders will retain exposure to these assets through a proposed initial in-specie distribution on an indicative basis of one Eastern Gas share for every five PH2 shares held.

PH2 managing director Scott Brown said the company has consistently assessed the strategic rationale for a demerger of its Australian gas assets after considering market conditions, given its stated strategy to advance the commercial rollout of zero emission vehicles, and hydrogen infrastructure and equipment.

“In that context, we are pleased to announce this planned spinout, which in our view reflects the robust outlook for natural gas as an important bridge fuel as part of the global energy transition, alongside the obvious potential for Eastern Gas to accelerate its exploration strategy with IPO funding as a separate listed entity,” Brown said.

“Through the IPO process, we intend for Pure Hydrogen shareholders to be given the opportunity to subscribe for shares in addition to the shares provided by their in-specie distribution. We look forward to providing additional updates in the near-term as the planned spin-out IPO process progresses.”

Eastern Gas

Eastern Gas will hold two tenements in Queensland – the Windorah gas project in the prolific Cooper Basin and Project Venus in the Walloon coal seam gas fairway.

Windorah is a basin-centred gas play that currently holds a best estimate (2C) contingent resource of 330 billion cubic feet of gas that was independently certified by petroleum engineering firms DeGoyler & MacNaughton and Aeon Petroleum Consultants.

Current plans will see funds from the IPO deployed towards carrying out a fracture stimulation program at the Queenscliff-1 well, which is expected to substantially increase gas flow rates.

Planned follow-up exploration and flow-testing analysis will comprise additional drilling and flow-testing for Queenscliff area, with the aim of confirming commercial flowrates.

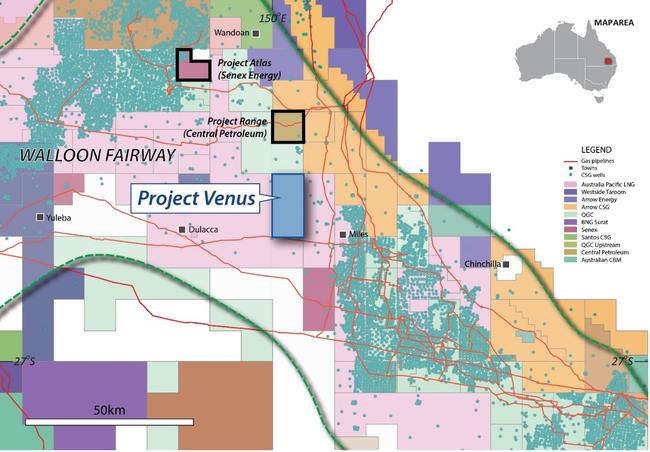

Project Venus is a suite of coal seam gas assets with a 2C contingent gas resource of 123Bcf in the Walloon CSG fairway adjacent to multiple nearby gas operators including major producer Senex Energy, which is owned jointly by Hancock Prospecting and South Korean steel major Posco.

The Walloon CSG fairway in the Surat Basin is a prolific gas production region with over 10,000 wells drilled.

Initial works programs that Eastern Gas will carry out post-IPO includes drilling, de-watering and flow testing two horizontal wells targeting the Upper Juandah coals, with the aim to confirm commercial flow rates and convert the 2C contingent resource to proven and probable (2P) reserves.

Shepherding these assets will be the responsibility of an experienced board and management team led by veteran executive and geoscientist David Spring, who has over 35 years’ experience and direct involvement in the delivery of multiple successful onshore and offshore international oil and gas exploration, appraisal and development projects.

He was previously the executive general manager of exploration at Senex and held senior executive roles at Maersk Oil and BHP.

The board will be chaired by corporate advisor James Canning-Ure while Brown and Alex Hunter – a senior business executive who runs Hunter Corporate Advisory – will serve as non-executive directors. PH2 non-executive director Lan Nguyen will act as an alternate director.

This article was developed in collaboration with Pure Hydrogen, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Pure Hydrogen eyes off an IPO for a strategic spinout of its Australian gas assets