MoneyTalks: Canary Capital’s Paul Hart sees upside in these three gold plays

Canary Capital’s Paul Hart remains bullish on gold and outlines why he’s chosen these three ASX stocks as potentially winning picks for investors.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

MoneyTalks is Stockhead’s regular drill down into what stocks investors are looking at right now. We tap our extensive list of experts to hear what’s hot, their top picks, and what they’re looking out for.

Today we hear from Canary Capital executive director Paul Hart.

Gold hit record highs of close to US$2800/oz ahead of the US election, and is now sitting at around US$2,606. Canary Capital remains bullish on the precious metal, which exec director Paul Hart believes is underpinned by strong central bank demand, geopolitical uncertainties, shifting global economic power and growing recognition of gold as a safe-haven asset.

“As the world navigates through complex economic and political landscapes, gold's appeal as a store of value and hedge against instability continues to grow, particularly in Eastern nations,” he said.

“With ongoing global tensions and economic challenges, the outlook for gold remains positive, making it an attractive option for investors seeking stability and preservation of wealth in uncertain times.”

Canary Capital has its eye on gold companies which are either in production and generating cash flow, those that have a near term pathway to move into production, and those that have significant JORC-defined resources with potential to grow through further drilling.

Based on these criteria, Hart has his eye on Resources and Energy Group (ASX:REZ), Navarre Minerals (ASX:NML) and Auric Mining (ASX:AWJ), which he believes could have significant upside heading into 2025.

Vat leach trial to kickstart cash flow

Resources and Energy Group has projects in WA and Queensland, with its flagship East Menzies gold project hosting an indicated and inferred resource of 46kt grading 5.7 g/t for 8,000 oz at the Maranoa prospect.

East Menzies hosts a pipeline of gold projects that are near production, with the plan to construct a trial vat leaching pit as part of the company’s near-term gold production strategy.

The second project slated for production is the Goodenough deposit, which holds a combined 43,000 oz resource across indicated and inferred categories at grades over 2.1. g/t Au.

“In the near term, REZ is expected to commence a vat leach trial campaign treating 5,000 tonnes of ore from Maranoa at an impressive grade of 4.6g/t gold,” Hart said.

“This trial program is projected to yield 821 oz of gold worth A$2.7m in revenue at a conservative gold price of A$3,250/oz.

“This is expected to generate significant initial cash flow from the project which will fund an expanded vat leach program at the Maranoa and Goodenough deposits, where an additional nine leach dams are anticipated to generate a further A$23.2m in sales.

“We estimate that adding another 20 dams could increase gold revenue by a further A$51.7m.”

This plan is based on vat leaching, a low-cost method of gold production and could generate margins of around $2,000 per ounce once the operation is running (based on a gold price of A$3,250).

“Margins will be significantly higher if the current AUD gold price of $4,000 is maintained,” Hart said.

But those prospects are not even the mainstay of the company’s path to gold production. Hart points to the aptly named Gigante Grande prospect’s potential to host more than a million ounces of gold, with recent drill results of 27m at 3.7g/t gold from 67m, including 14m at 6.34g/t from 65m, underscoring the prospect's “substantial scale and scope”.

“As the name suggests, the Gigante Grande gold deposit is large, returning economic gold intercepts over an area of 500m x 1600m and beyond 100m in depth,” Hart said.

“It represents an ideal open cut gold target with million-ounce plus potential.

“Gigante Grande is a virgin discovery by REZ’s own team made with RAB drilling through the 30m blanket of transported cover – similar to the Tropicana discovery.”

“Resources and Energy Group is on the cusp of generating significant cash flow from gold production at its Menzies gold project.

“Once the viability of the 5000 tonne trial vat leach pit is confirmed, Canary Capital believes the market is likely to re-rate REZ stock to reflect the significant cashflow this project can deliver over coming years in a very high gold price environment.

“Canary Capital prepared a discounted cash flow model on the company in September 2024 with an estimated valuation of 5.1 cents per share compared to the current price of 2.6 cents.

“Further upside can be expected from drilling success at Gigante Grande.”

Navarre trading at a discount per resource ounce to peers

Navarre Minerals is Hart’s next pick, with its flagship Stawell Corridor Irvine project in Victoria hosting a resource of 304koz at 2.43g/t gold and an exploration target of 280-420 koz.

The company also holds three other high priority gold projects: the St Arnaud and the Jubilee gold projects and the Tandarra Joint Venture (JV with Catalyst Metals).

Notably, the company entered into administration following the failed acquisition and re-start of the Mt Carlton project back in 2021, but current MD James Gurry saw an opportunity to purchase the Victorian assets from the administrator and recapitalise the company.

“The Victorian gold projects were purchased for only $525k, a significant discount to the portfolio’s capitalised exploration spend of $32.7m,” Hart said.

“The company underwent a restructure with shares being consolidated on a 1 for 500 basis.

“Following a successful $6m capital raise, NML was relisted on the ASX on November 12, 2024 with a market capitalisation of just $10.4m.”

An extensive exploration program across its Stawell Corridor Gold Projects is planned to commence shortly with the aim of converting the 280K to 420K ounce exploration target at Irvine into a JORC mineral resource. If the program is successful, this would give the company a total JORC resource of between 584K and 724K ounces of gold at Irvine.

At St Arnaud, NML plans to conduct a geophysical and air-core program across the northern side of the tenement area to expand the mineralised footprint, which lies under shallow cover.

And over the next 12 months, NML also plans to work with Catalyst Metals to define a large economic gold system at Tandarra, which is about ~50km northwest from Agnico Eagle’s Fosterville project.

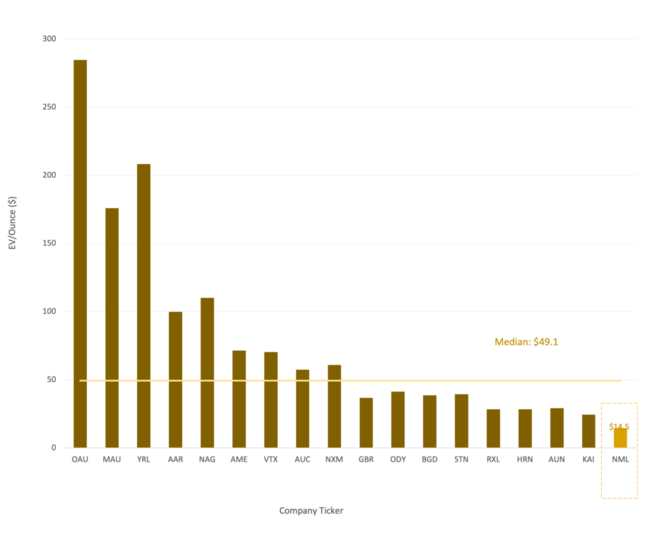

Hart says Canary Capital’s interest in the company is due to it trading at a significant discount per resource ounce to peers.

“With an EV/Ounce of $14.5, NML trades significantly below the peer median EV/Ounce of $49.1,” Hart said.

“This means the market currently values each ounce of NML's JORC mineral resources at approximately one-third the price compared to peers.

“This substantial valuation gap suggests potential for a sizeable upward adjustment in NML’s market capitalisation as it aligns more closely with its peer group valuations.

“The grade of the JORC resources at Irvine currently sits at 2.43g/t gold which is 47.3% above the median of its peer group, providing another measure of the attractiveness of the Irvine project.”

Hart notes that Navarre will be drilling two programs at Stawell and Tandara in December, so this should provide a strong finish to 2024.

“Canary Capital expects these upcoming exploration programs to generate substantial level of investor interest in the company with the potential for a significant re-rating of Navarre’s market capitalisation from current the current price of 10 cents,” he said.

Auric has a cash cow in Jeffreys Find project

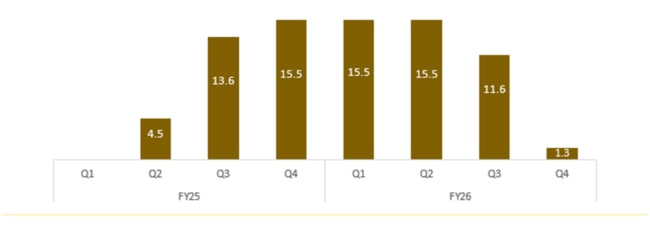

Canary’s final pick is Auric Mining. The company's flagship projects are the Jeffreys Find project which is currently in production until early 2025 and the Munda gold deposit, which hosts a sizeable indicated and inferred mineral resource of 198,700 ounces at 1.38g/t gold.

“Auric is currently generating cash from its Jefferys Find project,” Hart said. “Over the past 12 months, the focus has been on production from the Jeffreys Find gold mine under a joint venture with BML Ventures, an experienced mining contractor.

“Stage 1 of the project was completed in Q4 FY23 where 9,741 ounces were produced, generating $4.8m in surplus cash for Auric.

“Stage 2 of Jefferys Find commenced in February 2024 and is expected to generate between $8m and $10m in cash for AWJ based upon a gold price of A$3,600 per ounce, with the first $2.0m already received.

“Further cash payments are expected to be received during the current quarter.”

But that’s not the end of the profit production line. According to a 2023 scoping study, the Munda project looks set to welcome “exceptional economics” with a projected positive cashflow of $76.9m over a 13-quarter mine life based on a conservative gold price assumption of A$2,600/ounce.

“The potential surplus cash flows are substantially higher at current gold prices, around A$4,000/ounce,” Hart said.

“Based on the scoping study, AWJ will commence operations at Munda during the first half of 2025 using a starter pit with a mine life of three months and a low capital investment of $1.3m.

“The starter pit will require a working capital investment of ~$6.0m and is expected to produce $8.7m in surplus cash.”

But, despite the substantial cash flow potential of AWJ's projects, the company’s current market capitalisation stands at just $44.5m.

“This presents investors with a unique opportunity to invest in AWJ at a fraction of its intrinsic value,” Hart said.

“With its projects either operational or about to come online, no debt, upcoming catalysts and a strong management team, the company offers a compelling investment case with significant upside.

“In August 2024, Canary Capital prepared an updated discounted cash flow model on the company with an estimated valuation of 54 cents per share compared to the current price of 28 cents.”

Originally published as MoneyTalks: Canary Capital’s Paul Hart sees upside in these three gold plays