Lunch Wrap: ASX up as mining giants leap on US-China hopes; gold resets record again

The ASX has lifted on Wednesday with energy stocks, miners, and Insignia’s 7% surge, while gold hits a new high on trade war nerves.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX rises as energy stocks and miners lead

Insginia jumps after Brookfield's $4.60 bid

Gold hits record high as trade war jitters grow

The ASX has kicked off the day strongly again, rising 0.7% as Wall Street’s solid performance filters through.

In the US overnight, the S&P 500 lifted 0.75% while the tech-heavy Nasdaq 100 rallied 1.3%.

Big tech names like Meta continued their impressive run, but Alphabet fell short after earnings disappointments and its shares tumbled by 7% after the bell.

Mining stocks were driving the gains this morning, with giants like BHP (ASX:BHP), Rio Tinto (ASX:RIO) and Fortescue (ASX:FMG) up by about 3% each on the hope of a US-China tariff breakthrough.

With President Trump’s call to Xi just around the corner, it seems China’s president is giving diplomacy a go, much like the deals with Canada and Mexico, says ING’s chief economist for China, Lynn Song.

“Delaying the tariff implementation until February 10 will allow for top level leadership to meet before then, which still creates an opportunity for both sides to step back from the brink and de-escalate the situation,” he told Al Jazeera.

But while that's still unfolding, Trump’s comments on Gaza today are keeping the oil markets on edge.

Speaking with Israeli PM Netanyahu in the White House, Trump said the US should take ownership of the Gaza Strip and redevelop it after Palestinians are resettled.

"We will own it and be responsible for dismantling all of the dangerous unexploded bombs and other weapons," he said.

Big oil players like Woodside Energy Group (ASX:WDS) and Santos (ASX:STO) saw decent lifts of about 1.5% thanks to higher oil prices.

Meanwhile, gold prices surged to a new record, hitting $US2844.60 an ounce, as investors flocked to safe havens amid ongoing trade war worries.

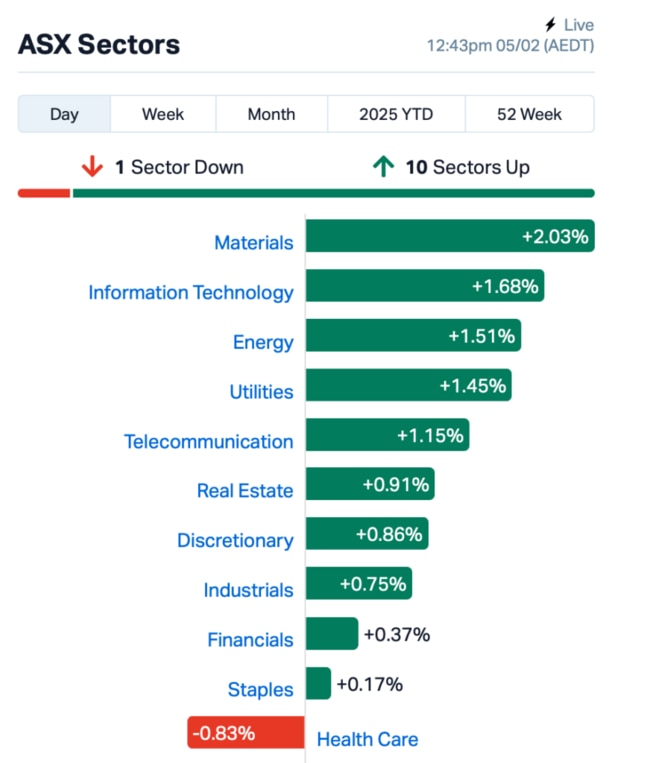

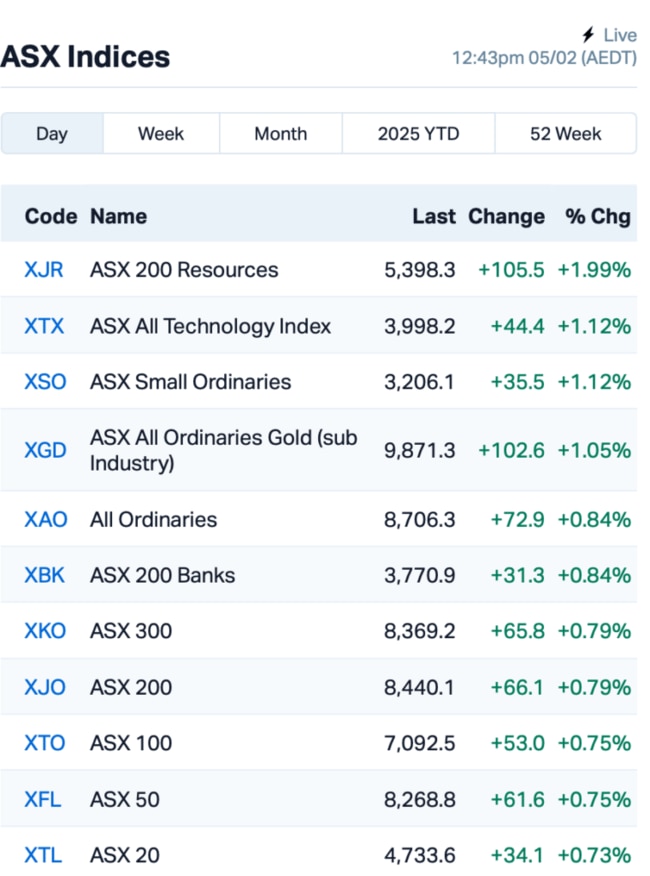

Here’s where things stood at around lunch time, AEDT:

In the large caps space, Insignia Financial (ASX:IFL) is in the spotlight, up 7% after Brookfield Capital Partners jumped into the bidding fray with a $4.60-per-share offer.

The $3 billion wealth fundie has now attracted multiple suitors, keeping shareholders on their toes. Bain and CC Capital, who had previously put in offers, will be watching closely to see what Brookfield does next.

Cleanaway (ASX:CWY) is dealing with a setback after a significant fire forced the company to close its liquid waste processing facility in St Marys, Sydney.

Thankfully, no one was injured, but the company is working on finding alternative options to process materials while the damage is assessed. Shares were down 2%.

Fortescue (ASX:FMG) has boosted its bid for copper-gold explorer Red Hawk Mining (ASX:RHK) to $1.20 per share after securing support from major shareholders. As of 4 February, FMG said it has acquired a relevant interest in over 75% of Red Hawk.

Finally, on the economic front, data today shows New Zealand’s jobless rate rose to a four-year high of 5.1%, reflecting a softening in the labour market.

Could this pave the way for the RBA to cut rates in the coming months?

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for February 5 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| EDE | Eden Inv Ltd | 0.002 | 50% | 353,048 | $4,109,881 |

| EQR | Eq Resources Limited | 0.041 | 41% | 16,494,361 | $67,715,941 |

| CT1 | Constellation Tech | 0.002 | 33% | 25,000 | $2,212,101 |

| LNU | Linius Tech Limited | 0.002 | 33% | 750,000 | $9,226,824 |

| MRQ | Mrg Metals Limited | 0.004 | 33% | 100,000 | $8,179,556 |

| PRM | Prominence Energy | 0.004 | 33% | 1,146,841 | $1,167,529 |

| TGN | Tungsten Min NL | 0.115 | 31% | 1,367,041 | $78,664,456 |

| VML | Vital Metals Limited | 0.003 | 25% | 50,201 | $11,790,134 |

| AGD | Austral Gold | 0.043 | 23% | 147,806 | $21,430,897 |

| 1TT | Thrive Tribe Tech | 0.003 | 20% | 47,669,748 | $5,079,308 |

| ADY | Admiralty Resources. | 0.006 | 20% | 247,508 | $13,147,397 |

| ALR | Altairminerals | 0.003 | 20% | 626,908 | $10,741,860 |

| RNX | Renegade Exploration | 0.006 | 20% | 4,325,000 | $6,420,017 |

| GWR | GWR Group Ltd | 0.099 | 19% | 3,121,042 | $26,660,982 |

| REC | Rechargemetals | 0.020 | 18% | 100,000 | $4,360,329 |

| CVB | Curvebeam Ai Limited | 0.135 | 17% | 1,705,888 | $36,865,299 |

| BUY | Bounty Oil & Gas NL | 0.004 | 17% | 900,089 | $4,495,503 |

| ENV | Enova Mining Limited | 0.007 | 17% | 994,441 | $7,383,862 |

| EPM | Eclipse Metals | 0.007 | 17% | 7,561 | $17,158,914 |

| NAE | New Age Exploration | 0.004 | 17% | 115,000 | $6,431,697 |

Renegade Exploration (ASX:RNX) has identified high-grade critical defence metals, germanium and gallium, at its Andrew Zn-Pb-Ag deposit in Yukon, Canada. Recent drilling results revealed significant concentrations of these sought-after metals, with impressive grades in several samples. The company is now investigating the potential to reanalyse drill samples for germanium and gallium using more accurate methods.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for February 5 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MGU | Magnum Mining & Exp | 0.006 | -40% | 10,320,248 | $8,093,614 |

| R8R | Regener8Resourcesnl | 0.092 | -39% | 99,986 | $4,875,375 |

| TX3 | Trinex Minerals Ltd | 0.001 | -33% | 188,234 | $2,817,978 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 10,577,917 | $57,867,624 |

| BMO | Bastion Minerals | 0.004 | -20% | 214,286 | $4,223,623 |

| CYQ | Cycliq Group Ltd | 0.004 | -20% | 525,000 | $2,302,583 |

| RLG | Roolife Group Ltd | 0.004 | -20% | 7,809,900 | $5,980,156 |

| IMI | Infinitymining | 0.009 | -18% | 1,956,144 | $4,631,174 |

| ERA | Energy Resources | 0.003 | -17% | 90,828 | $1,216,188,722 |

| SRI | Sipa Resources Ltd | 0.010 | -17% | 809,324 | $3,418,598 |

| BXN | Bioxyne Ltd | 0.040 | -15% | 3,007,044 | $96,313,750 |

| SVG | Savannah Goldfields | 0.015 | -14% | 1,680,040 | $4,918,986 |

| TNC | True North Copper | 0.260 | -13% | 1,010,872 | $37,751,705 |

| GNM | Great Northern | 0.013 | -13% | 67,854 | $2,319,436 |

| VRX | VRX Silica Ltd | 0.040 | -13% | 2,026,298 | $34,211,666 |

| DTM | Dart Mining NL | 0.007 | -13% | 5,037,409 | $4,784,445 |

| HHR | Hartshead Resources | 0.007 | -13% | 1,625,582 | $22,469,457 |

| SRN | Surefire Rescs NL | 0.004 | -13% | 500,000 | $9,665,231 |

| IBX | Imagion Biosys Ltd | 0.015 | -12% | 2,304,433 | $3,422,804 |

| IOD | Iodm Limited | 0.155 | -11% | 59,918 | $107,345,205 |

| CNJ | Conico Ltd | 0.008 | -11% | 6,250 | $2,137,386 |

| CUF | Cufe Ltd | 0.008 | -11% | 2,267 | $12,030,074 |

IN CASE YOU MISSED IT

Trigg Minerals (ASX:TMG) has become the first ASX-listed company accepted into the International Antimony Association, a global industry body promoting the responsible production, use, and trade of antimony. Membership provides Trigg access to key industry stakeholders, regulatory developments, and global market insights as it looks to advance its portfolio of high-grade projects in New South Wales.

Lithium Energy (ASX:LEL) has secured final environmental approvals for the next phase of development at the Solaroz lithium brine project in Argentina. While shareholders have approved the disposal of the company’s interests in Solaroz, it will continue advancing operations until the sale is completed in January ‘26. Under the terms of the amended sale agreement, CNGR will provide up to US$15 million in funding.

At Stockhead, we tell it like it is. While Trigg Minerals and Lithium Energy are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Lunch Wrap: ASX up as mining giants leap on US-China hopes; gold resets record again