High Voltage: BYD’s EV sales look set to overtake Ford this year

Chinese car maker BYD appears set to overtake US giant Ford in annual EV shipments. That’s largely because of demand for hybrids – which are also booming in Australia.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

EV maker BYD’s October sales put them on par with Ford year-to-date

This comes after the Chinese giant beat Tesla on quarterly revenue

Most consumer demand coming from hybrid vehicles

Our High Voltage column wraps all the news driving ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, and vanadium.

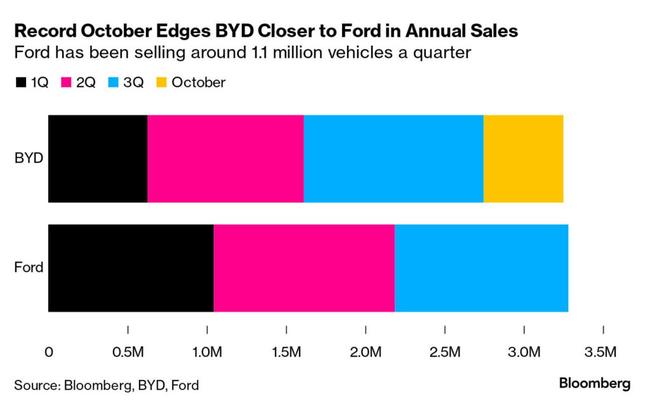

Chinese electric vehicle giant BYD looks set to overtake US automaker Ford in annual shipments this year, kicking off the December quarter by selling a record half a million vehicles in October.

This comes after the company just pipped Tesla at the post on quarterly revenue for the first time, with revenue soaring 24 per cent to 201.1 billion yuan ($US28.2 billion) for the three months that ended in September, exceeding Tesla’s $US25.2 billion in sales for the same period.

And according to Bloomberg Hyperdrive’s Danny Lee, October sales have already put BYD nearly on par with Ford year-to-date.

And almost all analysts covering BYD expect the momentum to continue.

The US automaker, which only reports global sales on a quarterly basis, has been averaging around 1.1 million vehicles a quarter.

“Getting to 4 million is a stunning milestone,” auto industry consultant Michael Dunne said.

“BYD will soon be seeing Ford in the rear-view mirror.”

That’s a milestone that would cement BYD’s position as a top 10 automaker globally.

Hybrid demand leads charge

It looks like BYD’s lineup of hybrids are resonating with consumers who are not quite ready to make the full switch – particularly in China where demand is in part being driven by government subsidies encouraging people to trade in their older EVs or ye old fashioned combustion automobiles.

That trend is also strong in Australia, with the Australian Automobile Association revealing that in the September quarter, (conventional) hybrid and plug-in hybrid (PHEV) sales and market share rose as ICE and battery electric vehicle sales fell across both measures. The latter had a stunning sales decline of more than 25 percent, with market share dropping from 8.1 per cent to 6.57 per cent.

Hybrid sales rose by 3.33 per cent and their market share rose from 14.93 per cent to 16.7 per cent. Meanwhile, PHEV sales skyrocketed by 56.64 per cent, as their market share rose from 1.49 per cent to 2.53 per cent.

Bloomberg notes Legacy carmakers such as Ford are finding the competitive landscape increasingly tough as Chinese automakers expand everywhere, with Nissan, Volkswagen and Stellantis all seeing shrinking profits, excess capacity and bloated workforces.

“Ford may find support under President-elect Donald Trump, who’s pledged to rescind funding for the Biden administration’s signature 2022 climate law, which includes more than $8.5 billion in incentives for individuals and families to decarbonise,” Bloomberg's Lee notes.

“BYD doesn’t sell passenger vehicles in the US, but that doesn’t seem to be holding the company back much.

“Senior Vice President He Zhiqi bragged on his Weibo account earlier this month that BYD increased production capacity by almost 200,000 units in the August-to-October period by hiring around the same number of people for its assembly and components businesses. BYD’s output for October was 534,003 units.”

Weekly small cap standouts

Once a fast-moving nickel explorer, MHK has raised $2.5 million at 20c per share to fund gold exploration at its Leinster South project, where an ‘extensive’ maiden drilling program has been promised.

A heritage survey is scheduled for early 2025 ahead of a maiden drilling campaign at Leinster South where a number of targets have been identified via mapping and geochemical sampling.

They include Siberian Tiger, Tysons and Thylacine, some 1.5km east-southeast of Siberian Tiger, where recent rock chips returned grades of up to 62g/t gold.

None have been drilled historically, but the location is intriguing – some 30km south Leinster in the vicinity of Gold Fields’ Agnew-Lawlers mine.

VULCAN ENERGY RESOURCES (ASX:VUL)

Vulcan has scored (A$162m) from the German Federal Ministry of Economics and Climate Protection (BMWK) and the European Recovery and Resilience Facility via the German Recovery and Resilience Plan (the BEW Funding) for its HEAT4LANDAU project.

The project comprises of infrastructure necessary for 255MW of renewable geothermal heat generation, transport and delivery to support German town Landau’s transition to sustainable and renewable district heating starting in 2026.

“Securing this funding is a major milestone for Vulcan in fulfilling our commitment to decarbonising Germany’s energy landscape,” managing director and CEO Cris Moreno said.

“By delivering sustainable, renewable geothermal heat to Landau and surrounding communities, we are taking a significant step towards a 100 per cent carbon neutral district heating network.”

The company says the BEW funding will enable transformative measures for decarbonising district heating networks in Landau, which is part of Vulcan’s Phase One Lionheart project, a billion-plus Euro development to make lithium hydroxide from fluids in geothermal wells.

VUL has produced its first lithium hydroxide for qualification by customers, which include European auto giants BMW, Stellantis, Renault and downstream materials producer Umicore.

The 24,000tpa first phase would be the first commercial lithium chemical producer in Europe with a domestic resource, producing enough lithium hydroxide for 500,000 vehicles annually.

INTERNATIONAL GRAPHITE (ASX:IG6)

Graphite player IG6 has completed a funding agreement for a $4.5 million grant from the WA government to build a 3000tpa micronising facility in Collie, where a bunch of state funding is being thrown to develop industries outside the South-West town’s threatened coal mining industry.

The first $2m will be put toward the first stage of the plant, which will carry a $4m cost. The balance of the funding will be provided via a critical minerals office grant from Canberra, taking the risk off IG6’s balance sheet.

A doubling of capacity in stage 2 will be partly funded with a further $2.5m from the State’s Department of Jobs, Tourism, Science and Innovation.

“We are excited to be pushing ahead with the construction of the new plant at Collie. Establishing a micronising business in Collie has been an important step in our development plans,” IG6 MD Andrew Worland said.

“Critically it will establish the company as a producer in the graphite industry and build further our technical skills as we progress our Springdale mine to market battery anode material strategy.”

IG6 plans to eventually produce 10,000tpa. It says high and ultra-high purity micronised graphite is “an essential ingredient for a wide range of industrial products, such as cathode additives for batteries, polymers, adhesives, ceramics and specialty lubricants”.

The company thinks it could become among the largest producers of micronised graphite outside China, looking to produce 95 per cent total graphitic content and 99 per cent TGC from concentrates sourced at the Springdale deposit near Ravensthorpe in WA’s south.

A 2023 DFS put a $US1980/t cost on producing micronised graphite using third party product with a $12.5m capex for a 4000tpa plant, though with front-end engineering design coming up the company says it expects operating costs to be lower than in the original feasibility study.

But a much larger investment, into the hundreds of millions, will be needed to build a fully integrated business included the $76m Springdale mine and spheronising plants at Collie, based off an early 2024 scoping study.

Battery Metals Winners and Losers

Here’s how a basket of ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, magnesium, manganese and vanadium is performing:

| Code | Company | Price | % Week | % Month | % Six Month | % Year | Market Cap |

|---|---|---|---|---|---|---|---|

| XTC | XTC Lithium Limited | 0.2 | 19900% | 19900% | 19900% | 0% | $17,528,272 |

| JLL | Jindalee Lithium Ltd | 0.415 | 57% | 77% | -19% | -61% | $29,616,766 |

| RLC | Reedy Lagoon Corp. | 0.003 | 50% | 50% | 0% | -40% | $2,285,120 |

| ADD | Adavale Resource Ltd | 0.003 | 50% | 0% | -40% | -63% | $3,671,296 |

| MHC | Manhattan Corp Ltd | 0.0015 | 50% | -25% | -10% | -55% | $6,746,955 |

| MHK | Metalhawk. | 0.25 | 35% | 43% | 390% | 25% | $25,167,501 |

| ODE | Odessa Minerals Ltd | 0.008 | 33% | 100% | 100% | 0% | $10,146,260 |

| RON | Roninresourcesltd | 0.18 | 29% | 50% | 38% | -5% | $6,628,502 |

| PFE | Panteraminerals | 0.027 | 29% | 0% | -29% | -52% | $12,277,728 |

| AXE | Archer Materials | 0.325 | 25% | 20% | -27% | -19% | $82,825,279 |

| AX8 | Accelerate Resources | 0.01 | 25% | 11% | -78% | -80% | $6,217,539 |

| SRN | Surefire Rescs NL | 0.005 | 25% | 0% | -55% | -44% | $9,931,539 |

| PVT | Pivotal Metals Ltd | 0.011 | 22% | 16% | -39% | -48% | $9,619,235 |

| WC8 | Wildcat Resources | 0.37 | 21% | 0% | -33% | -54% | $457,528,790 |

| VUL | Vulcan Energy | 6.11 | 21% | 39% | 47% | 159% | $1,149,832,169 |

| TEM | Tempest Minerals | 0.006 | 20% | -33% | -30% | -43% | $3,763,619 |

| EMT | Emetals Limited | 0.006 | 20% | 50% | 0% | -14% | $5,100,000 |

| IPX | Iperionx Limited | 3.89 | 19% | 9% | 83% | 158% | $1,165,674,693 |

| IG6 | Internationalgraphit | 0.075 | 17% | 12% | -35% | -58% | $14,516,875 |

| QPM | Queensland Pacific | 0.041 | 17% | 11% | 0% | -23% | $103,368,333 |

| NWC | New World Resources | 0.022 | 16% | 5% | -46% | -31% | $62,486,198 |

| CWX | Carawine Resources | 0.115 | 15% | 17% | 15% | 10% | $27,154,427 |

| ENV | Enova Mining Limited | 0.008 | 14% | -11% | -58% | 14% | $7,879,435 |

| CHR | Charger Metals | 0.076 | 13% | -12% | -5% | -79% | $5,883,939 |

| FG1 | Flynngold | 0.036 | 13% | 29% | 33% | -50% | $9,407,393 |

| LTR | Liontown Resources | 0.88 | 12% | 5% | -36% | -40% | $2,134,095,163 |

| NVX | Novonix Limited | 0.8 | 11% | -5% | -4% | 12% | $395,011,454 |

| CAE | Cannindah Resources | 0.042 | 11% | -19% | -24% | -58% | $29,529,358 |

| STK | Strickland Metals | 0.077 | 10% | 0% | -23% | -49% | $169,970,935 |

| CLA | Celsius Resource Ltd | 0.011 | 10% | 0% | 0% | 0% | $28,281,270 |

| DTM | Dart Mining NL | 0.011 | 10% | -21% | -56% | -43% | $4,737,945 |

| SYA | Sayona Mining Ltd | 0.034 | 10% | 3% | -17% | -56% | $349,972,064 |

| RAG | Ragnar Metals Ltd | 0.023 | 10% | 10% | 28% | 0% | $10,901,677 |

| MEI | Meteoric Resources | 0.115 | 10% | 19% | -45% | -51% | $264,351,789 |

| JRV | Jervois Global Ltd | 0.012 | 9% | -8% | -14% | -65% | $32,433,165 |

| M2R | Miramar | 0.006 | 9% | -25% | -36% | -71% | $2,380,940 |

| BCA | Black Canyon Limited | 0.063 | 9% | -7% | -58% | -55% | $5,504,294 |

| VMC | Venus Metals Cor Ltd | 0.076 | 9% | 38% | -8% | -24% | $14,905,780 |

| LEG | Legend Mining | 0.013 | 8% | 18% | -7% | -35% | $37,823,203 |

| MLS | Metals Australia | 0.026 | 8% | 0% | 24% | -28% | $18,907,708 |

| LMG | Latrobe Magnesium | 0.027 | 8% | -23% | -53% | -46% | $63,410,509 |

| EG1 | Evergreenlithium | 0.088 | 7% | 96% | -9% | -52% | $4,948,240 |

| RAS | Ragusa Minerals Ltd | 0.015 | 7% | -12% | -21% | -70% | $2,138,982 |

| PLS | Pilbara Min Ltd | 3.11 | 7% | 8% | -24% | -11% | $9,365,718,089 |

| PSC | Prospect Res Ltd | 0.096 | 7% | 5% | -34% | 2% | $54,885,480 |

| ESR | Estrella Res Ltd | 0.016 | 7% | 23% | 300% | 220% | $29,883,283 |

| MRR | Minrex Resources Ltd | 0.0085 | 6% | 6% | -23% | -43% | $9,221,374 |

| SUM | Summitminerals | 0.17 | 6% | -11% | 36% | 36% | $14,675,758 |

| AXN | Alliance Nickel Ltd | 0.039 | 5% | -13% | -29% | -25% | $28,307,745 |

| LRS | Latin Resources Ltd | 0.2 | 5% | 0% | -18% | -13% | $560,283,893 |

| ARL | Ardea Resources Ltd | 0.41 | 5% | -9% | -36% | -23% | $81,869,995 |

| BOA | Boadicea Resources | 0.023 | 5% | 10% | -8% | -45% | $2,837,115 |

| HXG | Hexagon Energy | 0.024 | 4% | 0% | 20% | 140% | $12,309,982 |

| MTM | MTM Critical Metals | 0.078 | 4% | -8% | 34% | 239% | $27,140,303 |

| BMM | Balkanminingandmin | 0.053 | 4% | 2% | -25% | -59% | $4,560,147 |

| TVN | Tivan Limited | 0.054 | 4% | 8% | 10% | -29% | $95,796,929 |

| REC | Rechargemetals | 0.029 | 4% | -15% | -15% | -79% | $4,051,009 |

| IGO | IGO Limited | 5.21 | 3% | -4% | -32% | -41% | $3,945,365,306 |

| SLM | Solismineralsltd | 0.09 | 2% | 3% | -10% | -56% | $6,961,755 |

| PAT | Patriot Lithium | 0.046 | 2% | 10% | -46% | -77% | $4,760,101 |

| LIN | Lindian Resources | 0.095 | 2% | -10% | -27% | -42% | $109,527,612 |

| BM8 | Battery Age Minerals | 0.097 | 2% | -8% | -8% | -50% | $9,872,092 |

| CNB | Carnaby Resource Ltd | 0.375 | 1% | -1% | -42% | -43% | $64,476,467 |

| PAM | Pan Asia Metals | 0.065 | 0% | 14% | -59% | -57% | $12,925,364 |

| RIL | Redivium Limited | 0.004 | 0% | 0% | 33% | -38% | $10,987,419 |

| LPD | Lepidico Ltd | 0.002 | 0% | -33% | -33% | -77% | $17,178,371 |

| MRD | Mount Ridley Mines | 0.001 | 0% | 0% | -33% | -50% | $7,784,883 |

| MNS | Magnis Energy Tech | 0.042 | 0% | 0% | 0% | -13% | $50,378,922 |

| QEM | QEM Limited | 0.051 | 0% | -45% | -59% | -72% | $9,732,518 |

| GLN | Galan Lithium Ltd | 0.15 | 0% | 15% | -46% | -73% | $109,364,101 |

| PNN | Power Minerals Ltd | 0.099 | 0% | -6% | -27% | -60% | $10,900,399 |

| ADV | Ardiden Ltd | 0.135 | 0% | 0% | -13% | -37% | $8,439,863 |

| IXR | Ionic Rare Earths | 0.01 | 0% | -17% | -23% | -62% | $48,697,626 |

| ARR | American Rare Earths | 0.24 | 0% | -20% | -4% | 71% | $120,581,592 |

| SGQ | St George Min Ltd | 0.025 | 0% | -7% | 25% | -36% | $27,213,511 |

| TKL | Traka Resources | 0.0015 | 0% | 0% | 0% | -62% | $2,918,488 |

| PRL | Province Resources | 0.041 | 0% | 0% | 0% | 0% | $48,441,219 |

| IPT | Impact Minerals | 0.012 | 0% | -4% | -45% | 0% | $36,713,205 |

| VML | Vital Metals Limited | 0.002 | 0% | -20% | -33% | -80% | $11,790,134 |

| BSX | Blackstone Ltd | 0.028 | 0% | -10% | -38% | -68% | $14,864,076 |

| POS | Poseidon Nick Ltd | 0.005 | 0% | 25% | 9% | -70% | $21,019,377 |

| AUZ | Australian Mines Ltd | 0.013 | 0% | 30% | 44% | -13% | $18,180,658 |

| ATM | Aneka Tambang | 0.86 | 0% | -11% | -22% | -27% | $1,121,138 |

| ALY | Alchemy Resource Ltd | 0.007 | 0% | 17% | 0% | -36% | $8,246,534 |

| GAL | Galileo Mining Ltd | 0.135 | 0% | 4% | -48% | -51% | $26,679,365 |

| LEL | Lithenergy | 0.37 | 0% | -4% | -23% | -37% | $41,440,581 |

| AQD | Ausquest Limited | 0.008 | 0% | -11% | -45% | -25% | $8,439,478 |

| LML | Lincoln Minerals | 0.007 | 0% | 27% | 8% | 17% | $14,393,817 |

| MRC | Mineral Commodities | 0.026 | 0% | 0% | 13% | -21% | $25,596,288 |

| AML | Aeon Metals Ltd. | 0.005 | 0% | 0% | -38% | -38% | $5,482,003 |

| WKT | Walkabout Resources | 0.095 | 0% | -5% | -27% | -39% | $63,769,838 |

| TON | Triton Min Ltd | 0.009 | 0% | -18% | -40% | -63% | $14,115,499 |

| AR3 | Austrare | 0.11 | 0% | -21% | 10% | -45% | $17,450,033 |

| CNJ | Conico Ltd | 0.001 | 0% | 0% | 0% | -75% | $2,201,528 |

| SMX | Strata Minerals | 0.024 | 0% | 0% | 33% | -61% | $4,579,564 |

| BYH | Bryah Resources Ltd | 0.004 | 0% | -20% | -56% | -79% | $2,013,147 |

| LSR | Lodestar Minerals | 0.001 | 0% | 0% | -38% | -69% | $3,372,329 |

| TMB | Tambourahmetals | 0.03 | 0% | -19% | -56% | -78% | $3,253,701 |

| EMC | Everest Metals Corp | 0.13 | 0% | -4% | 8% | 33% | $24,216,804 |

| KOR | Korab Resources | 0.008 | 0% | 0% | 33% | -53% | $2,936,400 |

| CMO | Cosmometalslimited | 0.018 | 0% | -28% | -59% | -61% | $2,357,872 |

| JMS | Jupiter Mines. | 0.16 | 0% | -3% | -57% | -14% | $313,680,851 |

| ENT | Enterprise Metals | 0.004 | 0% | 0% | 33% | 0% | $4,713,269 |

| RBX | Resource B | 0.036 | 0% | 3% | 9% | -67% | $3,718,241 |

| AKN | Auking Mining Ltd | 0.005 | 0% | -17% | -72% | -88% | $1,956,751 |

| RR1 | Reach Resources Ltd | 0.012 | 0% | 0% | -8% | -56% | $10,493,176 |

| AVW | Avira Resources Ltd | 0.001 | 0% | 0% | 0% | -50% | $2,938,790 |

| CAI | Calidus Resources | 0.115 | 0% | 0% | -12% | -32% | $93,678,206 |

| NWM | Norwest Minerals | 0.018 | 0% | -14% | -49% | -45% | $8,732,151 |

| RGL | Riversgold | 0.003 | 0% | -25% | -57% | -73% | $4,882,388 |

| STM | Sunstone Metals Ltd | 0.007 | 0% | -13% | -36% | -53% | $36,042,325 |

| YAR | Yari Minerals Ltd | 0.004 | 0% | 0% | -20% | -75% | $1,929,431 |

| LPM | Lithium Plus | 0.14 | 0% | 8% | 40% | -70% | $18,597,600 |

| AZI | Altamin Limited | 0.024 | 0% | -32% | -34% | -55% | $12,640,616 |

| LNR | Lanthanein Resources | 0.003 | 0% | -14% | -50% | -63% | $7,330,908 |

| CLZ | Classic Min Ltd | 0.001 | 0% | 0% | -86% | -98% | $1,544,026 |

| ASM | Ausstratmaterials | 0.54 | 0% | -11% | -47% | -65% | $97,912,603 |

| ETM | Energy Transition | 0.023 | 0% | 10% | -36% | -38% | $32,400,300 |

| CRI | Criticalim | 0.012 | 0% | 0% | -45% | 9% | $32,067,786 |

| RR1 | Reach Resources Ltd | 0.012 | 0% | 0% | -8% | -56% | $10,493,176 |

| AOA | Ausmon Resorces | 0.002 | 0% | -20% | 0% | -33% | $2,117,999 |

| WC1 | Westcobarmetals | 0.022 | 0% | -18% | -45% | -66% | $3,355,007 |

| ITM | Itech Minerals Ltd | 0.068 | 0% | -3% | 8% | -56% | $11,610,006 |

| KTA | Krakatoa Resources | 0.01 | 0% | 0% | -41% | -74% | $4,721,072 |

| LNR | Lanthanein Resources | 0.003 | 0% | -14% | -50% | -63% | $7,330,908 |

| WR1 | Winsome Resources | 0.51 | 0% | -14% | -59% | -59% | $112,964,588 |

| PBL | Parabellumresources | 0.06 | 0% | 20% | 40% | -83% | $3,738,000 |

| OM1 | Omnia Metals Group | 0.078 | 0% | 0% | 0% | 0% | $4,550,568 |

| LLL | Leolithiumlimited | 0.505 | 0% | 0% | 0% | 0% | $605,458,342 |

| LU7 | Lithium Universe Ltd | 0.01 | 0% | -41% | -47% | -73% | $5,939,136 |

| TMX | Terrain Minerals | 0.0035 | 0% | 0% | 17% | -13% | $6,300,101 |

| LM1 | Leeuwin Metals Ltd | 0.073 | 0% | -10% | 4% | -72% | $3,420,172 |

| LCY | Legacy Iron Ore | 0.012555 | 0% | 0% | -19% | -19% | $122,132,779 |

| ASR | Asra Minerals Ltd | 0.003 | 0% | -33% | -50% | -79% | $6,756,339 |

| FTL | Firetail Resources | 0.089 | -1% | -15% | 48% | -6% | $29,481,070 |

| ARN | Aldoro Resources | 0.085 | -1% | 13% | 31% | 2% | $11,443,018 |

| VHM | Vhmlimited | 0.385 | -1% | -16% | -21% | -20% | $63,489,447 |

| ASN | Anson Resources Ltd | 0.068 | -1% | -12% | -48% | -60% | $94,156,418 |

| HAS | Hastings Tech Met | 0.285 | -2% | -2% | 0% | -64% | $51,535,448 |

| NMT | Neometals Ltd | 0.089 | -2% | -10% | -10% | -63% | $68,478,832 |

| WA1 | Wa1Resourcesltd | 13.35 | -2% | -2% | -32% | 34% | $904,005,610 |

| ABX | ABX Group Limited | 0.042 | -2% | 0% | -28% | -44% | $10,501,693 |

| KOB | Kobaresourceslimited | 0.082 | -2% | -22% | -29% | 0% | $13,002,052 |

| EGR | Ecograf Limited | 0.081 | -2% | -8% | -44% | -63% | $36,784,677 |

| A8G | Australasian Metals | 0.078 | -3% | -38% | 10% | -55% | $4,065,399 |

| PMT | Patriotbatterymetals | 0.36 | -3% | -19% | -57% | -67% | $212,417,521 |

| BC8 | Black Cat Syndicate | 0.53 | -3% | -2% | 66% | 104% | $289,336,233 |

| LTM | Arcadium Lithium PLC | 8.06 | -3% | -1% | 16% | 0% | $2,361,076,532 |

| WCN | White Cliff Min Ltd | 0.0175 | -3% | -27% | 9% | 59% | $33,083,238 |

| RNU | Renascor Res Ltd | 0.069 | -3% | -14% | -31% | -58% | $175,386,247 |

| L1M | Lightning Minerals | 0.068 | -3% | -6% | -28% | -50% | $6,506,876 |

| RVT | Richmond Vanadium | 0.31 | -3% | -6% | 24% | -14% | $26,724,420 |

| EMN | Euromanganese | 0.059 | -3% | 23% | -30% | -39% | $12,540,568 |

| MAN | Mandrake Res Ltd | 0.026 | -4% | -10% | -32% | -26% | $16,308,758 |

| LYC | Lynas Rare Earths | 7.6 | -4% | -2% | 10% | 10% | $7,103,858,206 |

| FGR | First Graphene Ltd | 0.0375 | -4% | -17% | -31% | -53% | $25,118,498 |

| DEV | Devex Resources Ltd | 0.115 | -4% | -21% | -66% | -55% | $50,794,427 |

| MLX | Metals X Limited | 0.46 | -4% | 1% | 10% | 64% | $412,452,474 |

| REE | Rarex Limited | 0.0115 | -4% | -12% | -28% | -62% | $9,209,727 |

| ICL | Iceni Gold | 0.046 | -4% | 18% | -35% | -23% | $12,760,622 |

| PEK | Peak Rare Earths Ltd | 0.11 | -4% | -41% | -51% | -71% | $33,703,478 |

| ZNC | Zenith Minerals Ltd | 0.044 | -4% | -10% | -45% | -76% | $17,741,645 |

| PEK | Peak Rare Earths Ltd | 0.11 | -4% | -41% | -51% | -71% | $33,703,478 |

| CXO | Core Lithium | 0.105 | -5% | -13% | -28% | -71% | $225,016,632 |

| GBR | Greatbould Resources | 0.042 | -5% | -24% | -35% | -34% | $31,873,304 |

| CTM | Centaurus Metals Ltd | 0.42 | -5% | -17% | 2% | -13% | $208,614,509 |

| FRB | Firebird Metals | 0.105 | -5% | -16% | -50% | -40% | $14,947,947 |

| IDA | Indiana Resources | 0.105 | -5% | 11% | 35% | 82% | $66,766,484 |

| BUX | Buxton Resources Ltd | 0.062 | -5% | 0% | -46% | -69% | $13,074,394 |

| DYM | Dynamicmetalslimited | 0.205 | -5% | 8% | 24% | 3% | $7,380,000 |

| NTU | Northern Min Ltd | 0.02 | -5% | -5% | -44% | -33% | $160,685,107 |

| BHP | BHP Group Limited | 40.55 | -5% | -7% | -6% | -11% | $205,746,693,173 |

| PLL | Piedmont Lithium Inc | 0.195 | -5% | -3% | 0% | -51% | $80,805,075 |

| LIT | Livium Ltd | 0.019 | -5% | -14% | -28% | -42% | $24,977,281 |

| FBM | Future Battery | 0.018 | -5% | -5% | -65% | -79% | $11,976,407 |

| EMS | Eastern Metals | 0.018 | -5% | -14% | -44% | -36% | $2,046,172 |

| HRE | Heavy Rare Earths | 0.036 | -5% | -5% | -3% | -62% | $3,033,905 |

| OMH | OM Holdings Limited | 0.355 | -5% | -9% | -37% | -21% | $272,021,164 |

| E25 | Element 25 Ltd | 0.265 | -5% | -17% | -22% | -37% | $58,276,786 |

| AGY | Argosy Minerals Ltd | 0.035 | -5% | -15% | -73% | -76% | $50,957,233 |

| NIC | Nickel Industries | 0.875 | -5% | -5% | -11% | 14% | $3,753,583,645 |

| S2R | S2 Resources | 0.07 | -5% | -14% | -42% | -62% | $31,700,060 |

| BKT | Black Rock Mining | 0.049 | -6% | -2% | -25% | -57% | $61,350,381 |

| ILU | Iluka Resources | 5.54 | -6% | -16% | -27% | -20% | $2,372,442,320 |

| MEK | Meeka Metals Limited | 0.065 | -6% | 8% | 86% | 81% | $154,378,612 |

| S32 | South32 Limited | 3.54 | -6% | -2% | -2% | 16% | $16,007,985,938 |

| SRI | Sipa Resources Ltd | 0.016 | -6% | -6% | -6% | -24% | $3,650,530 |

| MIN | Mineral Resources. | 34.95 | -6% | -31% | -54% | -40% | $6,868,325,210 |

| AZL | Arizona Lithium Ltd | 0.015 | -6% | -12% | -32% | -64% | $67,107,218 |

| DRE | Dreadnought Resources Ltd | 0.015 | -6% | -17% | -17% | -56% | $56,291,250 |

| DLI | Delta Lithium | 0.22 | -6% | -14% | -31% | -57% | $156,949,571 |

| 1MC | Morella Corporation | 0.029 | -6% | -3% | -42% | -83% | $8,789,569 |

| EMH | European Metals Hldg | 0.145 | -6% | -17% | -68% | -77% | $30,079,482 |

| INR | Ioneer Ltd | 0.215 | -7% | -9% | 2% | 43% | $506,444,866 |

| A11 | Atlantic Lithium | 0.215 | -7% | -44% | -47% | -46% | $141,708,958 |

| 1AE | Auroraenergymetals | 0.043 | -7% | -4% | -47% | -56% | $7,699,741 |

| DVP | Develop Global Ltd | 2.19 | -7% | -9% | -4% | -23% | $594,420,947 |

| BNR | Bulletin Res Ltd | 0.041 | -7% | -9% | -21% | -74% | $12,038,146 |

| ARU | Arafura Rare Earths | 0.13 | -7% | -28% | -30% | -32% | $320,362,730 |

| M24 | Mamba Exploration | 0.012 | -8% | -8% | -45% | -60% | $2,256,987 |

| EV1 | Evolutionenergy | 0.035 | -8% | -17% | -49% | -75% | $12,619,850 |

| INF | Infinity Lithium | 0.034 | -8% | -11% | -36% | -72% | $15,728,131 |

| EVG | Evion Group NL | 0.034 | -8% | 6% | 42% | -6% | $11,796,748 |

| PTR | Petratherm Ltd | 0.045 | -8% | -24% | 67% | -4% | $13,656,704 |

| SBR | Sabre Resources | 0.011 | -8% | -15% | -42% | -69% | $4,322,581 |

| HAW | Hawthorn Resources | 0.054 | -8% | -7% | -19% | -46% | $18,090,843 |

| GRE | Greentechmetals | 0.105 | -9% | -19% | -46% | -85% | $8,723,397 |

| PNT | Panthermetalsltd | 0.021 | -9% | -30% | -33% | -60% | $4,942,321 |

| LLI | Loyal Lithium Ltd | 0.105 | -9% | -28% | -59% | -76% | $9,736,972 |

| KNI | Kunikolimited | 0.205 | -9% | 17% | -2% | -21% | $17,787,700 |

| PGM | Platina Resources | 0.02 | -9% | -2% | -9% | -29% | $12,463,607 |

| GSM | Golden State Mining | 0.01 | -9% | -9% | -23% | -47% | $2,793,706 |

| NC1 | Nicoresourceslimited | 0.1 | -9% | -20% | -31% | -67% | $10,945,058 |

| ASO | Aston Minerals Ltd | 0.01 | -9% | -17% | -23% | -69% | $12,950,643 |

| OCN | Oceanalithiumlimited | 0.03 | -9% | -30% | -38% | -76% | $2,474,940 |

| ANX | Anax Metals Ltd | 0.01 | -9% | -33% | -83% | -67% | $8,714,349 |

| GL1 | Globallith | 0.195 | -9% | -26% | -51% | -84% | $50,814,638 |

| BUR | Burleyminerals | 0.067 | -9% | -4% | -57% | -68% | $10,074,853 |

| IMI | Infinitymining | 0.019 | -10% | -50% | -68% | -84% | $4,807,139 |

| KZR | Kalamazoo Resources | 0.085 | -10% | 0% | -29% | -29% | $17,106,805 |

| LOT | Lotus Resources Ltd | 0.23 | -10% | -16% | -49% | -13% | $483,281,232 |

| QXR | Qx Resources Limited | 0.0045 | -10% | -36% | -64% | -85% | $5,760,350 |

| FRS | Forrestaniaresources | 0.0135 | -10% | -10% | -29% | -53% | $2,509,170 |

| GED | Golden Deeps | 0.027 | -10% | -16% | -31% | -53% | $4,091,103 |

| RMX | Red Mount Min Ltd | 0.009 | -10% | -10% | -40% | -79% | $3,486,220 |

| SLZ | Sultan Resources Ltd | 0.009 | -10% | 50% | -18% | -39% | $2,083,229 |

| WMG | Western Mines | 0.18 | -10% | -23% | -52% | -37% | $15,327,194 |

| DM1 | Desert Metals | 0.027 | -10% | 0% | 35% | -33% | $7,166,494 |

| TLG | Talga Group Ltd | 0.52 | -10% | 37% | -21% | -54% | $223,079,793 |

| TOR | Torque Met | 0.058 | -11% | -28% | -65% | -66% | $13,572,808 |

| OD6 | Od6Metalsltd | 0.041 | -11% | 8% | -41% | -78% | $5,276,297 |

| NVA | Nova Minerals Ltd | 0.2 | -11% | 11% | -18% | -20% | $54,627,376 |

| SRZ | Stellar Resources | 0.016 | -11% | -11% | -11% | 78% | $33,276,009 |

| WSR | Westar Resources | 0.008 | -11% | -20% | -20% | -58% | $3,189,799 |

| KNG | Kingsland Minerals | 0.195 | -11% | -7% | -11% | -25% | $14,149,378 |

| PGD | Peregrine Gold | 0.15 | -12% | -12% | -38% | -46% | $10,181,763 |

| GRL | Godolphin Resources | 0.015 | -12% | 7% | -40% | -57% | $4,743,168 |

| AVL | Aust Vanadium Ltd | 0.014 | -13% | -7% | -13% | -36% | $120,885,213 |

| EFE | Eastern Resources | 0.0035 | -13% | -13% | -50% | -71% | $4,346,813 |

| CTN | Catalina Resources | 0.0035 | -13% | 17% | 17% | 0% | $4,334,704 |

| CRR | Critical Resources | 0.007 | -13% | -13% | -42% | -77% | $13,745,785 |

| GCM | Green Critical Min | 0.007 | -13% | 133% | 100% | 8% | $10,682,298 |

| THR | Thor Energy PLC | 0.014 | -13% | 0% | -13% | -42% | $3,382,069 |

| COB | Cobalt Blue Ltd | 0.082 | -13% | -2% | -12% | -67% | $34,642,929 |

| TKM | Trek Metals Ltd | 0.026 | -13% | -13% | -37% | -49% | $13,360,694 |

| RXL | Rox Resources | 0.155 | -14% | 19% | -9% | -24% | $63,642,269 |

| VTM | Victory Metals Ltd | 0.365 | -14% | -1% | 46% | 55% | $38,408,463 |

| MOH | Moho Resources | 0.006 | -14% | 0% | 20% | -25% | $4,043,836 |

| AM7 | Arcadia Minerals | 0.03 | -14% | -17% | -50% | -66% | $3,511,503 |

| KGD | Kula Gold Limited | 0.006 | -14% | -14% | -40% | -54% | $3,859,272 |

| FIN | FIN Resources Ltd | 0.006 | -14% | 0% | -50% | -81% | $3,895,612 |

| SRL | Sunrise | 0.29 | -15% | -28% | -51% | -58% | $26,165,974 |

| LKE | Lake Resources | 0.052 | -15% | 8% | -17% | -69% | $90,330,552 |

| CY5 | Cygnus Metals Ltd | 0.115 | -15% | 39% | 37% | -26% | $54,584,713 |

| GT1 | Greentechnology | 0.068 | -15% | -26% | -32% | -83% | $26,435,143 |

| WIN | WIN Metals | 0.022 | -15% | -54% | -41% | -86% | $10,473,965 |

| TAR | Taruga Minerals | 0.011 | -15% | 10% | 22% | 16% | $7,766,295 |

| AS2 | Askarimetalslimited | 0.021 | -16% | -25% | -58% | -89% | $2,160,273 |

| CZN | Corazon Ltd | 0.005 | -17% | -17% | -50% | -69% | $3,339,528 |

| AAJ | Aruma Resources Ltd | 0.015 | -17% | -12% | 0% | -55% | $3,330,873 |

| PUR | Pursuit Minerals | 0.0025 | -17% | -17% | -44% | -75% | $9,088,500 |

| CMX | Chemxmaterials | 0.03 | -17% | -19% | -41% | -63% | $3,870,670 |

| KAI | Kairos Minerals Ltd | 0.015 | -17% | 20% | 20% | -6% | $39,463,683 |

| CHN | Chalice Mining Ltd | 1.46 | -18% | -5% | 7% | -7% | $567,979,110 |

| PVW | PVW Res Ltd | 0.018 | -18% | -18% | -40% | -67% | $3,580,286 |

| MQR | Marquee Resource Ltd | 0.013 | -19% | -19% | -7% | -61% | $5,412,997 |

| KFM | Kingfisher Mining | 0.051 | -19% | -22% | -26% | -64% | $2,739,465 |

| SYR | Syrah Resources | 0.24 | -20% | -16% | -49% | -66% | $248,374,024 |

| G88 | Golden Mile Res Ltd | 0.012 | -20% | -8% | 0% | -52% | $5,673,874 |

| WML | Woomera Mining Ltd | 0.002 | -20% | -20% | -50% | -92% | $4,333,180 |

| SCN | Scorpion Minerals | 0.012 | -20% | -25% | -48% | -79% | $4,913,474 |

| SYR | Syrah Resources | 0.24 | -20% | -16% | -49% | -66% | $248,374,024 |

| VR8 | Vanadium Resources | 0.031 | -21% | -34% | -34% | -28% | $17,441,381 |

| EUR | European Lithium Ltd | 0.023 | -21% | -38% | -52% | -71% | $32,156,821 |

| GW1 | Greenwing Resources | 0.049 | -21% | -26% | -37% | -67% | $11,791,923 |

| ASL | Andean Silver | 0.95 | -22% | -13% | 53% | 322% | $148,935,067 |

| KM1 | Kalimetalslimited | 0.125 | -24% | -26% | -70% | 0% | $9,603,453 |

| LRV | Larvottoresources | 0.485 | -25% | 33% | 416% | 360% | $162,747,998 |

| VRC | Volt Resources Ltd | 0.003 | -25% | -25% | -40% | -57% | $12,476,034 |

| EVR | Ev Resources Ltd | 0.003 | -25% | -27% | -64% | -70% | $4,188,814 |

| CDT | Castle Minerals | 0.002 | -33% | -33% | -67% | -81% | $3,334,462 |

Originally published as High Voltage: BYD’s EV sales look set to overtake Ford this year