Here are five companies with upcoming news that can move the needle

These five ASX resource juniors have upcoming news that might get the blood pumping.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Meteoric is awaiting a scoping study for its world-class Caldeira clay-hosted REE project

Assays pending for drilling at Equinox’s Rio Negro prospect within its Campo Grande project

Results also imminent for drilling at Iltani’s Orient West project in Queensland

Junior resource companies are leveraged to news from their projects, that is a fact of life that quite simply won’t change.

Be it exploration results, a maiden resource, or the results of mining studies, such updates could deliver real growth to a company’s share price.

It is no wonder then that investors are always keeping a keen eye on juniors and their coming news.

Here are five companies with potentially significant news that Stockhead has short-listed.

Meteoric Resources (ASX:MEI)

Arguably the benchmark by which Brazilian ionic adsorption clay-hosted rare earths plays are measured by, Meteoric Resources is certainly not resting on the achievements it has made at its giant Caldeira project in Minas Gerais state.

Just this year alone, the company has delivered two resource upgrades for the project, the first increasing resource at the Soberbo mining licence by 150% to 229Mt grading 2,601 parts per million (ppm) total rare earth oxides (TREO) while the second increased resources at Capão do Mel by 147% to 142Mt at 2523ppm TREO.

Collectively, these upgrades take the global Caldeira resource up to a rather spectacular 619Mt at 2538ppm TREO with valuable magnet rare earths – used to manufacture rare earth magnets found in electric vehicle motors and wind turbines – making up 23% of the REE basket.

Higher confidence measured and indicated resources, which have enough certainty for mine planning, have also been cranked up to nearly a quarter of the total resource at 171Mt at 2880ppm TREO.

Meanwhile, the high-grade core of 36Mt grading 4345ppm TREO at Capão do Mel will sit next to a processing facility, neatly supporting the company’s initial production strategy targeting feed grades greater than 4,000ppm TREO for the first 5-10 years.

Other significant work includes the lodging of the environmental impact statement with the Minas Gerais State Secretariat for the Environment and Sustainable Development, signing a non-binding offtake memorandum of understanding with Neo Performance Materials, and metallurgical testwork successfully producing a mixed rare earth carbonate product.

Unsurprisingly, MEI is looking forward to announcing the results of the scoping study that it has been working on, noting that the upgrade resource means that there are more than enough high-grade tonnes to update its financial projections.

Chief executive officer Nick Holthouse noted earlier this month that the high grades, high recoveries and easy access to tonnes from surface all contribute to a low operating cost environment.

Equinox Resources (ASX:EQN)

Speaking of ASX-listed companies with interests in Brazilian REE projects, Equinox Resources certainly fits the bill with projects in both the hard rock and IAC spaces.

The company is currently awaiting assays from maiden drilling at the highly prospective hard rock Rio Negro prospect at its giant 1801km2 Campo Grande project in the emerging Bahia State’s Rocha da Rocha rare earths district.

The company has good reasons to be excited about the project’s potential.

For starters, it has absolutely no shortage of neighbours including fellow Australians such as the Gina Rinehart-backed Brazilian Rare Earths (ASX:BRE), Australian Mines (ASX:AUZ) and Gold Mountain (ASX:GMN).

However, Campo Grande has no need to ride on the coattails of its neighbours.

Surface channel sampling has already proved that high grades of rare earth elements are present within the project’s clays – notable assays from this exercise include 3m at 1490ppm total rare earth oxides and 2m at 1145ppm TREO.

And while the assays themselves are still in the works, the drilling of 126 auger and three reverse circulation holes has already returned some insights, returning detailed geological profiles with saprolite clay, sand, and hard rock intercepts.

More recently, field work has uncovered new outcropping boulders that provide evidence of further hard rock REE potential at Rio Negro.

While the drilling will provide EQN with a concrete idea of just what is present at the Rio Negro prospect – and by inference Campo Grande – the company isn’t restricted to just that one project.

It recently moved to acquire an additional 127.8km2 of ground (up to almost 1000km2) at the Mata da Corda project, which has the potential to host IAC REE mineralisation and has seen >2000ppm TREO assays from surface and channel clay sampling over 10km2 of the project area.

Separately, the company defined a 108.5Mt at 58% iron direct shipping ore resource at its Hamersley iron ore project in WA’s Pilbara just 30km from FMG’s world-class Solomon Mining Hub.

Iltani Resources (ASX:ILT)

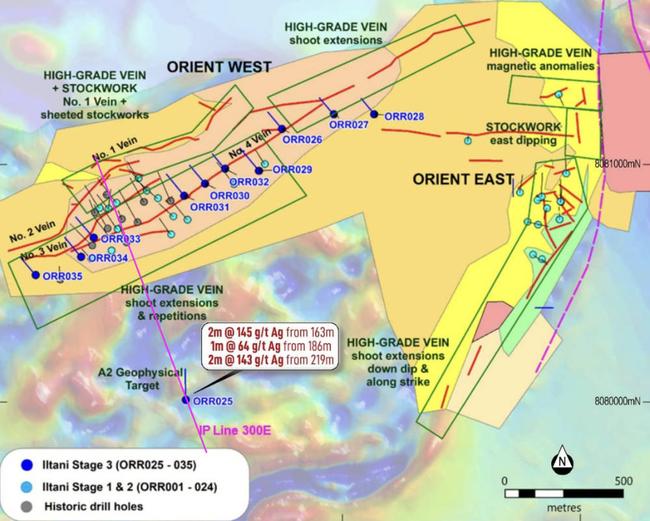

Another company waiting on (further) drill results is Iltani Resources, which had carried out an 11-hole program at the western end of its Orient project in north Queensland that is already known to host Australia’s highest grades of indium – up to 1070g/t.

Prior to the start of the latest program, the company had already drilled some 20 reverse circulation holes since 2023, delivering multiple silver-lead-zinc-indium-tin hits that indicated Orient’s potential to be a world-class discovery.

Notable assays include the highest ever indium results announced on the ASX of 5m grading 43g/t silver, 0.7% lead, 5% zinc and 263g/t indium.

Previous drilling at Orient West focused on a zone covering 800m of strike and intersected mineralisation at a vertical depth of 220m, with multiple holes intersecting significant values 150m downhole.

The current drill program was intended to infill some adjacent areas to the previous drill holes – particularly in the northeast where no drilling has been done before.

Results may then be used to plan further infill drilling on a 100m by 50m grid, which will set the stage for the company to define an inferred resource.

This has the potential to be hugely significant as indium is a highly sought-after critical mineral used in coatings and tech applications such as semiconductors and TVs.

Buoying its expectations, the first hole in the program – targeting the A2 geophysical anomaly about 650m southwest of known mineralisation at Orient West - delivered multiple silver-lead-zinc-indium intercepts of 2m grading 145.3g/t silver equivalent (AgEq) from 163m, 2m at 143.1g/t AgEq from 219m and 1m at 64.2g/t AgEq from 186m.

The success of hole ORR025 confirms the extension of Orient mineralisation given that A2 was a ‘blind target’ with no historical workings or previous drilling. It also indicates that geophysical exploration is a valid tool to target new vein systems under cover.

While indium is the real prize at Orient, silver’s continued strength – trading as it does near the US$30/oz mark – means that a successful drill program could significantly improve Orient’s economics.

ILT is also currently drilling the Orient deep diamond hole, which targets a deeper magnetic anomaly that could be representative of the mineralisation source under Orient West.

Mithril Resources (ASX:MTH)

With silver gaining strength, attention has turned towards companies with silver assets though companies focused on the precious/industrial metal are hardly common on the ASX and those with assets in Mexico, the world’s largest producer of the precious metal with growing industrial uses, are rarer still.

MTH’s high-grade Copalquin silver-gold project is an easy-to-process epithermal system with historical production from 70 small scale mines and workings.

Previous drilling in 2021 and 2022 returned top shelf results such as 8.26m at 80.3g/t gold and 705g/t silver from one of the deepest holes drilled at the Refugio area, 6.8m at 74g/t gold and 840g/t silver and 3m at 34.7g/t gold and 3129g/t silver.

While the project currently has a contained maiden resource of 529,000oz gold equivalent (AuEq) at 6.8g/t AuEq within Refugio/Soledad – the first of several target areas at the project, MTH is looking to at least double the resource within this zone.

Besides sample assay results from channel sampling over outcrop and underground areas, the company has also launched a 4,000m drill program over to follow-up the previous high-grade intersections, test new structures and zones, and test areas close the historical El Refugio and La Soledad mine workings.

First Lithium (ASX:FL1)

With the focus here on critical minerals, it is probably inevitable that the discussion will swing around to lithium, which remains key to the transition to net zero.

First Lithium has been progressing work that has continued to prove up its belief that the Blakala deposit in Mali deserves its original ranking as one of only two Tier 1 priority lithium targets in the country ranked by CSA Global in 2008.

The other is the giant 211Mt Goulamina mine that is due to begin exporting concentrate for EV chemicals in the September quarter.

Drilling at Blakala has returned encouraging results with FL1 noting in April that holes intersecting the +1.3km-long Main, Eastern, and Western pegmatite bodies had returned assays such as 21m at 1.96% Li2O from 22m and 15m at 1.76% Li2O from 32m.

The company has plenty to look forward to in the coming months.

First up is the maiden resource for Blakala due out later this month that will likely allow the company to really play up the comparisons with Goulamina.

Final assays from the first stage drilling at the deposit are also due imminently while metallurgical test work is underway.

Strong results from this will certainly be accretive for FL1 given that Leo Lithium (ASX:LLL) received US$347m for its 40% stake in Goulamina from its JV partner and lithium behemoth Ganfeng.

Originally published as Here are five companies with upcoming news that can move the needle