Government contracts are golden, and these ASX tech stocks are raking it in

Aussie tech stocks have been locking in government deals, which could mean steadier cash, stickier revenue, and less market mood swings.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

TechnologyOne becomes Canberra’s digital backbone

'Buy Australian Plan' aims to make it easier to land a public sector contract

ASX tech stocks with signed government deals

The third largest technology stock on the ASX, Technology One (ASX:TNE), is becoming the go-to IT backbone for governments across Australia.

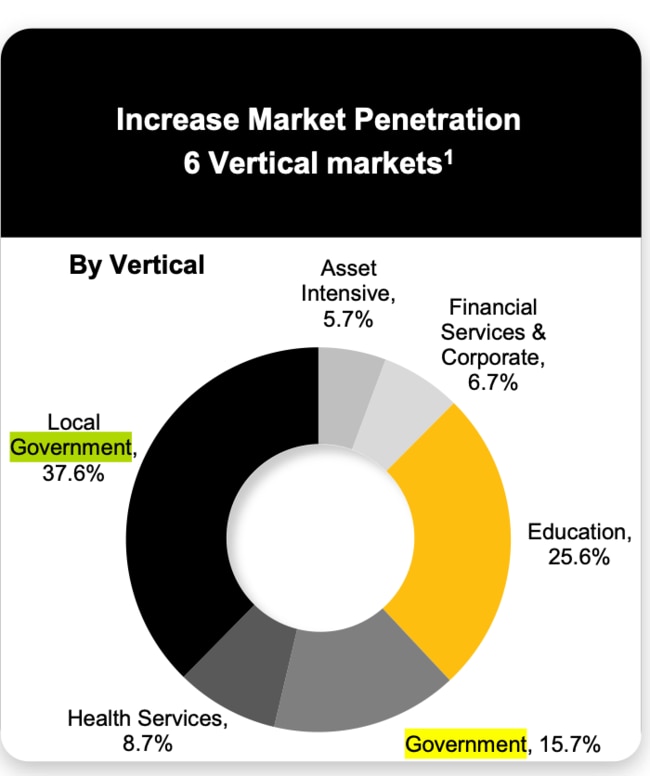

In its half-year deck released to the market last week, TNE reported that more than half (53%) of its revenue came from governments.

With more than 230 departments and agencies already on board, the company has indeed stitched itself deep into the public sector.

Recent wins include a major contract with the Australian Energy Regulator, and a $5.6 million deal with the ACT government to overhaul its development application system.

So why do governments keep signing up?

Well, because TechOne offers a no-fuss, fixed-fee SaaS+ model that delivers software, upgrades and support in one clean annual bill.

No cost blowouts, no army of consultants, just results.

Headquartered in Brisbane, TNE builds enterprise software that helps governments, councils and universities run their finances, payroll, HR, and procurement. Think of the company as the digital plumbing that keeps public services humming.

In its presentation deck, TNE also said it was planning to double in size every five years.

Buy Australian Plan

For tech companies – especially the smaller caps – a government contract is a bit like landing a Fortune 500 client, only with steadier legs.

It might not always be fast or flashy, but the revenue tends to stick around, and payment’s generally reliable.

A government contract could provide a stable, long-term, and recurring income for a tech company.

Sure, it might take a while to get through the red tape, but once you’re in, you’ve got a customer who doesn’t ghost you when markets wobble (well, not usually anyway).

Now the Australian government wants to make those contracts more accessible.

Under the new 'Buy Australian Plan', Canberra is putting its money where its mouth is, using its huge buying power to back local operators, not offshore giants.

The plan is all about making it easier for small businesses, First Nations companies and regional outfits to land government work without getting buried in red tape.

That means clearer rules, simpler tenders, faster payments and shutting the door on tax dodgers.

There’s also a new Procurement Capability Branch under the plan, which will help Aussie businesses go toe-to-toe for contracts.

Tech/biotechs with government deals

Several ASX-listed tech and biotech names have either locked in government contracts or are being officially linked to key programs.

Here are some notable examples:

Macquarie Technology Group (ASX:MAQ)

MAQ is one company the Aussie government seriously trusts.

Around 42% of federal government agencies reportedly use MAQ's services through its Macquarie Government division.

The company’s Australian data centres are all Certified Strategic, meaning they’re cleared to handle top-secret workloads and built to meet the toughest security standards in the country.

DroneShield has been securing notable contracts with the Australian Defence Force (ADF) and other government agencies.

In 2023, the company was awarded a $10 million Electronic Warfare contract by the Australian government, following the successful completion of a prior $3.8 million contract.

Additionally, DroneShield received a $9.9 million two-year research and development contract from a Department of Defence within the Five Eyes alliance.

In 2025, the company scored a $32.2 million deal via a local reseller tied to a global defence giant, with all gear heading to a major Asia-Pacific military force.

Harvest Technology Group (ASX:HTG)

Back in mid-2023, Harvest landed its first defence contract with a Five Eyes customer for its Nodestream technology.

Nodestream helps stream high-quality video and data even in super low-bandwidth or remote environments. This tech could be used for critical defence applications involving surveillance and remote communications.

It was a big step for HTG, marking the start of a potentially long-term relationship.

Fast forward to early 2024, and HTG announced a follow-up – not just one, but two more orders from the same customer.

The company also had other wins, including orders from the European Union Defence Force and new UK-based offshore contractors, plus a successful drone trial with Japan’s Self-Defence Force.

In early 2025, WhiteHawk was selected as the exclusive cyber risk partner on the US General Services Administration’s SCRIPTS program.

This is a 10-year, US$920 million contract vehicle focused on supply chain risk management across federal agencies.

Teaming up with Knexus Research, Babel Street, and Dun & Bradstreet, WhiteHawk will provide AI-driven cyber analytics to help US agencies detect and mitigate supply chain vulnerabilities.

In Australia, WhiteHawk is gradually expanding its footprint. In July 2024, the company secured a cybersecurity contract with Tabcorp.

In February, Micro-X scored a $6 million contract extension from the US Department of Homeland Security (DHS) to keep building its self-screening airport checkpoints.

It’s part of a bigger deal worth up to US$14 million, and this next stage funds two more units and a full round of testing over the next 16 months.

If things go well, DHS could tip in another $7.5 million to take the system all the way to live airport trials with real passengers.

Micro-X was also awarded up to US$16.4 million by the US Advanced Research Projects Agency for Health (ARPA-H) to develop a world-first portable full-body CT scanner.

The project leverages Micro-X's proprietary Nano Electronic X-ray (NEX) technology to create a lightweight CT scanner, approximately 225 kilograms, significantly lighter than conventional models exceeding 2000 kilograms.

HiTech Group Australia (ASX:HIT)

HiTech isn’t your average recruiter, the company’s been in the game over 30 years, quietly supplying top-shelf IT talent to more than 43 federal government departments across Australia.

From Defence to Home Affairs, HIT is trusted to scout for and deliver security-cleared tech brains.

As a DISP-accredited outfit, the company has practically got the keys to Canberra’s back office, helping plug skill gaps in everything from IT and finance to project support.

While not holding direct government contracts per se, Audeara’s headphones are officially approved as assistive listening devices under the NDIS (National Disability Insurance Scheme), DVA (Department of Veterans’ Affairs), and the Hearing Services Program.

This means the Australian government might help cover the cost if your hearing needs a boost.

NDIS participants can claim them as low-cost assistive tech, DVA veterans can get them through the rehab appliance scheme, and under HSP, they’re listed as fully subsidised alternatives.

At Stockhead we tell it like it is. While Audeara and Harvest Technology are Stockhead advertisers, they did not sponsor this article.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decision.

Originally published as Government contracts are golden, and these ASX tech stocks are raking it in