Could nuclear energy be the climate solution right under our noses?

Research firm Goehring & Rozencwajg believes nuclear energy trumps the green credentials of renewables thanks to small modular reactors.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Goehring & Rozencwajg reckons uranium’s time has come

New small modular reactors more efficient and economic than renewables

Even Google and Microsoft are on board the nuclear wagon

Research firm Goehring & Rozencwajg believes nuclear energy is more efficient and economic than renewables.

As we head in to 2025, the firm has released a research note highlighting its extremely bullish outlook for uranium.

It reckons the nuclear power industry is on the cusp of ‘radical change’ with the advent of molten-salt small modular reactors (SMRs) which promise to boost both the energy efficiency and safety of nuclear fission.

Safety being a key word in an industry plagued with nuclear failures (Three Mile Island, Chernobyl, Fukushima) and the associated (and unsurprising) bad publicity.

Essentially Goehring & Rozencwajg says nuclear is actually more efficient and economic than renewables, comparing it to the Boeing 747 vs the failed Concorde.

“After extensive study of the energy efficiency of renewables compared to hydrocarbons and nuclear power, we’ve concluded that large-scale adoption of renewables – including EVs – will be unfeasible unless societies are willing to accept substantial declines in economic growth and living standards,” the firm's note posits.

“The implications for investors are equally profound.

“The choice, as we see it, is between uranium and copper – between investing in the Concorde, a technological marvel that failed to take flight commercially, and the Boeing 707, the plane that launched the jet age.

“The Concorde sits in museums today; the legacy of the 707 is written in the contrails crisscrossing the globe.

“The parallels between SMRs and the energy revolution they promise are clear.

“At Goehring & Rozencwajg, we know which side of history we want to be on.”

Love the drama. And economically, they’re talking cents. (Pray the editor gods let me have that one.) (Sure, consider it your Christmas bonus – Ed.)

“Regarding renewables, we are just where the Concorde was in 1975 – there was huge hype, but the underlying problem of energy efficiency couldn’t be overcome and the Concorde was never successful,” Goehring & Rozencwajg notes.

“With the 707’s huge lift in energy efficiency, the global travel world was about to be disrupte – with huge societal benefits that are still being felt.

“The SMR, we believe, is the Boeing 707 of today.”

Uranium in short supply

Since 2018 when uranium prices bottomed at $17 per pound, the price has climbed over 300% currently sitting around $77 per pound.

And companies like producer Cameco have delivered returns exceeding 550%, outperforming the general market’s 150% gain in the same time.

“Much like copper, investor sentiment toward uranium has turned markedly bullish,’ Goehring & Rozencwajg writes.

“The looming structural deficit in global uranium markets is now widely acknowledged.”

Speaking of, the research firm points to Kazatomprom, the world’s largest uranium producer, which announced in August a substantial downgrade to its 2025 production guidance.

Back in 2023, the company had laid out ambitious plans to produce 79–80 million pounds of uranium in 2025 – a dramatic 45% increase over 2023 levels.

Now, its half-year update reveals a 13-million-pound shortfall against those 2025 projections, exacerbating the structural deficit in global uranium markets through 2030.

“Kazatomprom’s inventories now stand at 16 million pounds – a 40% reduction from five years ago.

“This sharp inventory decline raises the possibility that Kazatomprom may eventually need to enter the spot market to fulfil forward sales commitments, creating a potentially bullish inflection point.”

Even Google and Microsoft are moving to nuclear

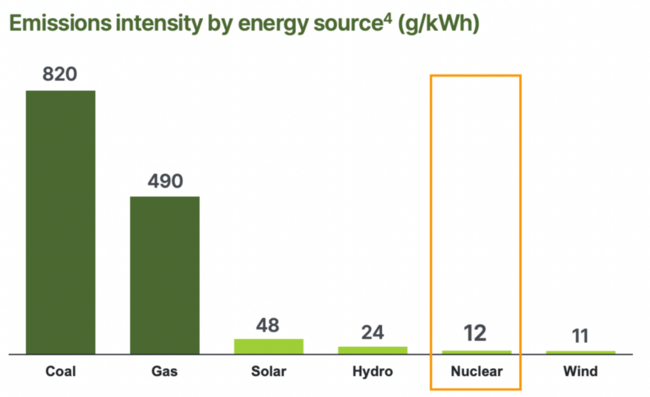

The research note also points to the significant advantage of generating electricity from uranium – namely zero CO2 emissions – which is “finally being recognised as an essential positive by environmentally conscious investors".

Both Google and Microsoft are looking to nuclear, with the latter recently announcing plans to reopen Three Mile Island.

Yep, you read that right. The idea is to reopen the Unit 1 nuclear facility which has been idle since 2019, with Microsoft to purchase 100% of the facility’s output to power its data centres.

ï¸'@Microsoft sees nuclear in the same vein as renewables for helping it to meet its clean energy goals.' Todd Noe. https://t.co/Tu8dnPKrVO ï¸

— World Nuclear Association (@WorldNuclear) September 10, 2024

Google, on the other hand, is planning to invest in small modular reactors (SMRs) for its own data centre energy needs.

“They reinforce our conviction that SMRs will dominate the nuclear power industry in the decades to come,” Goehring & Rozencwajg emphasises.

“This transformation carries enormous implications – not just for global climate goals, as SMRs replace coal-fired generation, but also for economic growth."

Renewables ‘levelized cost’ is a fallacy

It turns out, SMRs are up to six times more energy efficient than hydrocarbon-based power generation.

They’re also capable of providing the surplus energy needed to drive an increasingly power-intensive global economy.

“The adoption of SMRs represents a paradigm shift in uranium demand, introducing step-change increases that remain conspicuously absent from most analysts’ models,” Goehring & Rozencwajg asserts.

“With fundamentals for the uranium market growing increasingly bullish, these recent developments underscore the transformative potential of nuclear power in the 21st century.”

Especially when compared to the misguided opinion that the declining ‘levelized cost’ of wind and solar electricity are proof of their inevitable dominance.

The research firm maintains that you can look to Germany to see just how expensive and ineffective renewables actually are in practice.

It pointed out back in 2022 that not only will CO2 reduction goals not be met, but renewables only produce marginal surplus energy and since surplus energy drives economic growth, pursuing renewables hampers economic progress and leads to destabilisation.

“Over the past 15 years, Germany has invested nearly $1 trillion in renewable energy, primarily wind and solar, doubling its electricity production capacity.

“Concurrently, the government phased out nuclear power – its most energy-efficient source – greatly escalating the country’s energy problems.

“Pre-Fukushima, nuclear plants supplied about 25% of Germany’s electricity; today, none remain operational.

“Replacing nuclear power with renewables, an energy source with far less efficiency, has led to unintended and unfortunate outcomes – precisely as we predicted.”

As part of our commitment to clean energy, we’re signing the world’s first corporate agreement to purchase nuclear energy from multiple small modular reactors to be developed by @KairosPower. Learn more → https://t.co/K9nv7J9L4Q pic.twitter.com/GNuLs1dNA5

— Google (@Google) October 14, 2024

Addressing the Achilles' heel

The industry currently relies on large high-pressure, water-based reactors which, while energy efficient, require a lot of energy to construct due to operating pressures over 2,000psi requiring massive amounts of steel and concrete.

SMRs, on the other hand, operate at a lower pressure which reduces the need for heavy materials and complex safety systems.

“The molten salt-based small modular reactor (SMR) is not only a marvel of energy efficiency, but it also introduces advancements in operational safety – important to an industry haunted by its history,” the research firm notes.

Safety being the key word/Achille's heel when trying to change the public perceptions around nuclear power.

“Molten salt SMRs are poised to revolutionise energy production, addressing the fears of past accidents and the CO2 crisis that looms over our planet,” Goehring & Rozencwajg's note claims, adding:

“Data centres – prodigious energy consumers – are already adopting this technology to meet their immense demands.”

But more than that, there’s a transformation in perception underway – and with that comes a surge of uranium activity.

“Over the past several years, we’ve had to increase our uranium demand estimates by nearly 40 million pounds as plant closures have been deferred and new-build plans have accelerated," Goehring & Rozencwajg continues.

“With the introduction of SMRs, offering even greater efficiency and safety, the nuclear industry is poised to take another transformative leap.

“For investors, the uranium story has never been more compelling.

“The developments we witness are not merely bullish—they are the harbingers of a seismic shift.

“Like the nuclear industry itself, the uranium market is on the cusp of a remarkable transformation.”

Which ASX uranium stocks are in – or close to – production

Boss Energy (ASX:BOE)delivered its first quarter as a yellowcake exporter in October, producing 89,516lb of drummed yellowcake.

A first 57,000lb U3O8 shipment from the Honeymoon mine in South Australia was said to have met all converter quality metrics, with $23.4m banked from the sale of 200,000lb of uranium oxide.

There’s also the added bonus of the Gould’s Dam and Jason’s satellite deposits, which have combined resources of 36.7Mlbs of contained U308.

Boss says it is on track to hit production guidance of 850,000lb for FY25, with the 30% owned Alta Mesa project in South Texas also opened in early October.

That project is ramping up to an annualised production rate of 1.5 million pounds U3O8.

“With the production ramp-up at Honeymoon progressing so well, we are eager to press ahead with our plans to grow the annual output, cashflow and minelife,” Boss MD Duncan Craib said last month.

“These satellite deposits have the potential to drive growth as well as enabling us to leverage existing infrastructure and further capitalise on the opportunity presented by growing global demand for uranium from tier-one locations.”

Palladin’s (ASX:PDN) Langer Heinrich mine in Namibia returned to commercial production on March 30, 2024, and the company expects to produce 4-4.5Mlb and sell 3.8-4.1Mlb at costs of US$28-31/lb from the mine in FY25.

They’re also looking to takeover TSX-listed Fission Uranium and its PLS high-grade pre-development asset in Canada’s Athabasca Basin.

But some of Fission’s shareholders have been less than enthused with the takeover announced in September – notably 11.26% holder China General Nuclear Power Corp, which has opposed the final court approval of the scheme.

The latest potential roadblock has come in the form of a notice from the Minister of Innovation, Science and Industry asserting that a national security review had been launched into the arrangement.

That means consideration of the deal under the Investment Canada Act is yet to be cleared.

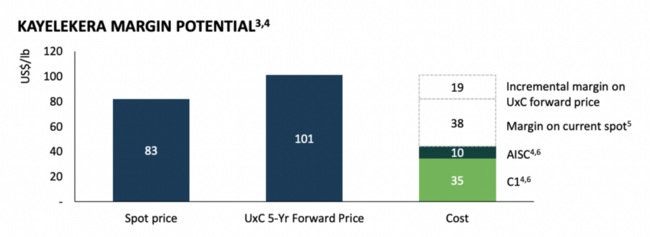

Lotus Resources (ASX:LOT)is looking to re-start the 19.3Mlb Kayelekera mine in Malawi in Q3 CY2025 after reducing capex to production from US$88m down to US$50m.

And just last week, Lotus increased indicated resources by 65% at its Letlhakane project in Botswana to 142.2Mt at 363ppm U3O8 for 113.7Mlb.

The company says Letlhakane has potential as a large-scale standalone uranium project to be developed in parallel to the Kayelekera restart.

Lotus has signed two uranium offtake arrangements with PSEG3 and Curzon4 totalling 1.5Mlbs between 2026-29, with discussions advancing with several parties for similar offtakes to complete a tranche of fixed price escalated contracts.

Plus, global metals investment manager Sprott has a 8.32% stake in the company.

NexGen Energy (ASX:NXG)is also hot on the heels of uranium production, securing uranium sales agreements with multiple leading US nuclear utility companies last week for yellowcake from its Rook I project in Canada.

The project has a production capability of up to 30Mlbs U3O8 annually.

“The contract awards are in parallel to ongoing discussions and negotiations with additional US, European and Asian utilities, which further complement NexGen's strong financial position and construction-ready status at Rook I,” CEO Leigh Curyer said at the time.

And finally there’s near-term producer Deep Yellow (ASX:DYL)which is progressing development of its two advanced projects: its flagship 121Mlb Tumas project in Namibia and the 104.8Mlb Mulga Rock in WA.

The company is targeting a final investment decision at Tumas in late Q4 2024, with construction slated for Q1 2025, and production in late 2026.

Discussion with global utilities on potential supply contracts is also underway and, notably, Sprott also has a stake in DYL – 7.82% to be exact.

BOE, PDN, LOT, NXG, DYL share prices today:

Originally published as Could nuclear energy be the climate solution right under our noses?