Closing Bell: Uranium surges on tariff exemption whispers; ASX rides energy wave higher

A surge in uranium stocks following whispers the mineral will be exempt from US tariffs has boosted the ASX for a fourth straight day of gains.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX uranium stocks have soared after the US administration flagged U3O8 would be included in tariff exemption list

Energy sector up more than 2pc, with Small Ords index close behind

Utilities, Info Tech, Resources, Real Estate sectors all up more than 1pc

Assurances from the US administration that uranium will be included in an upcoming list of tariff exemptions has given stocks dealing in the yellowcake mineral a welcome boost.

Small cap Boss Energy (ASX:BOE) is one of the best performing stocks on the ASX today, lifting 13.75% to $3.185 a share. The uranium producer’s core focus is the Honeymoon uranium project in South Australia, where it expects to produce 850k pounds of uranium in the 2025 financial year.

Micro caps Connected Minerals (ASX:CML) and Energy Resources of Australia (ASX:ERA) outperformed even Boss in terms of percentage gain (up 45% and 33.33% respectively), also enjoying attention from the uranium bulls.

Boss and ERA are joined by Bannerman Energy (ASX:BMN) up 12.86%, Lotus Resources (ASX:LOT) up 15.15%, Deep Yellow (ASX:DYL) up 12.44%, and Paladin Energy (ASX:PDN) with a 9.2% gain.

It’s difficult to judge the effect on uranium’s pricing, however, as its not traded openly on the market like other commodities, but rather directly between producers and end users in private long-term contracts.

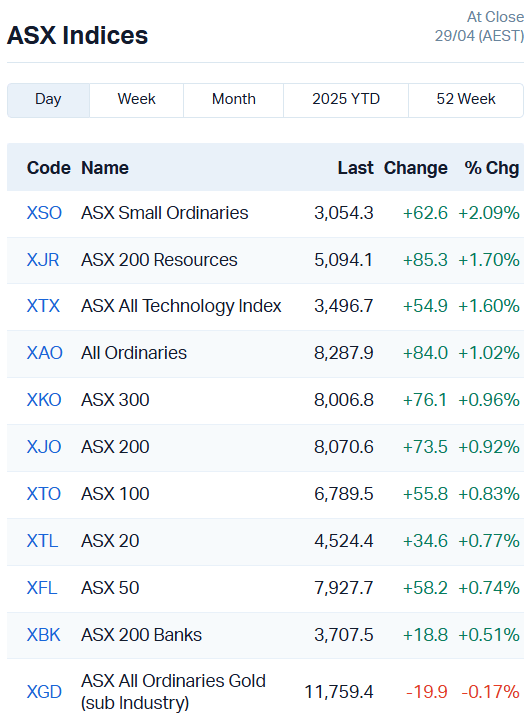

The effect on the wider Aussie market, on the other hand, was obvious. The ASX has gained almost a full percentage point today, lifting 0.92%.

The ASX Small Ords Index is up more than 2%, and the ASX 200 Resources close behind with a more than 1.5% lift.

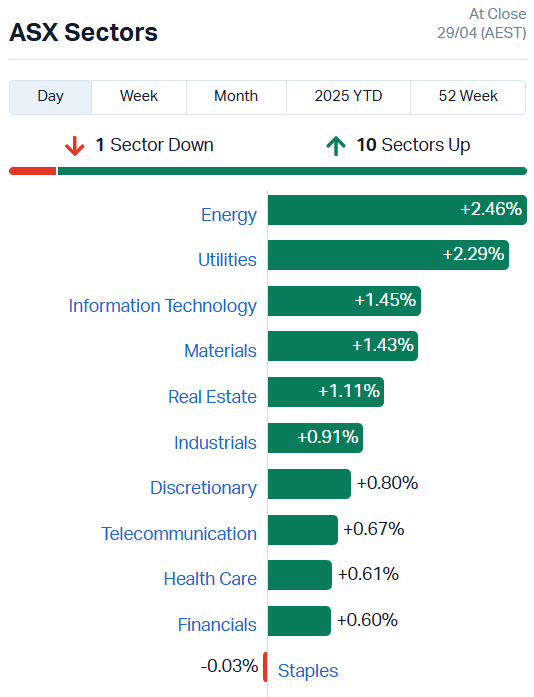

The optimism appears to have carried over into the rest of the market, with 10 of 11 sectors in the green, although Consumer Staples (-0.03%) held the class back.

Behind Energy, the Utilities and Info Tech sectors also enjoyed sizable gains, lifting 2.29% and 1.45% each.

Standouts included Origin Energy (ASX:ORG) up 3.15% and AGL Energy (ASX:AGL) with a 2.09% boost.

There was a 1.17% uptick for Wisetech (ASX:WTC), 1.05% for Xero (ASX:XRO), 1.45% for Technology One (ASX:TNE) and NextDC (ASX:NXT)rounded out the tech big caps with a 2.19% gain.

All to say, the ASX is on a bit of a tear at the moment, hovering around two-month highs after posting its fourth straight day of gains.

Of course, the bourse is still down 1.08% for the year to date, and the trade war that caused all the chaos is far from over, but for now things are looking up.

Speaking of which, here are today’s small cap movers and shakers on the Aussie market.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| DY6 | Dy6Metalsltd | 0.165 | 293% | 5842597 | $2,117,255 |

| 88E | 88 Energy Ltd | 0.002 | 100% | 9133331 | $28,933,812 |

| MMR | Mec Resources | 0.005 | 67% | 1080000 | $5,549,298 |

| EEL | Enrg Elements Ltd | 0.0015 | 50% | 2598009 | $3,253,779 |

| RAN | Range International | 0.003 | 50% | 270606 | $1,878,581 |

| CML | Connected Minerals | 0.16 | 45% | 189271 | $4,549,403 |

| ICR | Intelicare Holdings | 0.01 | 43% | 16556666 | $3,403,317 |

| PHL | Propell Holdings Ltd | 0.01 | 43% | 844830 | $1,948,367 |

| ADN | Andromeda Metals Ltd | 0.014 | 40% | 35683888 | $34,287,277 |

| EAT | Entertainment | 0.007 | 40% | 274684 | $6,543,930 |

| NYM | Narryermetalslimited | 0.042 | 35% | 2813 | $5,457,699 |

| 1TT | Thrive Tribe Tech | 0.002 | 33% | 4505606 | $3,047,585 |

| ADD | Adavale Resource Ltd | 0.002 | 33% | 1061407 | $3,430,919 |

| PRM | Prominence Energy | 0.004 | 33% | 1132 | $1,167,529 |

| QXR | Qx Resources Limited | 0.004 | 33% | 50200 | $3,930,987 |

| SIS | Simble Solutions | 0.004 | 33% | 429710 | $2,628,991 |

| EL8 | Elevate Uranium Ltd | 0.29 | 32% | 3345655 | $84,835,479 |

| MVP | Medical Developments | 0.61 | 31% | 1485471 | $52,386,121 |

| PNT | Panthermetalsltd | 0.017 | 31% | 21681035 | $3,911,759 |

| DTR | Dateline Resources | 0.009 | 29% | 43908802 | $19,358,980 |

| WYX | Western Yilgarn NL | 0.034 | 26% | 3215 | $3,714,149 |

| HMY | Harmoney Corp Ltd | 0.635 | 26% | 91637 | $51,491,894 |

| UVA | Uvrelimited | 0.094 | 25% | 1305 | $4,515,000 |

| RRR | Revolverresources | 0.035 | 25% | 162884 | $7,735,679 |

| ASR | Asra Minerals Ltd | 0.0025 | 25% | 21606559 | $4,746,254 |

Making news…

DY6 Metals (ASX:DY6) surged almost 300% after striking something special at Tundulu in southern Malawi, near the border with Mozambique. A fresh look at old drill data has uncovered high-grade gallium right from surface, with some hits showing eye-popping grades over long stretches. One standout drill hole pulled 74 metres at over 93 g/t gallium, including a spike at 310 g/t. DY6 said less than half the area has been drilled, and the gallium keeps going deeper, hinting there’s plenty more below.

Gallium is hot property right now thanks to demand in electronics and semiconductors, and most of the global supply is stitched up by China. DY6’s still running tests, but early signs point to a potentially serious play, and the market will be watching closely when results land in the coming weeks.

Joining in on the uranium bull run, Connected Minerals (ASX:CML) jumped 45% on release of its quarterly report, which included some promising uranium exploration results within the company's Namibian assets. Trench sampling at the Etango North-East prospect generated results of up to 46m at 506 ppm uranium, with grades peaking at 1m at 5,413 ppm U3O8.

InteliCare (ASX:ICR) is teaming up with Mecwacare to trial its smart care tech at the Trescowthick Centre in Prahran, Victoria. Mecwacare is a major aged care player in Victoria, and InteliCare’s AI-powered platform is part of its push to become a tech-savvy leader in aged and disability care. The trial will run for three months once the system’s fully set up, and if it goes well, Mecwacare could look to expand it across all 22 of its aged care homes. The deal’s worth $212k for now.

ASX SMALL CAP LAGGARDS

Today’s worse performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| HCF | H&G High Conviction | 0.055 | -84% | 427504 | $6,792,267 |

| SMX | Strata Minerals | 0.017 | -43% | 12258716 | $7,324,455 |

| IVT | Inventis Limited | 0.016 | -33% | 51875 | $1,834,185 |

| PAB | Patrys Limited | 0.002 | -33% | 4061410 | $6,172,342 |

| REY | REY Resources Ltd | 0.027 | -29% | 12682 | $8,039,314 |

| TON | Triton Min Ltd | 0.005 | -29% | 25388 | $10,978,721 |

| AKN | Auking Mining Ltd | 0.006 | -25% | 1411746 | $4,598,230 |

| AUK | Aumake Limited | 0.003 | -25% | 166666 | $12,042,769 |

| SFG | Seafarms Group Ltd | 0.0015 | -25% | 254852 | $9,673,198 |

| 3PL | 3P Learning Ltd | 0.6 | -21% | 14325 | $207,408,957 |

| ALM | Alma Metals Ltd | 0.004 | -20% | 503110 | $7,931,727 |

| AVE | Avecho Biotech Ltd | 0.004 | -20% | 1730579 | $15,867,318 |

| BYH | Bryah Resources Ltd | 0.004 | -20% | 2810980 | $4,349,768 |

| MEG | Megado Minerals Ltd | 0.008 | -20% | 835592 | $4,196,833 |

| RLL | Rapid Lithium Ltd | 0.002 | -20% | 46640 | $3,112,362 |

| PUA | Peak Minerals Ltd | 0.009 | -18% | 14258456 | $30,880,534 |

| PNN | Power Minerals Ltd | 0.059 | -18% | 2175314 | $8,197,551 |

| EMN | Euromanganese | 0.205 | -18% | 45937 | $10,247,906 |

| PGH | Pact Group Hldgs Ltd | 0.9 | -18% | 210275 | $376,997,608 |

| MNC | Merino and Co | 0.12 | -17% | 170932 | $7,696,103 |

| 1AI | Algorae Pharma | 0.005 | -17% | 2150156 | $10,124,368 |

| AZL | Arizona Lithium Ltd | 0.005 | -17% | 4252772 | $27,370,887 |

| BLZ | Blaze Minerals Ltd | 0.0025 | -17% | 2405674 | $4,700,843 |

| TMX | Terrain Minerals | 0.0025 | -17% | 385342 | $6,010,670 |

| BTE | Botalaenergyltd | 0.055 | -17% | 20000 | $16,510,297 |

IN CASE YOU MISSED IT

A listing to the OTCQB has unlocked access to US investors and global market traders for White Cliff Minerals (ASX:WCN), which has been approved to trade under the ticker WCMLF as of yesterday. The company says the listing will enhance accessibility for US investors, and increase liquidity and market visibility.

Anson Resources (ASX:ASN) is preparing to re-enter the Mt Fuel-Skyline Geyser 1-25 well after submitting a proposal to the local authorities, with plans to use the results from the Bosydaba#1 well to prove-up a JORC mineral resource at the Green River project.

Following-up on broad intersections of gold including 35.76m at 2.14 g/t gold from 14.27m of depth, Arika Resources (ASX:ARI) is set to begin a 6,000m RC drilling program to test extensions and investigate new prospects at the Yundamindra gold project in WA.

Trading Halts

Dimerix (ASX:DXB) - licensing agreement

Orthocell (ASX:OCC) - new regulatory approval for Remplir

Southern Cross Gold (ASX:SXG) - cap raise

Kalamazoo Resources (ASX:KZR) - cap raise

Alice Queen (ASX:AQX) - cap raise

Nanoveu (ASX:NVU) - cap raise

Blinklab (ASX:BB1) – cap raise

Sparc Technologies (ASX:SPN) - cap raise

BluGlass (ASX:BLG) - cap raise

Kore Potash (ASX:KP2) - financing proposal

DY6 Metals (ASX:DY6) - clarification to an announcement

At Stockhead, we tell it like it is. While White Cliff Minerals, Anson Resources and Arika Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: Uranium surges on tariff exemption whispers; ASX rides energy wave higher