Closing Bell: ASX slumps as banks and miners tumble; Trump taps Musk to run DOGE show

The ASX dropped on Wednesday as banks and miners slid, with MinRes falling hard. And Trump has tapped Musk to lead a new DOGE department. Yep, you read that right.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX falls 1pc with banks and miners hit

MinRes drops after halting Bald Hill operations

Trump taps Musk to lead new DOGE department

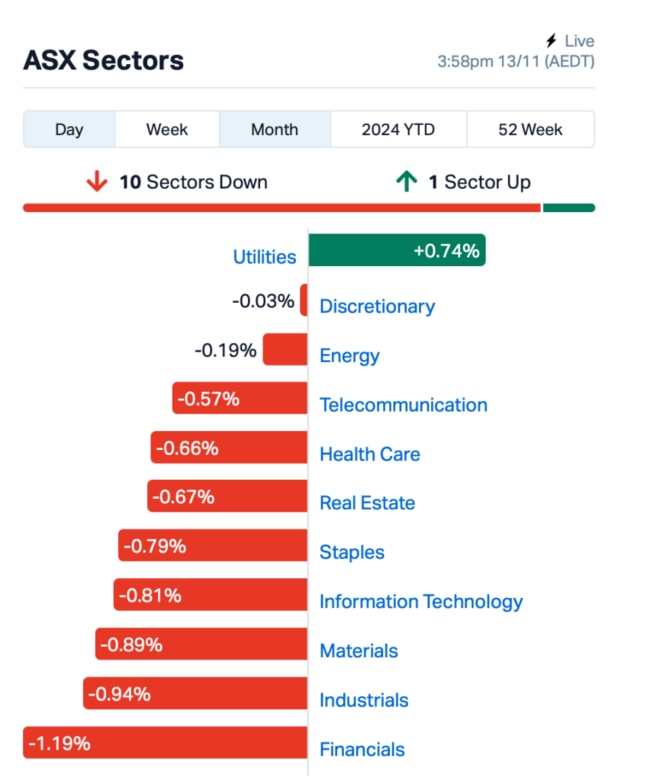

Investors were clearly feeling jittery on Wednesday, with many trimming positions in riskier assets amid a more uncertain global outlook.

The ASX dropped 0.75 per cent after a strong rally in US stocks lost momentum.

Banking stocks dragged after the Commonwealth Bank (ASX:CBA) fell 0.65 per cent following the release of its Q1 results for FY25.

While the CBA reported a a 3.5 per cent rise in operating income, it also reported a 3 per cent increase in expenses due to higher wages. The $2.5 billion profit was in line with market expectations, but loan impairments rose slightly.

Westpac (ASX:WBC) and National Australia Bank (ASX:NAB) also fell hard, while Australia and New Zealand Banking Group (ASX:ANZ) took the biggest hit, down by 4 per cent after going ex-dividend.

The mining sector hasn't escaped the bloodshed, either.

Mineral Resources (ASX:MIN) shareholders were feeling the pain as the stock tumbled 6.5 per cent. MinRes earlier announced that it will pause operations at its Bald Hill lithium site due to falling lithium prices.

Gold stocks were also under pressure as the precious metal continues its slide below $US2600 an ounce.

Bitcoin, however, has been holding relatively steady near $US88,000, with some speculating it could break through the $100,000 mark soon.

Despite some winners like James Hardie (ASX:JHX), which rose 6 per cent after posting a 23 per cent drop in net profit, the broader market sentiment is cautious.

Trump recruits Musk for 'DOGE' department

Donald Trump has chosen Elon Musk to lead the new "Department of Government Efficiency" (DOGE), a move that could boost the cryptocurrency space further.

The department, named after the popular meme-coin Dogecoin, has helped propel the digital asset to new heights in the past week.

Dogecoin, which started as a joke by software engineers Billy Markus and Jackson Palmer, has been on a tear since Trump's election win.

ASX SMALL CAP LEADERS

Wednesday’s best-performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| RIE | Riedel Resources Ltd | 0.002 | 100% | 529,838 | $2,223,836 |

| SWF | Selfwealth | 0.210 | 75% | 7,964,419 | $27,687,805 |

| 8IH | 8I Holdings Ltd | 0.013 | 63% | 79,861 | $2,785,287 |

| CDE | Codeifai Ltd | 0.002 | 50% | 8,750,006 | $2,641,295 |

| OLL | OpenLearning | 0.028 | 47% | 225,858 | $8,038,306 |

| DUB | Dubber Corp Ltd | 0.027 | 42% | 8,021,713 | $26,355,792 |

| FFG | Fatfish Group | 0.018 | 38% | 50,197,420 | $18,285,449 |

| AAU | Antilles Gold Ltd | 0.004 | 33% | 351,982 | $5,567,228 |

| AX8 | Accelerate Resources | 0.009 | 29% | 1,374,430 | $4,352,278 |

| BMG | BMG Resources Ltd | 0.015 | 25% | 29,317,853 | $8,205,566 |

| AU1 | The Agency Group Aus | 0.025 | 25% | 113,993 | $8,571,532 |

| AVE | Avecho Biotech Ltd | 0.003 | 25% | 678,925 | $6,338,594 |

| PRX | Prodigy Gold NL | 0.003 | 25% | 4,078 | $6,350,111 |

| MHK | Metal Hawk | 0.250 | 22% | 745,515 | $20,637,350 |

| NSX | NSX Ltd | 0.028 | 22% | 165,159 | $10,528,962 |

| G50 | G50 Corp Ltd | 0.180 | 20% | 95,496 | $18,384,000 |

| BLZ | Blaze Minerals Ltd | 0.006 | 20% | 250,000 | $3,142,791 |

| BP8 | BPH Global Ltd | 0.003 | 20% | 607,011 | $991,604 |

| HTG | Harvest Tech Group Ltd | 0.019 | 19% | 483,034 | $13,873,657 |

| MXO | Motio Ltd | 0.026 | 18% | 289,124 | $6,013,028 |

| FCL | Fineos Corp Hold PLC | 1.550 | 17% | 615,079 | $448,273,556 |

| MGT | Magnetite Mines | 0.140 | 17% | 322,501 | $13,842,141 |

| ALM | Alma Metals Ltd | 0.007 | 17% | 713,857 | $9,399,133 |

Bell Financial Group (ASX:BFG) has made a non-binding offer to acquire SelfWealth (ASX:SWF) for $0.22 per share, valuing the company at about $51 million.

The SWF board is now in exclusive negotiations with BFG and plans to recommend the offer to shareholders, unless a better proposal arises. BFG believes the deal offers a significant premium to SWF's recent share price.

The acquisition is expected to benefit both companies by increasing scale and creating cost synergies, with minimal disruption to clients. SWF”s shares rose 70 per cent on Wednesday.

Metal Hawk (ASX:MHK) has secured $2.5 million through a placement of shares at $0.20 each, a 2.5 per cent discount on the last closing price. The funds will support gold exploration at the Leinster South project in WA, including a maiden drilling program.

The placement will issue 12.5 million shares, with most of the funds coming from existing shareholders. Directors will also subscribe for $60,000 worth of shares, subject to shareholder approval. The placement is expected to be completed by November 18.

BMG Resources (ASX:BMG) is set to begin drilling at its 100 per cent-owned Abercromby gold project later this month.

The drilling aims to expand high-grade gold zones and upgrade inferred resources. With a maiden resource of 518,000 ounces at 1.45 g/t Au, BMG is confident further drilling will grow this resource.

Metallurgical tests show high gold recoveries of 93-95 per cent. Additional drilling is planned to explore new targets and extend the resource, potentially adding significant value to the project.

Dateline Resources (ASX:DTR) is advancing studies on repurposing waste and tailings from its Colosseum Gold Mine in southern Nevada for use in construction materials.

The scoping study for the mine, released in October, highlighted the potential to produce aggregate and asphalt from waste rock, addressing a projected shortage of construction materials in the region, driven by projects such as the South Las Vegas construction boom and the Southern Nevada International Airport.

Allup Silica (ASX:APS) had a nice lift earlier after announcing that managing director Simon Finnis would speak at the Noosa Mining Conference, held from November 13-15, at Peppers Noosa Resort in Queensland.

Finnis’s presentation took place late on Wednesday afternoon.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ATH | Alterity Therapy Ltd | 0.003 | -25% | 5,452,689 | $21,281,344 |

| CRB | Carbine Resources | 0.003 | -25% | 500,000 | $2,206,951 |

| EVR | EV Resources Ltd | 0.003 | -25% | 87,287 | $5,585,086 |

| GMN | Gold Mountain Ltd | 0.002 | -25% | 911,353 | $7,814,946 |

| MHC | Manhattan Corp Ltd | 0.002 | -25% | 2,020,000 | $8,995,940 |

| MTL | Mantle Minerals Ltd | 0.002 | -25% | 628,304 | $12,394,892 |

| NXL | Nuix Ltd | 5.830 | -23% | 4,942,658 | $2,491,040,649 |

| OVT | Ovanti Ltd | 0.032 | -22% | 181,095,828 | $83,235,969 |

| BNL | Blue Star Helium Ltd | 0.004 | -20% | 5,385,251 | $13,474,426 |

| CDT | Castle Minerals | 0.002 | -20% | 390,000 | $4,168,078 |

| RIL | Redivium Ltd | 0.004 | -20% | 16,605 | $13,734,274 |

| OCT | Octava Minerals | 0.105 | -19% | 1,197,409 | $7,701,798 |

| ADO | Anteotech Ltd | 0.022 | -19% | 6,187,686 | $67,223,790 |

| RFT | Rectifier Technology | 0.009 | -18% | 443,507 | $15,201,823 |

| MNC | Merino and Co | 0.590 | -18% | 288,812 | $38,215,130 |

| ICG | Inca Minerals Ltd | 0.005 | -17% | 1,083,562 | $6,160,335 |

| ICR | Intelicare Holdings | 0.010 | -17% | 1,454,726 | $5,834,258 |

| MPK | Many Peaks Minerals | 0.185 | -16% | 576,275 | $17,927,291 |

| DGR | DGR Global Ltd | 0.011 | -15% | 2,790,428 | $13,568,048 |

| ALR | Altair Minerals | 0.003 | -14% | 1,022,518 | $15,038,021 |

| ASP | Aspermont Ltd | 0.006 | -14% | 95,625 | $17,290,081 |

| JAV | Javelin Minerals Ltd | 0.003 | -14% | 34,795,001 | $18,162,887 |

| KGD | Kula Gold Ltd | 0.006 | -14% | 76,741 | $4,502,483 |

| M2R | Miramar | 0.006 | -14% | 350,000 | $2,777,763 |

Nuix (ASX:NXL) crashed by 18 per cent following an update released at its annual general meeting, where CEO Jonathan Rubinsztein discussed the company’s targets for FY25.

Rubinsztein said Nuix was aiming for around 15 per cent growth in annual contract value (ACV), and positive underlying cash flow for the year.

While the company was still targeting these goals, Rubinsztein acknowledged that the first half of FY25 was likely to fall short of these expectations.

This raised concerns among investors that Nuix may not meet its targets for the full year, even though Rubinsztein reassured that growth was expected to be weighted towards the second half of the fiscal year.

IN CASE YOU MISSED IT

Brightstar Resources (ASX:BTR) has started a ~6000m reverse circulation drill programtargeting the largest two deposits within the Montague East gold project in WA’s Murchison region. The Montague-Boulder and Whistler deposits have a strong probability for resource growth.

C29 Metals (ASX:C29) is poised to start exploration on its newly granted southern and northern tenements at Ulytau in Kazakhstan after receiving category four approval and strong local support. It plans to carry out airborne geophysical and geological programs and is mobilising for initial diamond drilling by the end of the week.

Drilling at Challenger Gold’s (ASX:CEL) Colorado-V project in Ecuador has returned more ultra-thick, gold, silver and copper intersections that are higher grade than the initial holes in the program. The results will feed into the maiden resource estimate for the project.

Octava Minerals (ASX:OCT) has secured a contractor to carry out a 3000m drill program to test the Discovery and Central antimony targets at its Yallalong project in WA’s Midwest region. Historical drilling at Discovery has already returned high-grade assays including 7m at 3.27 per cent antimony from a down-hole depth of 12m.

Vertex Minerals (ASX:VTX) has started moving the Gekko gravity plant from Ballarat to the high-grade Reward mine site in NSW’s prodigious Lachlan Fold Belt, which is positioned for the rapid start-up of gold production.

The plant will be constructed adjacent to the underground mine portal (640 Level), which extends into the resource and does not required stripping, and over the existing footprint of the existing plant. VTX has also mobilised the recently purchased LM90 drill rig from Kalgoorlie while the new mobile fleet that includes haul trucks and excavators is arriving on site.

The company remains on track to commission the plant and producing gold bars in January 2025.

Preparations for flow testing the Welchau-1 discovery well in Upper Austria are progressing for ADX Energy (ASX:ADX), which holds a 75 per cent economic interest in the Welchau Investment Area.

The workover rig and other surface testing equipment are already on site, while it’s also working on the rig up of flow testing facilities, the test separator, necessary permits, and production storage tanks.

Flow testing of the Steinalm formation is expected to begin about a week after well perforation, once the testing facilities are fully set up and tested.

GTI Energy (ASX:GTR) is on track to deliver a mineral resource estimate and exploration target for its Lo Herma uranium project in Wyoming by the end of the year.

The company will then decide whether to proceed with an interim scoping study for the project. GTI is also busy expanding its claim area at Lo Herma, possibly adding another 1.6kms via a staking program. It’s aiming to finish drilling in December, with the construction of three hydrogeologic and water monitoring wells.

Sovereign Metals (ASX:SVM) has wrapped up test mining of the pilot phase at its Kasiya rutile-graphite project in Malawi.

Trials showed the soft, friable Kasiya orebody is suitable for mining using different methods. The pilot phase continues under the oversight of the Sovereign-Rio Tinto Technical Committee, as SVM aims to optimise operations at its Tier 1 project, which boasts the world's largest natural rutile deposit.

At Stockhead we tell it like it is. While ADX Energy, Brightstar Resources, C29 Metals, Challenger Gold, GTI Energy, Octava Minerals, Sovereign Metals and Vertex Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX slumps as banks and miners tumble; Trump taps Musk to run DOGE show