Closing Bell: ASX drops to three-month low, while CHESS system outage halts settlements

The local bourse hit a three-month low on Friday as CBA led the banks down, Mesoblast gave back some of its 50pc gain and the ASX had a CHESS outage.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX hits three-month low as Fed dampens rate cut hopes

ASX CHESS system is down

Mesoblast shares reverse some of yesterday’s 50pc gain

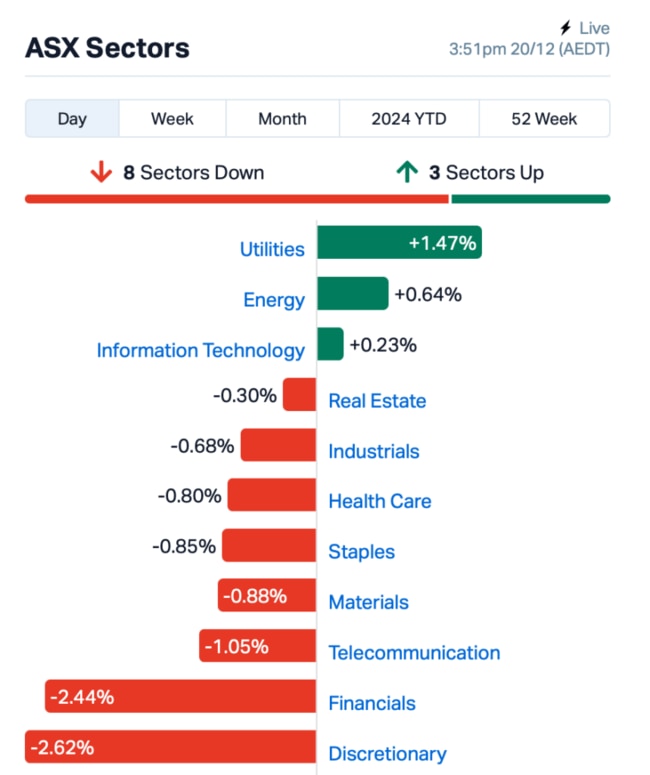

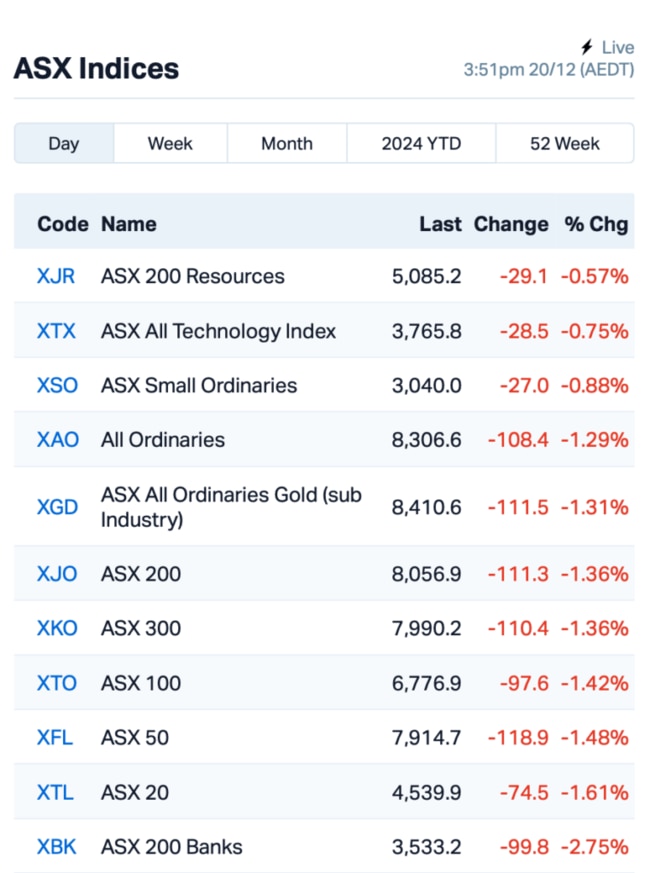

It’s been a rough week for Aussie shares, with the ASX 200 slumping to a three-month low on Friday.

The index shed 1.3% today, extending losses for the week to nearly 3%.

The pain in the local market came after the US Federal Reserve cut back its forecast for interest rate cuts next year – from three to two – signalling that it's staying vigilant.

The risk-off mood saw the Commonwealth Bank (ASX:CBA) become the day’s biggest large-cap casualty, down by 3.5%.

Its banking peers weren’t immune either, with NAB dropping 2% and Westpac following suit with a 1.5% fall.

The pain wasn’t confined to the banks.

Bellevue Gold (ASX:BGL), one of the big gold players, dived by 5% on the back of falling gold price.

But the one that caught everyone's eye today was Mesoblast (ASX:MSB).

The biotech, which was on a tear yesterday, rising by 50% after the US FDA approved its groundbreaking cell therapy Ryoncil, saw a massive reversal. Shares plunged by 21% in afternoon trading, erasing a good chunk of the gains.

Meanwhile, the ASX's (ASX:ASX) CHESS system has gone down this afternoon, delaying batch settlements and putting registry transactions on hold. While trades are still coming in, no settlements have occurred due to the delay. The ASX said it's investigating the cause, and its shares have dipped by 1.5%.

This is how things looked on the ASX at 15:50 AEDT:

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| LM1 | Leeuwin Metals Ltd | 0.094 | 57% | 407,080 | $2,811,100 |

| ERL | Empire Resources | 0.003 | 50% | 1,500,000 | $2,967,826 |

| PKO | Peako Limited | 0.003 | 50% | 166,667 | $2,190,283 |

| WBE | Whitebark Energy | 0.010 | 43% | 21,513,854 | $1,766,334 |

| QHL | Quickstep Holdings | 0.555 | 41% | 2,150,118 | $28,331,855 |

| BEL | Bentley Capital Ltd | 0.014 | 40% | 565,639 | $761,279 |

| AAU | Antilles Gold Ltd | 0.004 | 33% | 614,404 | $5,573,628 |

| CRB | Carbine Resources | 0.004 | 33% | 15,299 | $1,655,213 |

| IFG | Infocusgroup Hldltd | 0.024 | 33% | 1,173,784 | $2,824,368 |

| VMT | Vmoto Limited | 0.074 | 32% | 610,406 | $23,449,005 |

| ZMM | Zimi Ltd | 0.015 | 25% | 1,855 | $4,643,329 |

| ASP | Aspermont Limited | 0.005 | 25% | 489,483 | $9,880,046 |

| CDT | Castle Minerals | 0.003 | 25% | 503,275 | $3,345,628 |

| HCT | Holista CollTech Ltd | 0.010 | 25% | 844,572 | $2,286,134 |

| MMR | Mec Resources | 0.005 | 25% | 760,893 | $7,327,228 |

| MTB | Mount Burgess Mining | 0.005 | 25% | 62,500 | $1,358,150 |

| PRM | Prominence Energy | 0.005 | 25% | 6,501 | $1,556,706 |

| TSL | Titanium Sands Ltd | 0.005 | 25% | 21,400 | $8,846,989 |

| I88 | Infini Resources Ltd | 0.620 | 24% | 356,263 | $20,991,663 |

| AGD | Austral Gold | 0.026 | 24% | 325 | $12,858,538 |

| CNJ | Conico Ltd | 0.012 | 20% | 522,866 | $2,374,873 |

| RLL | Rapid Lithium Ltd | 0.006 | 20% | 790,000 | $3,660,554 |

Leeuwin Metals (ASX:LM1) has struck a deal to acquire the Marda Gold Project from Ramelius Resources (ASX:RMS). The project, covering 500km² in WA, includes 8 open pits and strong exploration upside with high-grade intercepts. Leeuwin will pay $500k in shares upfront, plus milestone payments tied to resource targets. Ramelius will become a strategic shareholder, paving the way for future collaboration.

Mount Burgess Mining (ASX:MTB) has secured a two-year extension for its Prospecting Licence PL043/2016 in Botswana, which now runs until December 31, 2026. The licence, covering 995.9 km² in Western Ngamiland on the Namibian border, supports the company’s Zinc, Lead, Silver, Copper, Vanadium, Gallium, and Germanium Project.

Whitebark Energy (ASX:WBE) has agreed to acquire King Energy, gaining control of one of Australia’s largest prospective hydrogen, helium and hydrocarbon projects in South Australia. The company said the Alinya project, in the Officer Basin, holds vast potential, with estimates of 710 million kilograms of white hydrogen, 97 Bcf of helium, and 153 million barrels of oil equivalent. Whitebark will issue 100 million shares and options to King shareholders in a deal valued at around $1.67 million.

Aerospace tech company Quickstep Holdings (ASX:QHL) has also inked a deal with ASDAM to be acquired for $0.575 per share, a premium of up to 195% on recent trading prices. The board is fully behind the deal, believing it offers strong value and stability for shareholders, provided no better offers come along.

Rapid Lithium (ASX:RLL) has signed a binding agreement to acquire the Prophet River Gallium-Germanium project in BC, Canada, covering 2,110 hectares, including the Cay Mine. With high grades of zinc, gallium, and germanium, the project is seen as strategic, especially with rising prices and China’s export bans. Rapid will pay CAD$130k and issue shares and options on completion.

ABX Group (ASX:ABX) is raising $1.8 million through the issue of 1.8 million convertible notes, with the funds aimed at advancing its Deep Leads Rare Earths Project and ALCORE fluorine recycling plant. The placement, backed by existing shareholders, will be conducted in two tranches, with directors contributing $230k. Investors will also receive unlisted options if shareholder approval is granted, with a 12% annual coupon on the notes.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| JAY | Jayride Group | 0.003 | -40% | 5,030,651 | $1,192,895 |

| VML | Vital Metals Limited | 0.002 | -33% | 33,381 | $17,685,201 |

| CSS | Clean Seas Ltd | 0.092 | -26% | 759,644 | $25,164,160 |

| GTR | Gti Energy Ltd | 0.003 | -25% | 5,682,674 | $11,851,799 |

| SER | Strategic Energy | 0.006 | -25% | 712,718 | $5,368,267 |

| TTI | Traffic Technologies | 0.003 | -25% | 4,600,000 | $4,475,272 |

| MSB | Mesoblast Limited | 2.390 | -22% | 27,814,486 | $3,482,441,548 |

| PAM | Pan Asia Metals | 0.042 | -21% | 69,564 | $10,723,171 |

| MDR | Medadvisor Limited | 0.215 | -20% | 2,753,461 | $149,010,472 |

| TEM | Tempest Minerals | 0.004 | -20% | 30,135 | $3,172,649 |

| SCP | Scalare Partners | 0.165 | -18% | 6,954 | $6,976,560 |

| 8VI | 8Vi Holdings Limited | 0.040 | -17% | 1,000 | $2,011,748 |

| ALR | Altairminerals | 0.003 | -17% | 209,127 | $12,889,733 |

| ERA | Energy Resources | 0.003 | -17% | 1,942,557 | $1,216,188,722 |

| RMI | Resource Mining Corp | 0.005 | -17% | 1,561,967 | $3,914,087 |

| TIG | Tigers Realm Coal | 0.003 | -17% | 55,553 | $39,200,107 |

| AJX | Alexium Int Group | 0.011 | -15% | 49,257 | $20,494,648 |

| WYX | Western Yilgarn NL | 0.022 | -15% | 115,983 | $3,219,048 |

| AXE | Archer Materials | 0.390 | -15% | 922,774 | $117,229,626 |

| TTT | Titomic Limited | 0.158 | -15% | 2,298,599 | $244,640,064 |

| LAT | Latitude 66 Limited | 0.047 | -15% | 222,559 | $7,887,039 |

| ADN | Andromeda Metals Ltd | 0.006 | -14% | 35,587 | $24,001,094 |

| AJL | AJ Lucas Group | 0.006 | -14% | 38,808 | $9,630,107 |

Clean Seas Seafood (ASX:CSS) has faced a tough time with its Year Class 2024 fish, reporting unexpectedly high mortalities. The company today revised its FY25 sales volume guidance downwards, from 3,000 tonnes to 2,550-2,650 tonnes. Shares fell heavily after the company revealed that poor feeding practices, predator management issues, and inadequate husbandry led to the those losses.

IN CASE YOU MISSED IT

EBR Systems (ASX:EBR)has scheduled its US FDA manufacturing Pre-Approval Inspection for the week of January 6, 2025, following the start of the FDA's substantive review of its pre-market approval submission for its WiSE CRT system. The company also has a Day-100 Meeting with the FDA on December 20, 2024.

Renascor Resources (ASX:RNU) has submitted its draft response document to the South Australian Department for Housing and Urban Development, allowing it to enter the final stages of the assessment process for its planned Purified Spherical Graphite (PSG) manufacturing facility. Approval from the South Australian Planning Minister will allow the company to construct a state-of-the-art facility to produce up to 100,000 tonnes per annum of PSG for lithium-ion battery anodes.

Lumos Diagnostics (ASX:LDX)has kicked off a vital FebriDx CLIA waiver study in the US, with the first patient successfully tested. The study is receiving support from the Biomedical Advanced Research and Development Authority (BARDA), which is contributing US$2,984,571 in non-dilutive funding to help with the waiver study, FDA application, and provide regulatory, technical, and clinical expertise for the FebriDx POC test.

At Stockhead, we tell it like it is. While EBR Systems, Renascor Resources and Lumos Diagnostics are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX drops to three-month low, while CHESS system outage halts settlements