BHP-backed Kingsrose unlocking critical mineral potential in Scandinavia

With $26m in cash and BHP’s backing, Kingsrose Mining is gearing up to drill the high-grade Penikat PGE project in 2025 while hunting for advanced assets.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

With BHP funding exploration on existing projects, Kingsrose has $26m cash to search for an advanced asset

The company is focused on copper, nickel and PGEs in Finland and Norway

It plans to get drill rigs spinning at Penikat in 2025

Special report: With $26m in the bank, and one of the world’s largest mining companies investing USD$5m per year to fund regional exploration, Kingsrose Mining finds itself in a unique position to grow with a dual focus on making discoveries and acquiring new opportunities.

Over the last three years, the ~$25m market cap explorer has undergone a corporate shift with a new team and new assets following its takeover of private UK company Element-46, granting access to mineral rights at the Porsanger and Penikat projects located in Norway and Finland.

That acquisition would set the scene for the company’s new approach to exploration and acquisitions in the years to come – seeking assets with exposure to forward facing critical minerals like PGEs, nickel and copper, which will all see demand rise to meet Paris agreement goals.

The Penikat PGE-nickel-copper deposit in southwestern Finland is one of the world’s highest-grade undeveloped PGE assets with mineralisation analogous to South Africa’s Bushveld complex.

At Porsanger, Kingsrose Mining (ASX:KRM) received permission from Norway’s Ministry of Trade and Fisheries to carry out drilling at the Karenhaugen prospect in Finmark Country, an area of interest under the alliance agreement with BHP.

While still early days, the projects pave the way for a potential onshoring of critical minerals as the EU currently relies on imports from overseas.

Around 92% of PGEs, a critical component in catalytic converters for the production of green hydrogen, are supplied from Russia and southern Africa.

BHP Xplor standout

Handily for the EU, Scandinavia has become an increasingly attractive region for mineral exploration with many areas still largely underexplored and having received little modern-day investigation.

Knowing these belts host some of Europe’s largest mines and offer significant development opportunities, KRM MD Fabian Baker said BHP (ASX:BHP) were quick to realise the potential.

The company was selected to take part in the inaugural BHP Xplor program in 2023, an accelerator program designed to help participants reach their exploration goals and address the challenge of declining global discovery rates by building a platform for cross-industry collaboration.

“I believe BHP recognised the opportunity Kingsrose presented, a large-scale generative exploration story spanning nearly 4000 square kilometres,” he said.

“We then spent the next six months working closely together, allowing BHP to gain a deep understanding of how Kingsrose operates.

“I feel BHP valued our technical expertise, our ability to drive forward a large-scale opportunity like this, and our commitment to responsible exploration practices.”

Solidified alliance agreements

The two companies then solidified their partnership, entering into exploration alliance agreements in May 2024, which will be carried out over three stages and span agreed areas of interest in Norway and Finland – excluding the Penikat and Råna projects, which Kingsrose will continue to advance independently.

This goes well beyond the USD$500,000 incubator style funding provided by Xplor, giving a sense of the large-scale potential BHP sees in Kingsrose’s assets.

During the first ‘project generation phase’, BHP will sole fund up to US$20m in exploration over up to four years for the exclusive right to select targets to become ‘defined projects’.

The next step is the ‘earn in phase’ and then the ‘joint venture phase’ follows, subject to BHP exercising the option to establish a joint venture on a pro-rata basis.

“This alliance has provided us with access to BHP’s extensive resources, networks and technical expertise, which have bolstered our capabilities,” Baker said.

“The partnership has also allowed us to refine our methodologies, adopt innovative approaches and gain a deeper understanding of global best practices.

“Thousands of junior companies have presented their ideas to BHP Xplor, yet Kingsrose stands out as the only public company to secure an alliance with them in the past three years.”

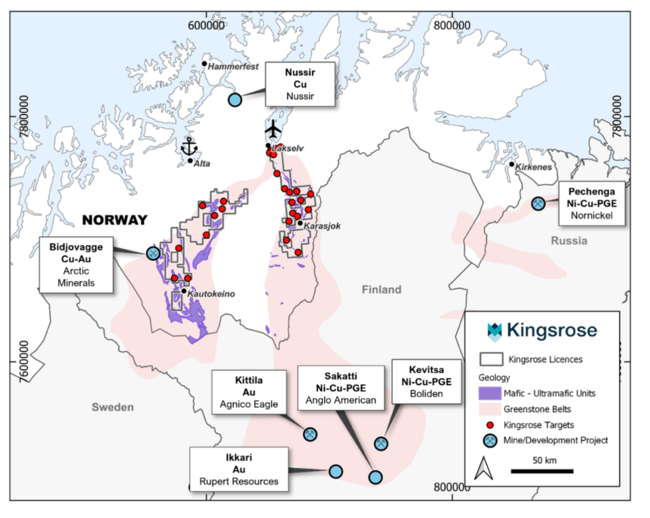

KRM has identified two mineral belts in Norway and Finland that total more than 3800km2 and host numerous historical and recent discoveries.

The company’s licences in Norway cover a combined strike of over 200km of prospective greenstone belt geology that is the under explored continuation of the Central Lapland Greenstone Belt in Northern Finland (‘CLGB’).

The CLGB is host to significant gold deposits, such as Agnico Eagle’s Kittilä mine (Europe’s largest gold mine) and Europe’s largest nickel-copper-PGE deposits including Boliden’s operating Kevitsa mine and the more recently discovered Sakatti nickel-copper-PGE project owned by Anglo American.

Reconnaissance sampling returned high-grade copper, palladium, gold, and silver from undrilled gabbro-hosted sulphide-quartz veins last year, a compelling indication of the potential for the discovery of magmatic sulphide copper-nickel-PGE deposits.

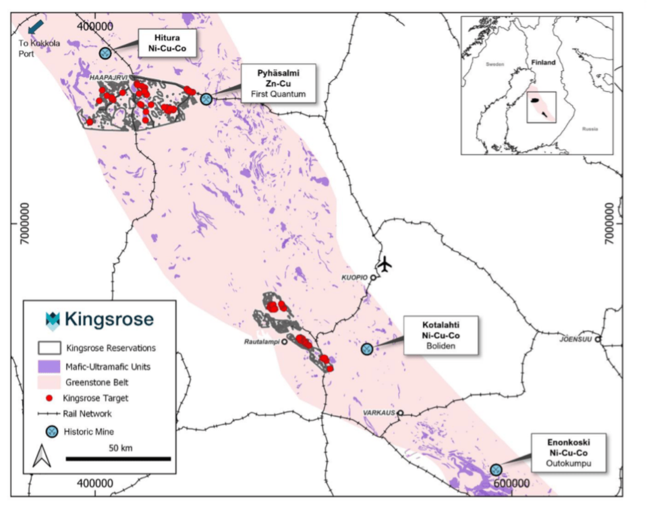

In Finland, Kingsrose has been granted four exploration reservations at the Central Finland project in the Kotalahti nickel belt, a 400-kilometre-long greenstone belt which hosts the past producing Hitura, Kotalahti and Enonkoski nickel mines.

Syn-orogenic mafic-ultramafic intrusions were emplaced approximately 1.88 billion years ago, a globally significant age for nickel-copper districts including the Raglan and Thompson districts, respectively located in Quebec and Manitoba, Canada.

Desktop targeting and field reconnaissance has defined 14 initial targets across the four exploration reservations.

As well as being geologically rich, Scandinavia offers a supportive and stable environment for companies to operate.

Baker said the infrastructure in both Norway and Finland is “excellent” with reliable transport networks, energy access and skilled labour.

“Regulatory frameworks are transparent and mining-friendly, providing explorers with the confidence to invest and operate in these areas,” he said.

“Scandinavia’s approach to sustainable development also aligns with modern exploration and mining practices.”

Hunting for a new asset

KRM also has strong cash backing, and KRM has been actively seeking opportunities to deploy its $26 million cash pile to acquire a more advanced asset.

“Over the past 10 months, we have been conducting a global search for opportunities ranging from projects with exciting drill targets to established resources focusing on base and precious metals” Baker said.

“While capital markets are not funding exploration significantly, we’re leveraging our strong cash position to access high quality opportunities. However, we intend to be patient and thorough in our due diligence to ensure we transact on assets with the highest potential.

“This approach ensures we remain true to our commitment to discovery and development while maximizing value for our shareholders.

“We have been close on a few opportunities, and have a number of opportunities we are in deep due diligence on.” he added.

Plans for 2025

Kingsrose has been working on permitting at Penikat for the past three years and 2025 is the year the company plans to begin drilling.

The decision by the Ministry of Trade and Fisheries of Norway to grant Kingsrose permission to conduct drilling at the Karenhaugen prospect within the Porsanger project was also received in early December.

Karenhaugen is within the Area of Interest under the Alliance Agreement with BHP, who are currently funding up to US$20m in exploration costs over four years.

This article was developed in collaboration with Kingsrose Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as BHP-backed Kingsrose unlocking critical mineral potential in Scandinavia