ASX Small Caps Weekly Wrap: Gold’s huge Friday secures its ASX win for the week

Gold and Real Estate were the week’s top sectors. Yes, again.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

It’s Friday the 13th, and the end of yet another trading week – one that saw the already beleaguered Energy sector take another beating while oil prices continued to fall.

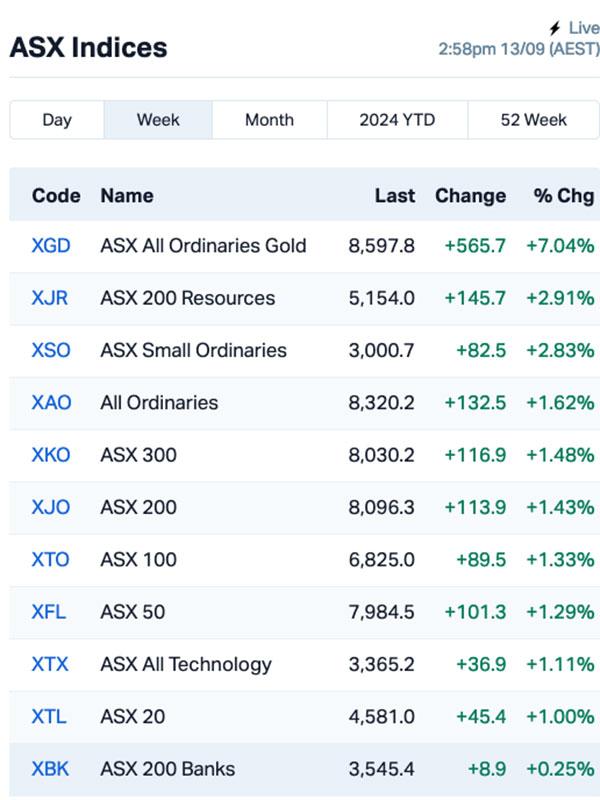

- The ASX 200 climbed a little over the past week, up about 1.4pc

- Real Estate did okay, but Energy was punished by vanishing oil prices

- Who won the Small Caps race? Read on to find out…

However, it was a late-in-the-week gold rush that pushed that subsector of the market well out in front of the rest of the group, eclipsing Real Estate, which was on its way to another solid, if slightly pedestrian, appearance on the top step of the podium.

Today’s surge for the goldies came as the ECB cut rates by 25 basis points overnight, and prior to the widely expected 25-point rate cut that everyone who hasn’t suffered a catastrophic head injury is 100% certain the Fed is going to hand down in the US next week.

The rate cuts – alongside gold hitting fresh new all-time highs above US$2,500 per ounce – have helped shift gold into a higher gear as an attractive option for parking money, prompting a swathe of interest in gold explorers and producers alike.

The performance of the ASX XGD All Ords Gold index this week is even more remarkable considering that it kicked off the week with a 1.9% plunge.

However, the far more interesting story this past week has been crude oil, which spent the week continuing to shed value as prices continued to plummet – despite a number of factors that would normally be pushing hard in the opposite direction.

Crude’s recent price movement is actually a cause for significant concern – and not just for investors whose portfolio is a little Energy-heavy.

While it’s been lovely filling up the car with petrol that costs less per litre than chocolate milk, economists have been sounding the alarm about what could be just around the corner, especially with crude prices dipping so low.

It doesn’t take much to spook oil prices – particularly when they’re at historically low levels, despite promised production cuts and all the usual stuff that generally keeps prices high.

The immediate issue is that the price reflects just how badly hobbled a number of major economies are at the moment. China is the obvious one that springs to mind, as it has been shuddering to a halt for months.

But the US is also faltering at the moment, with economists trying to guess whether or not the US Fed has overlooked something and missed the boat on chopping rates. The data this month out of the US has been “okay” at best, but there are a number of indicators that things under America’s bonnet aren’t running as smoothly as they need to be.

The spectre of a future issue with oil prices is arguably more worrying, as a sudden spike in oil prices – for example, if Israel and Iran throw their gloves to the floor and really start brawling – has the potential to trigger a 1970s-style stagflation event.

Stagflation – which is a stupid word and which, like webinar, the human race would be much better off without – happens when inflation is high, economic growth is slowing or has stopped, and unemployment stays high as well.

It puts policymakers in a really bad position, with a real Sophie’s Choice about what to do – as most of the tools they have at their disposal will almost invariably make one situation worse while trying to fix the other.

The next few weeks will be a bit of a litmus test in the US – whether a rate cut there is enough to put some pep back in the step of the US economy remains to be seen, and with a Presidential election only seven weeks away… it’s probably going to get messy.

With that to look forward to, probably the best thing to do now is look back and see what happened during the past week.

WHAT THE SECTORS DID

Here’s what the market sectors did:

Once again, Real Estate did well with a steady stream of modest wins that added up to a market-leading performance by that sector again.

There weren’t really any massive standout stories from there… as in, I didn’t spot any, but that’s far from an exhaustive yardstick… if I missed something, my email address isn’t hard to find – and it’s been a while since anyone’s bothered to hassle me about stuff.

Resources picked up nicely towards the end of the week, helping boost the Materials sector nicely into second place – but that’s almost all down to the action around gold, and a well-overdue spike of interest in lithium that happened earlier in the week.

THIS WEEK’S ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| OSM | Osmond Resources | 0.215 | 207.1 | $14,305,728 |

| PTR | Petratherm | 0.044 | 120.0 | $9,731,754 |

| TAS | Tasman Resources | 0.005 | 66.7 | $4,026,248 |

| CXU | Cauldron Energy | 0.023 | 64.3 | $24,530,613 |

| IXR | Ionic Rare Earths | 0.008 | 60.0 | $34,088,339 |

| SAN | Sagalio Energy | 0.008 | 60.0 | $1,637,281 |

| NSM | North Stawell | 0.02 | 53.8 | $2,797,516 |

| TMG | Trigg Minerals | 0.023 | 53.3 | $9,828,027 |

| AHN | Athena Resources | 0.006 | 50.0 | $4,281,870 |

| AUA | Audeara | 0.051 | 50.0 | $6,535,086 |

| BP8 | BPH Global | 0.003 | 50.0 | $1,189,924 |

| CDE | Codeifai | 0.0015 | 50.0 | $3,961,942 |

| INP | Incentiapay | 0.003 | 50.0 | $3,731,790 |

| TKL | Traka Resources | 0.0015 | 50.0 | $2,918,488 |

| AQI | Alicanto Minerals | 0.019 | 46.2 | $13,295,573 |

| AAJ | Aruma Resources | 0.023 | 43.8 | $4,885,280 |

| SHO | Sportshero | 0.01 | 42.9 | $5,560,496 |

| CVR | Cavalier Resources | 0.14 | 41.4 | $6,073,433 |

| PBH | Pointsbet | 0.685 | 41.2 | $215,370,152 |

| CMD | Cassius Mining | 0.007 | 40.00% | $3,794,031 |

| EMS | Eastern Metals | 0.029 | 38.10% | $2,955,582 |

| CTT | Cettire | 1.460 | 37.74% | $516,577,788 |

Super quickly, here’s how the Small Cap winners ended up where they were on the ladder.

Out in front was Osmond Resources (ASX:OSM), which was up again this week following a bumper run last week as well, while in second place, Petratherm (ASX:PTR) was up nicely on news that mapping, surface sampling, and re-assaying of historic drilling has discovered high-grade titanium rich heavy mineral sands (HMS) over several kilometres at the Muckanippie Project, southwest of Coober Pedy in South Australia.

And Cauldron Energy (ASX:CXU) made the news this week as the best-performer of the uranium stocks, after Russian president Vladimir Putin suggested that his country would be looking at limiting supplies of yellowcake around the world.

For all the details on those winners, see below.

THIS WEEK’S ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| VPR | Volt Group | 0.001 | -50.0 | $21,432,416 |

| M2R | Miramar | 0.008 | -46.7 | $3,158,236 |

| GED | Golden Deeps | 0.04 | -45.9 | $4,972,166 |

| RNE | Renu Energy | 0.0015 | -40.0 | $1,528,268 |

| AMM | Armada Metals | 0.009 | -35.7 | $1,872,000 |

| MTC | Metalstech | 0.17 | -34.6 | $32,481,633 |

| KLI | Killi Resources | 0.125 | -34.2 | $18,930,205 |

| BIT | Biotron | 0.0185 | -33.9 | $16,241,566 |

| 1TT | Thrive Tribe Tech | 0.001 | -33.3 | $917,432 |

| AIV | Activex | 0.006 | -33.3 | $1,293,015 |

| AVE | Avecho Biotech | 0.002 | -33.3 | $6,338,594 |

| BGE | Bridge Saas | 0.012 | -33.3 | $1,472,765 |

| CNJ | Conico | 0.001 | -33.3 | $2,201,528 |

| ECT | Env Clean Tech | 0.002 | -33.3 | $6,343,621 |

| EDU | EDU Holdings | 0.06 | -33.3 | $9,912,867 |

| GCR | Golden Cross | 0.002 | -33.3 | $2,194,512 |

| IEC | Intra Energy Corp | 0.001 | -33.3 | $1,690,782 |

| IVX | Invion | 0.002 | -33.3 | $13,533,183 |

| NXD | NextEd Group | 0.11 | -33.3 | $26,582,013 |

| MIO | Macarthur Minerals | 0.054 | -32.5 | $10,781,938 |

HOW THE WEEK SHOOK OUT

Monday 09 September, 2024

Adacel Technologies (ASX:ADA), which is an industry leader in advanced Air Traffic Management (ATM) and Air Traffic Control (ATC) simulation and training solutions, has advised the market that a hiccup with the bid submission process with the Federal Aviation Administration has been resolved in its favour, and that the five-year contract it announced in December, worth US$59 million, is set to go forward.

It’s a continuation of the contracts that have seen Adacel and the FAA continuing to work together for around 20 years, providing Tower Simulation system support for training air traffic controllers.

Larvotto Resources (ASX: LRV) surged after Canadian firm 1832 Asset Management bought 16.5 million shares since August 19, boosting its stake to 5.31% Meanwhile, Trafigura’s Urion Holdings reduced its stake from 15% to 5.46%. Larvotto is also ramping up exploration at its Hillgrove project, with a new drilling program underway and a recent PFS estimating a $73 million restart cost.

Larvotto isn’t the only explorer riding high on past glories, with last week’s leading stonker Osmond Resources (ASX:OSM) continuing its upward momentum since an announcement on Friday. The background there was the acquisition of an 80% stake in Iberian Critical Minerals, holding of the Orion EU project in Spain, which contains high grade samples of rutile, zircon and rare earths.

Those all screen as critical minerals, the sort of thing the EU needs to develop onshore thanks to its extreme reliance on imports, largely from China.

The EU wants to extract 10% of its critical minerals and process 40% of its consumption onshore, with permitting timeframes set at a maximum of 27 months for extraction projects under the European Critical Raw Materials Act, which came into force on May 23 this year.

But it currently produces none of its own titanium, light or heavy rare earths and less than 20% of its zircon. Located halfway between Seville and Madrid, the award of the ‘Province Bulletin’ permit is due in Q4 this year.

Macro Metals (ASX:M4M) shares lifted after announcing it had received the exploration licence for its Goldsworthy East project in the Pilbara.A programme of works application is in with WA’s Mines Department, with M4M aiming to complete a minimum of 30 holes in its maiden campaign at 50m spacing to an average depth of 200m.

All up between 6000m and 8000m will be punched into the red dirt, proximal to recently discovered hematite outcrops of a width of 220m and strike of 450 which remains open to the west.

Rock chips delivering significant results have graded between 58% and 65% Fe, with drilling to begin on September 25 subject to the POW’s approval timeline.

Invion (ASX:IVX) was up nicely on Monday morning, but the only news from the company was some housekeeping notices for the ASX.

Tuesday 10 September, 2024

Aruma Resources (ASX:AAJ) announced that assays from initial surface sampling of rock chips at its Fiery Creek project in the Mt Isa copper belt in QLD has cropped up multiple, very high-grade copper (Cu) and antimony (Sb) grades. Mineralisation was found to be consistent across 600m of strike at the Piper prospect and include grades of up to 11.83% Cu and 10,883ppm Sb – along with high-grade silver (Ag) assays up to 31.3g/t.

The assays confirm historical rock chip samples at the target area, which contained 36% Cu, 25.4% Cu and 15.2% Cu. Fiery Creek is a freshly acquired asset, part of a portfolio expansion for early-stage projects in May this year where Aruma also snapped up an IOC-uranium project near BHP’s (ASX:BHP) prolific Olympic Dam operations and Bortala – another copper play in Queensland.

Intra Energy Corporation (ASX:IEC) has released an update to its announcement of results from a 1,960-metre reconnaissance drilling program which identified a large-scale lithium-caesium-tantalum system and a large-scale gold system at the Maggie Hays Hill project, in the Lake Johnston Greenstone Belt, Western Australia. The numbers are the same as previously reported on September 04, 2024 – the update includes drill hole details and sectional views as required by the JORC code.

Austral Gold (ASX:AGD) was rising after being reinstated to the ASX, after it was suspended for not filing its FY24 financial reports on time.

Noble Helium (ASX:NHE) was rising on news that new NHE data available for NSAI evaluation indicates better reservoir properties, higher helium concentrations and more or larger prospective structures than previously at the Western Margin of the North Rukwa basin. The company says the total Western Margin P50 Helium Prospective Resource has increased by 66%, and the Lake Beds P50 Helium Prospective Resource has increased by 31%, while the deeper Karoo P50 Helium Prospective Resource jumped 500% after mapping with the 2023 seismic.

Audeara (ASX:AUA) was climbing earlier on news that it has signed a binding Letter of Intent with prominent, Hong Kong based technology services provider Eastern Asia Technology, to deliver Audeara’s healthy hearing technology into the Chinese medical device market. Eastech has “a strong presence in China and a proven track record of successfully delivering advanced technology products and solutions, ensuring high standards of quality and customer satisfaction,” the company says.

Lotus Resources (ASX:LOT) has found some of the thickest zones of uranium mineralisation at its Letlhakane project in Botswana, with recent drilling revealing significant new intersections. The updated resource estimate shows large quantities of uranium, with drilling continuing to confirm mineralisation and enhance the project’s resource classification. The company expects to complete the drilling by September and update the resource estimate by November, while also advancing development at its other project in Malawi.

They say things come in threes and it’s no different for explorer Metals Australia (ASX:MLS), where drilling and exploration is kicking off across (you guessed it!) three projects in WA and the NT, testing for gold, lithium-pegmatite and nickel-copper-cobalt mineralisation. The tenure is just 10km from SQM and Hancock Prospecting’s Andover lithium discovery, bought in the takeover of Azure Minerals for $1.7bn back in May.

A 6000m AC drill program is also underway at MLS’ Warrambie project in WA’s Pilbara – a set of tenements straddling the Scholl Shear Zone, which is analogous to the Mallina Shear – and host to the De Grey Mining’s (ASX:DEG) monster +10Moz Hemi gold deposit. In WA’s Murchison, a 120-hole AC drill program has been permitted to follow an extensive soil sampling and gravity program underway at Big Bell North, prospective for gold as it’s along strike from Westgold Resources’ (ASX:WGX) +5Moz Big Bell deposit.

Rising in share price for a second day in a row, Stavely Minerals (ASX:SVY) has laid eyes on copper oxide minerals (azurite and malachite) and copper sulphides as part of a now-completed AC drilling campaign at its Stavely project in Victoria. While assays are pending, the visual identification of mineralisation bodes well to complement significant historical intercepts at the Junction prospect, which included 35m at 3.44% Cu and 26g/t Ag from 24m to end-of-hole.

Phase 1 drilling at New Age Exploration’s (ASX:NAE) Wagyu gold project in WA’s Pilbara – nestled between De Grey’s tenements and right near its monster +10Moz Hemi gold deposit – has just been completed. The four-week exploration program involved the drilling and sampling of 156 AC drill holes for a total of 7460m. It’s looking for the same ‘Hemi-style’ intrusive system and Phase 1 is the start of a thoroughly formulated six-month exploration program.

Phase 2 will include follow-up AC drilling and sampling based on pending results, which NAE says will be crucial to further exploration planning. Additional ground gravity and passive seismic surveys are also in the mix at Wagyu, including carrying out work on the dry Yule Riverbed.

After analysing new data that became available for auditor evaluation of Noble Helium’s (ASX:NHE) North Rukwa Western Margin helium resource, larger and higher concentrations of the finite gaseous element have been realised.

The total Western Margin P50 helium prospective resource has now increased by 66%, including Lake Beds by 31% and the deeper Karoo resource jumping a whopping 500% after mapping the 2023 seismic data.

The gas play says the revelation has significant implications for Eastern Margin and a prospective resource update is now in progress.

Wednesday 11 September, 2024

Petratherm (ASX:PTR) was climbing quickly on Wednesday morning on news that mapping, surface sampling, and re-assaying of historic drilling has discovered high-grade titanium rich heavy mineral sands (HMS) over several kilometres at the Muckanippie Project, southwest of Coober Pedy in South Australia.

Melbana Energy (ASX:MAY) says that initial development of Unit 1B from the Alameda-2 well has been formally approved and is on track for Q1 2025. The company reported that it has received construction approval for the next Unit 1B well pad, and there are additional pads progressing through the permitting process.

Cauldron Energy (ASX:CXU) jumped on news that each of the first four holes drilled at the company’s Manyingee South uranium target have intersected mineralisation, “defining a thick, high-grade mineralisation along a continuous 1.5km strike length, open in all directions”.

Visionflex Group (ASX:VFX) climbed following a market update on three recent developments, including an agreement with Royal Flying Doctor Service (RFDS) Victoria to provide a virtual health solution and a trial agreement with Kha Loc Medical, a leading medical equipment distributor in Vietnam, with the first shipment already dispatched.

XReality Group (ASX:XRG) – formerly Indoor Skydive Australia – was up on news that the company has signed a US$5.6 million deal with the US Department of Defense to deliver a new immersive training capability and includes supplying Operator XR system licenses along with R&D services.

Up the top end of town, Mineral Resources (ASX:MIN) announced after hours yesterday that it has received unconditional approval from the the Foreign Investment Review Board for the sale of a 49% interest in the Onslow Iron haul road (Haul Road) to investment funds managed by Morgan Stanley Infrastructure Partners (MSIP) for total expected proceeds of $1,300 million.

Earlier, Invion (ASX:IVX) reported this morning that the company has been granted Human Research Ethics Committee (HREC) approval for its open label Phase I/II trial on patients with non-melanoma skin cancers (NMSC) using topical INV043. The company has secured all the necessary regulatory approvals for patient screening, treatment and follow-up, which are expected to commence from next month.

Thursday 12 September, 2024

SenSen Tech (ASX:SNS) was winning on news that the company has secured a tender to provide mobile and fixed camera technology in The City of Calgary, Canada. The deal will see Sensen provide mobile and fixed lane enforcement systems with a first-year value of $1.9 million, with the entire contract worth a reported $4.6 million over five years, with two additional two-year extension options for a total potential length of nine years.

GTI Energy (ASX:GTR) was up on news that it has completed 66 of the proposed 76 drill hole exploration program at its Lo Herma ISR uranium project, located in Wyoming’s prolific Powder River Basin which the company says “confirms that uranium mineralisation continues north from the current mineral resource area with strong mineralised intercepts over good thicknesses encountered stretching at least 2km north along projected trends”.

Locksley Resources (ASX:LKY) has reported results of a holistic review of antimony potential outside of the known high-grade REE mineralisation within the Mojave Project, California which the company says has uncovered six rock chip samples grading >0.5% Sb, including two samples grading 11.2% Sb and 8.3% Sb.

AML3D (ASX:AL3) reports the signing of a new Manufacturing License Agreement, which allows the company to work with key suppliers and internal teams within the US Navy submarine industrial base through the exchange of technical assistance and data, facilitating an expansion of AML3D’s activities to support the US Navy.

Earlier, Belararox (ASX:BRX) was rising on news that the company has bought the rights to 4,286km2 of prospective tenure across 14 prospecting licenses on Botswana’s highly prospective Kalahari Copper Belt, through the acquisition of 100% of KCB Resources, including its subsidiaries Blackrock Resources and NI MG Northern Nickel.

The acquisition secures BRX a second significant copper-prospective project in a highly prospective and mining-friendly jurisdiction, close to Sandfire Resources’ (ASX:SFR) Motheo Copper Mine, MMG Limited’s Khoemacau Mine and Cobre’s (ASX:CBE) flagship Ngami Copper project.

Great Western Exploration (ASX:GTE) was moving well after announcing that it has identified a “large, robust and coherent niobium lag soil anomaly”, which it has named the Sumo Niobium Target, 70km south-east of Sandfire Resources’ DeGrussa Copper-Gold Project and within Great Western’s 100% owned Yerrida North Project.

MTM Critical Metals (ASX:MTM) has announced promising results from its new Flash Joule Heating (FJH) technology, which recovers gold from electronic waste with high efficiency. Initial tests have achieved up to 70% gold recovery without using toxic acids, by rapidly heating e-waste in a chlorine gas atmosphere to separate and collect the metals. This eco-friendly method is scalable and offers a more sustainable alternative to traditional, energy-intensive recycling processes. Given the large volume of e-waste produced globally, which contains valuable metals, MTM believes FJH could significantly improve recycling efficiency and reduce environmental impact.

Critical Resources (ASX:CRR) has confirmed its antimony credentials at tenure that abuts the southern boundaries of August’s best-performing ressie stock Larvotto Resources’ (ASX:LRV) Hillgrove project, which contains 93,000t Sb. The junior’s Halls Peak project is an 884,000t zinc, copper and base metals deposit with some silver and gold trimmings, yet it’s the nearology to Hillgrove that has the explorer excited at the moment. CRR non exec director Nigel Broomham says the Mayview Homestead prospect, just 2.7km east of Larvotto’s Hillgrove, stands out as particularly promising.

And, radiopharmacy developer Clarity Pharmaceuticals (ASX:CU6) says its prostate cancer trial has produced further evidence that its proposed therapy is safe to use, with “strong preliminary safety data” in the first multi dose cohort enrolled in the phase 1/2a safety study. The trial, called Secure, uses the copper isotope 64Cu/67Cu-SAR-bis to image – and possibly treat – metastatic castrate-resistant prostate cancer patients expressing the prostate-specific membrane antigen (PSMA).

Friday 13 September, 2024

DXN (ASX:DXN) has released its FY24 results, and they’re excellent – the company is reporting that it has achieved a statutory EBITDA of $644,000 – the first positive EBITDA result in DXN’s history – on FY24 revenue of $10.8 million. Managing Director Shalini Lagrutto says the year has been “transformational”, following the company’s exit from its unprofitable data centre in Sydney.

eMetals (ASX:EMT) has delivered an update to its exploration in Uganda, revealing that a total of 40 soil samples and 77 rock-chip samples were taken on the Bukuya target within the Mubende Gold Project as part of the first phase of field activities. Numerous high grade rock chip samples were returned including 29.1g/t Au, 9.2g/t Au and 3.1g/t Au, with soil sampling confirmed gold mineralisation extends beyond current artisanal workings and has defined an anomalous zone across a strike of approximately 1,200m which remains open along strike in both directions.

Labyrinth Resources (ASX:LRL) was rising on news that the company has been reviewing the historical Vivien data base in the lead up to the company’s EGM and completion of the Distilled Acquisition. LRL says that the historical data shows “significant exploration upside and underexplored nature of Vivien and Comet Vale”. Both the Comet Vale and Vivien Projects are located close to existing infrastructure and linked via major access ways to the Goldfields, and the existing drilling shows that there is ample untested prospectivity at both projects.

An investor presentation outlining Mithril Silver and Gold (ASX:MTH)’s plan for Copalquin gold and silver project in Mexico (which supplies 25% of the world’s silver) has stirred the share price today.

It’s already shown a maiden resource of 2.41Mt at 4.8g/t gold, 141g/t silver for 373,000oz gold plus 10.9Moz silver (total 529,000 oz gold equivalent), demonstrating the project’s high-grade gold and silver resource potential and is drilling in and around the resource as part of its aim to double it by Q1 2025.

Assays have been received for six holes, a further three have been sent to the laboratory, two completed for logging and six more holes to be drilled in this initial 4000m program.

Earlier, Mount Burgess Mining (ASX:MTB) was climbing on news that local officials have finally let the company to move forward, after the Botswanan Department of Environmental Protection (DEP) confirmed it had approved a Scoping Report and requested a Final EIA be lodged following MTB’s receipt of DEP’s comments. The timeframe to the completion of the EIA review period is estimated to be in the region of four to six weeks, after which MTB should be able to begin infill drilling at its Nxuu Project.

M&A Activity is heating up in WA as Antipa Minerals (ASX:AZY) today agreed to sell its 32% non-controlling interest in the 2.84Moz Citadel gold project JV in the Paterson Province to Rio Tinto (ASX:RIO) for $17m, cashing up the junior to accelerate exploration at its nearby Minyari Dome gold project.

Recent exploration by the junior across Citadel’s Calibre deposit increased tested shallow resource extensions and together with the nearby Magnum deposit, showed very large-scale exploration upside with just 70-80m of predominantly free-digging, post-mineralisation cover.

The results, posted late August, were seemingly impressive enough for Rio to consolidate its 68% share. The cash injection will allow the junior to realise a range of exploration plans for Minyari Dome against a backdrop of moves and shakes in the Paterson region. Rio has spent more than $47m over the years on exploration at Citadel to earn its current 68% interest and the transaction to full ownership is expected to be completed by November.

Drilling continues at Tesoro Gold (ASX:TSO) Ternera prospect at El Zorro as it puts to bed a dispute over a cap raise and claims of work abandonment by minor shareholder Wanaco. A Chilean court rejected attempts by Wanaco to have mining concessions transferred to it as compensation over the allegations and has ordered Wanaco to pay for legal costs.

Diamond drilling is ongoing at the high-priority targets within 1.5 km of the existing Ternera deposit, with rigs currently operating at Ternera East and Ternera. Assay results from 10 completed holes remain outstanding and are expected back by the end of this month.

Rock chips sampled at the Komboro prospect, part of Mako Gold (ASX:MKG)’s flagship Napié project in Côte d’Ivoire, have returned hits of up to an eye-whopping 170g/t gold, while identifying new high-grade gold zones for potential resource growth.

Other very high-grade results including 41.92g/t, 6.27g/t, 4.63g/t, and 3.48g/t gold as part of the junior’s plans to grow Napié’s already impressive 868,000oz resource.

The samples reinforce gold mineralisation from previous shallow drilling at Komboro which returned high-grade gold intercepts of:

- 9m at 3.26g/t Au from 67m including 3m at 7.29g/t Au from 67m and 1m at 47g/t Au from 86m

- 1m at 8.45g/t Au from 74m; and

- 5m at 1.64g/t Au from 56m.

Further mapping and rock chip sampling across the Komboro prospect continues in preparation for a future drilling campaign.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as ASX Small Caps Weekly Wrap: Gold’s huge Friday secures its ASX win for the week