ASX Small Caps Lunch Wrap: Who’s hiding a fortune in fancy art in the bathroom this week?

Local markets have been dealt a blow by a shock +0.4% jump in inflation in May.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Local markets opened lower this morning, as investors braced for a fresh round of inflation data that somehow, deep down in the coccals of our bowels, we all knew wasn’t going to be good.

At 11.30am, the data dropped – and so did the benchmark. Because the figures are anything other than good, showing that inflation rose in May to +4.0%, a +0.4% jump from April. Ouch.

Investors showed their displeasure the only way they know how, sending the benchmark plummeting 63 points in a matter of minutes, leaving the ASX 200 needle deep in the red.

I’ll get into the details of that shortly, but first, a quick hat tip to the folks at Tasmania’s Museum of Old and New Art (Mona), who found themselves in a bit of a pickle after a visitor took umbrage at being excluded from a section of the museum set aside as a women-only space.

In April last year, a fella by the name of Jason Lau made a complaint to Tasmania's Anti-Discrimination Commissioner – who referred the matter to the Tasmanian Civil and Administrative Tribunal – because he’d paid the museum’s entry fee, but was stopped from entering the Ladies Lounge to view multiple artworks by Pablo Picasso.

The short version of the story is that Mr Lau’s complaint was upheld, and the museum was told in April that it had 28 days to stop refusing people who didn’t identify as women access to part of the museum.

Mona’s response: they’ve taken the Picasso paintings and hung them in the newly-minted ladies bathrooms – previously, Mona’s bathrooms were all unisex, but the gallery has since designated some as ladies only.

It’s a typically cheeky response from the gallery, and one that no doubt will do little more than fan the flames of this exhausting culture war that seems to have taken over everyone’s daily lives.

But – if there’s one thing that has emerged from this sordid tale of bathroom masterpieces, it’s from the lips of Tasmanian Civil and Administrative Tribunal deputy president Richard Grueber, in his description of a protest that occurred during the hearing into the matter.

A group of 20 supporters, dressed in navy blue suits, reportedly took part in an organised (if slightly baffling) protest, by reading feminist texts and then leaving the hearing to the gentle strains of 80s pop-rock stalwart Robert Palmer's song Simply Irresistible.

Yeah, I have no idea why, either.

But Grueber – who didn’t see the protest first hand – did include mention of it in his summation of the event, and in doing so taught me a brand new word.

Grueber said the protest was “inappropriate, discourteous and disrespectful, and at worst contumelious and contemptuous”.

Contumelious! What a glorious, glorious day it is when the English language is able to surprise me with a word that has taken more than 50 years to reach my ears.

But that's largely immaterial to the matter at hand, and – if I may be so bold – I suspect that I might have a way forward for this to get resolved.

We need only look to the Picasso paintings for inspiration – with Pablo's famous cubist style showing us that perhaps, with the right perspective, we might be able to see both sides of the debate at once, and perchance a way forward without consigning his masterpieces to a life of lurking in the bogs.

TO MARKETS

The ASX opened lower this morning, following a mixed bag on Wall Street that saw a surge in tech stocks, thanks to Nvidia bouncing back from the thumping it’s been receiving all week.

Local investors were, naturally, bracing for fresh inflation data from the ABS, and while many were expecting a bit of a jolt, I doubt many were ready for the thunderbolt that arrived at 11.30am.

The experts had largely been expecting inflation to rise slightly to 3.8%... but inflation rose in May to +4.0%, a +0.4% jump from April and enough of a lurch to effectively scuttle even the faintest rumour of a rate cut this year.

What it does mean, however, is that the interest rate debate among the RBA board members is set to continue, which is bad news for anyone like me, as I am so bored of writing about freakin’ interest rates right now.

That said, we’re in for a long haul on the topic, because the 0.4% jump puts the ball squarely in the sights of both sides of the fight – those who want rates kept on hold ‘just to see what will happen’, and those who will no doubt be using this as an argument to yank on the rate hike lever once more to try to arrest any further unwanted inflationary growth.

There’s a data drop slated for July 31 that will be something of a litmus test for which way the RBA is going to be leaning for the next few months – the quarterly inflation print is due out just before the RBA board gets together for a luncheon in August, and all eyes will be on that meeting to see which way the macro winds are blowin’.

To the actual market, and the inflation data has caused a fairly solid dose of the trembles throughout the ASX today.

Here’s a quick glance at how the benchmark has been doing – see if you can spot when it was that the inflation data dropped…

The result by lunchtime was a market in disarray. The only sectors still showing green were InfoTech and Utilities, and both of those are barely hanging on by their fingernails, while all else around them flails helplessly like dogs that have fallen into a backyard swimming pool.

The sectors look like this:

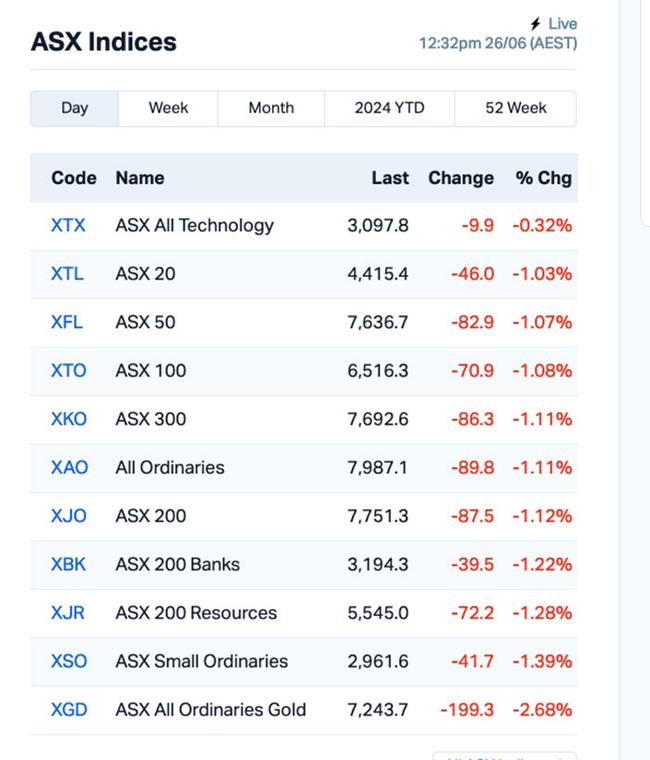

The ASX indices look like this:

Up the top end of town, some big names are taking an absolute caning today, including Harvey Norman Holdings (ASX:HVN), which has dropped -8.3% at the time of writing, and was still falling as I put this article to bed.

Big winner from yesterday, KFC owner Collins Foods (ASX:CKF), is down -7.3% after going ex-div this morning, while Liontown Resources (ASX:LTR) has fallen -4.4% throughout the morning session as well.

NOT THE ASX

On Wall Street overnight, the S&P 500 rose by +0.39%, the blue chips Dow Jones index was down by -0.76%, and the tech-heavy Nasdaq lifted by +1.26%.

Nvidia led the way for the so-called “Magnificent Seven”, bouncing back by +6.75% after a -13% slump in the previous three sessions.

But, as Eddy Sunarto reported this morning, while many are enthusiastic about the market darling, others have raised questions about its prospects.

“My question for the broader market: If Nvidia’s revenues are $120 billion next year and climbing to $250 billion by 2029 – which is the consensus – where is that money coming from?” says Adam Button at ForexLive.

In other US stock news, Rivian Automotive surged by +53% in post-session following the announcement that Volkswagen plans to invest US$5 billion to establish a joint venture with the electric-vehicle maker.

Carnival Corp jumped +9% after revealing that it was generating significant free cash flow and may consider paying dividends to shareholders down the line.

Meanwhile, US consumer confidence softened in June as concerns about the economic outlook persisted. However, the survey found that US households maintained a positive outlook on the job market and anticipated a decrease in inflation over the coming year, Eddy reports.

The data came as Fed Reserve Governor Michelle Bowman said if inflation remains at its current level, further interest rate increases will be considered.

“We are still not yet at the point where it is appropriate to lower the policy rate,” Bowman said overnight.

“Given the risks and uncertainties regarding my economic outlook, I will remain cautious in my approach to considering future changes in the stance of policy.”

In Asian market news, Japan’s Nikkei is climbing well, up +1.26% in early trade, while both the Hang Seng and Shanghai markets are largely flat as things get moving throughout the rest of the region today.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 26 June :

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Change Volume Market Cap ICR Intelicare Holdings 0.015 67% 3,021,026 $2,113,420 CLZ Classic Minerals 0.0015 50% 5,833,312 $551,029 YAR Yari Minerals Ltd 0.004 33% 150,000 $1,447,073 HLX Helix Resources 0.0025 25% 7,710,348 $6,528,387 SI6 SI6 Metals Limited 0.0025 25% 1,190,393 $4,737,719 MTH Mithril Resources 0.19 23% 1,036,283 $13,109,314 AML Aeon Metals Ltd 0.006 20% 1,838,791 $5,482,003 EFE Eastern Resources 0.006 20% 168,758 $6,209,732 LNR Lanthanein Resources 0.0035 17% 1,136,400 $7,330,908 LEX Lefroy Exploration 0.115 16% 150,172 $19,845,390 AAM Aumega Metals 0.059 16% 836,230 $26,802,297 CMD Cassius Mining Ltd 0.008 14% 1,529,607 $3,794,031 KOR Korab Resources 0.008 14% 200,000 $2,569,350 SPQ Superior Resources 0.008 14% 1,922,155 $14,008,543 A1G African Gold Ltd 0.024 14% 30,000 $5,023,530 NKL Nickelx 0.026 13% 251,780 $2,019,749 ADY Admiralty Resources 0.01 11% 516,347 $14,665,265 GTR Gti Energy Ltd 0.005 25% 9,325,115 $9,224,762 PLG Pearl Gull Iron 0.02 11% 78,515 $3,681,752 PTR Petratherm Ltd 0.02 11% 84,237 $4,045,521 MNB Minbos Resources Ltd 0.055 10% 752,189 $43,256,123 THB Thunderbird Resource 0.033 10% 211,747 $5,542,837 PVW PVW Res Ltd 0.023 10% 41,000 $2,129,500 HAV Havilah Resources 0.185 9% 78,998 $53,828,666 OZM Ozaurum Resources 0.053 8% 20,000 $7,778,750 KP2 Kore Potash PLC 0.027 8% 615,030 $16,301,144

Classic Minerals (ASX:CLZ) was up early, after announcing an extension to the closing date of its non-renounceable pro-rata rights issue at an issue price of $0.004 per new share, with 1 bonus option for every 2 shares subscribed for, exercisable at $ 0.02 on or before 30 June 2027.

Minbos Resources (ASX:MNB) was climbing on news that it has signed a non-binding collaboration agreement with Talus Renewables to develop the Capanda Green Ammonia Project through the deployment of Talus green ammonia technology, TalusAg, “a first-to-market green ammonia system which enables sustainable and cost-effective localised ammonia production”.

Mithril Resources (ASX:MTH) has received firm commitments for a capital raising of $3.7 million at $0.20 with cornerstone investment by Jupiter Gold and Silver Fundn at a 29 per cent premium to its last traded share price.

Eastern Resources (ASX:EFE) announced that the company has engaged Nagom, an experienced lithium consultancy in Perth, to plan and manage metallurgical testwork for samples from the Lepidolite Hill Project.

And Cassius Mining (ASX:CMD) was up on news that its international arbitration against the Government of the Republic of Ghana – seeking damages in excess of USD 275 million as a consequence of Ghana’s “breaches of contract and statute” – has taken a step in the right direction for the company, with the Tribunal finding that it has jurisdiction to hear the company’s contractual claims despite Ghana’s objections.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 26 June :

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap CZN Corazon Ltd 0.004 -33% 2,491,810 $3,693,587 LPD Lepidico Ltd 0.002 -33% 614,500 $25,767,358 MTL Mantle Minerals Ltd 0.002 -33% 1,039,263 $18,592,338 RIL Redivium Limited 0.002 -33% 27,283 $8,192,564 ALR Altair Minerals 0.003 -25% 151,000 $17,186,310 IBG Ironbark Zinc Ltd 0.003 -25% 16,710,535 $6,375,490 ODE Odessa Minerals Ltd 0.003 -25% 664,062 $4,173,130 PUA Peak Minerals Ltd 0.003 -25% 210,075 $4,165,506 SVG Savannah Goldfields 0.015 -25% 117,201 $5,621,698 FIN FIN Resources Ltd 0.007 -22% 1,486,088 $5,843,418 AMD Arrow Minerals 0.002 0% 4,000,000 $26,348,413 AYT Austin Metals Ltd 0.004 -20% 1,206,620 $6,620,957 LRL Labyrinth Resources 0.004 -20% 322,356 $5,937,719 MCT Metalicity Limited 0.002 0% 9,173,714 $11,214,632 POS Poseidon Nick Ltd 0.004 -20% 1,584,714 $18,567,674 RDS Redstone Resources 0.004 -20% 1,784,444 $4,626,892 AM7 Arcadia Minerals 0.034 -17% 798,085 $4,799,054 1MC Morella Corporation 0.0025 -17% 5,869,066 $18,536,398 BMO Bastion Minerals 0.005 -17% 116,000 $2,610,503 CCZ Castillo Copper Ltd 0.005 -17% 333,033 $7,797,032 DAL Dalaroo Metals 0.02 -17% 2,040,039 $1,986,000 FAU First Au Ltd 0.0025 -17% 1,310,818 $4,985,980 GMN Gold Mountain Ltd 0.0025 -17% 697,258 $9,533,230 NAG Nagambie Resources 0.01 -17% 4,527 $9,559,628 RGL Rivers Gold 0.005 -17% 627,462 $7,257,461

ICYMI – AM EDITION

Greenvale Energy (ASX:GRV) has completed product identification and certification work on bulk samples from its Alpha Torbanite project in Queensland.

This has found that as additional work is required to achieve a premium C170 bitumen product certification, the Alpha scoping study will now be suspended while key aspects of the project are re-evaluated.

Its business development program is also underway targeting additional growth opportunities for shareholders, with several highquality opportunities currently being evaluated and subject to advanced due diligence.

Marmota (ASX:MEU) has agreed to raise $1.25m through the placement of shares priced at 4.5c with key sophisticated and professional investors.

Proceeds will be used to fully fund the gold exploration that is due to begin at Campfire Bore.

“Our team has already mobilised to site over the weekend, and is now preparing tracks, drill collars and sumps. This is Marmota’s first ever program at Campfire Bore, and the first drilling at Campfire Bore in more than 8 years by anyone,” chairman Dr Colin Rose said.

Sovereign Metals (ASX:SVM) has entered into a memorandum of understanding with US-based international development entity The Palladium Group to collaborate around the Kasiya project in Malawi.

Palladium – a global impact firm that works to link social progress and commercial growth – will assist the company with providing key agricultural inputs, training, technologies, and financing to develop and integrate smallholder farmers into the emerging high growth agriculture value chains.

A key part of this is the company’s existing Conservation Farming Program, which aims to promote tried and tested improved small-scale agricultural practices, and the creation of community support and mentorship networks.

At Stockhead, we tell it like it is. While Greenvale Energy, Marmota and Sovereign Metals are Stockhead advertisers, they did not sponsor this article.

Originally published as ASX Small Caps Lunch Wrap: Who’s hiding a fortune in fancy art in the bathroom this week?