ASX Small Caps Lunch Wrap: Markets flat ahead of US rate call. It’s eerily quiet today

It’s all (well largely) quiet on the ASX ahead of US rate cut tonight.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

There’s not a whole lot happening for the ASX 200 this morning, as investors hunker down ahead of the US Fed’s rate call tonight (our time) to see who’s right about how big that cut will be.

Wall Street was very quiet overnight, as well – and this morning, save for a few outliers, there’s not an enormous amount happening.

But, in the interests of being thorough enough to ensure I earn my pay today, here’s a quick wrap of what’s been happening so far this morning.

TO MARKETS

The ASX recovered from a sharp dip early to be pretty much dead calm at midday today, ahead of the US rate call tonight.

Word on the street is that markets in the US have priced in a 65% chance that the Fed is going to go with the larger option of a 50 basis point cut, up from the 34% chance the market was prepping for last week.

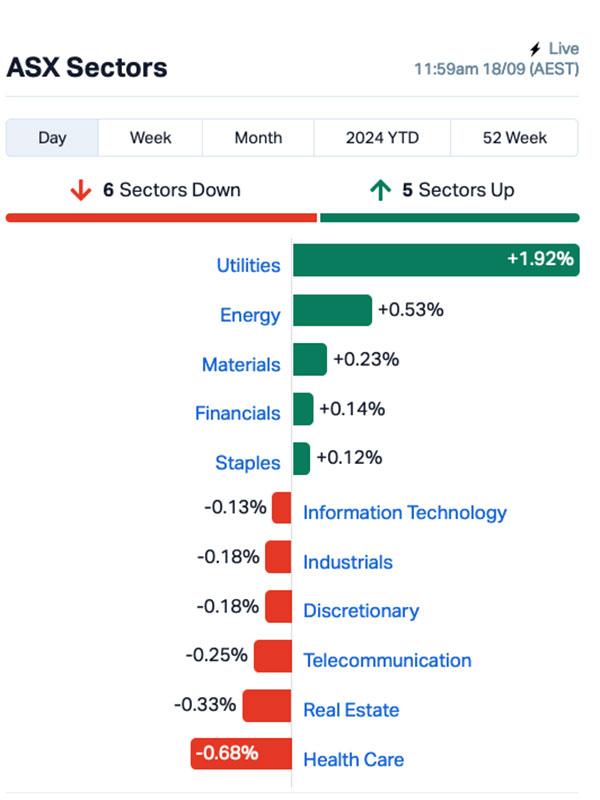

The only noticeable action is coming out of the Utilities sector, which was up close to 2.0% at lunch time, but those gains have been pretty much offset by a 0.6% dip among healthcare stocks, leaving the benchmark just 0.01% higher.

Most of the gains in Utilities can be attributed to a 3.3% spike for Origin Energy (ASX:ORG) this morning, however falls among the big end of Health – incluing CSL (ASX:CSL), ResMed (ASX:RMD) and Cochlear (ASX:COH), which were all down about 0.6% – have kept the market flat.

There’s some news among the big players, though – FMCG giant Harvey Norman (ASX:HVN) took a hit this morning with news of a class action lawsuit being brought by Echo Law, which claims that the extended warranties sold to customers after September 2018 are basically worthless.

The class action says that the terms of the extended warranties cover nothing that isn’t already covered under Australian consumer law, making them an entirely needless up-sell by staff at the big retailers Harvey Norman and Joyce Mayne.

Woodside Energy (ASX:WDS), meanwhile, has inked a deal to supply LNG to Japan, with the terms of the deal covering 400,000 tonnes of liquified natural gas (LNG) annually for a decade.

The oil and gas producer has signed the long-term supply deal with JERA, commencing in April 2026 with the LNG to be sourced from across Woodside’s global portfolio, The Australian reports.

“This LNG offtake agreement is Woodside’s first long-term sale to JERA from our global portfolio and delivers on one of the core elements of our strategic relationship outlined earlier this year,” said Woodside executive vice president and chief commercial officer Mark Abbotsford.

NOT THE ASX

US stocks stayed largely unchanged overnight as Wall Street tries to figure out the size of the rate cut by the Fed, Eddy Sunarto reported this morning. The S&P 500 finished slightly higher by 0.02%, the Dow Jones was down by 0.04%, and the tech heavy Nasdaq climbed by 0.20%.

The stronger-than-expected retail sales data, however, has thrown a bit of a wrench into the Fed’s plans.

Although CME FedWatch futures are showing a 63% chance of a 50 basis point rate cut, the strong August sales – up 0.1% instead of the forecasted 0.2% drop – has made that prediction less certain.

The data suggests the US economy isn’t heading for a recession.

“I’m sticking to my 25bp guns, for now, however, and must admit that I find the whole debate over a 50bp cut a little ridiculous,” said Michael Brown at Pepperstone.

Brown argues that knowing how quickly rates will return to a neutral level is more important than the size of tomorrow’s rate cut. Nevertheless, we can expect some significant market swings around the announcement, he added.

In US stock news, JPMorgan Chase is reportedly in talks with Apple to take over its credit card program from Goldman Sachs, according to the Wall Street Journal.

Apple wants to end its partnership with Goldman, which started with the credit card in 2019 and included a savings account launched in 2023.

Microsoft rose by 1% after the board approved a US$60 billion share buyback plan and a 10% dividend increase to $0.83 per share, effective November 21.

This decision is part of a broader trend among major tech companies, which have recently been increasing their stock buybacks and dividends to to investors.

Sam’s Club, owned by Walmart, announced that it will increase hourly wages for nearly 100,000 workers, boosting starting pay from $15 to $16. Walmart’s shares slumped by over 2%.

And, Hewlett Packard jumped nearly 5% after Bank of America upgraded the stock to a ‘Buy’. The upgrade is based on the expectation that profit margins will improve following the recent US$14 billion acquisition of Juniper Networks.

In Asian markets this morning, Hong Kong markets are closed for the Mid-Autumn Festival holiday.

Shanghai markets have reopened after a break, and they’re as flat as the ASX, while Japan’s Nikkei is up a relatively modest 0.6% in early trade.

In crypto news, Bitcoin has surged 4.0% in the past 24 hours, rising above US$62,200 at lunchtime today, while Ethereum (+2.4%) and BNB (+1.9%) have posted more modest rises over the same period, ahead of the expected rate cut in the US.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for September 18 :

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap BPM BPM Minerals 0.098 96.0 14,909,299 $3,356,111 88E 88 Energy 0.0025 66.7 94,195,823 $43,400,718 PEB Pacific Edge 0.175 52.2 77,911 $93,370,337 AL8 Alderan Resources 0.003 50.0 500,000 $2,545,723 IVX Invion 0.003 50.0 26,613,129 $13,533,183 LSR Lodestar Minerals 0.0015 50.0 1,614,667 $3,372,329 ERL Empire Resources 0.004 33.3 1,246,262 $4,451,740 SMM Somerset Minerals 0.004 33.3 36,041 $3,092,996 MHK Metal Hawk 0.12 33.3 532,339 $9,060,300 AQI Alicanto Minerals 0.022 29.4 378,560 $12,718,430 EP1 E&P Financial 0.465 27.4 29,036 $86,753,233 LRL Labyrinth Resources 0.023 25.8 2,543,690 $24,199,008 LPD Lepidico 0.0025 25.0 3,352 $17,178,250 PUR Pursuit Minerals 0.0025 25.0 10,000,000 $7,270,800 VML Vital Metals 0.0025 25.0 20,200 $11,790,134 HMI Hiremii 0.054 20.0 680,575 $6,065,066 DKM Duketon Mining 0.12 20.0 338,061 $12,241,158 AOA Ausmon Resorces 0.003 20.0 1,000,351 $2,647,498 LML Lincoln Minerals 0.006 20.0 86,666 $10,281,298 CLU Cluey 0.032 18.5 233,500 $9,526,241

BPM Minerals (ASX:BPM) was moving fast on Wednesday morning on news of high-grade initial drilling results from the second phase of drilling at the Louie Prospect, part of the Claw Gold Project in WA, where initial assays have returned 30m at 1.84g/t Au (from 25m) including 5m @ 7.12 g/t Au (from 35m).

88 Energy (ASX:88E) was up on news of a Significant Contingent Resource Update for Project Phoenix, with the Gross Best Estimate (2C) Contingent Resources increasing by over 50%, with an additional gross 128 million barrels of oil equivalent (MMBOE), 81 MMBOE Net Entitlement to 88E, added from the SMD-B and SFS reservoirs, comprising 115 million barrels (MMbbl) of Gross recoverable hydrocarbon liquids (oil and natural-gas liquids), 73 MMbbl Net Entitlement to 88 Energy; and 68 billion cubic feet (BCF) of Gross recoverable gas, 43 BCF Net Entitlement to 88 Energy.

Medtech Invion (ASX:IVX) was on the rise after it received a report authored by Scendea detailing a recently completed investigator-led Phase II prostate cancer trial using the photosensitiser INV043. The trial results showed that INV043 administered sublingually (under the tongue) has a solid safety profile and demonstrated promising efficacy signals three months post treatment, including 40% of patients showing a positive response as measured by the RECIST 1.1 standard, with 10% showing a complete response.

Metal Hawk (ASX:MHK) was up on news of an exploration update, with the company announcing that a UAV magnetic survey has been completed at Leinster South over prospective stratigraphy along the eastern limb of the Lawlers Anticline. Additionally, new rock chip gold results have extended the surface footprint and strike potential of Siberian Tiger, with further mapping and geochemical sampling set to continue to identify new drill targets.

Hiremii (ASX:HMI) was rising on news that the company has received commitments from new professional and sophisticated investors to raise $600,000 (before costs) via a placement at $0.06 per share, a 33% premium to the company’s last closing price. The funds raised will be utilised for the continued development of the Hiremii AI driven recruitment platform, expansion of recruitment service and general working capital.

Earlier, Sierra Nevada Gold (ASX:SNX) has reported staking two additional areas prospective for high-grade silver-gold-copper-antimony near its Blackhawk Project, Nevada USA. Initial sampling has returned 1,880g/t Ag from a quartz stockwork zone at Crystal Peak and 31.2g/t Au from G Mine area associated with copper up to 4.94%, while outcropping quartz stockwork zone at Crystal Peak returned high-grade silver results of 1,880 g/t Ag, 752g/t Ag, 485g/t Ag, 427g/t Ag, 142g/t Ag & 141g/t Ag within a 60m x 30m densely quartz veined area.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 18 September :

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap MGTRF Magnetite - Rights 0.001 -50.0 1,004,461 $40,932 RNE Renu Energy 0.001 -50.0 134,949 $1,528,268 MHC Manhattan Corp 0.001 -33.3 21,631 $4,638,800 AAU Antilles Gold 0.003 -25.0 10,409,383 $5,845,711 WNR Wingara Ag 0.006 -25.0 297,241 $1,404,340 CTO Citigold Corp 0.004 -20.0 7,000,000 $15,000,000 CYQ Cycliq Group 0.004 -20.0 200,000 $2,227,583 EXL Elixinol Wellness 0.004 -20.0 679 $6,605,912 FBM Future Battery 0.018 -18.2 128,220 $14,637,830 MPR Mpower Group 0.009 -18.2 55,028 $3,780,736 BMO Bastion Minerals 0.005 -16.7 200,000 $3,039,075 IBG Ironbark Zinc 0.0025 -16.7 13,543,496 $5,500,943 ICG Inca Minerals 0.005 -16.7 250,000 $4,863,219 OZM Ozaurum Resources 0.04 -16.7 627,968 $7,620,000 SFG Seafarms Group 0.0025 -16.7 486,153 $14,509,798 AW1 American West 0.097 -15.7 7,293,796 $59,591,501 ARV Artemis Resources 0.012 -14.3 1,626,435 $26,836,354 LNR Lanthanein 0.003 -14.3 704,724 $8,552,726 PGM Platina Resources 0.02 -13.0 150,000 $14,333,148 WBE Whitebark Energy 0.007 -12.5 300,000 $2,018,668

ICYMI – AM EDITION

ADX Energy (ASX:ADX) has intersected a 6.5m vertical oil column at its Anshof-2A sidetrack appraisal well in Upper Austria. This is three times greater than the oil column at the Anshof-3 discovery well and also features better porosity and permeability.

Bailador Technology Investments (ASX:BTI) has invested $7.7m in high-growth fitness studio management software platform Hapana, which has a presence across 17 countries and high-quality clients including Body Fit Training (BFT), KX Pilates, Strong Pilates, Gold’s Gym, and F45.

Sovereign Metals (ASX:SVM) has successfully installed an industrial scale spiral concentrator plant at its expanded laboratory and testing facility in Lilongwe, Malawi.

This plant has a throughput rate of 3t per hour and will produce graphite pre-concentrate using material sourced from its Kasiya rutile-graphite project to facilitate ongoing testwork and offtake discussions with lithium-ion battery makers and traditional graphite markets.

Notably, the spiral is identical to the model selected for the Wet Concentrator Plant envisioned in the company’s 2023 pre-feasibility study process flowsheet.

Toubani Resources (ASX:TRE) has appointed former Barrick and Gold Fields project director Mike Nelson as a non-executive director. He will bring his expertise developing international gold and copper projects such as Reko Diq and Quebrada Blanca Phase II to the role.

At Stockhead, we tell it like it is. While ADX Energy, Bailador Technology Investments, Sovereign Metals and Toubani Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as ASX Small Caps Lunch Wrap: Markets flat ahead of US rate call. It’s eerily quiet today