SA has more than $12 billion in major private projects underway – but it’s not enough, experts say

More than $12 billion in major private projects is rolling or being planned in SA – but it’s not enough to kickstart the state’s COVID financial slump, experts say, placing more pressure on the State Government.

SA Business

Don't miss out on the headlines from SA Business. Followed categories will be added to My News.

- $3 billion solar, wind project planned near Burra

- State Government asked for more stimulus funding

- How to get the most from your Advertiser digital subscription

Large-scale private projects worth more than $12 billion are underway or are in the planning stages across South Australia but much more will be required to drag the state out the COVID-inspired recession, experts say.

The state government has also committed to spending around $12 billion on infrastructure over four years, but a host of influential figures, including the Reserve Bank governor Philip Lowe, believe Premier Steven Marshall has to dig even deeper to fund more projects.

Reports from both the South Australian Centre for Economic Studies and Deloitte have highlighted the difficulty the state has had in attracting business investment.

The centre’s executive director Michael O’Neil said “that business investment spending has been stagnant through most of the last decade and COVID-19 has derailed the prospect of any imminent recovery”.

Professor O’Neil said businesses have “cut back their investment plans in lieu of a domestic and overseas economic environment’’.

“And financiers have become more cautious about providing capital for new ventures.’’

Professor O’Neil said the state government would be required to spend more money on public infrastructure to lead the way.

“SA will need to boost government investment in a way that then encourages private investment to follow,’’ he said.

In a briefing given to National Cabinet last week, Reserve Bank governor Dr Lowe said between them states and territories had to spend another $40 billion on job-creating infrastructure, a figure that would double their previous stimulus spending.

Dr Lowe said the prospect of continuing low interest rates would mean the states could afford the extra debt.

At a press conference after National Cabinet, Mr Marshall acknowledged Dr Lowe’s recommendations and said “more will need to be done’’, without offering any specifics.

“That will necessarily mean we do have to increase debt right across the country and we are not going to be immune from that here in South Australia,’’ he said.

The state government has previously announced a $12 billion capital investment program, but significant chunks of it, including the completion of the North-South motorway and the new Women’s and Children’s Hospital, have been delayed.

Civil Contractors Federation chief executive Phillip Sutherland urged Mr Marshall to spend the money more quickly to prop up the state’s ailing economy.

“They are too slow,’’ Mr Sutherland said. “This is a matter of very serious concern.’’

Mr Sutherland said the state government should demonstrate some of the spirit of former long-serving Liberal premier Tom Playford, who spent public money on improving infrastructure with the aim of attracting new private investment.

“That’s the pioneering spirit we need right now,’’ he said.

The state’s investment profile was boosted last week when the French company Neoen Australia announced it would spend $3 billion on a solar and wind energy project south of Burra, which could start construction later this year. Other big projects include BHP’s proposed Olympic Dam expansion, Nexif Energy’s wind farm near Port Augusta and the continued development of Oz Minerals Carrapateena gold and copper mine.

Prof O’Neil noted, however, that many of the bigger projects were earmarked for regional South Australia, “whereas much of the unemployment will because of cut backs in consumption spending and those businesses such as accommodation, cafes and restaurants and retail’’.

“What will be required is a very strong focus on employment in the labour intensive sectors of the economy,’’ he said.

“Which implies investment in health and education, infrastructure projects that are ‘shovel ready’ such as repairs to schools, public assets as we will not get a boost from any increase in population, from migrant numbers, from greater international student numbers or from any sudden influx of tourists.’’

PROPOSED & ONGOING MAJOR PRIVATE PROJECTS IN SA

$3B SOUTH WIND AND SOLAR PROJECT

French-owned Neoen Australia’s three-stage project will feature 163 turbines, 3000ha of solar panels and a huge lithium-ion battery on cropping and grazing land south of Burra and north of Robertstown.

About 100 permanent jobs and more than 1000 direct and indirect roles during construction are linked to the development, which would take 5-6 years.

The State Commission Assessment Panel has begun consultation on the project, expected to generate enough energy to power a million homes.

Neoen Australia, which owns the world’s largest lithium ion battery (using Tesla technology) at Jamestown, SA, is also behind the $500m Crystal Brook Energy Park development combining storage, solar and wind, and located about three kilometres north of Crystal Brook in the Mid-North.

$3.7B BHP OLYMPIC DAM MINE EXPANSION

The proposed expansion of the major miner’s Olympic Dam copper-gold operations in SA’s Far North has been on the cards for some years, but a recent move by the Federal Government to slash environmental approval times may fast-track it.

BHP wants to increase copper production to up to 350,000 tonnes per annum – from about 200,000 tonnes now.

The project was granted Major Development status by the state government last year and is expected to support 1800 jobs in construction and 600 new roles ongoing.

$1.2B LIBERTY, EDEN HOUSING PROJECTS

The state’s biggest home builder is expecting its housing projects to boost Two Wells’ population from around 2500 to 10,000. The residential estate development, 40km north of Adelaide, is expected to create more than 3000 jobs in the region, and around 470 construction jobs a year over the next 20 years.

Hickinbotham is also awaiting final State Government approval for a $215m estate at Seaford Meadows.

$1B WHYALLA STEELWORKS REVAMP

In June this year, UK billionaire Sanjeev Gupta’s GFG said it will build a “direct reduced iron facility” to produce iron from gas and later hydrogen at Whyalla, as well as an electric arc furnace to replace the existing blast furnace.

These will sit alongside a $600m steel rolling mill, which is now expected to start construction later this year. Mr Gupta said the new projects had not been exactly costed but would be in the $1 billion-plus range, and were a key plank in the company’s strategy to produce carbon-neutral steel by 2030.

Mr Gupta’s SIMEC Energy, part of the GFG group is also developing a $350m solar farm, which will generate enough energy to power 100,000 homes each year. The 12-month construction project will create more than 750 jobs, and is expected to be operational by July 2021.

FOOTBALL PARK REDEVELOPMENT

The transformation of the former home of football in SA is continuing as part of the staged 1600-home WEST development at West Lakes, creating thousands of construction and trade jobs.

The SANFL sold the AAMI Stadium precinct to developers Commercial & General for $71 million in November 2014. C&G’s project, to be completed by 2027, is also home to Uniting SA’s $50m aged care centre, which will include 125 private rooms and apartments and an 18-bed memory support unit for people with dementia.

$1B LINCOLN GAP WIND FARM & GENERATOR COMMISSIONING

Singapore-based power company Nexif Energy says it is heading toward a billion-dollar investment milestone in SA. The company recently secured approval to finish the second stage of its Lincoln Gap wind farm with the third stage currently being assessed for the site, 15km southwest of Port Augusta. Separately, the company has secured development approval to relocate the state’s emergency generators from Elizabeth to Outer Harbor, as part of its agreement to lease the generators for $93.7m for 25 years.

CARRAPATEENA COPPER-GOLD MINE

OZ Minerals is continuing to ramp up production at its second and SA’s newest operating mine, which produced its first concentrate in December following a three-year construction period. OZ has set a production rate of 4.25 million tonnes per annum at the underground sub-level cave operation with an estimated mine life of 20 years.

A feasibility study is underway to expand the operations further alongside plans to boost output at its older Prominent Hill mine.

$330M SKYCITY ADELAIDE’S CASINO, EOS HOTEL EXPANSION

Adelaide Casino will need 700 new workers when it opens four new restaurants and two bars as it nears completion of a $330m expansion this year.

The new venues include the Sol Bar and Restaurant, and are part of the Eos by SkyCity luxury hotel, which will take bookings from December 1. Additional jobs are linked to its upgrade of the Adelaide Railway Station heritage building’s portion, including The District at SkyCity, a microbrewery in partnership with Pirate Life opening in October.

The Guardsman Bar and Restaurant, a restoration of the former Overland Dining Hall, opened in January. Despite COVID-19 pushing out the economic boost originally anticipated, the local team is confident the improvements will deliver returns, albeit in the longer term.

$300M THOMAS FOODS ABATTOIR

Thomas Foods International is hoping to start building its new abattoir at Murray Bridge before the end of the year after getting planning approval for the project. It is expected to employ 2000 people directly and create another 4500 jobs indirectly.

The meatworks at Pallamana, north of Murray Bridge, will be a staged development and replaces the company’s previous facility, which was destroyed in a fire in 2018. The project is being supported by $7m from the Federal Government and $17m from the state government, which will go towards infrastructure, including roadworks.

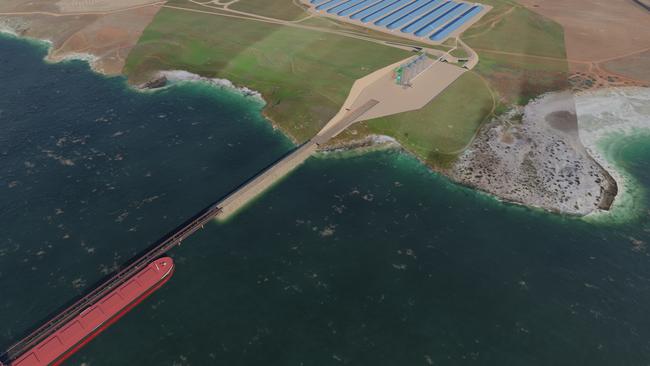

$230M GRAIN EXPORT DEVELOPMENT

Work is set to begin on Peninsula Ports’ new grain export facility on the Eyre Peninsula next month after the State Government gave the tick of approval for the major development. The project will create up to 150 jobs during construction and 20 more permanent local operational jobs. Operational staff numbers are expected to further peak at 80 staff during harvest.

*Select list of projects