Fears for 150,000 Aussies set for mortgage pain in transition from cheap fixed rate loans

Aussies who took advantage of cheap home loans during the pandemic are set to face more mortgage pain in the coming months.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

Treasurer Jim Chalmers has spoken with the big bank bosses amid fears of the financial future of the 150,000 Australians set to be transitioned off cheap fixed-rate home loans.

The Reserve Bank of Australia will meet on Tuesday to determine whether the cash rate is increased from 4.1 per cent or held in place for the second month in a row.

Australians who took advantage of cheap loans during the pandemic are now feeling the pain as they transition off fixed-rate loans to variable rates.

Fresh data, first reported in the Australian, flagged $32bn of mortgages will refinanced each month in the September quarter.

Dr Chalmers said the peak of the so-called mortgage cliff was earlier this year but he understood there was still a “substantial number” of Australians yet to transition to variable rates.

“First of all I’ve spoken to the bank CEOs about this challenge and the advice they have for customers is if you think you will be in trouble because of changes in your loan, the best thing is to engage with your bank as soon as possible,” he told ABC’s RN.

“If there’s something the bank can do to make it a little easier, they’re prepared to have that conversation with customers”

Borrowers have already been slammed with 12 rate hikes in the last 14 months.

Households with a $600,000 mortgage are now paying $1,451 more every month than they were before governor Lowe started raising rates at the start of May 2022.

Recent research from Roy Morgan showed an estimated 1.43 million Australians were struggling with mortgage repayments, soaring to levels not seen since the global financial crisis in 2008.

Just last week, fresh inflation figures revealed prices growth had eased to 6 per cent in the year to June, down from 6.8 per cent in the previous quarter. However, prices still remain high by historical standards.

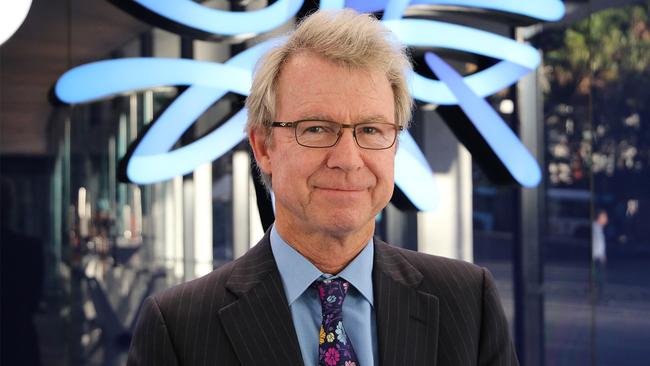

Given the delayed impact of rate hikes, AMP chief economist Shane Oliver argued that the Reserve Bank should pause at its August meeting.

“The inflation rate is actually falling faster than the Reserve Bank expected,” Mr Oliver said.

“We just run the very high risk of tipping us into recession if we just keep raising rates from here just because the most recent inflation numbers are too high.”

While markets anticipate just an 8 per chance that the RBA will raise rates at its August 1 meeting, economists have refused to rule out another hike despite new data showing price pressures had fallen faster than anticipated.

Commonwealth Bank economists expect that the RBA will hike rates by another 0.25 per cent when it meets on Tuesday but have described the decision as “another line ball call”.

“Overall there is enough evidence to suggest the path of least regret for the RBA is to lift the cash rate. This should provide an offset to any lingering risks in the inflation,” CBA stated.

Governor Lowe’s time as RBA governor will come to an end next month after Treasurer Jim Chalmers refused to extend his seven year term, installing deputy governor Michele Bullock as the central bank’s new head.

Originally published as Fears for 150,000 Aussies set for mortgage pain in transition from cheap fixed rate loans