Australia in recession: How saving money has affected economy

The economy has contracted by a huge seven per cent which has set a crazy new record, but there’s a huge missing piece of the puzzle.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

By now you know Australia is in recession.

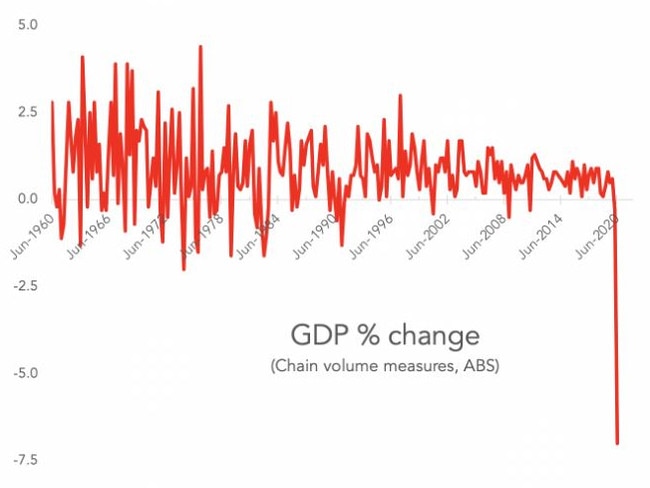

You’ve seen the amount of economic activity shrank by a huge seven per cent in the months of April, May and June. You know that sets a crazy new record – as the next graph shows.

RELATED: How the recession will affect jobs, wages, cost of living and the housing market

All of that is true. But there’s a missing piece of the puzzle. Australians slashed spending. Restaurants. Child care. Movies. Holidays. All of it went down. And that means there’s a factor you miss if you only look at spending.

Spending is not the only thing you can do with money. You can also save it. And earlier this year Australians started saving at a rate faster than ever before.

THE SAVERS

Usually in a recession, there’s two types of people. Those who lose their jobs dip into their savings to cover cost of living. Meanwhile people who keep their jobs save more than usual. They do that because they are worried about the future – they could be next to lose their jobs, after all. Usually this second group is bigger, and so overall national saving goes up.

That’s bad news that makes recessions worse. The more we save the weaker the economy gets. They call this “the paradox of thrift”.

If one person is thrifty and saves their money that’s great. But if we all do it, spending dries up, the economy gets weaker and we all suffer.

This time, on top of the usual paradox of thrift, we had lockdown and shutdown. That caused savings behaviour to go absolutely loopy. Some Australians are stuffing away thousands of dollars in every pay cycle. What else are you going to do with your income?

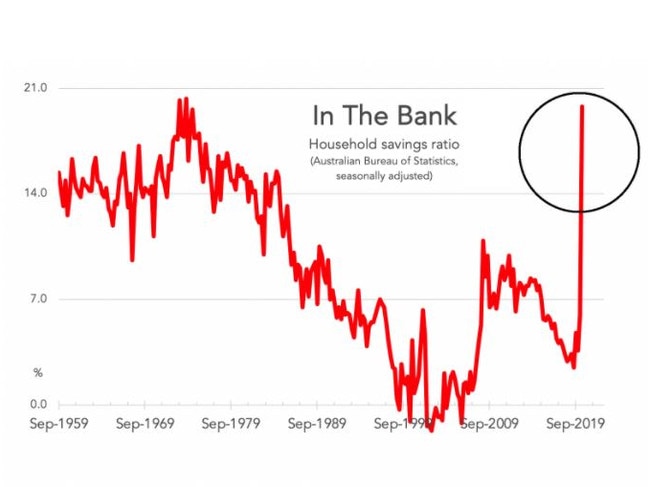

As the next graph shows, we saved an estimated 20 per cent of our income in the months of April, May and June this year. That is HUGE.

Recently saving was way down around three per cent. Now suddenly we are saving at rates exceeded only twice, way back in the early 1970s.

RELATED: Victoria’s economic crash will devastate us all

By the way, this huge boom in savings tells us something about monetary policy.

One way low interest rates are supposed to work is by discouraging saving and encouraging spending.

The RBA cuts interest rates to get the economy moving, and it hopes consumers will spend more and save less. Well, it has cut rates as low as they can go and it is obvious that effect is not very powerful!

Money is piling up in people’s bank accounts. There’s no doubt about this effect. We’re getting the same information from banks. They say savings accounts have 12 per cent more in them than they did pre-COVID.

RELATED: Australia’s big weakness exposed

How did it get there? The answer is partly saved income, and also partly Centrelink. Centrelink payments are a big part of household income but they don’t count towards GDP. The P in GDP is for product, as in production. GDP counts income you get for work but not income transfers. And there has been a record amount of income transfers.

Billions has been spent on the JobSeeker supplement. Those transfers have done two things: First, helped stop spending from getting even worse. Second, some of that money has been saved, and will be spent in future.

That’s the good news about these savings. They will flow back out into the economy over time. Economists are calling it “a war chest”.

“The household sector will have built up a massive war chest of savings over six months that are worth around four per cent of GDP,” said Commonwealth bank head of Australian Economics Gareth Aird in a note to clients on Wednesday. “These savings can support spending in the economy as fiscal stimulus is tapered.”

Having a war chest is good news. Australia certainly hasn’t fought its last battle with the coronavirus, so we need all the economic reserves we can possibly get. All those savings in people’s bank accounts are not just good news for the individuals. When the paradox of thrift goes into reverse we will all reap the benefit. The economy should be stronger later as higher spending brings about more jobs and hopefully that ingredient we’ve been missing for so long – higher wages.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology

Originally published as Australia in recession: How saving money has affected economy