Hamilton Property Group under fire for allegedly taking deposits from collapsed builder

Liquidators cannot find tens of thousands of dollars that homeowners paid as a deposit to a now defunct building company owing $28 million.

Companies

Don't miss out on the headlines from Companies. Followed categories will be added to My News.

Tens of thousands of dollars in deposit money paid by several customers to a collapsed residential builder has allegedly mysteriously disappeared, with liquidators claiming they are unable to locate the funds.

Last month the Victorian Supreme Court ordered Snowdon Developments into liquidation but some deposit holders have been left reeling after learning that they might never see the money they shelled out as a five per cent down payment for homes that may never be built.

Snowdon’s collapse left 550 homes in limbo as well as 52 staff members jobless and 262 creditors are, at last count, owed $28.6 million.

Now Snowdon’s liquidators can’t find any records of some customers’ building deposit money ever being transferred into the company’s bank accounts.

At a creditor’s meeting last month, liquidators alleged that property developer and sales agent Hamilton Property Group, who engaged Snowdon to build their clients’ homes, took the deposits as a commission fee and the money was never paid to Snowdon.

One customer, Josh Curmi, claims a Hamilton staff member admitted over the phone that the developer had his $11,000 deposit.

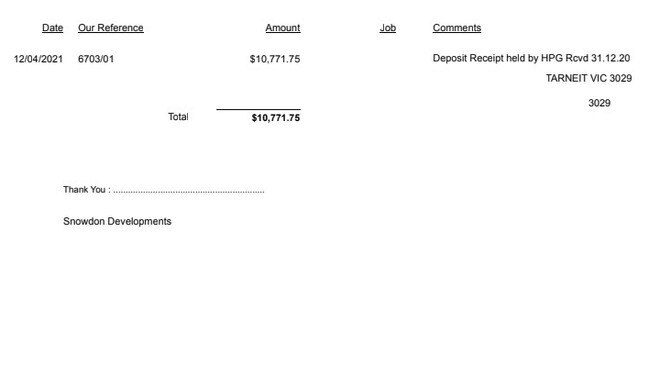

Another homeowner received a receipt that shows more than a year since paying his $10,000 deposit, the money is being held in a trust by HPG — Hamilton Property Group.

In an email to a customer trying to locate their $10,000 deposit, seen by news.com.au, a Hamilton employee denied the company had the money. But when news.com.au contacted Hamilton, an employee said the developer would not be commenting on the matter.

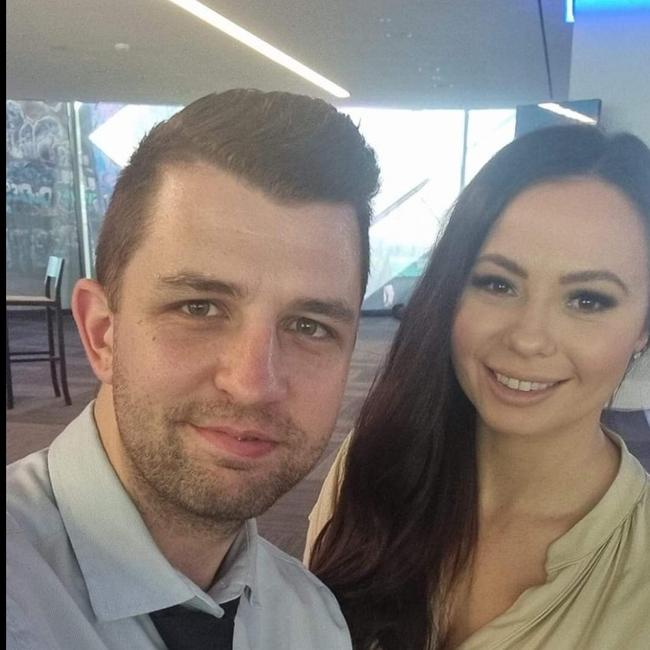

Josh Curmi and his wife Alicia Hele, both 29, bought a home-and-land package through Hamilton in February last year. Snowdon was brought on board as the builder for their $225,000 Melbourne house but no construction work ever started.

They’ve asked Hamilton to refund their $11,264 deposit for the build but the developer has not responded to their requests.

“I just want our money back,” Mr Curmi told news.com.au.

Mr Curmi and his wife along with several others aren’t entitled to any insurance payouts because no work was done on their block of land and Snowdon hadn’t yet taken out domestic building insurance, which is where a homeowner’s losses would be partially covered by the state insurer.

Now they claim the property developer, Hamilton, has the rest of their money, never having passed it on to Snowdon.

Snowdon’s liquidators have encouraged those homeowners to pursue Hamilton themselves to recoup their losses.

Earlier this month, Mr Curmi sent Hamilton a formal letter demanding a refund within seven days. The developer missed the deadline and never responded.

Do you know more or have a similar story? Continue the conversation | alex.turner-cohen@news.com.au

When Snowdon first collapsed in July this year, Mr Curmi said he felt supported by Hamilton as the company tried to help him find another builder. He instead ended up choosing his own builder, which will cost an extra $25,000 as build costs have gone up massively in the past 18 months.

But since Snowdon’s collapse, liquidators alleged at a creditor’s meeting that Hamilton had pocketed the build deposits for Snowdon customers as a commission, without informing affected homeowners.

At least a dozen Snowdon would-be homeowners that news.com.au knows of signed home-and-land packages with Hamilton and now might not recover a cent.

Minutes from Snowdon’s creditor meeting held last month, which have been filed with the Australian Securities and Investments Commission, stated: “Hamilton Property Group introduced projects to the company (Snowdon) and for those projects it would receive commission, which was paid using customer deposits …

“Deposits may be able to be recovered from the VMIA (Victoria’s home insurer) if the homeowners had insurance. If no insurance was obtained, homeowners may be unsecured creditors for the amount of the deposit and may choose to pursue the sales agent for a refund of their deposit … and if the deposit had been paid to the sale agent and not the company.”

According to the meeting minutes, liquidators say Snowdon is not holding any customer deposits, based on investigations to date.

Dye & Co Solvency’s Shane Deane, who is the appointed liquidator of Snowdon, told news.com.au that Snowdon doesn’t currently hold any customer deposits, and no deposits from Hamilton had been paid to Snowdon in relation to the abandoned builds.

Writing to homeowners, Mr Deane stated: “It appeared that the practice was that deposits paid to introducers (Hamilton) were retained by the introducer and charged as a commission to the builder.

“Homeowners that paid a deposit that are not insured should seek their own legal advice in regard to the recoverability of the deposit.”

Mr Deane added “introductions are not uncommon in the building industry”, but said a five per cent cut “seems high”.

He is currently investigating the nature of the business relationship between the now-defunct builder and developer, and whether liquidators need to pursue Hamilton for money to pay back to creditors.

“If there’s a recoverable action, if it was a commercial arrangement, we’ll review the commerciality of it,” he added.

Greg*, another affected Melbourne deposit holder, was stunned to hear claims that Hamilton had his money all along when he attended the creditor’s meeting.

“I was shocked,” he told news.com.au. “That was a big mic drop moment.

“I was under the impression (Snowdon) had this money.”

He paid $10,771 towards his $400,000 house, signing the land-and-build package with Hamilton on December 31, 2020. By April last year, he had secured Snowdon as a builder and paid the deposit.

The dad-of-one, 46, is waiting on a refund from Hamilton and described the whole ordeal as a “horrible experience”.

“In one word it (the entire process) has been non-transparent,” he said.

Outraged by being told at the meeting the developer had allegedly retained his deposit, Greg demanded a refund from Hamilton and also asked for proof that his money had been deposited into Snowdon’s accounts.

A Hamilton staff member denied that the company had his money but when they showed him a receipt, it appeared to prove his deposit had been “held by HPG” since April 2021.

More than a month since requesting a refund, he still hasn’t received anything and is taking the matter to the Victorian Civil and Administrative Tribunal (VCAT).

Greg also questioned why Hamilton continued signing up Snowdon clients as the builder neared collapse, saying it seemed unusual that they didn’t know the building firm was in trouble “if they share that kind of a business arrangement”.

“That creditors meeting laid bare the extent of their connections,” he added.

Two more angry homeowners spoke to news.com.au, with one owed as much as $22,500 and the other spending thousands on lawyers to recover their money.

Raynan Abella, 30, his wife and two kids were expecting to move into their new home early this year, after signing a build contract with Snowdon in June 2021.

However, their Melbourne site still remains empty.

They’re now worried what will happen to their $11,000 deposit, which they claim they are owed from Hamilton.

Mr Abella bought a plot of land but said Hamilton failed to mention the previous landowner had defaulted on the property, which meant the young family was left to foot the bills.

“I was pretty much sent a recision notice, a legal notice saying we had to pay the fees of the previous person that ended up totalling $11,000,” he told news.com.au.

“I said that was unfair. It should be on Hamilton to take ownership of this, this shouldn’t be on us.”

In the end he struck a deal with Hamilton where the developer agreed to “cover our five per cent deposit if we paid the $11,000”, he explained.

As a result, Mr Abella says he should be entitled to get back his $11,000 now that Snowdon has been wound up.

He’s spent $4000 on lawyers but his legal letter demanding a refund expired on July 29 and he says he’s received “no other response to date” from Hamilton.

Shiju*, 41, went through Hamilton to settle on a piece of land in August last year in the suburb of Melton but says he regrets that decision a year later.

He paid $22,500 to Hamilton for his build with Snowdon but now says he thinks it ended up in the sales agent’s coffers instead.

What was supposed to be his family’s home is still an empty plot of land.

“The saddest part is we are not very wealthy. Everything is not easy, we lost one year’s rent. We wanted to move into our new home, interest rates are going up, build prices are going up,” he said.

“My wife was 70 per cent (keen on the idea of building a home), I was 30 per cent, (so) we had arguments.

“This is one of the saddest things I’ve gone through.”

News.com.au first raised the alarm about Snowdon Developments in June after an investigation revealed that subcontractors and suppliers hadn’t been paid for months while construction sites languished, untouched, and staff were owed thousands in unpaid wages.

In early July, the company was placed into voluntary administration but just weeks later, it was court-ordered to go into liquidation.

Within hours of the company going under, liquidators secured a deal with another residential builder, Mimosa Homes, to buy some of Snowdon’s intellectual property for $300,000, which added a little more money to be paid back to creditors.

*Names have been changed for privacy reasons

alex.turner-cohen@news.com.au

Originally published as Hamilton Property Group under fire for allegedly taking deposits from collapsed builder