Banks change borrowing rules leaving nearly half of homeowners as ‘mortgage prisoners’

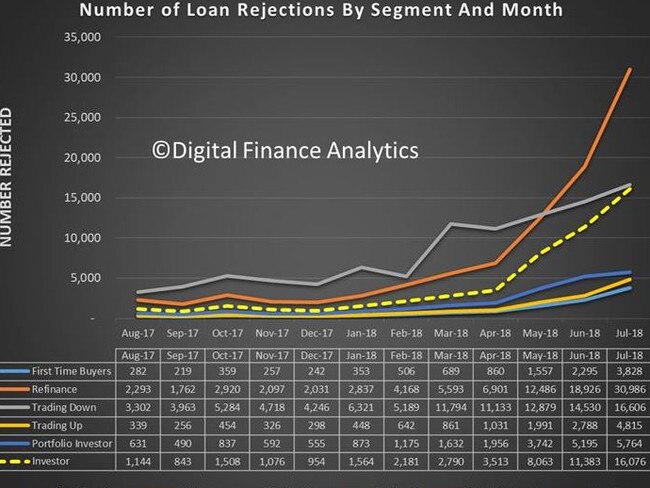

NEARLY half of all homeowners are now shackled to their mortgage, with refinance rejections up 1250 per cent in less than a year as banks are being rattled by the Royal Commission.

Banking

Don't miss out on the headlines from Banking. Followed categories will be added to My News.

EXCLUSIVE

NEARLY half of all homeowners are now shackled to their mortgage, with refinance rejections up 1250 per cent in less than a year as banks rattled by the royal commission drastically tighten borrowing rules.

Loan sizes are being slashed by 30 per cent, trapping many financially stressed customers including some who have been slugged with “out of cycle” interest rate rises.

House hunters are also being hit by the credit crunch, with dramatic implications for property markets.

The crunch stems from two big shifts in the way banks judge borrowers, experts say.

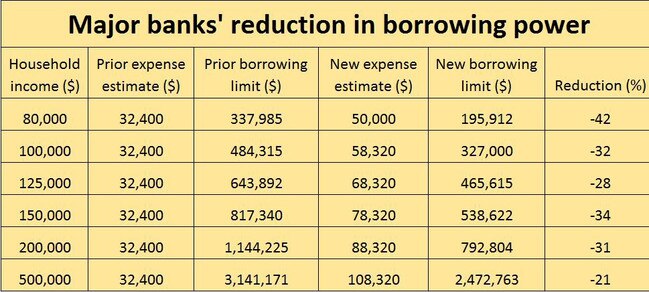

Expense estimates have been raised substantially — the minimum outgoings for an average household are now assumed to be a third higher, according to the nation’s top bank analysts UBS.

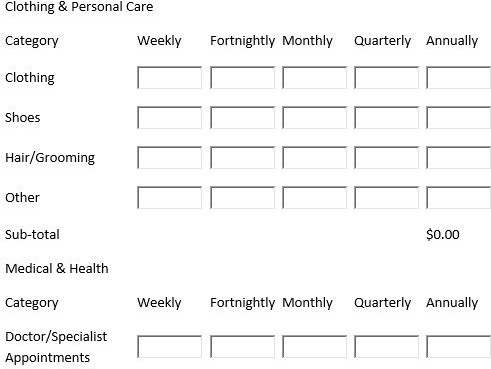

On top of this, granular cost breakdowns must be provided. After the royal commission revealed in March that expense checks were so lax as to be borderline illegal, new tests have been imposed requiring in some cases detail of weekly, fortnightly, monthly, quarterly and annual spending in as many as 37 categories from alcohol and haircare to shoes and pets, as well as doctor visits.

RELATED: Largest lender’s new customer expense checklist revealed

Four in 10 households would now have difficulty refinancing, said leading industry observers Digital Finance Analytics.

“That means you are basically a prisoner in the loan you’ve currently got,” DFA principal Martin North told News Corp Australia.

DFA — which bases its insights on 52,000 household surveys plus data from a range of official sources — estimates 31,000 households’ refinance applications were rejected in July versus 2300 in August last year. That’s an increase of 1248 per cent.

“It’s unbelievable,” said comparison service Mozo’s lending expert Steve Jovcevski. “There’s such a huge pool of people who are in that boat.”

Mr Jovcevski said the most common motivation among those seeking to refinance was to save money by finding a better deal. Many were feeling the pinch because living costs were rising faster than wages and rates on interest-only or investment loans had increased.

Mr North said the chief problem these households were facing in seeking a new deal was banks’ definition of a “suitable loan now is different to six months ago because of the royal commission” and a clampdown by the Australian Prudential Regulation Authority.

MORE: Royal Commission hears bank doesn’t check expenses

Just how different can be seen in borrowing calculators on bank websites.

“Those calculators, compared to a year or 18 months ago, are now on average showing a 30 per cent lower number,” Mr North said.

For some, the reduction in borrowing power is even greater. The head of UBS’s bank analysis team Jon Mott said that for a household with pre-tax income of $80,000 would get 42 per cent less from a bank; for a $150,000-a-year household, would get 34 per cent less.

Mozo’s Mr Jovcevski said in one example he was personally aware of, a person pre-approved to borrow $630,000 last year was recently offered just $480,000. The would-be borrower’s job and income hadn’t changed.

The implications for property markets were severe, Mr Jovcevski said.

“There are fewer qualified buyers,” he said.

Reduced borrowing power would drag down selling prices and eventually cut valuations.

“It’s a double whammy for those mortgage prisoners,” Mr Jovcevski said. “Their valuations come in lower so their equity may end up being less than 20 per cents so they have to pay lenders mortgage insurance again” if they refinance.

Australian Banking Association CEO Anna Bligh said banks had to make reasonable inquiries to satisfy APRA’s strengthened mortgage lending standards.

“The term ‘home loan prisoners’ does not represent the facts of a fiercely competitive home loan market where everyday banks are seeking to attract new customers,” Ms Bligh said.

How you can still get a new home loan

JUSTINE Clemow is one of the lucky ones. She is about to settle a refinancing deal with a major bank, something 40 per cent of households would struggle to do right now.

The scrutiny and stress-testing being applied to borrowers is unlike anything that’s been seen in recent Australian history.

The broker who struck the deal for the Clemow family, Angelo La Selva of Buyers Choice, said lenders now want to see detailed breakdowns of household expenses.

“Not just fixed costs but discretionary spending,” he said.

For Mrs Clemow, that wasn’t a problem. She maintains a budget and was able to hand it over to Mr La Selva.

“It was all there in black and white,” Mrs Clemow, of Dicky Beach on Queensland’s Sunshine Coast, said.

Only 28 per cent of Australian households run a budget, according to recent research by Ubank.

Mr La Selva has long insisted on expense checks from his clients, which makes them appealing to lenders in the current climate.

Further aiding the Clemows’ cause was husband Brian recently got a promotion at the mine where he works.

Having more money coming in the door helps when banks run their expanded rate “buffer” tests, checking whether would-be borrowers could afford repayments if interest rates rose as high as 8 per cent — twice the interest rate on many loans on offer today.

Mozo lending expert Steve Jovcevski said homeowners seeking to give themselves the best chance of successfully refinancing should reduce their expenses in the months prior to applying and ensure all bills have been paid on time.

Mark Hewitt — general manager of broker and residential at AFG which arranges 10,000 home loans a month — said would-be borrowers whose budgets were at breaking point or beyond could still get a loan if they had equity, a clean repayments history and the ability to ditch key expenses such as fees for private school if under the pump.

Some people seeking their first home loan are signing documents in which they promise to cut their spending if a new loan is approved.

“When you get a mortgage you make sacrifices — you continue some of your discretionary spending but not all of it,” said Brett Spencer, head of Opica Group, which sells software to brokers that works out how much a prospective customer can cut back.

A figure is agreed between the broker and the would-be borrower which is then provided to the bank, which would otherwise rely on the higher, raw expense figures.

“We do know that we can improve borrowing capacity,” Mr Spencer said.

Are you a mortgage prisoner? Contact John: john.rolfe@news.com.au

Follow John’s work on Facebook or Twitter

Originally published as Banks change borrowing rules leaving nearly half of homeowners as ‘mortgage prisoners’