Challenger back in the black as CEO Richard Howes resigns

Challenger CEO Richard Howes has unexpectedly resigned after swinging the company back to profitability.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Challenger chief executive Richard Howes has announced his resignation after swinging the financial services company back into the black.

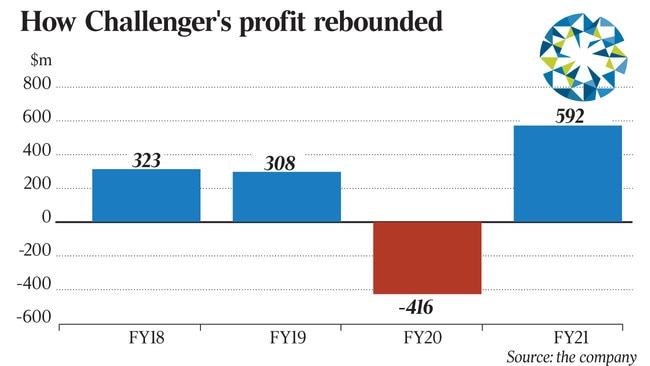

The company reported a $592m profit for the year to June, a $1bn turnaround from the $416m loss in the previous year.

Revenue more than doubled to $2.8bn, driven by a 35 per cent increase in life insurance sales and 46 per cent increase in annuity sales.

However, underlying profit fell 19 per cent to $279m as the company took a more cautious approach during the Covid-19 pandemic, noting that a more “defensive portfolio and enhanced risk settings”, including holding higher levels of cash, resulted in a lower return on equity.

Mr Howes announced he would be stepping down as chief executive in March after 18 years with the company, and three years in the top job.

He said the company had taken “decisive action to set up the business for future growth” by diversifying revenue, repositioning the company’s investment portfolio and strengthening its balance sheet.

“Following our decision to reposition the investment portfolio during the early stages of the pandemic, as flagged, we gradually deployed significant cash balances into higher returning assets throughout the year, with the full benefits to be realised next year,” he said.

“We have maintained our strong capital position and enhanced our risk settings to underpin our strong brand and customer franchise and ensure we have the flexibility to withstand market movements.

“There is positive momentum across the business and a clear strategy to capture the growth

opportunities created by long-term structural tailwinds.

“The superannuation system continues to grow significantly, and retirement income reforms are progressing that will see increased focus on providing better retirement solutions.”

A 29 per cent increase resulted in a record $110bn in assets under management, with significant improvements in both the life and funds management sides of the Challenger business.

Sales of life policies were up 35 per cent to $6.9bn, with institutional sales up 53 per cent to $4bn and retail sales 19 per cent higher at $2.1bn.

The strong results follow last month’s approval of Challenger’s $35m acquisition of Catholic Super’s banking arm, MyLife MyFinance, as it seeks to tap into the country’s $1 trillion term deposit market.

“We are the prominent provider of guaranteed income streams for retirement in our life business and government-guaranteed term deposits are a very natural adjunct to add to that,” Mr Howes said.

“From a customer point of view it also gives us the opportunity to go in more directly to customers, and at a time earlier in their journey towards retirement – it’s going to be really important for us strategically.”

Challenger expects to generate strong profit growth in 2021-22, with normalised net profit before tax expected to reach between $430m and $480m, with a mid-point of $455m representing a 15 per cent increase on the 2020-21 result.

It also flagged a commitment to continue payouts, targeting a dividend payout ratio of between 45-50 per cent of normalised net profit before tax.

Mr Howes said he would leave the company in a strong financial position.

“With the certainty that the business is primed for growth, I feel that now is a good time to step aside and begin the process for a new leader to drive Challenger’s exciting next chapter,” he said.

“For me it is an opportunity for a change. I’m going to be changing gears – I won’t be going for another CEO gig – I’ll be moving out of corporate life.

“I’ve always been passionate about education and I want to have an opportunity to be able to give back in that space.”

Mr Howes’s decision to step down surprised analysts, with Citi suggesting a leadership transition could weigh on the share price in the short term. It noted that a new chief executive “may take time to gain market confidence and may reduce or remove the longer-term ROE (return on equity) target”.

Challenger chairman Peter Polson said Mr Howes had developed a “clear and compelling strategy”, which created a strong platform for growth.

“In recent years he has shepherded Challenger through extraordinary headwinds, and under his leadership our life and funds management businesses are leaders in their respective markets, delivering record growth this year,” he said.

“The highly strategic acquisition of MyLife MyFinance Bank will further strengthen our customer offering.”

Long-serving executive Chris Plater has been appointed to the role of deputy chief executive while the Challenger board conducts an internal and external search for Mr Howes’s replacement.