Surplus capital ‘burning a hole in NAB’s pocket’, say analysts on Citi buy

NAB’s move to scoop up Citigroup’s Australian consumer banking arm has been broadly well received by banking analysts, but some see regulatory hurdles ahead.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

NAB’s move to scoop up Citigroup’s Australian consumer banking arm has been broadly well received by banking analysts, who say the deal, while not a material buy, has strategic value as the lender looks to beef up its personal banking business.

At the same time the competition regulator has formally advised it is monitoring the $1.2bn deal.

“We expect to commence a public review shortly once we have received a submission and certain information from NAB and Citigroup, and will consult with industry participants as part of the review,” the Australian Competition & Consumer Commission said on Tuesday night.

NAB on Monday said it had agreed to buy Citi’s local business, which includes a $6.7bn mortgage book, $3.5bn credit card portfolio and more than $9bn in deposits.

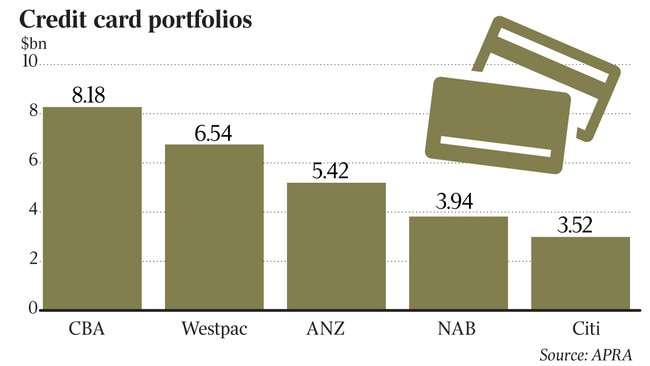

The $1.2bn price tag includes a $250m cash premium over the net assets and the deal will see NAB become the nation’s second-largest credit card issuer.

Goldman Sachs analysts said they saw strategic merit in the transaction.

“(It) would contribute to an improvement in the returns drag NAB has suffered versus peers from being underweight consumer banking and having a consumer bank that relatively under-earns, given a lower exposure to unsecured lending,” they told clients.

“We calculate that the transaction would result in a 1.5 per cent better earnings per share outcome than if the equivalent capital was bought back on-market.”

Macquarie analysts, meanwhile, said the acquisition, while not material, won’t leave the bank financially stretched and has a relatively low integration risk.

“With surplus capital appearing to burn a hole in NAB’s pocket, management (has) announced a second acquisition this calendar year,” they told clients. (NAB in January announced that it would buy 86400 to boost the growth of its digital bank.)

“We see the financials underpinning the transactions as broadly favourable, providing NAB with the needed margin of safety,” the analysts said.

Alongside these acquisitions, the lender is also returning capital to shareholders in the form of a $2.5bn on-market buyback.

“NAB’s strong financial performance, combined with the divestment of MLC Wealth, has created an opportunity for NAB to reduce our surplus capital while retaining a strong balance sheet during these uncertain times,” NAB chief executive Ross McEwan said last month as he announced the capital return.

“Our target CET1 range reflects a balance between retaining a strong balance sheet through the cycle, supporting growth and recognising the importance of capital discipline to improve shareholder returns.”

An on-market buyback was the most appropriate way to reducing its shares on issue and driving sustainable return on equity benefits, he added.

On the Citi transaction, Me McEwan said its assets would bring the bank scale and expertise in unsecured lending, particularly in credit cards, which was the big draw card.

“The market for unsecured lending and payments more broadly is always evolving, and it’s very competitive,” Mr McEwan said.

“In this changing landscape, we are thinking more broadly about our customer proposition, and the value we can bring to our customer relationships. Personal banking, access to payments and transaction data will be critical tools to drive innovation and deliver market-leading customer experiences.”

NAB is currently Australia’s fourth-largest credit card issuer, while Citi sits just behind in fifth place.

If the deal gets over the line, NAB will jump to the number two spot when Citi’s “white label” credit cards for institutions such as Qantas, Bank of Queensland, Coles and Suncorp, among others, are included. Stripping out the white label products, NAB moves into third place.

But it comes as credit cards face their biggest test yet, with younger consumers turning their back on them and instead opting for lower cost buy now, pay later schemes.

Morgan Stanley said they didn’t see it as a compelling transaction and questioned the further push into credit cards.

“NAB stated that unsecured lending is core to its retail bank strategy and that increased scale and expertise will support new technology investment and innovation in an evolving unsecured lending and payments market.

“We question the strategic merit of getting larger in the increasingly competitive, low-growth consumer unsecured lending market, but we see value in increased access to data and a large customer base,” they told clients.

Ord Minnett analysts looked through the structural headwinds, saying “the proposed acquisition will add scale to NAB’s consumer unsecured operations and the key metrics look sound, even allowing for attrition of the mortgage book”.

“The transaction, which is subject to regulatory approval, should be marginally accretive to earnings per share and return on equity post completion.

“We estimate it would be 1 per cent more accretive than the alternative option of using that surplus capital to buy back shares.”

But they also cautioned on the uncertainty surrounding regulatory approval.

“We believe there is a material risk that ACCC will knock it back, given it will increase the combined major bank share of APRA system credit cards to 93 per cent,” they warned clients.

Already the ACCC has given its initial view on the deal, expressing its concerns over the dampening of competition in the market.

We are extremely concerned about protecting competition in the banking sector and we will look at this very closely,” ACCC chief Rod Sims said.

“Players outside the big four banks provide good competition and that is going to be lost with this transition. The big four don’t provide that competition between themselves, they more accommodate each other rather than compete with each other.

“So when you’ve got a big player like this being taken out, it concerns us very much.”

Originally published as Surplus capital ‘burning a hole in NAB’s pocket’, say analysts on Citi buy