Billionaire Laurence Escalante launches bid to buy out Virtual Gaming Worlds shareholders

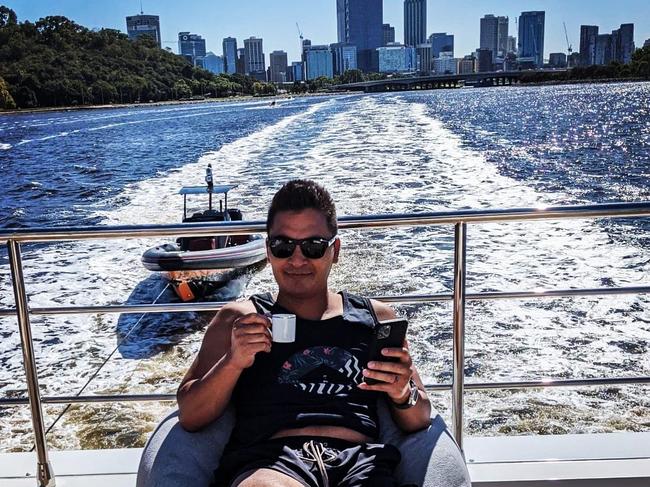

Online gaming billionaire Laurence Escalante is thankful for the support, but has moved to buy out minority shareholders of his online casino business.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Billionaire Laurence Escalante is putting together a package up to $1.26bn to fund the buying out of minority shareholders in his private Virtual Gaming Worlds online casino empire, after two previous attempts were rejected for being “below fair value”.

Mr Escalante, via his private office, is offering almost $1bn for the 30 per cent of shares he does not own in his online casino gaming giant that was established only in 2010 and has since grown into a business with annual revenue of $6bn, operating under a sweepstakes model that has most of its customers in the US.

The offer in the unlisted public company comes after Mr Escalante reportedly expressed frustration with some smaller investors in recent months, after some had grown concerned about a lack of a liquidity event – a stockmarket float has been ruled out – for the shares some have held for more than a decade.

Mr Escalante’s Lance East Office has offered minority shareholders $5.05 per share for their holdings less any dividends paid. VGW announced it was planning to pay shareholders, including Mr Escalante, dividends of up to 45c per share for the 2025 financial year, earnings for which the company flagged would be soft compared to 2024 due to increasing regulatory issues in the US.

Mr Escalante, who will receive about $200m from the upcoming dividends that will be paid in two tranches, has obtained binding debt commitment letters from external lenders for a US$310m ($486m) loan to a new “BidCo” that will acquire VGW to fund part of the cash consideration payable under the proposed deal.

He has offered existing minority VGW shareholders a deal to take cash for their shares, take scrip in the new BidCo or a combination of both.

VGW has also entered into a loan agreement with BidCo to loan excess cash to BidCo of up to US$586m ($910m) to fund part of the cash consideration payable to VGW shareholders for the deal should they take up the cash offer.

“VGW is a fantastic business and I thank all shareholders for their support in helping us build the company we have today. As the regulatory, competitive and economic landscape evolves, we face many new opportunities but also challenges and uncertainties,“ Mr Escalante said in a statement.

“For some time now, many VGW shareholders have asked how and when a liquidity event may arise, and the Scheme [offer] represents an efficient opportunity to allow those shareholders looking to monetise their investment for cash to do so.”

The transaction values VGW at $3.2bn.

VGW hired Mike Symons of Canterbury Partners as an independent non-executive director to assess the deal. He and long-time VGW executive Mats Johnson had recommended the deal.

Mr Symons told The Australian that Mr Escalante had made an initial $3.50 per share offer to “selected shareholders” only, before upping the bid to $4.00, “which was pretty quickly dismissed … on the basis that we didn’t think it reflected fair value, and in order to give existing minority shareholders that were eligible the ability to participate in the business moving forward” via a scrip element.

“This took three or four iterations over many, many months, and the dialogue got a little bit frosty at times,” Mr Symons said. “We are comfortable where we’ve landed. Because it’s not just this is a cash offer, take it or leave it and move on. It gives everyone the ability to go on the journey with Laurence and the executive team, and if the business turns out to be worth the multiple of what it is currently priced at, good luck to everybody.”

VGW said it was experiencing tougher trading conditions this calendar year, and expected earnings for the second half of FY25 are likely to be 10 per cent to 15 per cent lower than earnings for the first half of FY25.

It had $6.1bn revenue last year and made a whopping $497m net profit – enough for Mr Escalante to already have an estimated $4.37bn fortune, placing him 32nd on The List – Australia’s Richest 250 this year.

Mr Escalante has said he has ambitions for VGW to be the biggest gaming company in the world and expand outside the casino-themed games it offers. It has clinched a deal with the global toy giant Hasbro to develop a match-three online game (where players win when three tiles or elements are lined up) for the world-famous Monopoly board game brand that has soft launched in Canada ahead of a release in the US mid-year.

While the company makes just about all of its income in the US, it has been battling some regulatory headwinds. There have been a string of legal battles in the US, where VGW has faced accusations – which it has consistently denied – of operating illegally in a handful of states.

Since the end of December VGW has ceased providing casino-themed social games in Nevada and Delaware, it said, which has impacted revenue. Additionally, VGW has informed players that it is phasing out sweepstakes promotions in the State of New York.

More than one million customers now play virtual casino games inside VGW’s Chumba Casino every day.

VGW users can play for free and also pay real money to buy virtual “gold coins” to enhance their casino games or poker. VGW also offers sweepstakes promotions.

More Coverage

Originally published as Billionaire Laurence Escalante launches bid to buy out Virtual Gaming Worlds shareholders