BDO report: Australia’s exploration sector cashed up after market chipped in $11.2bn in 2021

Australia’s junior explorers tucked away $11.2bn in new cash in 2021. The trick now will be to turn record raisings into new discoveries.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Australia’s exploration juniors raised a staggering $11.2bn in 2021, according to accounting firm BDO, with lithium cementing its place as the year’s hottest commodity on the Australian metals and mining market.

BDO will release its latest quarterly cashflow financing report on Australia’s junior explorers on Monday, showing 2021 was the best year the sector has had since the last mining boom.

Australian-listed explorers raised $3.75bn in the December quarter, the biggest total in a single quarter since BDO began tracking the state of the sector’s finances in 2013, and more than $11.2bn in total in 2021.

It is only two years since the junior exploration sector hit its nadir, with the capital markets contributing only $834m into explorers in the first three months of 2020 as raisings in the sector hit a four-year low.

Now the junior end of the market is cashed up and, with almost 90 per cent of explorers holding a cash balance of more than $1m, spending from the sector’s war chest is in full flow.

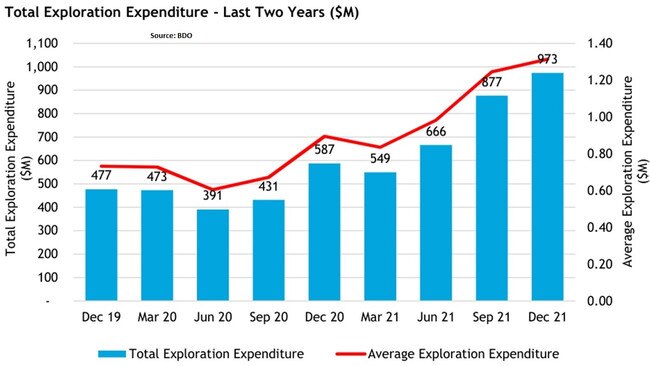

BDO’s latest report shows exploration spending reported in the quarterly cashflow statements lodged by listed resources explorers hit $973m in the December quarter – almost four times the low mark of $267m reached in the March quarter of 2016.

BDO head of natural resources Sherif Andrawes told the Australian the cost inflation being experienced across the Australian mining sector played some role in the lift in exploration spending, but said there had also been a considerable lift in activity with mining services providers still struggling to keep up with booming demand from their clients.

“There’s still a shortage of equipment (such as drilling rigs) and there’s still a waiting list to get more. But there is new kit coming in, and older equipment is not being retired – it’s being used longer,” he said.

The year also saw a bumper crop of new resources listings. Three were 40 new initial public offerings in the December quarter, traditionally a quiet period on the capital markets, bringing the total number of new listings for 2021 to an extraordinary 104.

“The average cash balance of exploration companies was $11.88m at the end of the December quarter, compared with $11.40m for the September 2021 quarter. We note that this has steadily increased with each quarter since March 2020,” the BDO report says.

Of the $3.75bn raised in the December period, almost 80 per cent went to the 71 companies that recorded debt and equity raisings of $10m or more – led by lithium hopeful Liontown Resources, which tucked away $450m to back development of its Kathleen Valley lithium project in WA in early December.

Liontown’s trip to the markets was enough to make lithium the biggest beneficiary of 2021’s investment rush. From the group of companies on BDO’s so-called “fund finder” list – those companies that raised more than $10m in a single issue – more than $2.01bn was raised by lithium-focused listed companies in 2021.

Lithium hopefuls narrowly pipped out gold companies – traditionally the sector of choice for Australian speculative resources investors – for the top spot, with gold companies raising $1.94bn through the year.

Also of note is the return of uranium stocks to favoured status in 2021, amid the global energy crisis and the growing push to end the world’s reliance on fossil fuels.

Uranium companies raised $474.9m in 2021, putting the energy metal in fourth position on the hottest commodity list – only narrowly below oil and gas explorers, which collectively raised $477.5m.

Mr Andrawes said he saw little sign of the sector’s resurgence ending, saying the accounting firm was still seeing a long queue of company directors keen to list new companies, and the market still open for top-up capital raisings for explorers.

“The exploration sector is not slowing, despite the record levels of activity we saw throughout 2021,” he said.

“The sector is continuing to send out very positive signals, with growing investment and exploration spending still well-supported by a steady access to funding.”

More Coverage

Originally published as BDO report: Australia’s exploration sector cashed up after market chipped in $11.2bn in 2021