Liontown Resources, the $3bn-plus lithium miner, is believed to be preparing for a major equity raising with investment bank Macquarie Capital and broker Bell Potter sounding out fund managers in the market.

It is understood meetings with investors were held on Friday and will continue through this week in what is expected to be a move to brief them on spending plans for the fresh equity.

Expectations are that the group will be capitalising on its elevated share price and will use the proceeds to fund its lithium project in the Kathleen Valley in Western Australia.

A major raise is expected to be needed to fund the development.

Liontown Resources, based in Perth, is run by former BHP and Rio Tinto executive Tony Ottaviano and has seen its share price increase from 9c at the start of last year to $1.57.

It announced the outcome of a feasibility study into its Kathleen Valley development on Thursday, confirming the potential to develop a second-generation lithium-tantalum mining and processing operation in Western Australia’s Northern Goldfields, which has a net present value of $4.2bn.

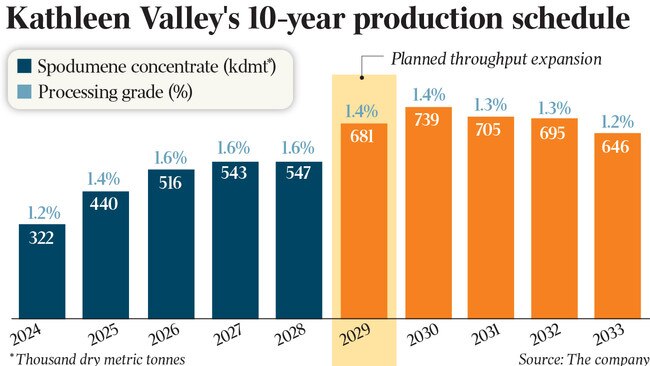

Liontown said the initial cost of the project is $473m and the first production is expected to start in the first half of 2024.

It is forecast to produce 511,000 tonnes per annum of spodumene concentrate at 6 per cent lithium oxide and 428 tonnes of 30 per cent grade tantalum concentrate, based on the initial mine production of 2.5 mega tonnes per annum.

The company said the ore reserve underpinned a 23-year mine life.

In an announcement to the market on Thursday, it said project funding discussions were well advanced, with a combination of debt and equity financing options being considered and proposals received from several Tier-1 financiers, institutions and equity funding groups.

Liontown plans to have funding in place for a final investment decision on or before the second quarter of 2022.

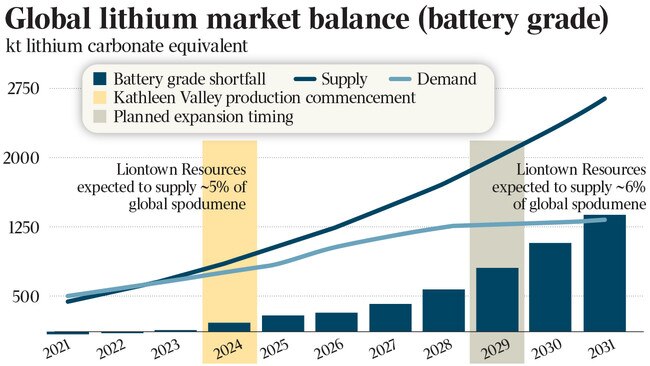

Liontown Resources has prospered on the back of the surging demand for resources used to make batteries in electric vehicles as institutional investors increasingly shun coal and other commodities used for unclean forms of energy and focus on more environmentally friendly investment opportunities.

No doubt, the company will be keen to capitalise on the strong market conditions for raising equity while it can.

However, for those still looking to launch initial public offerings into the market, the thinking is that it may be too late.

A number of floats were pulled last week in a situation creating uncertainty for the $1.1bn-$1.2bn IPO of services company Ventia.

There was growing doubt in the market on Friday that its owners, CIMIC and Apollo Global Management, would get a deal across the line at its current terms.

So far, it is understood that institutional investors have committed to support about half the amount of funds Ventia’s owners hope to secure and retail investors are unlikely to provide enough to account for the rest.

Compounding matters for Ventia was that the listing of $3.25bn disability services provider APM staged a disappointing debut on the ASX on Friday, with its share price closing more than 6 per cent lower at $3.33.

Ventia’s bookbuild is being held on Monday and Tuesday.