Canadian pension fund swoops on historic WA cattle stations

Two WA cattle stations, which span a combined 470,000ha, are set to be sold to a familiar Canadian investment group.

A Canadian superannuation fund’s footprint in Western Australia’s Kimberley region has expanded beyond three million hectares following its proposed acquisition of two historic cattle stations.

The Alberta Investment Management Corporation (AIMCo) has swooped on the 473,608ha Yeeda and Mt Jowlaenga Stations aggregation, intending to purchase the properties located near Derby in northwest WA.

Listed for sale earlier this year, the Yeeda and Mt Jowlaenga Stations formed part of the Yeeda Pastoral Company portfolio of assets alongside subsidiary, the Kimberley Meat Company, which were both placed into administration in March.

It is understood AIMCo, subject to regulatory approvals, have purchased the Yeeda Pastoral Company portfolio of assets in a deal reportedly worth $53 million.

This portfolio includes the Yeeda and Mt Jowlaenga Stations, Kimberly Meat Company Abattoir, Kimberley Properties’ eight residential properties in Broome and Derby as well as associated plant and equipment and conditionally registered Human Induced Regeneration (HIR) carbon project.

The portfolio was owned by a consortium of investors with the major shareholder Hong Kong-based equity fund Asia Debt Management Capital (ADM Capital).

The acquisition takes AIMCo’s Kimberley pastoral holdings to more than 3.4 million hectares following its $300 million purchase of the Kimberley Cattle Portfolio, from the Hong Kong-based Australian citizens the Hui family, and their Archstone Investment Group.

AIMCo’s investment partner New Agriculture, who was appointed to manage the Kimberley Cattle Portfolio Company, will also manage the Yeeda and Mt Jowlaenga Stations.

Following the deal, the embattled Kimberley Meats Company and its abattoir are likely to be run separately.

“Whilst New Agriculture is proposed to manage the Yeeda Pastoral Group and its related entities, this excludes the Kimberley Meat Company as it is outside our expertise. If the transaction is successful, the entity will either be self-governed, or a separate manager may be appointed,” a New Agriculture spokesperson said in a statement.

New Agriculture assisted AIMCo in preparing the deed of company arrangement and liaised with the Yeeda Pastoral Company administrator KordaMentha.

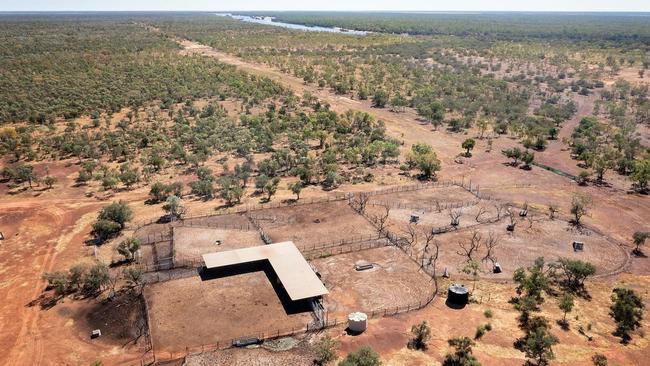

Spanning mostly leasehold country, the Yeeda and Mt Jowlaenga Stations have a current potential carrying capacity of 22,990 standard cattle units, while the walk-in, walk-out sale will include about 13,800 head, counted in a partial muster in October last year.

The AIMCo acquisition is subject to final approval by the AIMCo Investment Committee, the FIRB, the Pastoral Lands Board and the ACCC.

The investment manager of pension, endowment and government funds in Alberta, AIMCo entered Australian agricultural investment with the initial acquisition of the 105,000-hectare Lawson Grains portfolio from Macquarie Agriculture in 2021 for $600 million.