Australian economy continues to grow, despite share drop overnight

Australia’s economy grew at 0.4 per cent according to new figures released today. This comes despite global stocks taking a hit overnight – causing Australia’s shares to drop 1.5 per cent.

The Australian economy is growing at a slow rate as share prices take a dive on the nation’s stock market.

The latest quarterly report from the Australian Bureau of Statistics shows there was a 0.4 per cent growth in seasonally adjusted volume terms since September, and a 1.7 per cent growth since January 1.

Net exports contributed 0.2 percentage points to growth this quarter, according to ABS chiefs economist Bruce Hockman.

Economy grew 0.4% in September quarter https://t.co/kps3LGbkW8

— Australian Bureau of Statistics (@ABSStats) December 4, 2019

He added the domestic final demand remained subdued contributing 0.2 percentage points.

“The economy has continued to grow, however the rate of growth remains well below the long run average,” he said.

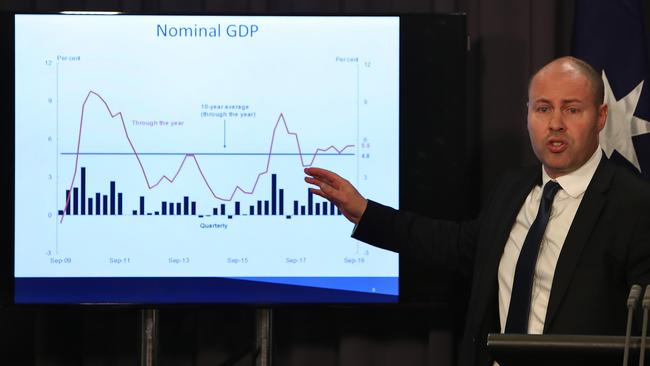

ABS DATA: TREASURER DEFENDS GDP FIGURES

Treasurer Josh Frydenberg is thrilled about the nation’s latest Gross Domestic Product (GDP) figures, saying “Australia is back on track”.

Commenting on national TV about 12.45pm today, Mr Frudenberg said Australia was only second to the United States in through-the-year real GDP growth.

He added growth was broadbased with household consumption, public final demand and net exports contributing to GDP growth.

Household consumption has increased by 0.1 per cent in the September quarter, Mr Frydenberg said, and the household savings rate is up to 4.8 per cent.

“What you need to look at in the context of the economic challenges that Australia faces is that we are not alone and these challenges – be they be trade tensions between the United States and China (or) the devastating drought at home – these domestic and global economic challenges are very real,” he said.

“They are being felt across the Australian economy, but the economy, as shown by the numbers today, is being remarkably resilient.”

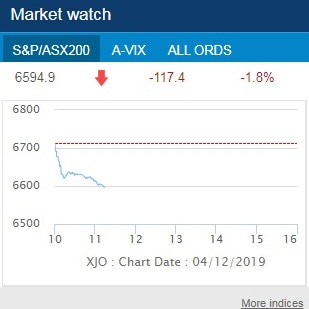

AUSTRALIAN STOCK MARKET

The ABS data comes as Australian shares plummeted after the global stock market dropped overnight following incendiary comments from US President Donald Trump.

In the first few minutes of the Australian Securities Exchange (ASX) opening online, the S&P/ASX200 dropped 1.2 per cent.

That is on top of the 2.2 per cent, or 6712.3 points, at closing time (4pm) on Tuesday.

Today’s figure is currently hovering between 1.1 and 1.8 per cent.

The international slump – knocking the Dow Jones Industrial Average more than 350 points under expectation – follows Trump’s doubts on the potential for a trade deal with China this year and proposing tariffs on $2.4 billion in French products.

The tariffs will affect tech giant products, including those from Google, Amazon and Facebook.

Since Trump’s comments in London – where he is attending a NATO summit – France’s CAC 40 fell 0.3 per cent to 5770, Britain’s FTSE 100 about one per cent to 7216, the US’s S&P 500 futures by 0.3 per cent to 3105 and, as of 12am AEDT today, Dow Jones Industrial Average by 0.4 per cent to 27,684.

OMG @realDonaldTrump is embarrassing us as he speaking on the world stage. Trump don’t know what the hell he’s doing, this trade war with China is making the stock market tumble. If our and the world economy crashes, it’s Trump’s fault. Please make him stop talking! #NATOSummit pic.twitter.com/aH31qYZbJb

— Angela Coleman (@angelatcoleman) December 3, 2019

The drop was expected to have a similar effect when Australian shares opened at 10am AEDT.

Trump’s threat comes after Monday comments on raising tariffs on Argentinian and Brazilian steel and aluminium.

Technology stocks, which have taken a major hit, are leading the loses.

This is because companies in the sector heavily rely on China for sales and supply chains, and it is reactive to changes in the trade dispute.

Apple has so far fallen 2.2 per cent and Intel 2.9 per cent.

Trump’s comments also follow the Australian share market dropping amid renewed fears over global trade uncertainty.

The benchmark S&P/ASX200 index dropped 1.72 per cent to 6744.6 points at 12pm on Tuesday. The broader All Ordinaries were also down 1.67 per cent to 6849.1 points.

Prior to this it had slumped two per cent.

Consumer staple and tech shares were also down the same time on Tuesday – dropping 2.73 per cent and 2.36 per cent respectively.

#ASXclose. Today the #ASX200 closed at 6712.3, down 150.0 points or 2.2%.

— ASX 🛠The heart of Australia's financial markets (@ASX) December 3, 2019

Coles dropped 3.39 per cent, Woolworths by 2.59 per cent and Metcash, IGA’s supplier, fell 1.19 per cent.

The WAAAX tech shares — WiseTech, Afterpay, Appen, Altium and Xero — also dropped between 2.23 per cent and 3.91 per cent.

Each sector in the Australian market lost at least 1.26 per cent overnight, with industrials the best performing segment of the day.

Telstra dropped 2.08 per cent, CSL by 1.25 per cent, BHP by 1.36 per cent, Rio Tinto by 0.81 per cent and Fortescue Metals by 1.35 per cent.

The big four banks – ANZ, Commonwealth, NAB and Westpac – were down 1.36 per cent, 1.88 per cent, 1.43 per cent and 1.02 per cent respectively.

NEW CAR SALES DOWN IN NOVEMBER

The latest data from the Federal Chamber of Automotive Industries shows a drop in the number of new cars being sold on Australian soil.

According to the peak industry body representing the manufacturers and importers of cars, November sales were down about 10 per cent, while the year-to-date market is down eight per cent.

Holden was the most affected, with sales being down 48 per cent.

More Australians bought Mercedes-Benzes than Holdens in November, while the once top-selling Commodore was outsold by the Chinese MG3 hatchback.

Federal Chamber of Automotive Industries head Tony Weber said it was “a tough market – full stop”.

The industry has been looking for a lift for some time now and has activated multiple levers to achieve some stimulation, including incentives, sales and special vehicle editions,” he said.

“However, the appetite for new vehicles remains suppressed.”

The sale of conventional sedans and hatchbacks were also down 20 per cent, and sales to private buyers were 25 per cent less than November last year.

RESULT OF TRUMP COMMENTS

At 6.45 AEDT the S&P500 Index – the stock market index measuring the stock performance of 500 US companies on stock exchange – was down 0.9 per cent.

The Dow Jones Industrial Average fell 1.2 per cent, the index was briefly down 457 points, and the NASDAQ Composite – a stock market index of common stocks and similar securities – fell 0.9 per cent.

The Russell 2000 Index – a small-cap stock market index of the bottom 2000 stocks in the Russell 3000 Index – was down 0.6 per cent, and the Asian and European markets fell as well.

Speaking to reporters in London on Tuesday, Trump said a trade deal with China potentially had to wait until after the US presidential election in November 2020.

Dear Trump haters and Dems,

— Tim Stewart (@timstewart185) December 3, 2019

If you’re so distraught and dissatisfied get @ me or DM me so you can forfeit all the gains n your 401k or stock market to a quality charity or shut the hell up and get over it. #Trump2020 #educatingliberals@realDonaldTrump

“I have no deadline, no,” he said.

“In some ways, I like the idea of waiting until after the election for the China deal. But they want to make a deal now, and we’ll see whether or not the deal’s going to be right; it’s got to be right.”

Bank stocks have also suffered loses as a result, with investors heading for the safety of bonds, pushing yields lower.

This is used by banks to charge more lucrative interest rates on mortgages and other loans.

As a result, the 10-year Treasury yield fell from 1.83 per cent late on Monday to 1.71 per cent.

The Bank of America and Citigroup also fell as well, to 2.3 per cent and 1.8 per cent respectively.

WHAT THE DROP FOLLOWS

The stock market slump follows the S&P500 having a strong month in November, with a 3.4 per cent gain since June.

This is a result of trade tensions cooling.

This month the S&P500 has dropped about two per cent – a figure just shy of the NASDAQ slipping 2.1 per cent.

WHERE HAVE THE COMMENTS COME FROM

Trumps comments followed as sources in Beijing and Washington saying while there has been progress, the countries were still wrangling over whether existing US tariffs would be removed and the number of Chinese purchases of US agricultural products as part of a “phase one” trade deal.

“The Chinese side must have such a requirement, because the Chinese side has promised more U.S. agricultural purchases. This is in a way, to some extent, a transaction,” a source told Reuters.

Originally published as Australian economy continues to grow, despite share drop overnight