VFF financial ‘mess’: Farmer lobby hits borrowing limit

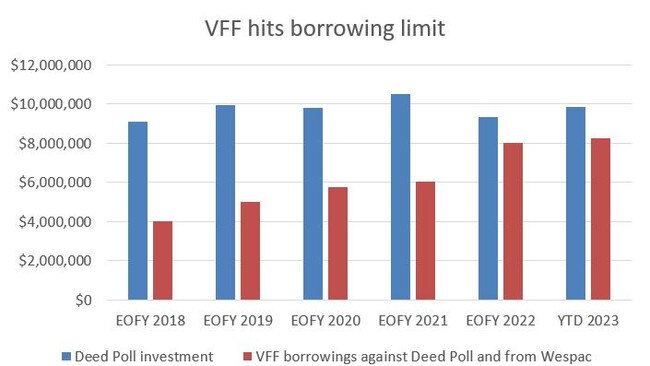

The Victorian Farmers Federation’s borrowings have more than doubled since 2018 to $8.2m today, posing a major liquidity risk.

Victorian Farmers Federation financials show the lobby group has maxed out its credit card, more than doubling its borrowings from $4 million in 2018 to the current $8.2 million.

A resolution and financials compiled by the VFF’s Risk, Audit and Finance Committee warned “the interest costs associated with the debt held by VFF against the CS (Credit Suisse) asset and Farrer House are increasing with interest rates.

“This cost is now a significant expenditure item for the VFF resulting in cash flow challenges that pose a liquidity risk in 2024 that may result in mandated liquidation of securities and property assets.”

The board passed a resolution in April to cash out the VFF Grain Group’s $9.8 million deed poll investment fund, so it could pay off $3.01 million it had borrowed from Credit Suisse and another $1.7 million towards $5.15 million it had borrowed from Westpac.

The VFF RAF Committee argued the fund was at risk, due to it being managed by Credit Suisse, which got into trouble earlier this year and was compulsorily bought out by the larger Swiss bank UBS.

But Grains Group members told The Weekly Times they instead wanted another fund manager appointed to oversee the deed poll, which helps fund their policy and advocacy work.

A VFF spokesman declined to comment when asked questions about its financials and why the board did not appoint another manager.

After reviewing financial information put together by the RAF Committee, former Grains Group president Andrew Weidemann said the VFF finances were a “mess”.

Mr Weidemann said “clearly there are some systemic issues the VFF has to deal with immediately”, and cashing out the deed poll and borrowing more money was “only masking the problem”.

“We’re only deferring the inevitable, when you look at the accounts and what’s happened over the past three years,” he said.

The VFF’s RAF Committee’s analysis shows the VFF’s borrowings have climbed from $5 million in 2019 to $8.24 million in April this year.

VFF members said they were concerned that even after cashing out the deed poll and paying off a large chunk of borrowings, the RAF Committee’s forward estimates showed it would have to continue borrowing money to survive.

The RAF Committee’s estimates show that after using the deed poll to pay down $8.24m in borrowings to $4.3m, the VFF will have to borrow another $1.85m in 2023-24, eventually lifting its borrowings to almost $7m by 2027-28.

The ongoing need to borrow money to survive is reflected in the VFF recording an operating deficit of $305,450 in 2021, which blew out to $927,757 last year.