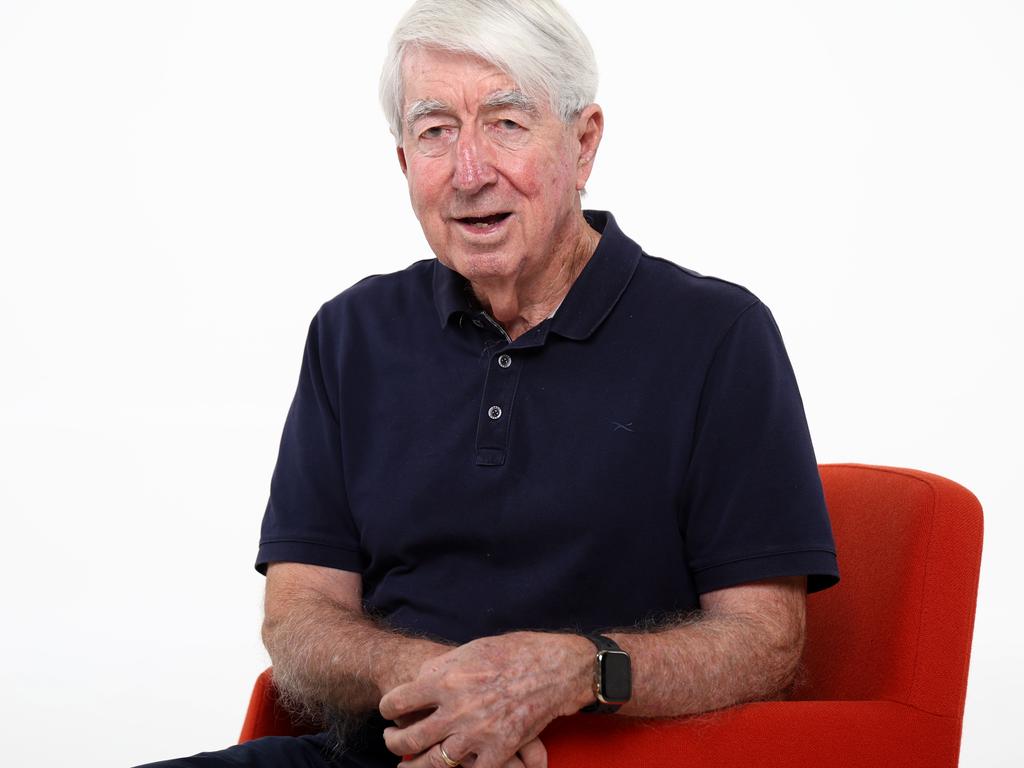

Noel Whittaker reveals 50 best tips to reach financial goals

Finance guru Noel Whittaker gives his top 50 tips to achieve your goals with 10 easy steps to follow for every age group. SEE THE FULL LIST

To celebrate half a century as a columnist, finance guru Noel Whittaker gives his top 50 tips to achieve your goals with 10 easy steps to follow for every age group.

See the full list below >>>

UNDER-21

Learning the ropes

What you learn now will lay the foundation for financial success in the future. At this

stage in your life, it is not the money that counts so much as the habit.

1. A part of all you earn is yours to keep

Follow this principle, and you’ll be ahead of 90% of people from day one.

Most people spend more than they earn and borrow to cover the shortfall – a fast track to financial stress.

The key to building wealth is to be the rare person who consistently saves and invests.

While the classic recommendation is to save 10% of your income, the exact amount isn’t as

important as the habit itself.

2. Get a job as soon as possible

Earning your own money gives you financial independence and teaches responsibility.

A job helps you develop essential life skills such as punctuality, discipline, and customer

service – qualities that will benefit you in any career.

Taking on a variety of part-time jobs can give you valuable experience and help you discover which fields interest you most.

3. Understand how money works

Money is earned by providing value. The better your skills and services, the more valuable

you become – and the more you can earn.

Focus on improving your knowledge and abilities through education, experience, and self-learning.

Seek out mentors, take on challenges, and never stop learning. Developing expertise in a high-demand field can significantly boost your earning potential.

4. Learn to set goals

Financial success doesn’t happen by accident. Set clear goals for what you want to

achieve – whether it’s saving for something special, starting a business, or investing.

Write down your goals, create a plan, and take action – clear goals give you direction, motivation, and a sense of purpose, making financial success far more attainable.

5. Don’t fall for Buy Now, Pay Later

Buy Now, Pay Later may seem convenient, but in reality, it’s just another form of debt.

When you use it, you’re borrowing to buy something because you don’t have the money

upfront.

This not only adds to your financial obligations but also reduces your future income

due to ongoing repayments. Over time, these small debts can snowball.

Instead of relying on short-term credit, develop the habit of saving first and spending later.

Delayed gratification is one of the key principles of financial success.

6. Know your enemies

Marketing, peer pressure, and impulse spending are all designed to separate you from your

money.

Companies use clever tactics to make you feel like you need something immediately – whether it’s the latest gadget, fashion trend, or subscription service.

Learn to recognise these sales strategies and avoid financial traps like high-interest loans,

unnecessary subscriptions, and impulse purchases.

Always ask yourself: Do I really need this? Will it add long-term value to my life?

7. Use a budget

A budget helps you control your money instead of letting it control you.

It gives you a clear picture of where your money is going and ensures that your spending aligns with your financial goals.

A budget doesn’t have to be complicated – even a simple spreadsheet or budgeting app can

help you monitor your finances.

By planning ahead, you can allocate funds for savings, investments, and essential expenses while also allowing some room for discretionary spending.

8. Start learning about investments

The earlier you start, the more you benefit from compound growth, where your money earns

returns that are reinvested to generate even more returns over time.

This is why starting young gives you a massive advantage – time is your biggest asset in investing.

Begin by understanding the basics – savings accounts, shares, property, and superannuation.

You don’t need to invest right away, but consider reading books, listening to finance podcasts, or following reputable investment experts to build your knowledge.

9. Take charge of your finances – don’t be swayed by the emotion of the moment

Creating a habit of thoughtful spending prevents wasteful purchases and keeps your finances

in better shape.

Learning to differentiate between needs and wants is essential for smart spending.

Needs are essentials like food, housing, and education, while wants are things you desire but can live without.

Before buying something, ask yourself if you really need it or if waiting a few days might change your mind.

10. Build a network of like-minded people

Your friends influence your financial habits.

Surround yourself with people who have good money sense and encourage smart financial choices.

Consider starting a ‘mastermind group’ where you and your friends share ideas, challenges, and tips on building wealth.

AGE 21 TO 34

Laying the foundations

Mistakes now can be costly. This is the time when you’ll likely form a lasting relationship, buy a home, and start a family. Each of these is a major life change — and all come with significant financial commitments.

1. Maximise your super’s growth

Your retirement balance depends on your fund’s returns after fees, tax, and insurance.

High-growth options outperform over time, yet many stick with conservative choices

out of habit. Review your super annually — small changes can mean big gains.

2. Protect your credit score

It’s easier to maintain a good credit rating than fix a bad one. Pay bills on time,

manage debt wisely, and avoid missed payments — lenders scrutinize your history. A

strong score means better loans and lower rates, while a poor one limits options and

raises costs.

3. Understand good debt and bad debt

Smart money managers borrow to invest in growth assets like property, benefiting

from long-term capital gains and tax-deductible interest. In contrast, poor money

managers take on debt at high interest rates with no tax deductibility to buy

depreciating assets like furniture or to fund holidays, which offer no lasting financial

value.

4. Understand your prospective life partners’ values

Major differences in money attitudes can strain a relationship. That’s why open

conversations before committing are essential. Financial incompatibility can cause

major conflicts and, if the relationship ends, assets may need to be split. Transparency

is key. Your partner should disclose their financial situation, including savings, debts,

and spending habits. A red flag is one person saving while the other accumulates debt

with no plan. Discuss financial priorities early.

5. Manage your money with a budget

Becoming wealthy depends more on how you manage your money than how much

you earn.

6. Set goals and stay on track

To be a financial winner, you need to set goals, follow the process, and stay on track.

Most successful people in every field are skilled at goal setting. Goals don’t just give you

focus — they keep you disciplined. If your goal is to save $50,000, staying focused on that

target will help you resist impulse purchases that offer no lasting value.

7. Make buying a home a major goal

There’s no doubt that buying a home can be challenging – but don’t give up.

In Ireland in 2000, property prices soared.

Many people, believing they had no chance of owning a home, splurged on brand-new Mercedes instead.

Then the market crashed, leaving them with second-hand cars and no house deposit.

Even if home ownership feels like a distant goal, commit to setting aside money from every pay. Invest it wisely with the long-term goal of using it as a house deposit.

8. Assess your net worth regularly

If you were lost, even the best map in the world would be useless if you didn’t know

where you were.

That’s why it’s essential to track your financial goals and prepare a statement of assets and liabilities at least every six months.

This helps ensure you’re on track.

A net worth statement also helps you refine your goals.

For example, if you have a home loan, reviewing your finances might prompt you to negotiate a lower interest rate.

9. Avoid credit cards

Too much credit card debt is the main reason people get into financial strife.

It’s a bit like an addictive drug – you start with a few small purchases, pay them off, and all

seems fine.

But then a bigger item tempts you.

Most credit card companies charge interest of more than 20 per cent if you don’t pay on time. Suddenly, you’re mortgaging future income to pay for past purchases.

These days, it’s hard to live without a card, but choose a debit card, which gives you access to your own funds — so you can never get into strife.

10. Become a money saver

Smart shopping and using available tools can significantly boost your financial success.

Planning purchases around Black Friday or Boxing Day sales can save you a fortune.

Apps like the 7-Eleven fuel app, which locks in fuel prices for seven days, are great for reducing everyday costs.

Bulk buying at stores like Costco can also lead to major savings.

Consider sharing large purchases with friends to take advantage of bulk discounts while keeping costs manageable.

Small, smart choices like these add up over time, helping you save without sacrificing.

35–50 YEARS

Navigating a Challenging Financial Period

At this age, you may have children and be juggling mortgage payments, school fees, and other education-related costs while trying to keep your head above water. Controlling cash flow is critical during this time.

1.Work to a budget

Budgeting has never been more important. You need to ensure funds are available for all the essentials mentioned above, as well as unexpected expenses that are bound to arise. Reviewing your budget regularly and identifying discretionary costs is vital. These could be as small as magazine subscriptions and streaming services, but they add up. It may also be worth considering making lunches at home instead of buying them at work.

2. Involve the family

When every dollar counts, it’s crucial that the entire family is on board and working towards the same financial goals. Holding regular family meetings — at least once a month — can make a huge difference. It’s amazing what resources can be discovered when everyone contributes ideas and support. Discussing household finances openly ensures that all family members understand the situation and can contribute in their own way.

3. Review your insurance regularly

If you have debts and dependants, adequate life insurance is essential.

If you need coverage, consider purchasing it through your super fund, where deductible contributions can make it a tax-effective strategy.

Income protection insurance, on the other hand, should be paid personally so you can claim it as a tax deduction.

Remember, insurance has a cost.

There’s no point in having unnecessary coverage – it can be just as bad as having inadequate insurance.

4. Be cautious with unsolicited financial offers

If someone contacts you with a “free” seminar, an investment opportunity, or a strategy to pay off your mortgage faster, ignore them.

Anyone who approaches you with a financial offer is doing so for their benefit, not yours. Good investments don’t require cold-calling or mass email campaigns.

One of the biggest red flags is when they encourage you to withdraw your super and transfer it into a self-managed fund, which they conveniently arrange for you.

5.Think about a Clayton’s budget

It’s too late to change the past, but you can reduce future stress with a simple budgeting strategy.

I call it the “Claytons Budget” – the budget you have when you aren’t having a budget.

List your fixed expenses including mortgage, loans, school fees, rates, insurance, and savings. Add them up and divide by your pay cycle (26 for fortnightly, 52 for weekly).

For example, if your annual total is $52,000 and you’re paid fortnightly, you’ll need $2,000 per pay.

Deposit that into a separate account solely for these expenses. Avoid dipping into it, and you’ll always have your fixed costs and savings covered.

6. Learn to love shares

Shares rise and fall, but over time, they outperform.

In 50 years, I’ve never seen a time without predictions of doom – yet markets keep growing. The truth is, no one can consistently and accurately predict investment markets.

Many people make financial decisions based on dire predictions, leading to inaction – waiting for a crisis that never comes. Investing in shares has the potential for high returns over time.

7. Be wary about buying an investment property

Many assume property is the next step after owning a home, but it can be costly.

To profit, you must buy undervalued property and add value, which is impossible with apartments.

Buying and selling costs are high, and finding anything under $600,000 is tough.

Over time, shares have outperformed property.

An index fund is a simpler, low-cost option with minimal fees, and you can start with just $1,000.

8. Keep your estate plans in order

Preparing a will and granting a power of attorney are essential tasks that many people delay until “the right time” – but it is too important to put off.

They should be properly prepared and stored in a place where family members can access them if needed.

This is particularly crucial if you are in a second relationship and have a spouse and children from a previous one.

Without clear legal instructions, disputes can arise, creating unnecessary stress and financial complications for your loved ones. Expert legal advice is essential to ensure your estate plan is legally sound and aligns with your wishes.

9. Create a safety buffer

Living pay to pay is stressful.

A financial buffer eases pressure and protects against unexpected expenses.

Pay loan repayments fortnightly to add an extra month’s worth each year.

Use an offset account to park spare funds and reduce mortgage costs Keep at least three months’ living expenses in a savings account.

This protects you from surprises like medical bills or job loss, keeping you off credit cards and loans.

10. Avoid credit cards

Credit cards can be a debt trap if not paid in full each month, with interest rates over 20% quickly adding up. If money was tight before, adding interest and debt only makes it worse. Build a safety buffer and use debit or savings accounts instead. If you must use a card, pay it off monthly to avoid extra costs.

51-67 YEARS

Protect your kids – save your retirement

Your retirement plans may be on track until an emergency strikes one of your children, and you’re called upon to help. The cost could run into the thousands. A smarter approach is to ensure your children and their partners have sufficient life, TPD, and income protection insurance.

1. Understand compounding

You can’t create more time, so the return your investments generate – after fees and taxes – directly affects how much you need to save and how long your portfolio will last. Seek the best returns suited to your goals and risk profile while staying vigilant about fees. Make Time Your ally.

2. Don’t rush to dip into your super

Staying in the workforce a little longer can make a huge difference. If you’re 60 with $500,000 in super, working until 65 could see it grow to $800,000 — without adding a cent. A little patience now can mean a far more comfortable retirement.

3. Watch out for Capital Gains

Adding your name to your child’s property title might help them secure a loan, but it can also trigger a hefty capital gains tax bill down the track. A better approach? Get advice beforehand to avoid costly mistakes — alternatives like acting as a guarantor could save you thousands.

4. Involve your partner in financial decisions

In many households, one partner manages the finances, even if major decisions are discussed jointly. This can create chaos if they become incapacitated or pass away. Both partners should be familiar with financial records, asset holdings, and essential passwords.

5. Get your own credit card

For couples, this means having your own account, not just a supplementary card on your partner’s account. Lenders assess eligibility based on taxable income, not assets, making it difficult to obtain a credit card after retirement.

6. Avoid the bank of mum and dad

Wanting to help your children is natural, but going guarantor can put your finances at risk. If you must, cap your guarantee – such as to a home’s value – and exit as soon as possible. Avoid business loan guarantees altogether – 80% of businesses fail within five years.

7. Regularly review your financial affairs

Life changes as markets fluctuate, new investment opportunities arise, and family situations evolve. Review your Will, powers of attorney, and portfolio at least annually with your advisers to ensure everything remains optimal.

8. Plan early on age pensions

Depending on your circumstances, it may be beneficial to give away assets before applying for a pension. Centrelink disregards any giveaways made more than five years before the application. However, your life expectancy may be longer than you think, and your expenses may be higher than anticipated. When the time comes to apply, keep in mind the process may take six months or more.

9. Eliminate debt before retirement

The last thing you want in retirement is mortgage repayments. Focus on paying off the mortgage as early as possible. One of the best ways to do this is by maximising tax-deductible super contributions, aiming to build sufficient funds to withdraw tax-free and clear the debt upon retirement. Mortgage payments come from after-tax dollars, while deductible super contributions come from pre-tax income.

10. Take advice on super strategies

The government is targeting large super balances with higher taxes. For couples, it may be better to have two more equal super balances rather than one partner holding most of the super. This is especially important if one partner is significantly younger. Super is not accessible until the member reaches preservation age (currently 67) unless they start a pension from their fund. By maximising super in the younger partner’s name, it may be possible for the older partner to qualify for a full or part age pension.

AGE 67+

Focus on key financial and estate planning considerations

1. Keep your will up to date, considering tax implications

Many people draft a will and then forget about it – ignoring changes in their assets,

beneficiaries, and financial circumstances. Not all assets are equal, and tax treatment varies.

Regularly reviewing your will ensures it reflects your current situation and maximises tax

efficiency. Consider whether a testamentary trust could benefit your heirs. Also, ensure your

executor understands their role and can easily access the will when needed.

2. Arrange Enduring Powers of Attorney and an Advance Health Directive

An Enduring Power of Attorney is essential to keep family affairs running smoothly if you

become incapacitated. An Advance Health Directive allows you to guide medical decisions in

your final stages of life. However, these documents are only useful if trusted family members

or friends can locate them quickly. Keeping them locked in a bank safe deposit box may

render them useless when needed most.

3. Understand the wide range of concessions available to seniors

This is a complex area, made even more complicated by the fact that concessions vary from

state to state. One little-known benefit is the Commonwealth Seniors Health Card (CSHC),

which is available to people of pensionable age who don’t receive the pension. There is no

assets test. A calculator for the CSHC is available on my website at www.noelwhittaker.com.au . There is also a comprehensive calculator on the National Seniors website – you may be amazed at what’s available.

4. Don’t spend unnecessarily just to maximise your Centrelink benefits

The assets test can be harsh, with every $100,000 in surplus assets currently reducing an

assets-tested pensioner’s income by $7,800 per year. While Centrelink does not assess money

spent on renovations or travel, consider the trade-off carefully. If you spend $100,000 to

increase your pension by $7,800 annually, it would take 13 years to break even — during

which time Centrelink rules may change.

5. Consider whether a Binding Death Benefit Nomination is right for your super fund

The trustee of your super fund determines who receives your superannuation benefits upon

your death. A Binding Death Benefit Nomination (BDBN) allows you to bypass the trustee

and direct where your super goes, but it may limit the flexibility of your executor to manage

your estate in the most tax-effective way. Seek specific advice before making a decision.

6. If considering a reverse mortgage, involve your family in the decision

Reverse mortgages typically require no repayments of principal or interest, meaning the debt

compounds over time, reducing the amount available for your estate. If a reverse mortgage

suits your circumstances, discuss it with your family so they understand the impact on their

potential inheritance. In some cases, your children may be able to cover the interest

payments, preventing the debt from growing.

7. If the age pension is a factor, take special care when drafting your will

Many couples make the mistake of leaving all their assets to each other, which can push the

surviving partner over the threshold for a single pension when one passes away. This can

result in the loss of the entire pension and associated benefits. A properly structured will can

help prevent this issue before it arises.

8. Take steps in advance to protect your will from being challenged

Challenges to wills are becoming increasingly common. If you anticipate potential disputes

over your will, seek advice sooner rather than later to ensure your estate is as secure as

possible. Strategies may include holding assets as joint tenants — where the survivor

automatically inherits the asset — or using investment bonds, which are often protected from

many will challenges.

9. Do extensive research on your downsizing options

Many seniors downsize to a cheaper residence for convenience and to free up capital tied up

in their existing family home. There is a range of options available, and moving can entail

considerable expense while also impacting the age pension. Take advice so you understand

what you will have left to spend once the move has been made.

Furthermore, a major factor in a happy retirement is a good social network. Make sure this

will be available in the property you choose. For many people, a retirement village is a great

option because of the built-in social network and planned activities.

10. Check out the aged care situation well in advance

If entry into aged care is likely within a year or so, do all your research and complete the

necessary forms sooner rather than later. There can be long waiting lists in this area, and they

are growing.

Originally published as Noel Whittaker reveals 50 best tips to reach financial goals