Renewable crash: Wind and solar subsidy scheme collapses

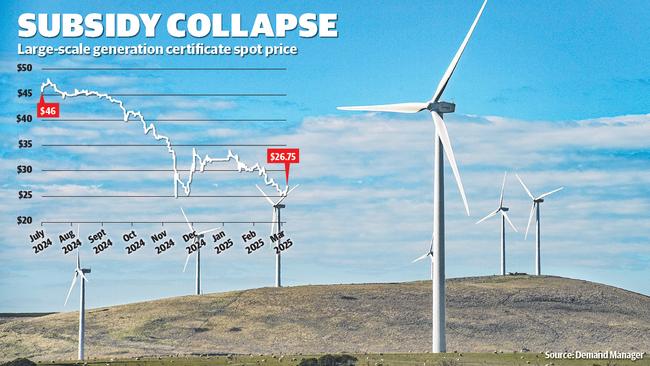

Wind and solar developers face a 40 per cent slump in the price of certificates that subsidise their operations.

The value of large-scale generation certificates that subsidise wind and solar developers has collapsed, from $46 in October last year to just $26 today.

Until now, corporate wind and solar developers have been able to earn about a third of their income from selling the certificates to electricity retailers, under a mandated target.

The federal government forced retailers to buy 33 million LGCs last year alone, the cost of which retailers recovered from their household, businesses and industrial customers, adding about $1.6bn to Australians’ power bills.

But brokers said the market was in decline, as the government prepares to sunset the LGC scheme in 2030, replacing it with a voluntary Renewable Energy Guarantee of Origin Scheme that will be phased in from the end of this year.

During his second reading speech on the Guarantee of Origin Bill last year, Assistant Minister for Climate Change and Energy Josh Wilson said the legislation enabled “certificate demand and value to be market driven by voluntary purchases”.

But brokers warned the voluntary REGO could not replace an LGC market based on a mandated target.

In analysing the REGO scheme, Allens law firm reported that in the absence of a mandatory market “it is not immediately clear what the market for REGO certificates will be”.

“The government’s view, expressed in the explanatory memorandum for the GO Bill, is that the REGO certificate market will be driven by the demand of corporates to acquire green certificates in order to voluntarily surrender them in pursuit of sustainability goals and commitments.

“The value of REGO certificates remains to be seen, and could be driven by a range of factors. For example, we could see a relative decline in the value of REGO certificates compared to LGCs, given the absence of any mandatory surrender regime or, alternatively, a drop in LGC prices as the voluntary market moves to REGO certificates.”

Energy brokers said that while corporates were already voluntarily buying LGCs to improve their green credentials, the market was small at around seven million certificates, compared to the mandated trade to meet a target of 33m.

Allens also raised concerns on the impact of the government’s plans to expand the eligibility of generators who can create REGO certificates, further increasing supply, such as hydro-electricity plants built before 1997, offshore wind farms in international waters and rooftop solar and battery systems.

The Clean Energy Council failed to respond to questions on the impact of the REGO.