Budget Direct refuses to pay out on loss of Robina couple’s stolen car

A Gold Coast couple who had their car stolen from their garage while they slept have been dealt another blow, with their insurance company refusing to pay out on the vehicle. Here’s why their claim was denied.

A Gold Coast couple whose home was broken into and car stolen from their garage in a late night robbery is almost $40,000 out of pocket after their insurer refused to pay up.

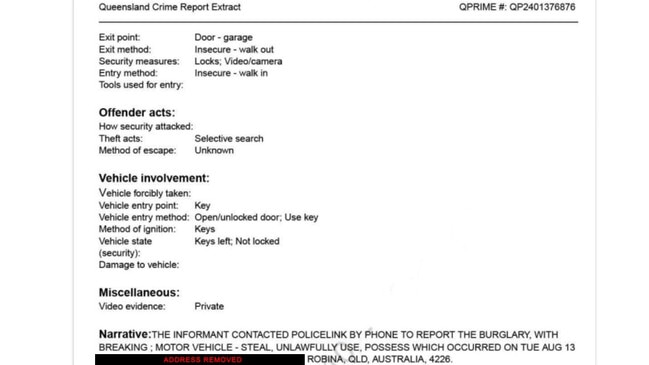

Guy and Nadine Broadbent were fast asleep on Tuesday, August 13, when thieves used tools to pry open a side gate and laundry door, gaining entry to their Robina home.

“We had no idea they’d been and gone,” Mr Broadbent said.

“The car was secured in the garage. They’ve gone through our home, into the garage, lifted up the roller door and taken off in the car.”

It wasn’t until Mr Broadbent went to leave for work at 4am the next morning that he found his brand new 2023 Kia Seltos Sport sedan had been taken. He immediately reported the incident to police.

“I feel silly for being honest with them (police) but I’m an honest person and do the right thing ,” Mr Broadbent said.

“I told them the car was locked up in the garage and the key was in the centre console. We got broken into and they’ve driven away with it.”

The stolen car was never recovered.

The Broadbents lodged a claim with insurer Budget Direct (Auto General Services) the following day.

A few weeks later they received a letter from the company advising them the theft of the Kia would not be covered. Although the car had been stolen from their locked garage, the fact the key was in the centre console was a deal breaker.

“After careful consideration we advise that we are unable to accept your claim,” the letter said.

“During the lodgement of your claim, we were advised that Mr Guy Broadbent had left your main key inside the vehicle. This information was also confirmed within the police report.”

In determining the claim Budget Direct said the couple had not complied with the conditions set out on page 16 of the policy Product Disclosure Statement.

“You must ensure that you or the person in charge or control of the car, lock the car, activate any required security devices, and keep all keys, remote locking devices or proximity keys safe and secure,” the letter states.

“This includes, but is not limited to, ensuring all keys, remote locking devices or proximity keys are not left in the car.”

The Broadbents appealed the decision by their insurer and argued that the vehicle was still secured in the garage inside their home and was not left unattended when it was stolen during the burglary. Budget Direct, in rejecting the appeal said: “Whilst we recognise that leaving the key in the car may have been unintentional, leaving the key in the car while unattended for any period of time breaches the policy conditions. We also appreciate that you may not agree with the exclusion applied to our policy, however insurance is not designed to cover every eventuality.”

A further appeal by the Broadbents to the Australian Financial Complaints Authority was also unsuccessful.

“At the end of the day, this is theft regardless of where my keys were,” Mr Broadbent said.

“Our car was in our home, not parked in the driveway or on the street. They state that the keys were left in the car whilst unattended. I don’t understand how a car parked in someone’s garage can be considered unattended.

“It is no different to them (thieves) breaking into the house, grabbing the car keys off the bench or out of a hand bag and stealing it.”

A spokesman for Budget Direct told the Bulletin “privacy considerations” prevented it from commenting on the Broadbents’ insurance claim.

“However, we note that to help keep insurance affordable for as many customers as possible we believe it’s reasonable to expect customers to take appropriate steps to prevent or at least not contribute to their cars being stolen,” the spokesman said.

“We are very clear in our PDS that if you leave your car unattended, for any period of time, you must always lock it and not leave the keys in or on the car. Our advice regardless of what insurer you are with, please always read your PDS before taking out cover.“

More Coverage

Originally published as Budget Direct refuses to pay out on loss of Robina couple’s stolen car