Victorian postcodes most in the red revealed as credit card debt climbs $500 million

A man who racked up $6000 in debt is one of many Aussies in the red as credit card debt skyrockets by $500 million in Australia. See the worst-hit areas in Victoria.

EXCLUSIVE: Debt-laden Aussies are turning to plastic more than ever before, with new figures showing an increased reliance on credit cards, buy now pay later schemes and payday loans.

New data from digital financial advice platform Otivo, has revealed the nation’s top postcodes for eye-watering levels of debt — and much of it is ‘bad debt’, defined as high-interest borrowing for non-essential spending.

In Victoria, Selby tops the state and is one of the highest in the country for credit card debt, owing on average $54,000 per household.

Port Melbourne has one of the highest Buy Now, Pay Later (BNPL) debts, owing on average $16,900 per household, while those in Kallista owe $14,700.

Investors are also carrying significant mortgage debt. Households in Ashburton have the biggest investment property loans in the state, with an average debt of $658,000.

AUSSIE CREDIT CARD DEBT CLIMBS $500 MILLION

Nationally, Otivo’s report shows the Vaucluse and Watsons Bay postcode, home to Sydney’s well-heeled, tops the list with the highest amount of ‘good debt’, with the average household owing more than $4.9 million, mostly on mortgages.

Home loans, property investments and education loans are seen as ‘good debt’ because it builds long-term value.

It comes as the latest Reserve Bank of Australia figures reveal that the total amount of Aussie credit card debt climbed $500 million to $41.7 billion, up from $41.2b this time last year.

Of that, the amount of debt accruing interest is almost $20 billion ($19.8b), up from $17.7b this time last year.

Debt management service Debt Angles Solutions has noticed a huge surge in short term lending options, including BNPL, with its clients.

“Between 2023 and 2025, the number of BNPL debt accounts we are managing increased by 50 per cent,” Debt Angels CEO and founder Kitty Thomas said.

“Credit cards make up 40 per cent per cent of all debt accounts we manage — a 19 per cent increase over just two years. This reflects not only increased usage but also how deeply embedded revolving credit has become in managing daily life expenses.

“One of the biggest issues we’re now seeing is debt stacking. The way BNPL and payday loans have evolved is creating a dangerous debt cycle. People are taking out payday loans — then more payday loans — to cover the repayments on their existing payday loans.”

Otivo CEO and founder Paul Feeney said “debt is coming to rather high levels” and blamed it on the cost of living.

“Australians are struggling and unfortunately, for a lot of people, it involves taking out some debt,” Mr Feeney said.

“Debt doesn’t discriminate. Whether you live in a beachfront mansion or a regional town, Australians everywhere are under pressure, and many are doing it alone without licensed financial advice.”

He said people tended to hit financial stress when their unsecured debt crept above 10 to 15 per cent of their annual income. According to Otivo’s data, the national average credit card debt is $7459.

Mr Feeney advises people who are struggling with soaring debt to really reflect on the expenses they could live without to try and find $50 of savings in the first month, then up that to $100 the second month, explaining that before too long they would have $500 to start paying down that debt.

He said people with $50,000 of debt against a high interest credit card at 20 per cent could be paying $10,000 a year in interest alone.

“That’s money that’s got going towards your future, it’s just servicing the past,” Mr Feeney said, suggesting some people may benefit from consolidating their credit cards debts into one no or low interest card or a lower interest personal loan.

‘WAKE-UP CALL’: SYDNEY MAN RACKS UP $6K DEBT

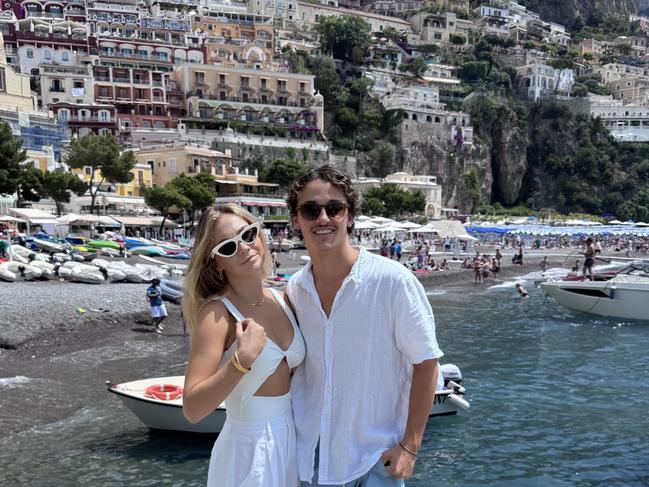

For Ben Cheshire, 20, from Sydney’s northern beaches, his debt snowballed after he booked a “trip of a lifetime” to Europe and then one week later was in a minor car crash, where he had to fork out money for repairs.

He said he put the flight costs and repair expenses, totalling above $6000, on a credit card but did not understand the ramifications for not paying that off in the interest free period – and so his debt grew.

He said there were a few sleepless nights where he would lay awake worrying about how he could pay it off.

“I was earning enough to be comfortable by not enough to fund expected costs, so I picked up two other jobs (to pay it off),” he said,

“It gave me a real wake-up call though. It gave me a real insight into what I need to do financially to now plan (for future unexpected costs) and saving is actually a necessity to life.”

More Coverage

Originally published as Victorian postcodes most in the red revealed as credit card debt climbs $500 million