Meet the international billionaires who are spending big in the Australian bush

The world’s richest business figures are involved in a multi-billion dollar buy up of Australia's landmark farms.

They are the billionaires of the bush.

The top-end-of-town men and women known more for their boardroom acumen, who are forging a very large stake in our prime agriculture real estate.

And they are not all Australian.

An investigation into farm ownership in Australia can reveal some of the world’s richest business figures – from the high-rise offices of New York, Hong Kong, London and Shanghai – are digging deep into the pockets of their tailor-made suits to participate in a multi-billion dollar buy up of some of our most iconic properties.

Fifteen of the richest investors have a combined wealth of more than A$185 billion. Leading the charge is Hong Kong’s richest person, the 92-year-old Sir Li Ka-shing (net worth: $A44.82 billion), whose CK Life Sciences company has about $1 billion invested in Australian farmland, from vineyards to grain properties and berry farms.

Other major foreign investors with significant Aussie farmland assets include US hedge-fund billionaire Ray Dalio (net worth: $A26.22 billion), UK billionaire currency trader and Tottenham Hotspur Premier League team owner Joe Lewis (net worth: $A6.46 billion) and UK-based Australian financier Sir Michael Hintze (net worth: $A2.97 billion).

Closer to home, Australian billionaires getting dust on their boots through farmland acquisitions include mining magnates Gina Rinehart (net worth: $A30.87 billion) and Andrew ‘Twiggy’ Forrest (net worth: $A26.22 billion), as well as Seven Network chairman Kerry Stokes (net worth: $A5.42 billion). Ms Rinehart owns more than 10 million hectares of cattle stations and farms – valued at about $1 billion – while Mr Forrest’s rural property portfolio exceeds 1.5 million hectares.

Victorian farmer and Grain Growers Association chairman Brett Hosking said the top-end-of-town investing in Australian farmland was a case of “smart business people making smart business decisions”.

“It does seem to be a safe investment and we are seeing a real upturn in land values reflecting that,” Mr Hosking said. “Anyone that has bought land in the past 10 years would say would look back on it and say it was a pretty good decision. And looking ahead there is lot of positivity in (farm produce) commodity prices, which are tracking strong, and there’s no indication of major hurdles ahead.”

BILLIONAIRES OF THE BUSH – GLOBAL RICH LISTERS WITH SIGNIFICANT INVESTMENTS IN AUSTRALIAN FARMLAND

1. SIR LI KA-SHING

COUNTRY: HONG KONG

NET WORTH: $A44.8 BILLION (forbes.com)

Backer of the Hong Kong-listed CK Life Sciences company, which is involved in nutraceuticals and pharmaceuticals and has about $1 billion invested in Australian agriculture, and is one of the nation’s biggest vineyards owners. It also has citrus and grape growing properties in Victoria’s Sunraysia region as well as grain, cotton, mango and berry investments.

2. GINA RINEHART

COUNTRY: AUSTRALIA

NET WORTH: $A30.87 BILLION (forbes.com)

Mining magnate and one of Australia’s richest persons, Gina Rinehart is at the helm of one of Australia’s biggest pastoral empires, overseeing about 10 million hectares of land with the capacity to run more than 340,000 cattle and assets valued at $1 billion. Rinehart is looking to offload 1.9 million hectares, having this year listed for sale seven cattle stations and a feedlot in the Northern Territory and Western Australia.

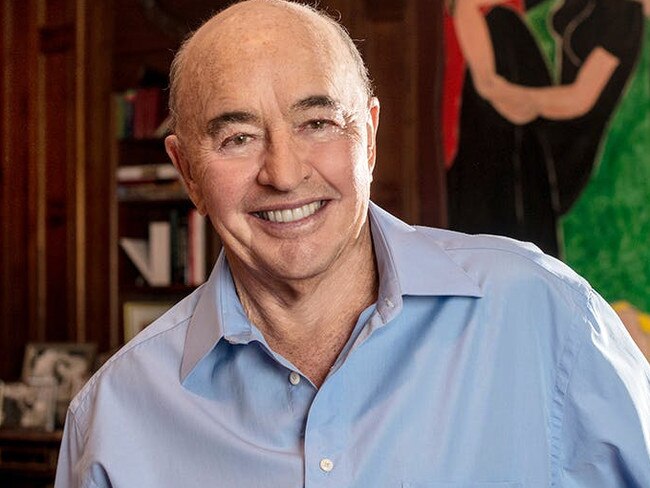

3. RAY DALIO

COUNTRY: UNITED STATES

NET WORTH: $A26.22 BILLION (forbes.com)

US hedge-fund billionaire Ray Dalio is the founder and co-chairman of Bridgewater Associates which has grown into one of the most successful private companies in the US. Dalio, who has appeared on the list of Times 100 most-influential people, is a shareholder in Australian Food and Agriculture, which owns 225,405 hectares of land around Coonamble, Deniliquin and Hay in NSW.

4. ANDREW ‘TWIGGY’ FORREST

COUNTRY: AUSTRALIA

NET WORTH: $A26.22 BILLION (forbes.com)

Australian mining magnate Andrew ‘Twiggy’ Forrest – the former chief executive and current non-executive chairman of Fortescue Metals Group – operates a beef cattle business across about 1.5 million hectares of Western Australia. His holdings include Minderoo Station – the Pilbara property on which he grew up but was later sold by his family, and which he bought back in 2009.

5. HANS RAUSING (DEC.) FAMILY

COUNTRY: UNITED KINGDOM/SWEDEN

NET WORTH: $A15.5 BILLION (forbes.com – 2019)

The British-based Swedish Rausing family – which owns the multinational Tetra Pak food processing and packaging company – is a major investor in Australian farmland through its Ingleby Farms and Forests business. It has 11 farms in Australia covering more than 21,000 hectares of Tasmania, Western Australia and Victoria, including the 4770-hectare Mt Elephant Station in the Western District, formerly owned by the Baillieu family.

6. HUI WING MAU

COUNTRY: CHINA/AUSTRALIA

NET WORTH: $A12.92 BILLION (forbes.com)

Chinese-born Hui Wing Mau – the founder and chairman of Shimao Property – paid $70 million in 2017 for West Australian cattle stations Bulka, Margaret River and Yougawalla, covering a combined 1.3 million hectares in the Kimberley. The same year he paid $120 million for a majority share in the NSW Bindaree Beef feedlot, processing and marketing business.

7. JOE LEWIS

COUNTRY: UNITED KINGDOM

NET WORTH: $A6.46 BILLION (forbes.com)

UK billionaire currency trader Joe Lewis’ Tavistock Group, which owns the Tottenham Hotspur Premier League team, is a more-than-40 per cent shareholder in Australian Agricultural Company. Founded in 1824, AACo occupies 6.4 million hectares of land in Queensland and the Northern Territory running 400,000 cattle.

8. KERRY STOKES

COUNTRY: AUSTRALIA

NET WORTH: $A5.42 BILLION (forbes.com)

Seven Network boss Kerry Stokes has put an impressive agricultural portfolio together over the years. In 2016 he paid more than $20 million for Mt House Station at Halls Creek in Western Australia’s Kimberley Region, a year after purchasing Napier Downs Station at Derby. In 2017 he added Leopold and Fairfield stations to his WA portfolio and in 2019 sold properties on South Australia’s Kangaroo Island for about $25 million.

9. FENG HAILIANG

COUNTRY: CHINA

NET WORTH: $A4.65 BILLION (forbes.com)

Feng Hailiang chairs the Hailiang Group, one of China’s top 500 companies, which is based in Zhejiang and has business in the copper smelting, real estate and education sectors. In 2015, Hailiang paid $40 million for the 50,000-hectare Hollymount Station and Mt Driven properties near St George in Queensland.

10. SIR MICHAEL HINTZE

COUNTRY: UNITED KINGDOM

NET WORTH: $A2.97 BILLION (forbes.com)

The Sydney-raised, UK-based billionaire Sir Michael Hintze has been a major investor in Australian farmland since 2007. His MH Premium Farms business now operates across more than 70,000 hectares and 41 properties in NSW, Queensland and Victoria. It paid $36 million for prized Victorian Western District holding, Minjah at Hawkesdale, this year.

11. BRETT BLUNDY

COUNTRY: BAHAMAS/AUSTRALIA

NET WORTH: $A2.71 BILLION (forbes.com)

The beef division of Australian-born retail king Brett Blundy’s private investment company owns 2.43 million hectares across four cattle stations in the Northern Territory. The biggest property in the portfolio is the one million-hectare Walhallow and Cresswell Downs aggregation, which Blundy purchased in 2015 for $100 million.

12. PERICH FAMILY

COUNTRY: AUSTRALIA

NET WORTH: $A2.26 billion (forbes.com – January 2019)

Best known as property developers, the Perich family are keen investors in the Australian dairy industry. They are partners in Australian Fresh Milk Holdings, whose farming assets include the $100 million Moxey Farms at Gooloogong in NSW, and run Leppington Pastoral Company which milks about 2000 cows on farms at Bringelly and Wilberforce in NSW.

13. URS SCHWARZENBACH

COUNTRY: UK/SWITZERLAND

NET WORTH: $A1.8 BILLION (Sunday Times – May 2020)

UK-based Swiss financier Urs Schwarzenbach has farming interests in Australia through his

Romani Pastoral Company. His properties include the 13,700-hectare Windy Station at Quirindi NSW, which he purchased for $19 million in 1996, as well as Mandeville at nearby Premer, and in southern NSW, Brawlin Springs and Garangula at Cootamundra and Harden.

14. LI FUCHENG

COUNTRY: CHINA

NET WORTH: $A1.42 BILLION (forbes.com – March 2017)

Li Fucheng, the chairman of Chinese automotive interior company the Fucheng Group, has bought up big. In 2015, he purchased the 2177-hectare Eilan Donan and Breadalbane properties at Sutton Grange in Victoria and the 31,000-hectare Woodlands at Roma in Queensland. He has since added farms around Melton, on Melbourne’s outskirts, including the 5000-hectare Woodhouse Station, which he paid $100 million for in 2016.

15. ISARA VONGKUSOLKIT

COUNTRY: THAILAND

NET WORTH: $A1.29 BILLION (forbes.com – April 2020)

Thailand’s Vongkusolkit family owns the Mitr Phol company, which is one of the biggest sugar producers in the world. In 2012 it purchased a stake in the Australian sugar producer, MSF Sugar Limited, which owns about 13,700 hectares of land around Gordonvale and Maryborough in Queensland.

OTHERS

PASPALEY FAMILY – AUSTRALIA

NET WORTH: $A1.06 BILLION (NT News – 2021)

The well-known Paspaley pearling family runs prime lambs, cattle, Merinos and one of Australia’s oldest Poll Hereford studs across more than 140,000 hectares in NSW and the Northern Territory.

PRITCHARD-GORDON FAMILY – UNITED KINGDOM

The billionaire family of the late Giles W. Pritchard-Gordon, who made his fortune in shipbuilding and farming in the UK, own the 14,876-hectare Tubbo Station at Darlington Point in NSW which is on the market for $40 million-plus.

PUI NGAI WU – CHINA

Billionaire Pui Ngai Wu heads up Shanghai Zhongfu – one of Shanghai’s largest private real-estate investors – which has invested heavily in the Ord River region of Western Australia. It also purchased the 475,745-hectare Carlton Hill Station at Kununurra in 2016, which is leased back to Consolidated Pastoral Company.

XINGFA MA – CHINA

Chinese billionaire Xingfa Ma runs TBG Agri Holdings, the Australian arm of his Tianma Bearings Group. TBG has been a big investor in Western Australia in recent years with its portfolio including the 639,500-hectare Balfour Downs Station at Roy Hill, for which it paid $18 million in 2014, and the 8000-hectare Emu Downs Station at Cervantes.