Home ownership up to 13 times harder than in 1975, as landmark report reveals wage–price blowout

Home ownership in Australia is at its lowest point in 50 years, with a landmark report revealing a widening gap between wages and property prices that’s locking out a generation. Have your say

EXCLUSIVE

Owning a home is now three times harder than it was 50 years ago, with the most comprehensive report this century revealing the widening gap between wages and property prices that has locked a generation of Australians out of the housing market.

The Australian Property Institute’s (API) Valuation Report, released Tuesday, shows that in 1975, Sydney homebuyers needed just 4.2 times the average annual income to purchase a home. By 2024, that figure had soared to 13 times.

Melbourne’s ratio more than doubled from 3.5 to 8.4, while Brisbane’s nearly tripled from 2.9 to 8.3. Nationally, the income-to-house-price ratio jumped from 3.4 to 8.1.

Smaller capitals have seen the sharpest price growth over the past 20 years. Adelaide house prices rose 175 per cent, ahead of Hobart (172 per cent), Sydney (171 per cent), Brisbane and Melbourne (169 per cent), Canberra (148 per cent), and Darwin (102 per cent) — far outpacing the 67 per cent rise in inflation.

“Looking at the data, housing affordability is now at a 50-year low, driven by incomes failing to grow above inflation and a corresponding shortage of new homes being built,” API CEO Amelia Hodge said.

“What this means is that young people today need 13 times their annual salary to pay off an average priced home.

“In comparison, their parents only needed four times annual salaries in the mid-1990s and their grandparents only needed 3.4 times in the 1970s.”

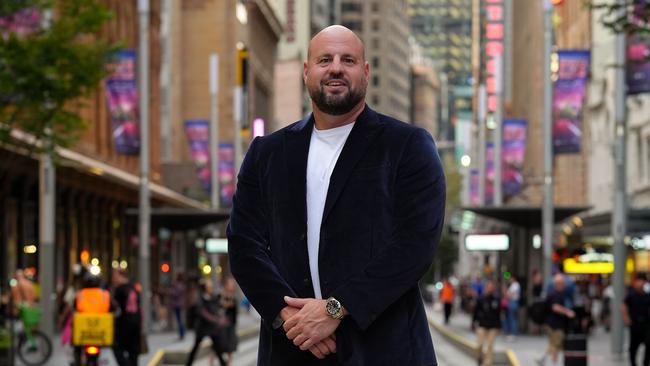

AMP Chief Economist Shane Oliver said the worsening gap between wages and property prices has dramatically extended the time it takes to enter the market, placing an unprecedented burden on younger generations

Mr Oliver said existing government support schemes offer limited relief and called for structural reform, including increasing housing supply and easing development restrictions. He also recommended “rentvesting” — buying a rental property while living elsewhere — as a viable strategy.

“This is grossly unfair and is not something baby boomers and Gen X had to put up with,” he said.

“Government schemes like the low deposit guarantee and stamp duty concessions for first home buyers can help.

“But the benefit usually turns into a mirage as they just push up house prices even further unless you get in really early when those schemes are first offered.”

Mr Oliver said the only real solution is to boost housing supply relative to demand.

“This means releasing land quicker, approving new properties faster, reducing regulatory constraints on developers, training more home builders and restricting immigration for a while until supply catches up with demand,” he said.

“Longer term we should be thinking about more decentralisation away from our big cities to regional centres – and this means encouraging more work from home and improving transport infrastructure from the cities to the regions.”

UNSW Professor of Housing Research and Policy Hal Pawson agreed that affordability barriers remain steep for those without family support.

“Most potential first home buyers lacking access to the bank of mum and dad are up against it in most parts of Australia,” he said.

He said that while the First Home Guarantee helps lower the deposit hurdle, it “doesn’t reduce the size of the mortgage you need.”

Professor Pawson also said that buying in more affordable markets while renting in major cities can be a practical alternative.

“For as long as the current private landlord tax breaks remain available, investing in property in a more affordable state while renting in a major city remains an appealing option, at least for residents of the most expensive cities such as Sydney,” he said.

“But the financial pay-off from holding rental property is substantially dependent on retaining ownership for a long period.”

Mr Oliver pointed to job concentration and “development constraints around those cities limiting the supply of new homes” as key drivers of price hikes in Sydney, Melbourne, and Brisbane.

He said that regional property is “about 25 per cent cheaper,” particularly in South Australia and Tasmania, though “that all depends on job prospects.”

“At present it looks a bit bleak as the risk is that housing will become even more expensive relative to wages,” he said, adding that governments must meet their target of building 1.2 million homes by 2029.

The report also found farming, not housing, saw the strongest growth among property asset classes over the past two decades.

Agricultural land values surged 256 per cent, driven by strong commodity prices, favourable weather, and low interest rates.

In comparison, housing rose 154 per cent, industrial property 164 per cent, and commercial property 143 per cent.

With capital cities becoming less accessible, many buyers are turning to regional areas.

“Places like the Sunshine Coast, Hervey Bay, and other parts of Queensland are absolutely taking off,” PRPTY 360 founder Julian Fandini said.

“They’ve got billions flowing in for new infrastructure, jobs popping up everywhere, and the kind of lifestyle that city folks are increasingly craving.”

“While the big cities will always be economic powerhouses, the real opportunities are in spotting those next boom regions.”

Between April 2024 and April 2025, house prices jumped from $871,671 to $918,296, according to Ray White senior data analyst Atom Go Tian.

In the last 12 months Perth house prices made the biggest gains in the country, surging by

$95,022 from $812,482 to $907,504.

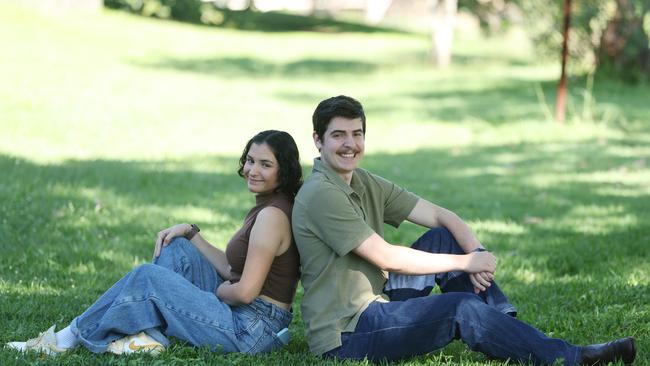

For Queenslander Levi Parker, home ownership feels increasingly unattainable.

Levi, who’s been renting with his partner Janelle in Brisbane for the past five years, said it had been “quite difficult” trying to save for a deposit and pay rent at the same time.

The 23-year-old saw a mortgage broker in January to inquire about purchasing his first home but was told he did not have enough for a deposit.

He said that conversation left him feeling “disappointed”, especially having tried hard to save over the last few years and “being on a double income and (still) not having enough for a deposit”.

More Coverage

Originally published as Home ownership up to 13 times harder than in 1975, as landmark report reveals wage–price blowout