Fuel prices: How much is petrol post-fuel excise cut?

Diesel and petrol prices continue to put pressure on household incomes, despite more than a month of fuel excise cuts.

More than a month after the Federal Government announced a cut to the fuel excise in a bid to reduce petrol prices for motorists, fuel prices are still sitting at almost $2 a litre in some parts of Australia.

One industry body has slammed the excise cut, claiming it does nothing to address long-term tax issues for motorists.

According to RACV fuel data, Ampol Foodary on the Maroondah Highway was selling unleaded fuel between 191.4-196.4c/lt today, while Ampol Tallarook off the Hume Highway was selling fuel for 186.4-191.4c/lt.

Some of the state’s cheapest unleaded fuel can be found in Shepparton at the Caltex on Benalla Rd for less than 171.4c/lt.

Coles Express Wangaratta sold diesel for 214.5-291.5c/lt, with the same price posted for diesel at Piangil Caltext on the Victoria-NSW border.

Some of the state’s cheapest diesel can be found at BP Hamilton for less than 171.4c/lt, or at the BP Warragul on Brandy Creek road for less than 171.4c/lt.

Before the fuel excise was announced, effective March 30 this year, petrol prices surged beyond 220c/litre, with RACV putting the average price at 193.7c/lt.

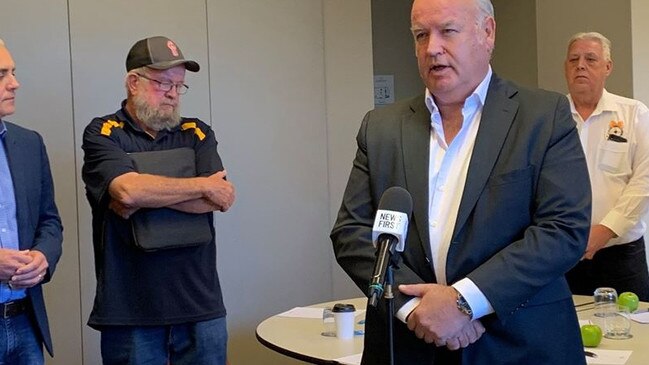

Victorian Transport Association chief executive Peter Anderson said rising diesel costs would result in a reduction in the discretionary income of motorists, as they accommodate a higher fuel bill.

“It gets even worse for freight operators who get no relief from the fuel excise reduction, and therefore have no capacity to reduce transport costs for customers and consumers,” Mr Anderson said.

Mr Anderson said if diesel prices continued to increase, transport costs could remain the same or potentially rise even further.

“When the excise was halved, freight customers expected that saving to be passed on, because they didn’t understand transport operators didn’t qualify for the full saving,” Mr Anderson said.

“Prices of food, clothing, medicine and other goods will not reduce one bit, and will continue to rise as the impact of higher inflation and now higher interest rates flow through the supply chain, which includes primary producers.”

The diesel fuel rebate is “critical” for operators to keep transport costs as low as possible, Mr Anderson said, “bearing in mind freight margins are already wafer thin and labour costs are higher because of driver shortages”.

According to data provided by the Australian Taxation Office, fuel tax credits for heavy vehicles for travelling on public roads was 17.8c/lt for liquid fuels between February and March this year, up on the 16.9c/lt from August last year to January 21 this year.

“The biggest loser of steady or rising transport costs are consumers,” Mr Anderson said.

“After wages, fuel is the second biggest direct expense for transport companies, accounting for around a third of costs.

“The risk of freight companies going under because of higher operating costs and cash flow pressures is real, which is why they must resist absorbing higher fuel and labour costs.

Australian Automobile Association managing director Michael Bradley said the Federal budget’s temporary halving of the fuel excise “doesn’t address long-term motoring tax issues and means $3.3 billion of foregone revenue is no longer available to be spent on vital safety upgrades of our transport network”.

“Instead of tinkering with fuel excise, the AAA encourages both major parties to outline their plans for long-term motoring tax reform,” Mr Bradley said.