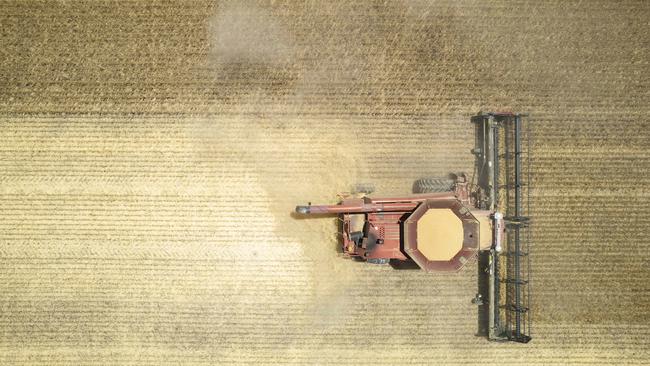

Foreign investment in Australian farms plummets

Historically foreign investors spend between $7 billion and $8.5 billion on new farming investments in Australia. That changed in 2023-24, with that figure dropping 34 per cent.

Foreign investment in Australian farmland has plummeted to its lowest level in almost a decade.

The Treasury’s latest annual report shows the value of approved investment proposals for the agriculture, forestry and fisheries sector was $5.3 billion in 2023-24 – a 34 per cent drop on the previous year.

It comes amid revelations the federal government’s registers of foreign-owned agricultural land and water are now more than two years out of date, leaving farmers and investors with an incomplete picture of who owns Australian farms.

Aside from 2020-21 during the height of the pandemic, Foreign Investment Review Board approvals for agricultural investments have been valued between $7bn and $8.5bn since 2016-17.

The sudden dip is alarming, with National Farmers’ Federation president David Jochinke warning Australia would struggle to reach its target of $100bn farmgate value by 2030 without foreign interest.

“Foreign investment remains critical to the future success of Australian agriculture,” he said.

Mr Jochinke said research has found the sector needs almost $9bn a year in additional capital investment to reach its $100bn target in six years.

One of Australia’s most experienced agricultural fund managers, David Goodfellow, said a recent dip in commodity prices, particularly in Australia, meant foreign institutional investors have tread more carefully when weighing up an investment opportunity in Australia.

“In the last two years, because commodity prices have been a bit lower and land prices had risen so much before then, the yields of return have been much lower than the long-term averages and during that same time interest rates have risen, so these big institutions (pensions funds) are earning more on their bond markets or share portfolios (so) they’re finding it a little harder to justify paying for Australian agricultural assets,” Mr Goodfellow said. “They’re just looking more carefully for the right opportunities.”

He said there may also be a hesitancy to purchase ahead of the looming federal election and any potential changes to land use rules that may bring.

But he stressed foreign interest, particularly from overseas pension funds, for Australian farmland remained strong.

“Ag is a very scarce resource, we don’t make any more ag land these days, in fact we’re taking it away when we’re expanding towns or environmental projects, so people have recognised that if you can buy good agricultural land in a stable country, then that’s a good investment,” Mr Goodfellow said.

LAWD Agribusiness senior director Col Medway said traditional overseas buyers from the likes of North America and Europe were still chasing top-tier Australian farmland, particularly row cropping properties, but limited assets were available.

“We have seen reports recently showing we have seen historically low listings and so a lot of those investors are lamenting the lack of opportunities on the market with sufficient scale and so they haven’t had a swing at it,” Mr Medway said.

“At their end of the market it is minimum assets worth $50m but ideally $100m or more because regardless of the deal size they are paying the same in fees and due diligence.”

The nose dive in foreign investment in Australian farmland coincides with a two-year silence from the federal government about just how much land and water is owned by offshore entities, with federal registers more than two years out of date.

The previous Coalition government set up two registers – for foreign-owned agricultural land and water – in 2015, to increase transparency of the level of foreign ownership of the nation’s major agricultural assets.

The 2022-23 reports were to be the final stand-alone reports before they were to be bundled into a new Register of Foreign Ownership of Australian Assets, which is managed by the Australian Taxation Office and also includes mining assets, business and residential interests.

Yet neither report has been published. The most recent available data covers the end of June 2022 – and was published in September last year, 15 months after the 2021-22 financial year ended.

When asked where the latest data was, an ATO spokeswoman said the most recent reports available were on its website, which would not be updated with the new register’s first report encompassing all Australian assets until “well into 2025”.

Nationals leader David Littleproud said there was “no excuse” for the lack of publicly available data on foreign investment.

“This is about having the real-time data to make decisions about foreign investment and whether or not it’s in the national interest,” Mr Littleproud said.

“Not all foreign investment is bad, but we need to make sure it’s in our national interest.”