Interest rates costing taxpayers more than NDIS, Jim Chalmers ahead of MYEFO

Higher interest rates are not burning a hole in household budgets, but are increasingly hurting the federal budget as well.

Australian taxpayers will be soon paying more on interest rates than the National Disability Insurance Scheme, according to figures to be released in the latest economic update.

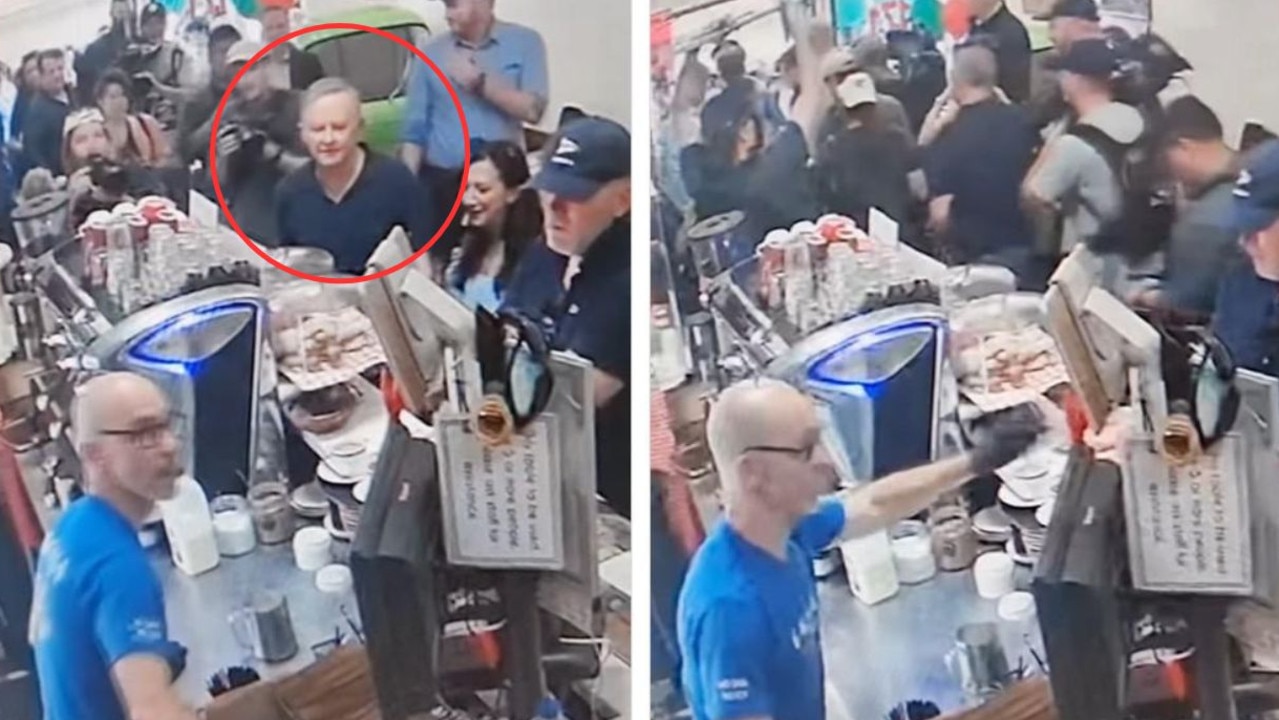

The mid-year economic update, to be unveiled by Treasurer Jim Chalmers on Wednesday, will show borrowing costs are now the fastest growing area of spending and will put the most pressure to the budget over the coming decade.

“With higher rates, the interest on the trillion dollars of debt left to us by the Coalition is costing taxpayers more,” Dr Chalmers said.

“The interest bill on the Coalition’s wasted decade is now the fastest growing expense in the budget.”

Since last May, the Reserve Bank has hiked rates from the record-low Covid-era 0.10 per cent to 4.35 per cent. The 13 rate rises have burned a hole not only in households budgets but also the government’s coffers.

MYEFO will reveal the cost of the rate rises will be in the tens of billions of dollars.

On Sunday, Dr Chalmers ruled out the potential of a second surplus in the 2023-24 financial year, but confirmed gross debt as a share of the economy would peak lower than forecast.

He said the trillion dollars in debt Labor had inherited had been reduced and was now “much closer to $900bn”.

“That saves us tens of billions of dollars in interest costs,” he said.

The Treasurer said debt was not only becoming more expensive to service, but borrowing costs in global and domestic markets had been increasing since the May budget.

As a result, Treasury has updated its assumption for the average cost of new borrowing to be 4.7 per cent – compared to 3.4 per cent as forecast in May.

That increase will cost the budget $80bn more in interest payments over the coming decade.

Gross debt would be $94bn lower by 2033-34 if it weren’t for the increase in borrowing costs.

Dr Chalmers said gross debt as a share of GDP was now expected to peak at 35.4 per cent of GDP, 1.2 percentage points lower than forecast in the May budget, and 9.5 percentage points lower than forecast before the last election.

Increased borrowing costs will also mean gross debt will peak in 2027-28.

Dr Chalmers said despite that, gross debt in GDP terms was still on track to be lower than forecast in every year over the medium term.

“We’re getting government debt on a better trajectory, but that debt is becoming more expensive to service,” he said.

“Our responsible economic management is getting the budget in much better nick, but higher interest rates aren’t helping.”

Originally published as Interest rates costing taxpayers more than NDIS, Jim Chalmers ahead of MYEFO