Banking lobby says customers are ignoring warnings about scams

The Australian banking lobby chief has revealed some customers are ignoring warnings about scammers, at an inquiry into new laws to help victims.

Banks are already chalking up losses as people transfer money to scammers despite being warned of suspicious activity, the Australian Banking Association says.

Bank Association chief Anna Bligh made the comments to a Senate committee on Tuesday.

The Senate Economics Legislation Committee is running the ruler over the details of the Scams Prevention Framework Bill 2024.

The Bill would require social media companies, banks and telcos to “take robust steps” to prevent and respond to scams.

Ms Bligh said “the whole issue of reimbursement” for scammed customers should focus on scam prevention.

“It’s important customers have an understanding of when is the company liable, what is their obligations as a customer,” Ms Bligh said.

The banking lobby boss said banks had plenty of examples of anti-scam staff warning customers that a transfer looked suspicious, but the customer proceeded anyway.

“We believe the best way to protect Australians is to stop the scam from getting to them in the first place,” Ms Bligh said.

“By the time a customer is directing their bank to transfer money to another account, the scam has already happened.

“The person has already been tricked and they are about to send their money to a fraudulent investment scheme or a fraudulent romance scam.”

In its current form, the proposed Bill had “serious civil penalties” for companies which failed to protect customers, Ms Bligh said.

“And just as importantly, a regime that will allow those customers who have lost money because of a failure to comply by any of the companies involved, some redress and compensation.”

“AWKWARD”, “FINGER-POINTING”

Proposed anti-scam laws are currently a murky shallow attempt to keep consumers safe online, a digital industry advocate says.

The Digital Industry Group managing director Sunita Bose told the senate committee “critical” amendments needed to be made, and digital platforms needed to be subject to mandatory penalties.

Ms Bose said there were “awkward” and “not clear” codes across industries.

“No one can confidently explain today when companies are liable for scams because those key details haven’t been worked out before we’re legislating,” she said.

“With dozens of companies involved in any one particular scam, that confusion will frustrate consumers.

“It will see industry focus on finger-pointing, sometimes over lengthy legal battles, rather than collaborating to beat scammers at their game.”

The Digital Industry Group is a non-profit which advocates for the sector.

Ms Bose says “attack chains” of “sophisticated white collar criminals” are behind the scams on multiple services Australians use every day.

As the Bill stood, amendments were needed to detail “crystal clear obligations for industry”, she said.

When asked, Ms Bose acknowledged platforms needed to improve, but the platforms were already investing and focusing on scam prevention.

Members of the Digital Industry Group include Meta, eBay, TikTok and X.

“Every story of a scam has a complex attack chain,” Ms Bose said.

“Scammers, in order to be successful, need to build a web across, exploiting various services Australians use everyday.”

A scam network begins with an offshore account to receive funds, Ms Bose explained. Fake Australian Business Numbers or social media profiles follow.

Scammers make contact with potential victims, and if the victim hands over financial details, that is when the scam is carried out.

“I’ve stepped through five different areas – and some scams will have more – there are dozens of companies that are involved in every particular scam,” he said.

“And what I hope to see is a bolstering of defences across every single sector.”

Major platforms ‘inundated’

Meta and Google platforms are inundated with scammers, consumer advocate Choice says.

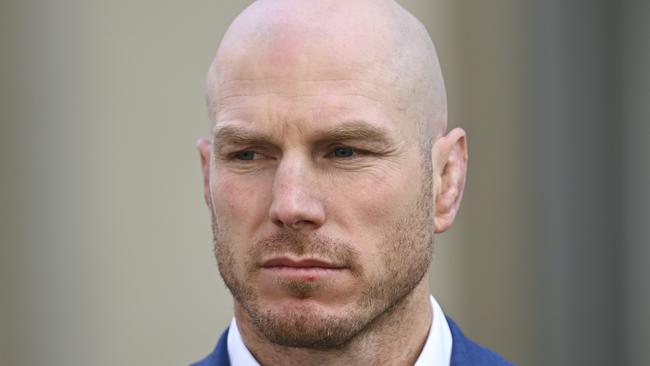

Choice chief executive Ashley de Silva made the comments to the Economics Legislation Committee on Tuesday.

How ripped-off consumers got money under the proposed new laws was unclear, Mr de Silva said.

“If the bill is not passed, industry scam prevention standards will continue to fall short of

expectations and consumers will bear the consequences.

“The current voluntary approach to scam protection is not working and we need strong laws, with penalties, to incentivise the tech giants, as well as banks, telecommunications platforms, super funds and other businesses that might be captured in the future, to take scam prevention seriously,” he said.

“Our current laws leave victims of scams carrying the entire burden of scams, and let big businesses off the hook for inadequate security and safety.”

Choice says despite “ample public scrutiny of scams in the media and the looming threat of legislation over the last few years”, the digital platforms are not doing enough.

The multinational companies in this sector will not dedicate meaningful resources to addressing scams unless they are forced to do so,” Mr de Silva told the committee.

Senator David Pocock concurred, saying clamping down on scammers was a conflict of interest for digital platforms, because the fraudulent operators pay ad revenue.

Choice research also found who consumers were most aggrieved by. Polling by the consumer group found while 39 per cent of people feel banks do not do enough to protect customers from scammers, 68 per cent of people feel the same disapproval toward Google, Facebook and Twitter/X.

“This level remains unchanged from the findings in June 2023, where 66 per cent of respondents found social media and digital platform companies were not doing enough to protect users from scams,” Mr de Silva said.

“The platforms of companies like Meta and Google are currently inundated with scam accounts, communications and advertisements that are causing consumer harm.”

The Senate committee is officially looking at the provisions of the Scams Prevention Framework Bill 2024.

Tuesday is the lone public hearing session, and the committee will report its findings to the upper house by February 3.

Originally published as Banking lobby says customers are ignoring warnings about scams